US Tariff Pause Sends Euronext Amsterdam Stocks Up 8%

Table of Contents

The Impact of the US Tariff Pause on Euronext Amsterdam

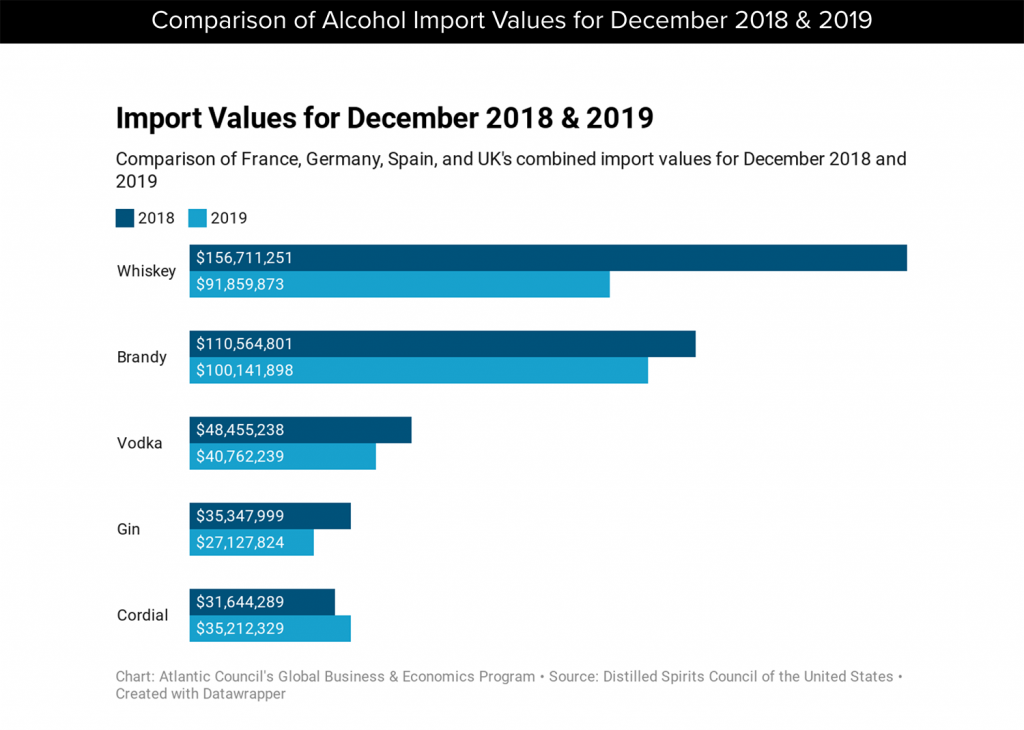

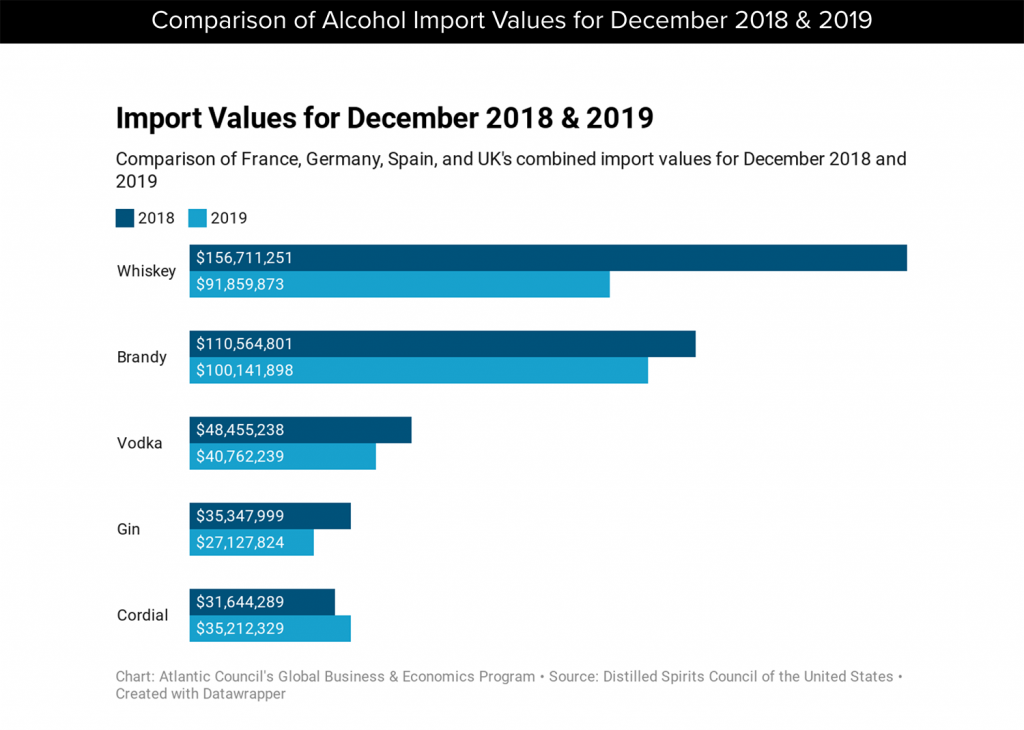

The relationship between US tariffs and Euronext Amsterdam-listed companies is complex but significant. Many European businesses, particularly those involved in manufacturing and exporting to the US, faced increased costs and reduced competitiveness due to previous tariffs. The pause on these tariffs effectively removes this burden, allowing companies to operate more efficiently and potentially increase their profitability.

Specific Sectors Affected

The technology and manufacturing sectors saw the most substantial gains following the tariff pause. These sectors are heavily reliant on international trade, and the reduction in trade barriers has provided a considerable boost.

- Technology: Companies involved in semiconductor manufacturing and software exports experienced significant price increases. For example, ASML Holding NV, a leading semiconductor equipment manufacturer, saw its stock price jump by over 10% in the days following the announcement. (Link to ASML financial report, if available).

- Manufacturing: Companies producing goods for export to the US, particularly in automotive and aerospace, benefited from the reduced tariffs. Examples include companies like Airbus (if listed on Euronext Amsterdam) which saw a notable surge in its share price. (Link to relevant financial reports, if available).

- Other Sectors: While technology and manufacturing saw the largest gains, other sectors, such as consumer goods and chemicals, also experienced positive impacts, albeit less pronounced.

Investor Sentiment and Market Reaction

The immediate market reaction to the news was overwhelmingly positive. Investors, who had previously expressed concerns about the negative impact of tariffs on European businesses, responded with enthusiasm. The surprise element played a significant role, as many analysts had not anticipated such a swift pause. Trading volumes increased substantially, indicating a heightened level of investor activity. The prevailing sentiment suggests that investors are cautiously optimistic about the future, but remain vigilant to potential future changes in trade policy.

Broader Implications for the European Economy

The pause in US tariffs has significant implications that extend far beyond the Euronext Amsterdam stock market. It offers a glimmer of hope for improved trade relations between the US and the EU, which could contribute to increased economic activity across the continent.

Impact on Trade Relations

The tariff pause signals a potential easing of trade tensions between the US and the EU. This could lead to increased trade volumes, fostering economic growth on both sides of the Atlantic. However, the situation remains fragile, and any resurgence of protectionist sentiment could quickly reverse the positive momentum.

Economic Growth Projections

Economists have revised their growth projections for the European economy upwards following the tariff pause. The positive impact on business confidence and investment is expected to contribute to improved GDP figures. Many experts believe that the pause, even if temporary, could provide a much-needed boost to economic growth, particularly in export-oriented sectors.

Future Outlook for Euronext Amsterdam Stocks

While the current upward trend is encouraging, investors should approach the future with caution. Sustained growth hinges on the continuation of the tariff pause and broader economic factors.

Risk Factors to Consider

Several factors could reverse the current positive trend:

- Renewal of Trade Tensions: The possibility of renewed trade disputes between the US and EU remains a significant risk. Any resurgence of protectionist measures could trigger another downturn in Euronext Amsterdam stocks.

- Global Economic Slowdown: A global economic slowdown could dampen the positive impact of the tariff pause, reducing demand for European goods and services.

- Geopolitical Uncertainty: Other geopolitical events could influence market sentiment and impact investor confidence.

Investment Strategies

The pause on US tariffs presents a potentially attractive investment opportunity in Euronext Amsterdam stocks. However, investors should carefully consider their risk tolerance and diversify their portfolios. A long-term perspective is advisable, recognizing that market volatility is inherent. Consult with a financial advisor before making any investment decisions.

Conclusion

The significant rise in Euronext Amsterdam stocks following the US tariff pause is a clear indication of the positive impact that reduced trade barriers can have. The technology and manufacturing sectors experienced the most substantial gains, reflecting their dependence on international trade. The broader implications for the European economy are positive, although risks remain. The pause offers a potentially lucrative opportunity for investors in Euronext Amsterdam. However, it's crucial to stay informed about the evolving situation and conduct thorough research before making any investment decisions. Learn more about the impact of US tariffs on Euronext Amsterdam stocks and start building a strong investment portfolio today.

Featured Posts

-

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025 -

A Realistic Guide To Escaping To The Country

May 25, 2025

A Realistic Guide To Escaping To The Country

May 25, 2025 -

Apple Stock Wedbush Remains Bullish Even After Lowering Price Target

May 25, 2025

Apple Stock Wedbush Remains Bullish Even After Lowering Price Target

May 25, 2025 -

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 25, 2025

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 25, 2025 -

Apple Stock Forecast Will Aapl Reach 254 Investment Analysis

May 25, 2025

Apple Stock Forecast Will Aapl Reach 254 Investment Analysis

May 25, 2025

Latest Posts

-

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025 -

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025 -

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025