House Tax Bill Passes: Impact On Stock Market, Bonds, And Bitcoin Today

Table of Contents

Impact on the Stock Market

The passage of the House Tax Bill could lead to increased corporate profits due to potential tax cuts. This may boost investor confidence and drive stock prices higher. However, the impact will vary across sectors. The Stock Market reaction will depend largely on the details of the final bill and how companies utilize any tax benefits. Analyzing the sectoral impact is key to understanding the overall effect.

- Some sectors may benefit more than others from tax breaks. For example, companies with high tax burdens might see a significant boost to their bottom line, while others may see a more modest impact. This could lead to a period of market readjustment as investors re-evaluate their portfolios. Understanding these nuances is vital for successful stock market navigation.

- Increased corporate investment could lead to job growth and economic expansion. If corporations use their tax savings to invest in expansion, research and development, or hiring, it could stimulate economic growth and create jobs. This positive feedback loop could further enhance investor confidence and support higher stock prices. The potential for this positive effect makes the bill's passage a keenly watched event for economic forecasters.

- Uncertainty surrounding the bill's Senate passage could lead to market volatility. Until the bill is passed by the Senate and signed into law, market uncertainty will prevail. This uncertainty can create short-term volatility as investors react to the ongoing political process. Tracking Senate progress and analyzing potential amendments is crucial for mitigating this volatility.

- Long-term effects on stock valuations remain to be seen, depending on how corporations utilize tax savings. Will companies use the tax savings for share buybacks, increasing dividends, or reinvestment in their business? The strategic decisions made by corporations will play a crucial role in shaping the long-term effects on the stock market. This makes ongoing analysis of corporate statements vital.

Effects on the Bond Market

The tax bill's impact on bond yields is complex. Increased government spending, potentially financed by increased borrowing, could push bond yields higher. Conversely, increased corporate investment spurred by the tax cuts could reduce the demand for government bonds, potentially lowering yields. The interplay of these forces will determine the overall effect.

- Inflationary pressures from increased spending could negatively impact bond prices. If the tax bill leads to significant increases in government spending, it could fuel inflation. Rising inflation is generally bad for bond prices, as the fixed income stream becomes less valuable in real terms. Investors need to carefully assess inflation expectations when making bond investment decisions.

- The overall effect on bond yields depends on the interplay of several economic factors. Other economic indicators, such as interest rate decisions by central banks, will also influence bond yields. The House Tax Bill is just one factor amongst many that influence the bond market. Comprehensive economic analysis is key to predicting its effect.

- Investors will need to carefully assess their risk tolerance within the bond market. Depending on the overall impact on yields, investors may need to adjust their bond portfolios to maintain desired levels of risk and return. This involves carefully evaluating risk and return profiles in light of the potential impact of the House Tax Bill.

- Monitoring changes in interest rates is crucial for bondholders. Interest rates and bond yields are closely related. Changes in interest rates, in response to the tax bill's passage, will significantly influence bond prices. Staying abreast of central bank policy is therefore essential for bond investors.

Bitcoin's Response to the House Tax Bill

The cryptocurrency market, particularly Bitcoin, is known for its volatility. The tax bill's passage introduces further uncertainty. While the direct impact might be less clear than on stocks and bonds, regulatory changes related to cryptocurrency taxation could significantly affect Bitcoin's price.

- Increased regulatory clarity could potentially boost Bitcoin's legitimacy and adoption. Clearer tax rules for cryptocurrencies could reduce uncertainty for investors and potentially encourage broader adoption. This could lead to increased demand and a higher Bitcoin price. However, the nature of any regulatory changes is currently unknown.

- Conversely, unfavorable tax regulations could dampen investor enthusiasm. If the tax bill introduces unfavorable regulations for cryptocurrencies, it could lead to reduced investment and a lower Bitcoin price. This makes continued monitoring of the developing regulatory landscape crucial for Bitcoin investors.

- The overall sentiment towards risk assets will influence Bitcoin's price. Bitcoin is often considered a risk asset. If the overall market sentiment shifts towards risk aversion following the tax bill's passage, Bitcoin's price could fall. Conversely, a bullish market sentiment could support higher prices. Understanding general market sentiment is therefore crucial.

- Bitcoin's price is highly susceptible to market sentiment and news events. As a volatile asset, Bitcoin's price reacts strongly to news and changes in market sentiment. The House Tax Bill is just one of many factors that could impact its price. Continuous monitoring of news and market sentiment is essential for Bitcoin investors.

Conclusion

The House Tax Bill's passage marks a significant event with far-reaching consequences for the stock market, bond yields, and even Bitcoin. While the immediate impact is uncertain, investors should carefully monitor market reactions and adjust their strategies accordingly. The potential for increased corporate profits, altered bond yields, and shifting regulatory environments for cryptocurrencies makes close observation crucial. Stay informed on the latest developments regarding the House Tax Bill and its potential future impacts on your investments. Understanding the intricacies of this legislation is critical for making sound investment decisions in the wake of this momentous event. Continue to monitor the news and stay updated on the evolving impact of the House Tax Bill and its potential implications for your portfolio.

Featured Posts

-

Andy Peebles Remembered A Bbc Lancashire Tribute By Andy Bayes

May 23, 2025

Andy Peebles Remembered A Bbc Lancashire Tribute By Andy Bayes

May 23, 2025 -

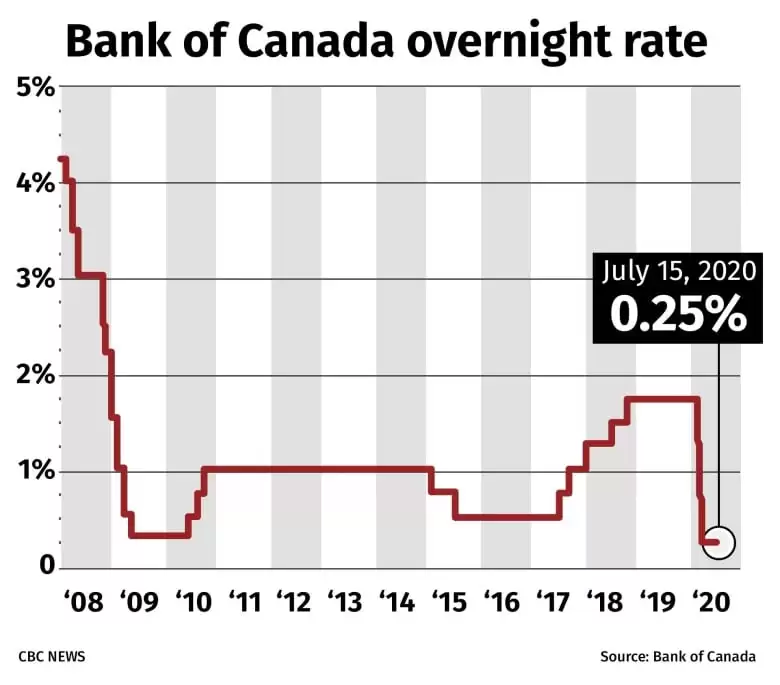

Bank Of Canada Rate Cuts Desjardins Predicts Three More

May 23, 2025

Bank Of Canada Rate Cuts Desjardins Predicts Three More

May 23, 2025 -

Erik Ten Hag Leverkusens Second Choice Manchester United Manager Update

May 23, 2025

Erik Ten Hag Leverkusens Second Choice Manchester United Manager Update

May 23, 2025 -

Rain Hit Day Shantos Unbeaten Half Century Fuels Bangladeshs Advantage

May 23, 2025

Rain Hit Day Shantos Unbeaten Half Century Fuels Bangladeshs Advantage

May 23, 2025 -

Bahrain Gp Piastri Claims Pole Position

May 23, 2025

Bahrain Gp Piastri Claims Pole Position

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time Opening Lea Michele And Castmates Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Lea Michele And Castmates Celebrate

May 23, 2025 -

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025 -

The Jonas Brothers Joe And The Unexpected Marriage Dispute

May 23, 2025

The Jonas Brothers Joe And The Unexpected Marriage Dispute

May 23, 2025 -

The Jonas Brothers A Couples Hilarious Fight And Joes Response

May 23, 2025

The Jonas Brothers A Couples Hilarious Fight And Joes Response

May 23, 2025 -

The Jonas Brothers A Couples Unexpected Fight And Joes Response

May 23, 2025

The Jonas Brothers A Couples Unexpected Fight And Joes Response

May 23, 2025