Hernando, Mississippi: Preparing For The Elimination Of Income Tax

Table of Contents

Understanding the Proposed Income Tax Elimination in Hernando, Mississippi

The Current State of Affairs:

Mississippi currently has a graduated income tax system. While specifics regarding a Hernando-only income tax elimination are currently unavailable (as of [insert current date]), any statewide elimination would drastically impact Hernando. We will therefore focus on the statewide implications and their potential effects on Hernando, MS. Keep an eye on local news and government websites for official announcements specific to Hernando.

- Current income tax brackets: [Insert current Mississippi income tax brackets and rates here. Link to the official Mississippi Department of Revenue website for this information].

- Proposed legislation timeline: [Insert information on the proposed timeline for income tax elimination legislation. Include links to relevant bills or legislative websites.]

- Potential exemptions or exceptions: [If any exemptions or exceptions are proposed, detail them here. Link to relevant documentation if available.]

- Anticipated effective date: [If an effective date is proposed, include it here. Otherwise, state that the date is yet to be determined.]

Economic Implications for Hernando:

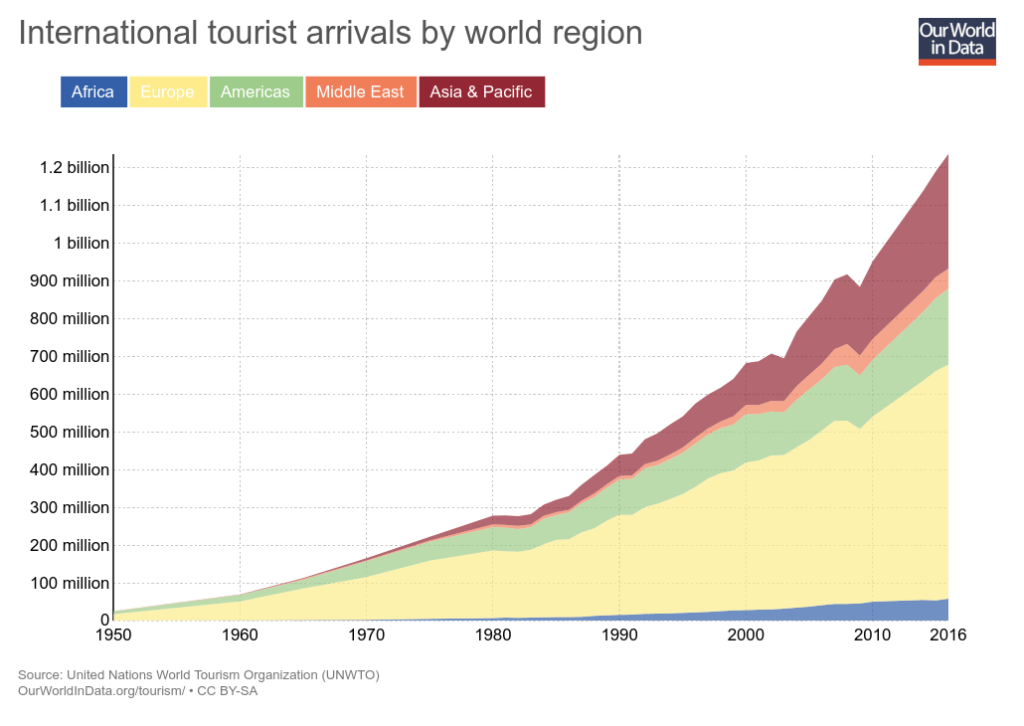

The elimination of income tax in Mississippi could significantly impact Hernando's economy, both positively and negatively.

- Potential for increased business investment: Lower taxes could attract new businesses and encourage existing ones to expand, creating jobs and boosting economic growth.

- Job creation: The influx of businesses could lead to significant job creation across various sectors, benefiting Hernando residents.

- Attraction of new residents: A tax-free environment could draw new residents to Hernando, increasing the population and demand for goods and services.

- Possible increase in property taxes or sales taxes: To compensate for the loss of income tax revenue, the state might increase property taxes or sales taxes, potentially offsetting some of the benefits.

- Potential strain on public services: Reduced tax revenue could potentially strain public services like schools, roads, and public safety if not properly managed.

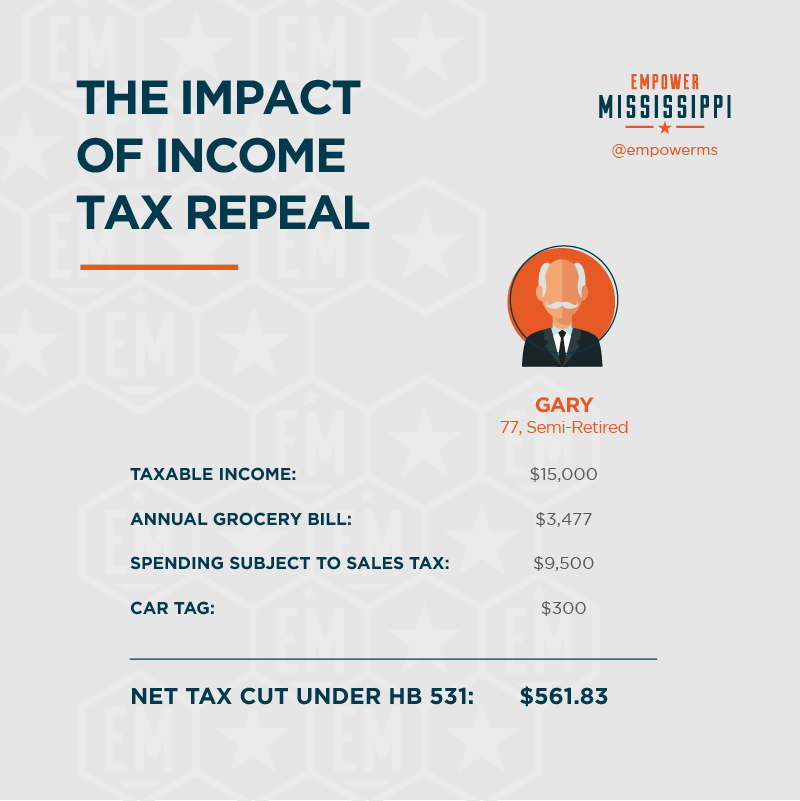

Who Will Benefit Most?

The impact of income tax elimination will vary across different demographics.

- High-income earners: These individuals will likely see the most significant tax savings.

- Low-income earners: While they will benefit from the absence of income tax, the impact may be less dramatic, and potential increases in other taxes need consideration.

- Small business owners: Reduced tax burdens could significantly boost profitability and growth for small businesses.

- Retirees: Fixed-income retirees will benefit from the absence of income tax, but potential increases in other taxes must be factored into their financial planning.

- Families: Families with higher incomes will likely see substantial savings; families with lower incomes may experience a more nuanced impact depending on changes to other taxes.

Financial Planning in a Tax-Free Hernando

Adjusting Your Budgeting Strategies:

Preparing for the potential income tax elimination requires careful financial planning.

- Re-evaluating savings goals: With potential changes in income after tax, you may need to adjust your savings targets.

- Investment strategies: The tax landscape shift could affect investment choices. Seek professional advice to optimize your portfolio.

- Potential impact on retirement planning: Changes to income taxes could impact retirement savings and withdrawals, requiring a review of your retirement plan.

- Adjusting charitable giving strategies: Tax deductions for charitable contributions will no longer apply; consider alternative ways to support your favorite causes.

Tax Implications Beyond Income Tax:

While income tax elimination is significant, other taxes remain.

- Property tax rates in Hernando: [Insert current property tax rates for Hernando. Link to official county tax assessor's website.]

- Sales tax rates in Mississippi: [Insert current sales tax rates for Mississippi. Link to the official Mississippi Department of Revenue website.]

- Potential increases in other taxes: Be prepared for possible adjustments to property taxes or sales taxes to make up for lost income tax revenue.

- Exploring tax-efficient investment options: Consult with a financial advisor to explore tax-advantaged investment options that are still relevant in the new tax environment.

Seeking Professional Financial Advice:

Navigating these changes requires expert guidance.

- Finding reputable financial advisors in Hernando: [Suggest ways to find reputable advisors, such as online directories or referrals.]

- Types of financial advice to seek: Seek advice on budgeting, investments, retirement planning, and tax optimization strategies.

- Importance of personalized financial plans: A personalized plan tailored to your specific situation is crucial for effectively managing your finances in the new tax environment.

Opportunities and Challenges for Businesses in Hernando

Attracting New Businesses:

The elimination of income tax could be a powerful magnet for new businesses.

- Reduced operating costs: Businesses will enjoy lower operating costs, enhancing their competitiveness.

- Improved competitiveness: Hernando could become a more attractive location for businesses compared to areas with income tax.

- Increased business investment: The tax savings could incentivize businesses to invest more in expansion and job creation.

- Potential for growth and expansion: The overall economic boost could create significant opportunities for growth for both new and existing businesses.

Adapting Business Strategies:

Existing businesses need to adapt to thrive in this new landscape.

- Reviewing pricing strategies: Adjust pricing models to account for changes in both costs and consumer spending habits.

- Adjusting marketing campaigns: Highlight the benefits of operating in a tax-free environment to attract customers and employees.

- Optimizing business operations: Streamline operations to maximize efficiency and profitability in the new environment.

- Exploring new investment opportunities: Identify and pursue investment opportunities made possible by the tax changes.

Navigating Regulatory Changes:

Tax reform may lead to changes in regulations and compliance requirements.

- Understanding new tax forms and filing requirements: Stay informed about any changes to state tax forms and filing deadlines.

- Seeking guidance from business advisors and accountants: Consult professionals for expert advice on navigating the new regulatory environment.

- Staying informed about regulatory updates: Regularly monitor announcements from relevant government agencies to stay updated on any changes.

Conclusion:

The potential elimination of income tax in Hernando, Mississippi, presents a complex scenario with both significant opportunities and potential challenges. Understanding the implications for your personal finances and your business is crucial. By proactively adjusting budgeting strategies, seeking professional financial advice, and staying informed about the latest developments, you can effectively navigate this transition and prepare for a thriving future in a tax-free Hernando. Prepare for Hernando's changing tax landscape today! Don't wait – plan for the elimination of income tax in Hernando. Take control of your financial future in a tax-free Hernando.

Featured Posts

-

Huge Raves Economic Impact A Positive Boost

May 19, 2025

Huge Raves Economic Impact A Positive Boost

May 19, 2025 -

U Conn Stars Azzi Fudd And Paige Bueckers Casual Style Compared To Wnba Draft Night

May 19, 2025

U Conn Stars Azzi Fudd And Paige Bueckers Casual Style Compared To Wnba Draft Night

May 19, 2025 -

Eurovision 2025 Protest Resilience And Austrias Jj

May 19, 2025

Eurovision 2025 Protest Resilience And Austrias Jj

May 19, 2025 -

Final Destination Bloodlines Streaming And Showtimes Where To Watch Now

May 19, 2025

Final Destination Bloodlines Streaming And Showtimes Where To Watch Now

May 19, 2025 -

Marko Bosnjak Sanse Za Popravak Prema Kladionicama

May 19, 2025

Marko Bosnjak Sanse Za Popravak Prema Kladionicama

May 19, 2025