IMF's $1.3 Billion Loan To Pakistan: A Review Amidst Regional Instability

Table of Contents

Economic Conditions Preceding the Loan

Pakistan's Debt Crisis

Pakistan's economy faced a severe crisis before securing the IMF loan. Years of political instability, coupled with unsustainable fiscal policies and a reliance on imports, led to a mounting debt burden. This crippling debt, exceeding $100 billion, left Pakistan struggling to meet its financial obligations and maintain basic public services.

- Debt Figures: Pakistan's external debt reached alarming levels, exceeding 40% of its GDP in recent years. Significant portions of this debt are owed to various international lenders, including China, Saudi Arabia, and the World Bank.

- Economic Distress Indicators: The country witnessed hyperinflation, a rapidly depreciating currency (the Pakistani Rupee), and a significant slowdown in economic growth. These indicators pointed to a looming economic collapse.

- Key contributing factors: Climate change impacts, particularly devastating floods, further exacerbated the situation, causing significant damage to infrastructure and agriculture, adding billions to the recovery cost.

IMF's Conditions for the Loan

The IMF loan wasn't a blank check. It came with stringent conditions designed to ensure Pakistan's fiscal sustainability and structural reforms. These conditions typically involve:

- Fiscal Consolidation: Implementing austerity measures, including reducing government spending and increasing taxation.

- Structural Adjustments: Reforming state-owned enterprises, promoting privatization, and improving governance.

- Exchange Rate Management: Allowing greater flexibility in the exchange rate to reflect market forces.

While these measures aim to improve Pakistan's long-term economic health, their short-term impacts can be harsh, potentially leading to social unrest and increased poverty if not implemented carefully and coupled with adequate social safety nets. The success hinges on effective implementation and the government’s commitment to reform.

Geopolitical Implications and Regional Instability

Pakistan's Relations with Neighboring Countries

Pakistan's geopolitical landscape significantly impacts its economic prospects. Strained relations with neighboring India, ongoing conflicts in Afghanistan, and regional power dynamics create economic instability. These tensions often disrupt trade, deter foreign investment, and exacerbate security concerns.

- India-Pakistan Tensions: The ongoing dispute over Kashmir significantly impacts trade and investment between the two countries, hindering Pakistan’s economic growth.

- Afghanistan's Instability: The volatile security situation in Afghanistan affects Pakistan's border security and its trade routes, creating economic uncertainty.

- Impact on IMF Assessment: These geopolitical risks influence the IMF's assessment of Pakistan's creditworthiness and its willingness to provide further financial assistance.

International Security Concerns

Terrorism and regional conflicts pose considerable risks to Pakistan's economic stability. These issues undermine investor confidence, hindering foreign direct investment (FDI) and capital inflows crucial for economic recovery.

- Investor Confidence: Security concerns directly affect investor perception, making Pakistan a less attractive destination for FDI.

- Security Spending: A significant portion of Pakistan's budget is allocated to security, diverting resources from essential social programs and economic development initiatives.

Long-Term Sustainability and Prospects

Potential for Economic Recovery

The IMF loan provides a crucial lifeline, but it's not a guarantee of long-term recovery. Success hinges on several factors:

- Effective Implementation of Reforms: The government's commitment to implementing the IMF's conditions is paramount.

- Foreign Investment: Attracting significant foreign investment to boost economic growth and create jobs is essential.

- Political Stability: A stable political environment is crucial for fostering investor confidence and economic growth.

- Tackling Corruption: Addressing corruption within government institutions and improving governance is critical for long-term sustainability.

Alternative Development Strategies

Pakistan needs to consider alternative economic strategies for sustainable development and reducing reliance on IMF bailouts. This could include:

- Diversification of the Economy: Reducing dependence on a few key sectors (e.g., textiles) and diversifying into other industries.

- Promoting Local Industries: Supporting domestic businesses and entrepreneurs through targeted policies and investments.

- Sustainable Agriculture: Investing in climate-resilient agricultural practices to improve food security and reduce reliance on imports.

Conclusion

The IMF's $1.3 billion loan to Pakistan represents a temporary reprieve, offering some short-term stability but not a long-term solution to the country's deep-seated economic problems. The loan's success depends on effective implementation of economic reforms, coupled with a stable political environment and a concerted effort to address underlying geopolitical challenges. Sustained economic recovery requires a multifaceted approach, encompassing both structural reforms and a broader strategy for sustainable economic growth. The IMF’s $1.3 billion loan to Pakistan needs continued monitoring and critical analysis, focusing on its long-term impact on the nation's economy and its ability to navigate regional instability. Further research and discussion are vital to understand the complete picture and chart a course towards sustainable economic development for Pakistan.

Featured Posts

-

How To Check Madhyamik Result 2025 And Merit List Online

May 09, 2025

How To Check Madhyamik Result 2025 And Merit List Online

May 09, 2025 -

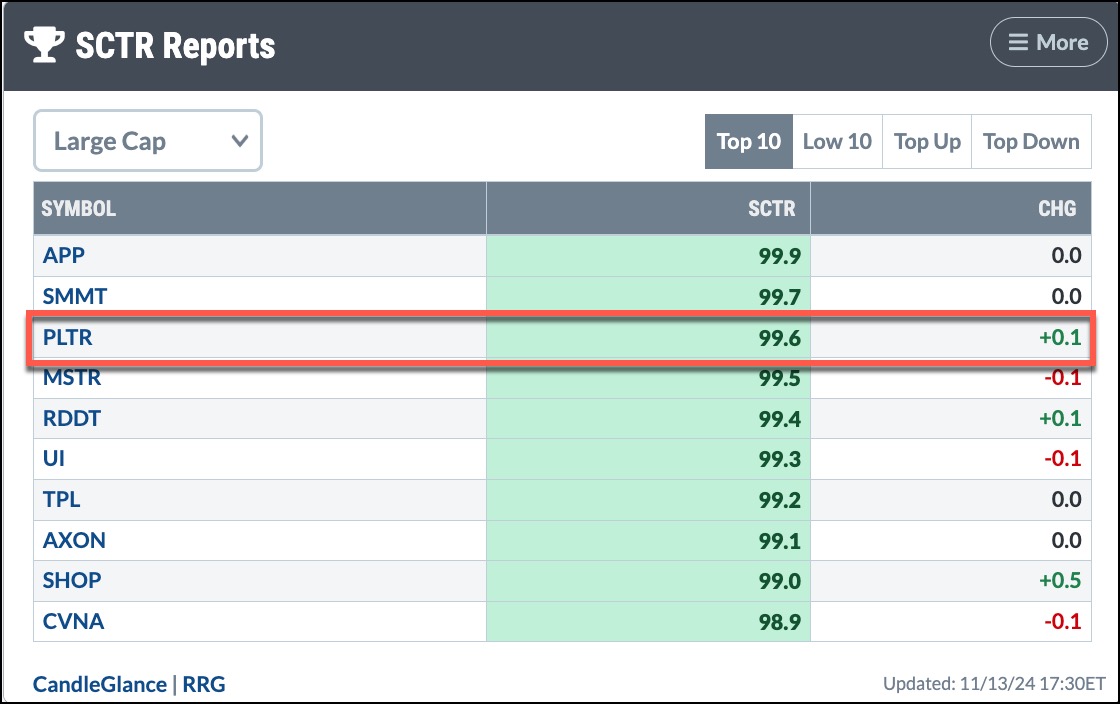

Investing In Palantir A Comprehensive Guide

May 09, 2025

Investing In Palantir A Comprehensive Guide

May 09, 2025 -

The Shifting Sands Of The Chinese Auto Industry A Look At Bmw And Porsches Experience

May 09, 2025

The Shifting Sands Of The Chinese Auto Industry A Look At Bmw And Porsches Experience

May 09, 2025 -

Analyzing Palantir Stock Before May 5th A Practical Approach

May 09, 2025

Analyzing Palantir Stock Before May 5th A Practical Approach

May 09, 2025 -

Lightnings Hit On Hertl Leaves Golden Knights Facing Potential Lineup Change

May 09, 2025

Lightnings Hit On Hertl Leaves Golden Knights Facing Potential Lineup Change

May 09, 2025