How Increased Federal Debt Could Increase Mortgage Costs

Table of Contents

The Relationship Between Federal Debt and Inflation

Increased federal debt often fuels inflation. When the government borrows heavily, it increases the money supply. This injection of money into the economy, without a corresponding increase in goods and services, can lead to a rise in prices – inflation. This is further exacerbated by demand-pull inflation, where increased government spending boosts demand, outpacing supply and pushing prices upward. The result? A reduced purchasing power of the dollar.

- Increased money supply due to government borrowing: The government finances its debt by issuing bonds, essentially printing more money.

- Demand-pull inflation driven by increased government spending: Increased government spending, often funded by borrowing, fuels demand, pushing prices up.

- Reduced purchasing power of the dollar: Inflation erodes the value of money, meaning your dollar buys less than it did before.

To combat inflation, the Federal Reserve (the Fed), the central bank of the US, often employs a key tool: raising interest rates. This makes borrowing more expensive, cooling down the economy and curbing inflation.

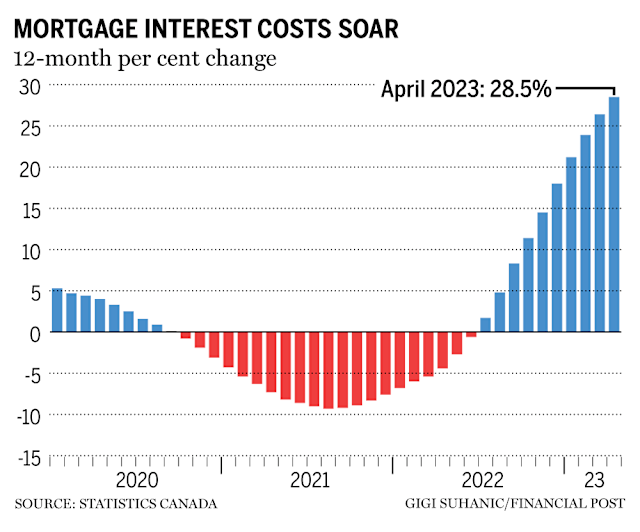

How Interest Rate Hikes Affect Mortgage Rates

The Fed's actions directly impact mortgage rates. When the Fed raises the federal funds rate (the target rate banks charge each other for overnight loans), it influences other interest rates throughout the economy. This includes the rates lenders charge for mortgages. Mortgage rates are also significantly influenced by the 10-year Treasury yield, a key benchmark for long-term borrowing costs. Increased federal debt can push up Treasury yields, making borrowing more expensive for lenders.

- Mortgage rates are influenced by the 10-year Treasury yield: The yield reflects the cost of borrowing for the government and sets a benchmark for other loans.

- Increased borrowing costs for lenders: Higher interest rates make it more expensive for lenders to borrow money, impacting their profitability.

- Lenders pass increased costs onto borrowers: To maintain their profit margins, lenders inevitably pass these increased borrowing costs onto mortgage borrowers, resulting in higher mortgage rates.

The Impact of Investor Confidence and Government Bond Yields

High levels of federal debt can erode investor confidence in government bonds. Investors may perceive a greater risk of default or inflation, leading them to demand higher yields (returns) on those bonds to compensate for this increased risk. This increase in demand for higher yields on government bonds directly impacts mortgage rates, as these yields serve as a benchmark for other long-term borrowing, including mortgages.

- Increased risk perception by investors: High debt levels can signal financial instability, making investors demand higher returns.

- Demand for safer assets increases, potentially driving up yields: Investors may shift towards safer assets, increasing their demand and driving up yields.

- Higher bond yields translate into higher mortgage rates: Increased yields on government bonds increase the cost of borrowing for lenders, ultimately resulting in higher mortgage rates for consumers.

Other Factors Contributing to Higher Mortgage Costs

It's crucial to remember that increased federal debt isn't the sole factor influencing mortgage rates. Other important elements include:

- Housing supply and demand: A shortage of housing inventory can drive up prices and mortgage demand.

- Economic growth and employment rates: A strong economy typically leads to higher mortgage rates due to increased demand.

- Global economic conditions: International economic events can also impact interest rates and mortgage costs.

Conclusion: Understanding the Link Between Increased Federal Debt and Your Mortgage

Increased federal debt can contribute to inflation, prompting the Federal Reserve to raise interest rates. These higher interest rates directly impact mortgage rates, making homeownership more expensive. Understanding this relationship between federal debt and personal finances is crucial, especially when making significant financial decisions like buying a home. Staying informed about economic trends and the potential impact of increased federal debt on your future mortgage payments is essential. Consider further research or consultation with a financial advisor regarding managing the impact of federal debt on mortgage costs and developing a robust mortgage plan. Proactive financial planning can help you navigate the challenges posed by increased federal debt and successfully achieve your homeownership goals. Understanding how federal debt affects mortgage rates empowers you to make informed decisions about your financial future.

Featured Posts

-

I Nea Epoxi Stis Sxeseis Ierosolymon Kai Antioxeias Prokliseis Kai Eykairies

May 19, 2025

I Nea Epoxi Stis Sxeseis Ierosolymon Kai Antioxeias Prokliseis Kai Eykairies

May 19, 2025 -

Pedro Pascal Confirmed For The Last Of Us Season 2 Despite Characters Fate

May 19, 2025

Pedro Pascal Confirmed For The Last Of Us Season 2 Despite Characters Fate

May 19, 2025 -

Record Drone Attack On Ukraine Russias Escalation

May 19, 2025

Record Drone Attack On Ukraine Russias Escalation

May 19, 2025 -

Recordando Los Exitos Espanoles En Eurovision Cuando Estuvo Espana Cerca De Ganar

May 19, 2025

Recordando Los Exitos Espanoles En Eurovision Cuando Estuvo Espana Cerca De Ganar

May 19, 2025 -

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 19, 2025