HKD/USD Interest Rate: Post-Intervention Analysis And Market Outlook

Table of Contents

HKMA Intervention and its Impact on the HKD/USD Interest Rate

The HKMA's role is crucial in maintaining the HKD's peg to the USD. Recent interventions have involved the buying and selling of US dollars in the foreign exchange market to stabilize the exchange rate and influence interest rates. These actions directly impact the HKD/USD interest rate and broader market conditions.

- Specific dates and amounts of intervention (if available): While precise figures are often not publicly released immediately due to market sensitivity, news reports often indicate the general scale of interventions. For example, reports might mention the HKMA's actions during periods of significant HKD weakness or strength.

- Impact on the overnight interbank rate (HIBOR): HKMA interventions directly influence the HKD overnight interbank rate (HIBOR), which serves as a benchmark for short-term borrowing costs in Hong Kong. Buying USD increases HKD liquidity, generally leading to lower HIBOR, while selling USD has the opposite effect.

- Effect on the Hong Kong Dollar's exchange rate: The primary goal of HKMA interventions is to keep the HKD within its trading band against the USD (7.75-7.85 HKD/USD). Interventions are designed to counter excessive fluctuations, preventing significant deviations from the peg.

- Comparison to previous interventions: The frequency and scale of recent interventions can be compared to historical precedents. Analyzing past interventions helps assess the current situation's significance and potential long-term implications for the HKD/USD interest rate.

Analysis of the Post-Intervention Market

The immediate market reaction to HKMA interventions is usually a stabilization of the HKD/USD exchange rate and a corresponding adjustment in the HKD interest rates. However, the long-term effects can be more complex.

- Changes in market volatility: Interventions often reduce market volatility in the short term, as the HKMA's actions provide a sense of stability. However, prolonged periods of intervention may raise questions about market confidence and underlying economic conditions.

- Shift in investor sentiment: The market's perception of the HKMA's actions can significantly influence investor sentiment. If investors see the interventions as a sign of confidence in the Hong Kong economy, it could lead to increased investment flows. Conversely, frequent interventions might signal underlying economic weakness.

- Impact on borrowing costs for businesses: Changes in HIBOR directly affect borrowing costs for businesses in Hong Kong. Lower HIBOR translates into lower borrowing costs, while higher HIBOR increases borrowing costs, impacting business investment and expansion plans.

- Effect on Hong Kong's monetary policy: The HKMA's interventions are a key component of Hong Kong's monetary policy. The effectiveness of these interventions in maintaining the currency peg and supporting economic stability influences the overall monetary policy framework.

Factors Influencing Future HKD/USD Interest Rate Movements

Several factors beyond the HKMA's direct control can significantly impact the future trajectory of the HKD/USD interest rate.

- US Federal Reserve policy decisions: Changes in US interest rates influence capital flows between the US and Hong Kong. Higher US interest rates tend to attract capital out of Hong Kong, potentially putting upward pressure on the HKD/USD exchange rate and influencing the HKD interest rate.

- Global economic conditions: Global economic growth and uncertainty significantly impact capital flows and investor sentiment toward Hong Kong. Economic downturns or geopolitical risks can lead to capital outflows, affecting the HKD/USD exchange rate and interest rates.

- Geopolitical risks affecting Hong Kong: Political and geopolitical events can trigger significant capital movements and volatility in the HKD/USD exchange rate, leading to adjustments in the HKD interest rate.

- Potential future HKMA actions: Anticipating future HKMA interventions is challenging. However, understanding the HKMA's past actions and its stated objectives helps in assessing potential future policy responses to market fluctuations.

Market Outlook and Investment Strategies

Predicting the HKD/USD interest rate with certainty is impossible. However, based on the above analysis, we can outline a potential outlook and suggest investment strategies.

- Likely range for the HKD/USD interest rate: The HKD/USD interest rate is likely to remain relatively stable within a narrow range, influenced by the HKMA's interventions and global economic conditions.

- Recommended investment strategies (e.g., hedging, speculation): Investors might consider hedging strategies to mitigate exchange rate risk, especially during periods of heightened uncertainty. Speculative strategies require a deep understanding of the market and a higher risk tolerance.

- Risk factors to consider: Key risk factors include changes in US interest rates, global economic growth, and geopolitical events impacting Hong Kong.

- Potential benefits and drawbacks of different strategies: Each investment strategy has its own benefits and drawbacks, and investors should carefully consider their risk tolerance and financial objectives before making any investment decisions.

Conclusion

The recent HKMA interventions have significantly shaped the HKD/USD interest rate, impacting market dynamics and investor strategies. Understanding the post-intervention landscape, including the interplay of global economic conditions and potential future policy adjustments, is crucial for navigating this important currency pair. While forecasting remains inherently uncertain, analyzing the factors influencing the HKD/USD interest rate allows for informed decision-making. Continue to monitor the HKD/USD interest rate and related economic indicators for the most up-to-date information and adjust your investment strategies accordingly. Stay informed on future developments regarding the HKD/USD interest rate for effective risk management and investment planning.

Featured Posts

-

Inter Milans Victory Sends Them To Europa League Quarter Finals

May 08, 2025

Inter Milans Victory Sends Them To Europa League Quarter Finals

May 08, 2025 -

Prelazna Vlada Pavle Grbovic Prihvata Sve Predloge

May 08, 2025

Prelazna Vlada Pavle Grbovic Prihvata Sve Predloge

May 08, 2025 -

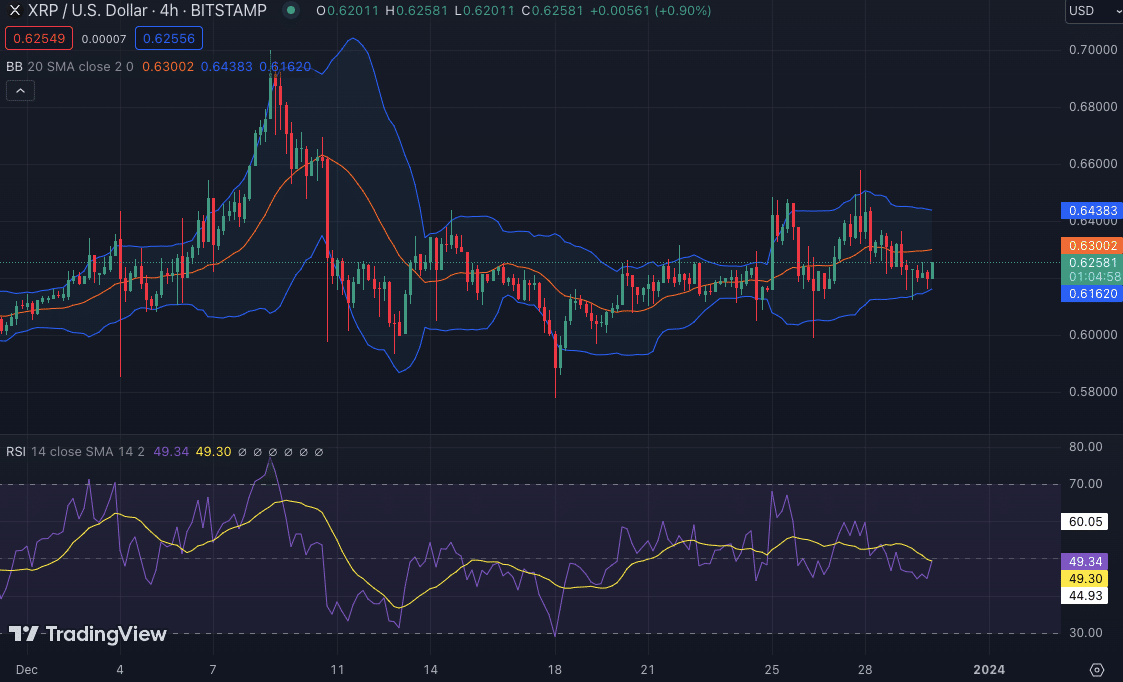

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025 -

Ethereums Resilient Price Signs Of An Upcoming Rally

May 08, 2025

Ethereums Resilient Price Signs Of An Upcoming Rally

May 08, 2025 -

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025

Latest Posts

-

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025 -

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025