How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the net asset value of each share in the Amundi Dow Jones Industrial Average UCITS ETF. In simpler terms, it's the total value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. This figure reflects the underlying value of your investment in the ETF.

-

Definition: For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV represents the market value of the 30 Dow Jones Industrial Average (DJIA) constituent stocks held by the ETF, less any expenses or liabilities. It's a snapshot of the ETF's worth at a specific point in time.

-

Calculation: The NAV is calculated daily using the following formula:

(Total Assets - Total Liabilities) / Number of Outstanding SharesFor example, if the ETF holds assets worth €100 million, has liabilities of €1 million, and there are 10 million shares outstanding, the NAV would be (€100 million - €1 million) / 10 million shares = €9.90 per share.

-

Impact of Market Fluctuations: The daily market movements of the 30 companies comprising the Dow Jones Industrial Average directly influence the ETF's NAV. If the Dow rises, the NAV of the Amundi Dow Jones Industrial Average UCITS ETF will generally rise as well, and vice versa.

-

Frequency of Calculation: The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated and published daily, usually at the close of market trading.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is key to interpreting NAV movements accurately.

-

Underlying Asset Performance: This is the most significant factor. The performance of the 30 individual stocks within the Dow Jones Industrial Average directly impacts the overall value of the ETF. A strong performance by the underlying stocks generally leads to a higher NAV, and poor performance results in a lower NAV.

-

Currency Fluctuations: For investors holding the ETF in a currency different from the base currency (likely USD or EUR), exchange rate fluctuations between the investor's currency and the ETF's base currency will affect the NAV expressed in their local currency.

-

Expenses and Fees: The ETF incurs management fees and other operational expenses. While these expenses are relatively small, they have a cumulative effect over time, slightly reducing the NAV.

-

Dividend Distributions: The underlying Dow Jones stocks pay dividends. The Amundi Dow Jones Industrial Average UCITS ETF may either reinvest these dividends into purchasing more shares of the underlying stocks (leading to potential growth in NAV) or distribute them directly to shareholders (which would reduce the NAV immediately after the distribution). The ETF's prospectus will clearly indicate its dividend reinvestment policy.

Analyzing NAV Changes Over Time

Monitoring NAV changes over time provides valuable insights into the ETF's long-term performance.

-

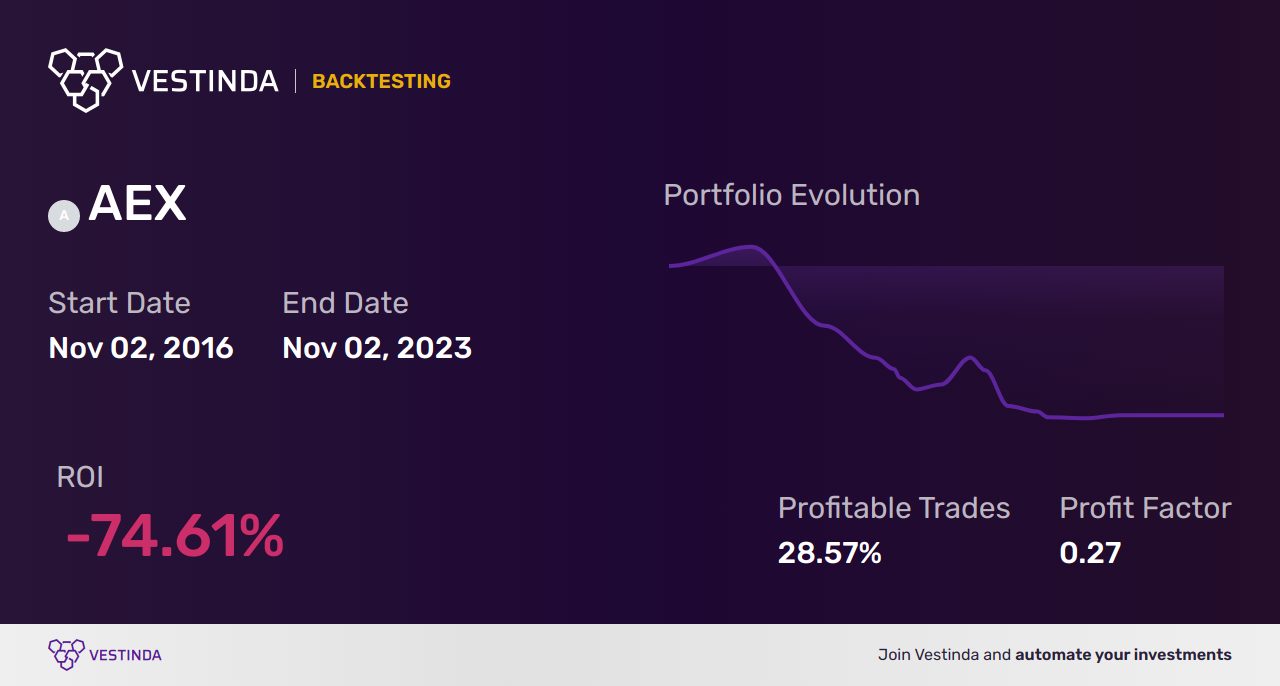

Trend Analysis: Tracking the NAV over weeks, months, and years allows you to identify upward or downward trends, indicating the overall performance of your investment.

-

Comparing to Benchmark: Compare the ETF's NAV performance against the Dow Jones Industrial Average index itself. This comparison helps assess how effectively the ETF tracks its benchmark index.

-

Using Charts and Graphs: Visual representations such as line graphs, showing NAV changes over time, provide a clearer picture of performance patterns than simply looking at numerical data.

Using NAV to Make Informed Investment Decisions

While NAV is a critical piece of information, it shouldn't be the sole factor driving your investment decisions.

-

Buying and Selling Strategies: Some investors use NAV as a partial indicator for buying low (when NAV is relatively low) and selling high (when NAV is relatively high). However, timing the market based solely on NAV is risky and not always successful.

-

Evaluating Performance: Compare the percentage change in NAV over a period to evaluate the ETF's performance relative to its stated investment objective (tracking the Dow Jones Industrial Average).

-

Risk Assessment: Understanding the volatility of the NAV, and therefore the price of the ETF, helps you assess the level of risk involved in this investment.

-

Comparison with other ETFs: Compare the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF with similar ETFs tracking the Dow Jones Industrial Average or other relevant indices to assess relative performance and choose the best option for your portfolio.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decisions. By analyzing the factors that influence the NAV and tracking its performance over time, you gain a better understanding of its potential and manage risk effectively. Remember to consider the NAV alongside other market indicators and your overall investment strategy. Regularly monitor the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment to make optimal investment choices. Learn more about interpreting the Net Asset Value and other investment strategies today!

Featured Posts

-

First Official Ferrari Service Centre Opens In Bengaluru An Inside Look

May 24, 2025

First Official Ferrari Service Centre Opens In Bengaluru An Inside Look

May 24, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025 -

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025 -

Solve New York Times Connections 646 Hints And Answers For March 18 2025

May 24, 2025

Solve New York Times Connections 646 Hints And Answers For March 18 2025

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Its Net Asset Value

May 24, 2025

Latest Posts

-

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025