Housing Market In Crisis: Sharp Decline In Home Sales

Table of Contents

Economic Factors Fueling the Crisis

Several intertwined economic factors are fueling this unprecedented sharp decline in home sales.

Rising Interest Rates and Mortgage Costs

The Federal Reserve's aggressive interest rate hikes have significantly increased mortgage costs, making homeownership less affordable for many.

- Higher Monthly Payments: Increased interest rates translate directly into higher monthly mortgage payments, stretching household budgets and reducing purchasing power. A 1% increase in interest rates can add hundreds of dollars to a monthly payment, significantly impacting affordability.

- Reduced Purchasing Power: With higher mortgage rates, potential homebuyers can afford to purchase less expensive homes, reducing demand in the higher price brackets and impacting the overall market. Data from the National Association of Realtors shows a considerable decrease in the number of purchase contracts signed in recent months.

- Impact on Buyer Demand: The combination of higher monthly payments and reduced purchasing power has significantly dampened buyer demand, leading to a substantial slowdown in sales. Many prospective buyers are delaying their purchase decisions or opting out of the market entirely. Keywords: Mortgage rates, interest rate hikes, affordability crisis, home buying costs.

Inflation and Reduced Consumer Spending

Rampant inflation is further exacerbating the housing market crisis by reducing consumer spending and disposable income.

- Inflationary Pressures: Soaring prices for essential goods and services are leaving less money available for discretionary spending, including purchasing a home. Inflation rates haven't been this high in decades, impacting household budgets drastically.

- Impact on Household Budgets: The increased cost of living is forcing many households to prioritize essential expenses, leaving little room for the significant financial commitment of homeownership. This has a knock-on effect on the housing market, reducing demand.

- Consumer Sentiment: Negative consumer sentiment regarding the economy further reduces willingness to take on the risk of a large financial commitment like a mortgage in uncertain times. Keywords: Inflation, consumer spending, disposable income, economic downturn, housing affordability.

Recessionary Fears

The looming threat of a recession is creating significant economic uncertainty, discouraging potential homebuyers.

- Market Volatility: Concerns about job security and economic instability are causing many to delay major purchases, including homes. The volatility in the stock market adds to this apprehension.

- Hesitancy to Commit: In an uncertain economic climate, many view buying a home as a risky proposition, opting to wait for greater economic stability. This hesitancy further contributes to the sharp decline in home sales.

- Expert Predictions: Many economists predict a continued slowdown in the housing market until economic uncertainty lessens. Keywords: Recession, economic uncertainty, market volatility, housing market forecast.

Inventory Issues and Market Dynamics

Beyond economic challenges, the current housing market struggles with inventory issues and shifting buyer dynamics.

Limited Housing Supply

A significant shortage of homes for sale is compounding the problem of the sharp decline in home sales.

- Construction Delays: Supply chain disruptions and labor shortages have hampered new home construction, leading to a limited supply of available properties.

- Material Shortages: Increased material costs and difficulties in sourcing building materials have further constrained new home construction and renovation projects.

- Low Inventory Levels: The limited supply of homes for sale is driving up prices, further reducing affordability and exacerbating the decline in sales. Data shows that inventory levels are at historic lows in many areas. Keywords: Housing shortage, low inventory, new home construction, housing supply chain.

Shifting Buyer Demand

Changes in buyer preferences are also impacting the market, contributing to the sharp decline in home sales.

- Location Preferences: The pandemic has shifted buyer preferences towards suburban or rural areas, impacting demand in traditional urban centers.

- Desired Home Features: Remote work opportunities have changed the demand for home features, with buyers prioritizing home offices and outdoor spaces.

- Buyer Demographics: Millennials are a significant portion of the home buying market, but their purchasing power is impacted by increased mortgage rates and inflation. Keywords: Buyer demand, housing preferences, market trends, real estate market analysis.

Impact on the Broader Economy

The sharp decline in home sales has significant ripple effects across various sectors.

Ripple Effects on Related Industries

The slowdown in the housing market has a cascading effect on related industries.

- Construction Industry: Reduced demand for new homes and renovations has led to job losses and decreased investment in the construction sector.

- Real Estate Investment: Lower sales volumes impact real estate investment returns, affecting both individual investors and large-scale investment firms.

- Economic Growth: The housing market's downturn has a direct impact on overall economic growth, affecting GDP and employment figures. Keywords: Construction industry, real estate investment, economic impact, job losses.

Government Intervention and Policy Responses

Governments are exploring various policy options to address the housing market crisis.

- Interest Rate Adjustments: The Federal Reserve's monetary policy decisions directly affect mortgage rates and the affordability of homes. Adjustments in interest rates are under constant review.

- Tax Incentives: Tax breaks or other incentives aimed at stimulating home buying activity are being considered in many countries.

- Regulatory Changes: Regulatory adjustments to streamline the home building process and address supply chain issues are also being evaluated. Keywords: Government policy, housing policy, economic stimulus, regulatory changes.

Navigating the Sharp Decline in Home Sales

The sharp decline in home sales is a multifaceted crisis driven by a confluence of economic factors, inventory issues, and shifting market dynamics. The consequences are far-reaching, impacting not only individuals seeking to buy or sell homes but also the broader economy. Understanding these factors is crucial for navigating this challenging market. The future trajectory of the housing market remains uncertain, but by staying informed about economic forecasts, inventory levels, and policy changes, buyers and sellers can make better-informed decisions. Utilize resources like market analyses and expert advice to best navigate this current sharp decline in home sales and prepare for potential future trends.

Featured Posts

-

Top 48 Things To Do In Dc This May Pride Concerts And More

May 31, 2025

Top 48 Things To Do In Dc This May Pride Concerts And More

May 31, 2025 -

Millions Stolen Hacker Targets Execs Office365 Accounts

May 31, 2025

Millions Stolen Hacker Targets Execs Office365 Accounts

May 31, 2025 -

From Crypto To Corporations Elon Musks Strategic Shift

May 31, 2025

From Crypto To Corporations Elon Musks Strategic Shift

May 31, 2025 -

Is Goran Ivanisevic Tsitsipass New Coach Tennis World Reacts

May 31, 2025

Is Goran Ivanisevic Tsitsipass New Coach Tennis World Reacts

May 31, 2025 -

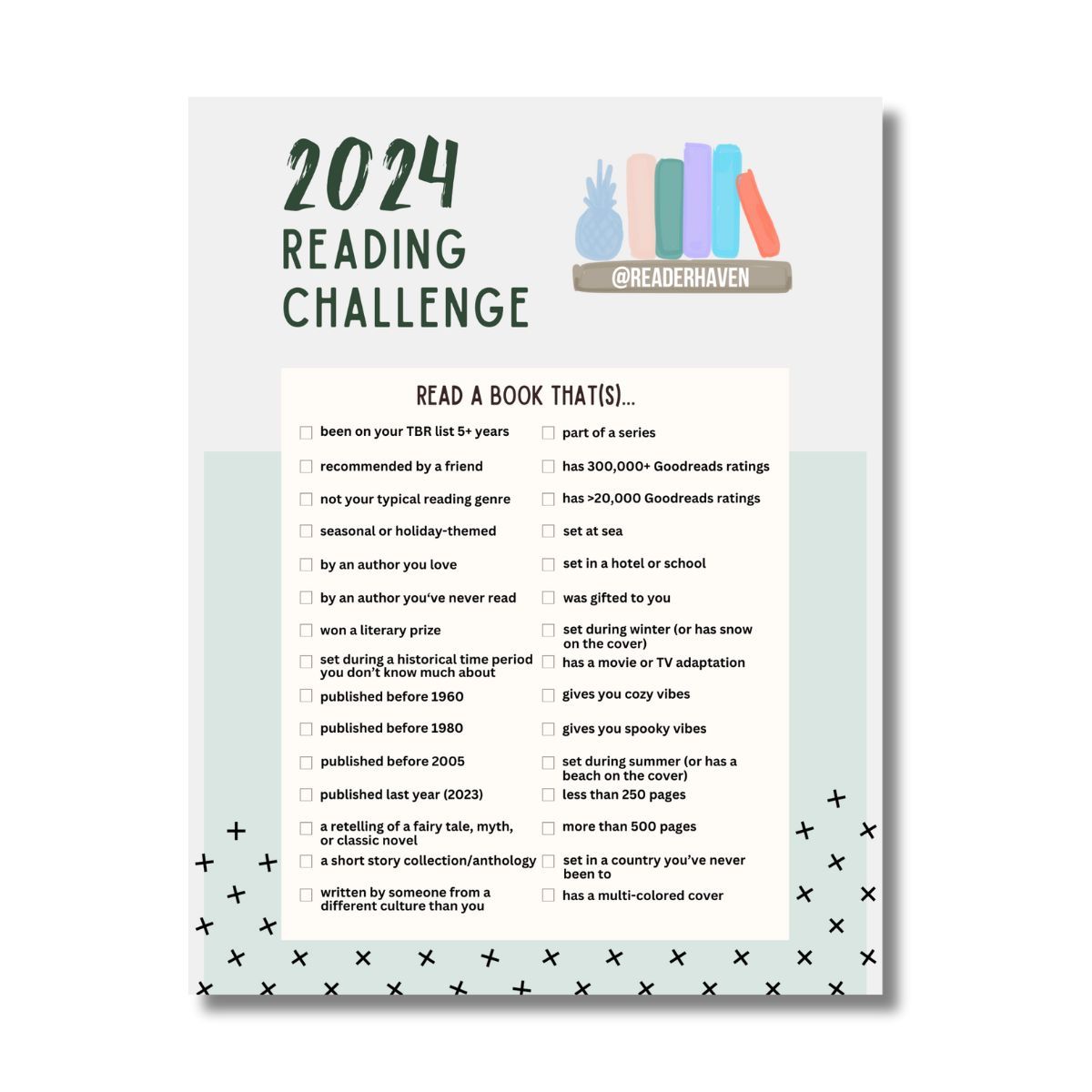

Summer Reading List 30 Books Recommended By Critics

May 31, 2025

Summer Reading List 30 Books Recommended By Critics

May 31, 2025