High Stock Market Valuations: A BofA Analysis And Reasons For Investor Calm

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

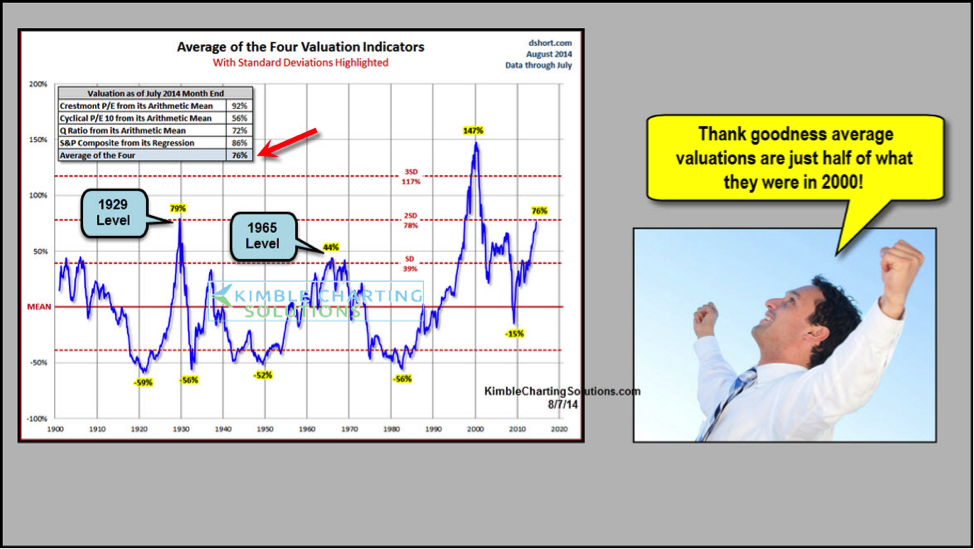

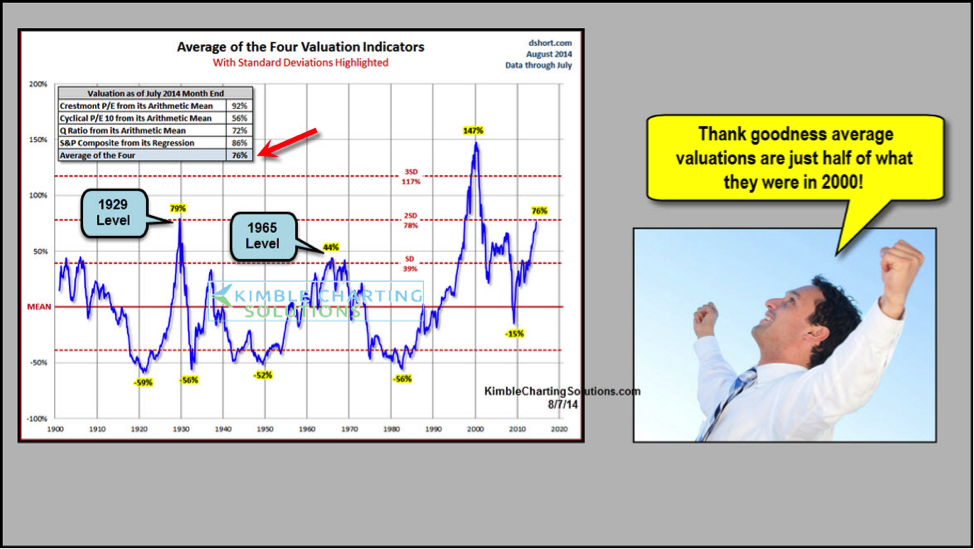

Bank of America's recent analysis highlights the elevated nature of current stock market valuations. While BofA hasn't released a single, definitive number representing overall market valuation, their reports consistently point towards elevated price-to-earnings (P/E) ratios across various sectors. Specific data points often referenced include comparisons to historical averages and analysis relative to economic growth indicators, like market capitalization to GDP ratios. These ratios suggest that many stocks are trading at premiums compared to their historical norms.

-

BofA's valuation methodology: BofA utilizes a multi-faceted approach, combining fundamental analysis (examining company financials and earnings) with macroeconomic factors (interest rates, inflation, economic growth projections) to assess valuations. They often utilize various valuation metrics, comparing them against historical data and peer groups.

-

Key metrics used in BofA's analysis: Beyond P/E ratios, BofA likely incorporates the Shiller PE ratio (cyclically adjusted price-to-earnings ratio), which smooths out earnings fluctuations over time, providing a more stable long-term valuation picture. Other metrics could include price-to-sales ratios, price-to-book ratios, and dividend yield analysis.

-

BofA's prediction for future market performance: Predicting future market performance is inherently challenging. While BofA doesn't offer crystal-ball predictions, their analyses often suggest potential scenarios based on various macroeconomic factors and their impact on earnings growth. They may highlight potential upside if economic growth remains strong but also caution against downside risks if growth slows or interest rates rise significantly.

-

Identification of sectors or companies with particularly high valuations according to BofA: BofA reports frequently identify specific sectors, like technology or certain growth stocks, as exhibiting particularly high valuations. These are often sectors with strong growth prospects but also carry a higher degree of risk due to their elevated valuations.

Factors Contributing to Investor Calm Despite High Valuations

Despite the acknowledged high stock market valuations, several factors explain investors' relatively calm demeanor:

-

Low interest rates: Historically low interest rates make bonds less attractive compared to stocks, pushing investors towards equities even at higher valuations. This low-cost borrowing environment fuels further investment and potentially inflates asset prices.

-

Quantitative easing (QE) and other monetary policies: Central banks' actions, such as QE, have injected massive liquidity into the financial system, supporting asset prices across the board, including stocks. This artificial increase in money supply can contribute to higher valuations.

-

Continued strong corporate earnings: Despite high valuations, many companies have delivered strong earnings growth, justifying—at least partially—the higher prices. This earnings growth can support high stock valuations, even if it doesn't fully explain the premium.

-

Investor confidence in future economic growth: Optimism about future economic prospects and corporate profitability supports investor confidence and willingness to accept higher valuations, anticipating future earnings growth to justify current prices.

-

Technological innovation: The ongoing technological revolution has fueled significant growth in certain sectors, justifying—to some extent—high valuations in companies driving technological advancements.

-

Passive investment strategies: The rise of passive investing (index funds and ETFs) has reduced the number of active traders making valuation judgments, leading to less market correction based on valuation concerns.

Potential Risks Associated with High Stock Market Valuations

While investor calm prevails, it's crucial to acknowledge the inherent risks associated with high stock valuations:

-

Increased market volatility and potential for corrections: Highly valued markets are inherently more susceptible to sharp corrections as even minor negative news can trigger significant sell-offs.

-

The risk of a market bubble: The current market environment bears similarities to historical bubbles, raising concerns about a potential significant downturn if investor sentiment shifts negatively.

-

The impact of rising interest rates: Rising interest rates increase borrowing costs for companies, potentially impacting earnings growth and thus reducing stock valuations. This creates a headwind for high-valuation stocks which are particularly sensitive to interest rate hikes.

-

Geopolitical risks: Unforeseen geopolitical events (wars, trade disputes) can negatively impact investor sentiment and trigger market corrections, particularly in a market already considered overvalued.

-

Inflationary pressures: High inflation erodes corporate profits and can lead to a reassessment of stock valuations. Higher inflation often leads to higher interest rates, further impacting stock prices.

Diversification Strategies to Mitigate Risk

To manage the risks associated with high stock market valuations, investors should adopt robust diversification strategies:

-

Diversification across asset classes: Spread investments across stocks, bonds, real estate, and other asset classes to reduce the overall portfolio's exposure to any single market segment.

-

Sector diversification: Avoid over-concentration in any particular sector, particularly those showing exceptionally high valuations. Diversifying into sectors with lower valuations can reduce portfolio risk.

-

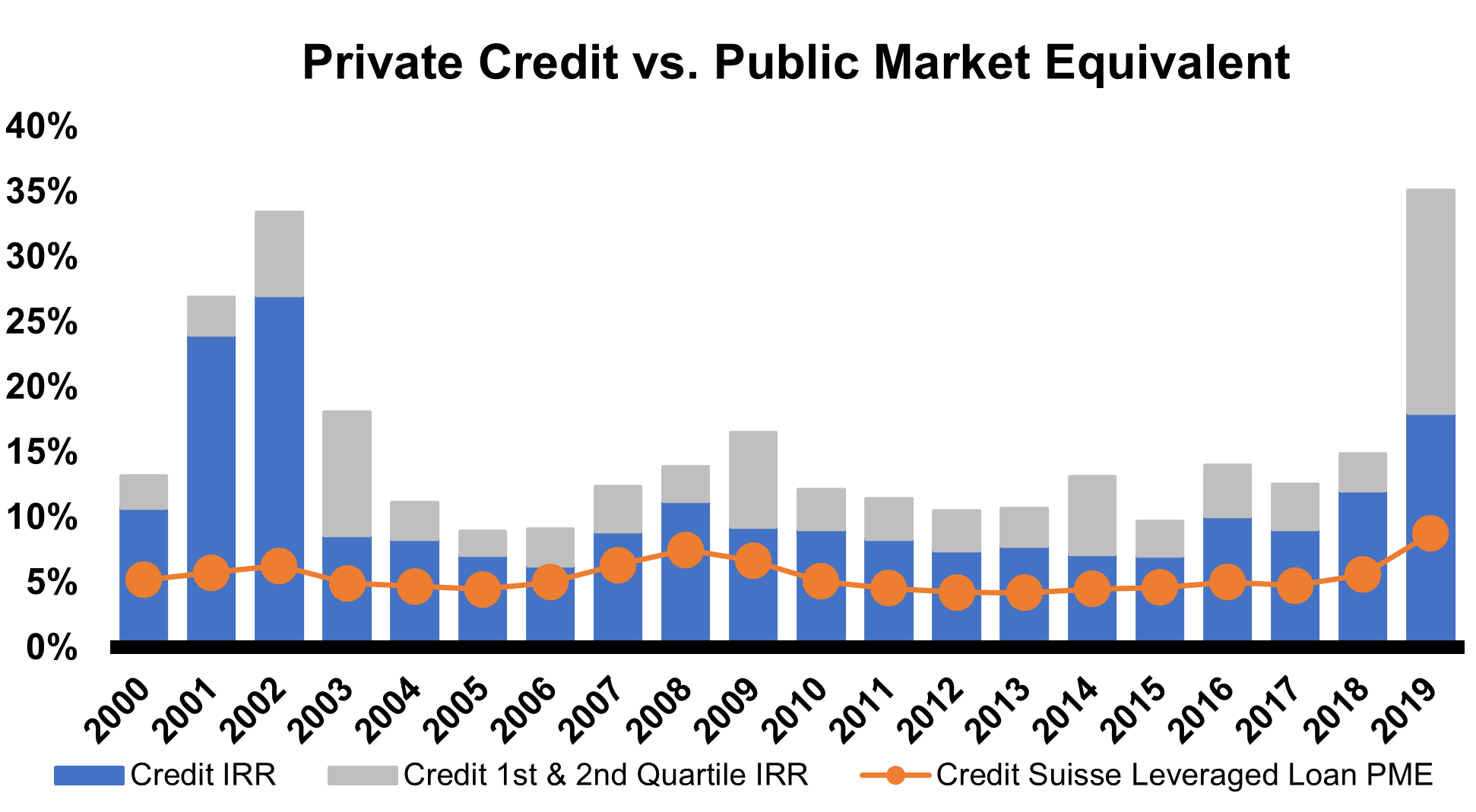

Alternative investments: Consider adding alternative investments (private equity, hedge funds) to further diversify and potentially reduce correlation with traditional equity markets.

-

Long-term investment horizon: Maintaining a long-term investment horizon can help ride out short-term market volatility and benefit from long-term growth.

Conclusion

This article examined BofA's analysis of current high stock market valuations and explored the reasons behind investor calm. While high valuations present inherent risks, factors like low interest rates and strong corporate earnings have contributed to a sustained, albeit potentially precarious, market environment. The potential for corrections and market volatility remains significant.

Understanding the complexities of high stock market valuations is crucial for informed investment decisions. By carefully considering the potential risks and employing effective diversification strategies, investors can navigate this challenging landscape and potentially benefit from continued market growth. Learn more about managing your investments in the face of high stock valuations and develop a robust investment strategy tailored to your risk tolerance.

Featured Posts

-

4 Kwietnia Dzien Zwierzat Bezdomnych Solidarna Akcja Na Rzecz Bezdomnych Zwierzat

May 01, 2025

4 Kwietnia Dzien Zwierzat Bezdomnych Solidarna Akcja Na Rzecz Bezdomnych Zwierzat

May 01, 2025 -

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025 -

Smart Cruise Packing Items To Avoid

May 01, 2025

Smart Cruise Packing Items To Avoid

May 01, 2025 -

Bao Cao Tran Mo Man Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien

May 01, 2025

Bao Cao Tran Mo Man Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien

May 01, 2025 -

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

May 01, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

May 01, 2025

Latest Posts

-

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025 -

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025 -

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Win Against Portland

May 01, 2025

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Win Against Portland

May 01, 2025 -

Celtics Defeat Cavaliers 4 Important Observations From Derrick Whites Performance

May 01, 2025

Celtics Defeat Cavaliers 4 Important Observations From Derrick Whites Performance

May 01, 2025 -

Hunters Strong Performance Fuels Cavaliers 10 Game Winning Streak

May 01, 2025

Hunters Strong Performance Fuels Cavaliers 10 Game Winning Streak

May 01, 2025