India's Large-Cap Stocks: Reliance Earnings Impact And Market Analysis

Table of Contents

Reliance Industries Q[Insert Quarter] Earnings Report: A Deep Dive

Reliance Industries' Q[Insert Quarter] earnings report revealed [Insert overall summary: e.g., strong performance across key sectors, mixed results, etc.]. Let's dissect the key performance indicators (KPIs) to understand the finer details.

- Revenue Growth: Reliance reported a [Insert Percentage]% increase/decrease in revenue compared to the same quarter last year, reaching ₹[Insert Revenue Figure] . This growth/decline can be attributed to [Insert reasons for revenue change, e.g., strong performance in Jio, increased retail sales, etc.].

- Profit Margin Analysis: The profit margin stood at [Insert Percentage]%, showcasing [Insert analysis: improvement, decline, or stability] compared to the previous quarter. Factors contributing to this include [Insert reasons for profit margin change, e.g., cost-cutting measures, increased operational efficiency, etc.].

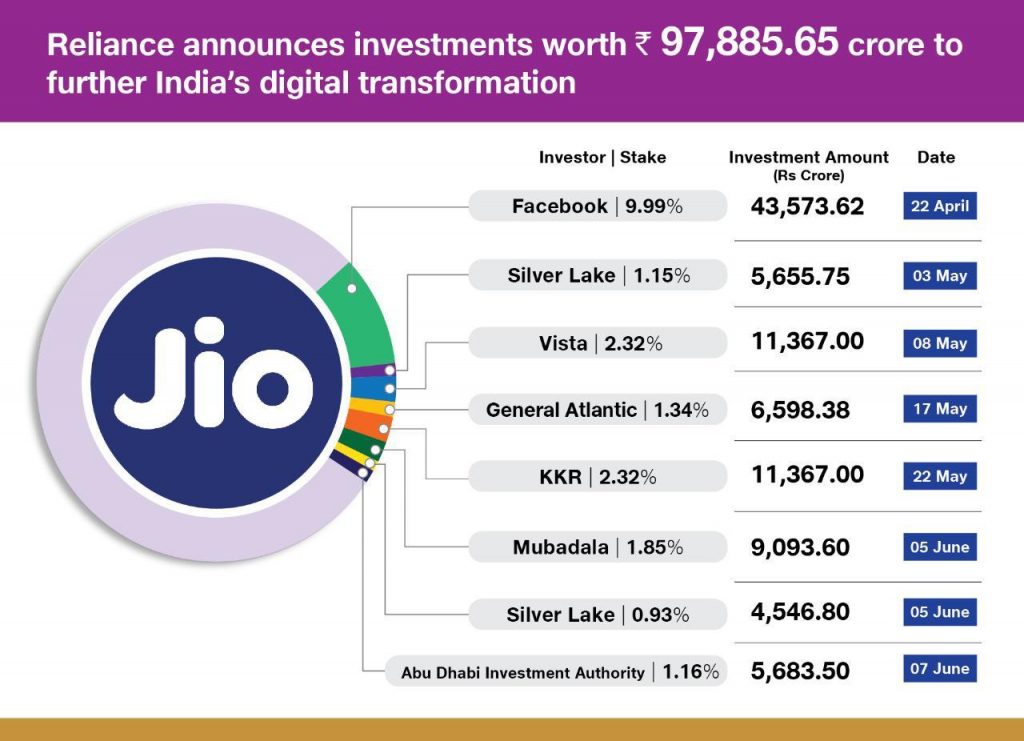

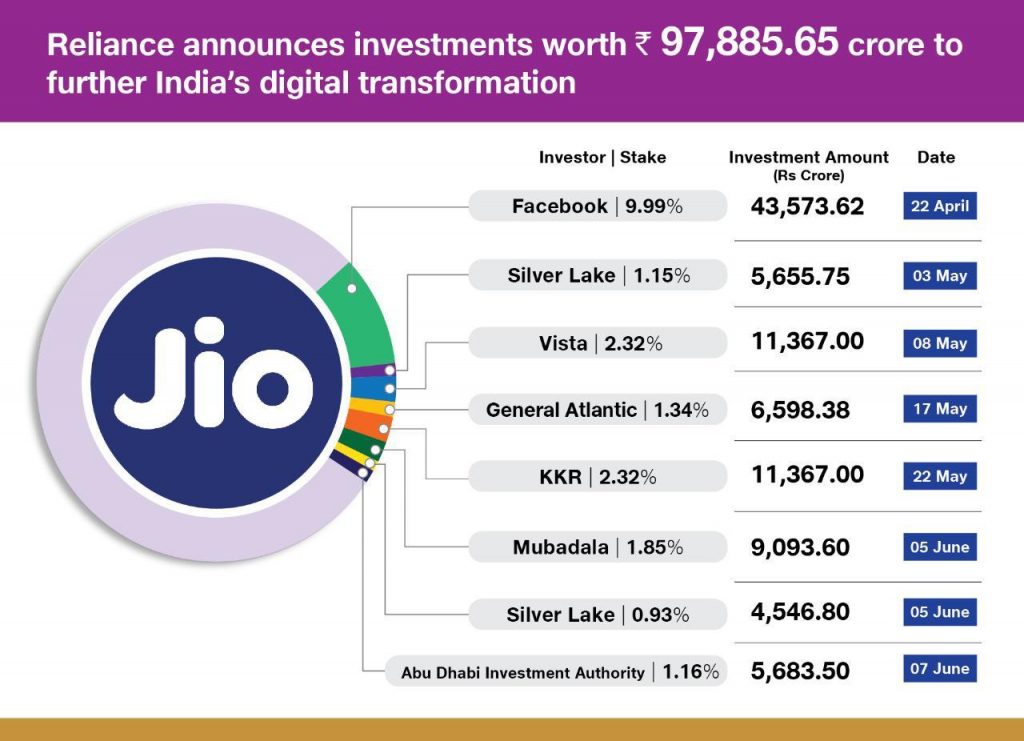

- Debt and Investments: Reliance's debt levels [Insert description: increased, decreased, remained stable] while investments in [Insert specific areas of investment] have [Insert impact: yielded positive results, require further evaluation, etc.].

- Unexpected Developments: A significant development during this quarter was [Insert any unexpected event, e.g., a major new partnership, a regulatory change, etc.], which [Insert impact of the event on the earnings].

The Reliance Industries earnings, particularly the EPS Reliance figure of [Insert EPS], are crucial for understanding the overall health of the company and its potential impact on the market. The revenue growth Reliance experienced shows the continued strength of its various business units, while the profit margin Reliance maintains reveals important insights into its operational efficiency.

Impact on the broader Indian Large-Cap Market

Reliance's performance is intrinsically linked to the overall health of the Indian large-cap index. A strong showing from Reliance generally boosts investor confidence, leading to positive sentiment across the broader market. Conversely, weak performance can trigger market volatility and negatively impact other large-cap stocks.

- Index Impact: The Nifty 50 and SENSEX indices, key indicators of the Indian stock market, showed [Insert description of index reaction: a positive correlation, a negative correlation, or no significant correlation] with Reliance's Q[Insert Quarter] earnings.

- Sectoral Impact: The telecom sector, heavily influenced by Reliance Jio, witnessed [Insert description of impact: a surge, a dip, or no significant change] following the earnings announcement. Similarly, the energy and petrochemicals sectors also experienced [Insert description of impact].

- Short-term and Long-term Implications: The short-term impact of Reliance's earnings was [Insert description: a market rally, a correction, or subdued trading]. The long-term implications depend on [Insert factors influencing long-term outlook, e.g., sustained growth across business units, global economic conditions, etc.].

Sector-Specific Analysis: How Reliance Earnings Affected Different Sectors

Reliance's diverse business portfolio spans telecom (Reliance Jio), retail (Reliance Retail), energy, and petrochemicals. Therefore, its earnings impact various sectors.

- Telecom: Reliance Jio's performance directly influenced other telecom stocks. [Insert specific examples of how Jio's performance affected competitors].

- Retail: The performance of Reliance Retail impacted other retail stocks, with [Insert specific examples of impact].

- Energy and Petrochemicals: Reliance's energy and petrochemical performance had [Insert specific examples of the ripple effect on other companies in those sectors].

Future Outlook and Investment Implications for Large-Cap Stocks in India

Based on the analysis of Reliance's Q[Insert Quarter] earnings and its impact on the broader market, the outlook for India's large-cap stocks appears [Insert overall outlook: positive, cautiously optimistic, or uncertain].

- Investment Opportunities: Investors might consider focusing on [Insert specific sectors or stocks showing potential based on the analysis].

- Potential Risks: Factors such as [Insert potential risks, e.g., global economic slowdown, regulatory changes, etc.] could pose risks to the market.

- Factors for Future Investments: Thorough due diligence, considering diversification, and a long-term investment strategy are crucial for navigating the Indian stock market.

Conclusion: Summarizing the Impact of Reliance Earnings on India's Large-Cap Stocks

Reliance Industries' Q[Insert Quarter] earnings significantly impacted India's large-cap market. The performance of Reliance, especially the EPS Reliance and revenue growth Reliance figures, served as a key indicator of market sentiment. Understanding the correlation between Reliance's performance and the broader index is crucial for informed investment decisions. Analyzing sectoral impact helps investors refine their strategies. To make sound investment choices in India's large-cap stocks, staying updated on Reliance's future performance is essential. Subscribe to our newsletter for regular updates on India's large-cap stocks and insightful market analysis.

Featured Posts

-

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 29, 2025

Bof As Take Are High Stock Market Valuations A Cause For Concern

Apr 29, 2025 -

Ten New Nuclear Reactors Approved In China Implications For Energy And The Environment

Apr 29, 2025

Ten New Nuclear Reactors Approved In China Implications For Energy And The Environment

Apr 29, 2025 -

6 3 Twins Victory Mets Lose Middle Game Of Series

Apr 29, 2025

6 3 Twins Victory Mets Lose Middle Game Of Series

Apr 29, 2025 -

50 000 Fine For Anthony Edwards Nba Addresses Players Fan Interaction

Apr 29, 2025

50 000 Fine For Anthony Edwards Nba Addresses Players Fan Interaction

Apr 29, 2025 -

Are La Landlords Price Gouging After Recent Fires A Celebrity Weighs In

Apr 29, 2025

Are La Landlords Price Gouging After Recent Fires A Celebrity Weighs In

Apr 29, 2025

Latest Posts

-

Exclusive University Group Defies Trump Administration Policies

Apr 29, 2025

Exclusive University Group Defies Trump Administration Policies

Apr 29, 2025 -

Elite Universities Unite A Private Collective Challenges The Trump Administration

Apr 29, 2025

Elite Universities Unite A Private Collective Challenges The Trump Administration

Apr 29, 2025 -

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025 -

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025 -

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025