Individual Investors And Market Swings: Opportunities And Risks

Table of Contents

Market swings are an inherent part of investing. For individual investors, understanding these fluctuations is crucial for both mitigating risks and capitalizing on opportunities. Successfully navigating market volatility requires a blend of knowledge, discipline, and a well-defined investment strategy. This article will guide you through understanding market swings, identifying opportunities, managing risks, and ultimately, harnessing volatility for long-term profit.

Understanding Market Swings and Their Causes

Identifying the underlying causes of market movements is the first step towards effective investment management. This involves analyzing market trends, understanding different types of market swings, and acknowledging the limitations of predicting market movements.

Identifying Market Trends: Analyzing market trends involves a combination of technical and fundamental analysis, alongside monitoring key economic indicators. Technical analysis uses charts and indicators (like moving averages and the Relative Strength Index or RSI) to identify patterns and predict short-term price movements. Fundamental analysis focuses on a company's financial health and future prospects to assess its intrinsic value. Economic indicators such as inflation rates, GDP growth, and unemployment figures provide a broader macroeconomic context.

- Technical Indicators: Moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD).

- Fundamental Analysis: Price-to-earnings ratio (P/E), dividend yield, revenue growth, debt-to-equity ratio, return on equity (ROE).

- Economic Indicators: Inflation rate, Gross Domestic Product (GDP) growth, unemployment rate, consumer price index (CPI), interest rates.

Types of Market Swings: Market movements come in various forms and intensities. Corrections are relatively short-term declines (typically 10-20%), while bear markets are more prolonged periods of decline (often exceeding 20%). Bull markets, conversely, are characterized by sustained upward price movements. Understanding these different market phases is vital for adapting your investment strategy.

- Corrections: Short-term dips, often caused by temporary factors like profit-taking or specific news events.

- Bear Markets: Prolonged downturns, often associated with economic recessions or significant geopolitical events. These can last for months or even years.

- Bull Markets: Extended periods of upward price movement, often fueled by economic growth and investor optimism.

Predicting Market Swings (Limitations): While analysis helps to understand market trends, accurately predicting the timing and extent of market swings is extremely difficult, if not impossible. Unexpected events, such as geopolitical instability or unforeseen economic data releases, can dramatically impact market sentiment and prices. Trying to time the market perfectly is generally a losing strategy for individual investors.

- Unpredictable Events: Geopolitical risks (wars, political instability), natural disasters, unexpected economic reports (e.g., unexpectedly high inflation), technological disruptions.

- Market Sentiment: Investor psychology plays a crucial role in market movements. Fear and greed can drive irrational behavior, leading to market bubbles and crashes.

Opportunities Presented by Market Swings

Market swings, while presenting risks, also provide unique opportunities for savvy investors. By understanding these opportunities and employing suitable strategies, individual investors can potentially increase their returns.

Dollar-Cost Averaging (DCA): Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy mitigates the risk of investing a lump sum at a market peak.

- Advantages of DCA: Reduces the impact of market volatility, simplifies the investment process, psychologically easier than trying to time the market.

- Implementation: Regular contributions (e.g., monthly) to a chosen investment (e.g., index fund, ETF).

- Effectiveness: Most effective during periods of market uncertainty, as it averages out purchase prices over time.

Value Investing During Market Corrections: Market corrections often create opportunities to acquire undervalued assets. By focusing on fundamental analysis, investors can identify companies with strong long-term prospects trading below their intrinsic value.

- Finding Undervalued Stocks: Analyze financial statements, compare to industry peers, consider future growth potential, look for companies with strong balance sheets and consistent earnings.

- Importance of Fundamental Analysis: Focus on intrinsic value rather than short-term price fluctuations.

- Risk Mitigation: Diversify investments and maintain a long-term perspective. Don't panic sell during market downturns.

Strategic Asset Allocation: Diversification is crucial for managing risk. By spreading investments across different asset classes (stocks, bonds, real estate, alternative investments, etc.), investors can reduce the impact of any single asset's underperformance. Regularly rebalancing your portfolio ensures you maintain your target asset allocation.

- Diversification: Spreading investments across different asset classes to reduce overall portfolio risk. This helps to smooth out returns over time.

- Rebalancing: Adjusting your portfolio periodically (e.g., annually or semi-annually) to maintain your desired asset allocation. This involves selling some assets that have performed well and buying more of those that have underperformed.

Risks Associated with Market Swings

While opportunities abound, market volatility also presents significant risks. Understanding and mitigating these risks is crucial for protecting your investments.

Emotional Investing: Fear and greed can significantly impair investment decisions. Fear often leads to selling during market downturns, locking in losses, while greed can lead to overconfidence and excessive risk-taking during bull markets.

- Emotional Biases: Fear of missing out (FOMO), herd mentality, overconfidence bias, confirmation bias.

- Mitigation Strategies: Develop a well-defined investment plan, stick to your strategy, avoid making impulsive decisions based on emotions, seek professional advice if needed.

Loss Aversion and its Impact: The pain of losses often outweighs the pleasure of equivalent gains. This psychological bias can lead investors to hold onto losing investments for too long, hoping for a recovery, leading to even greater losses.

- Behavioral Finance: Understanding the psychological factors that influence investment decisions is key to making rational investment choices.

- Risk Tolerance: Understanding your own comfort level with risk and aligning your investment strategy accordingly.

- Stop-Loss Orders: Setting predetermined limits to reduce potential losses. These automatically sell your investment if it drops below a certain price.

Market Timing Risks: Attempting to time the market – buying low and selling high – is notoriously difficult and rarely successful. Most investors struggle to consistently predict market tops and bottoms. Focusing on long-term strategies is generally more effective than trying to time the market.

- Difficulty of Market Timing: Predicting market movements with accuracy is extremely challenging, even for professional investors.

- Long-Term Strategy: Focus on long-term investment goals rather than trying to time the market. A buy-and-hold strategy is often a more successful approach for individual investors.

Conclusion: Harnessing Market Swings for Long-Term Success

Understanding the dynamics of individual investors and market swings is paramount for long-term investment success. By combining knowledge of market trends, strategic asset allocation, and disciplined risk management, investors can mitigate the risks associated with market volatility and harness the opportunities it presents. Develop a robust investment plan aligned with your risk tolerance and long-term financial goals to effectively navigate market swings and achieve your financial objectives. Remember, consistent, well-informed investing, rather than trying to time the market perfectly, is key to long-term success with individual investors and market swings. Consider seeking professional financial advice if you need assistance in developing your investment strategy.

Featured Posts

-

Exploring The Florida Keys From Railroad To Scenic Route

Apr 28, 2025

Exploring The Florida Keys From Railroad To Scenic Route

Apr 28, 2025 -

Ai Browser Wars An Interview With Perplexitys Ceo

Apr 28, 2025

Ai Browser Wars An Interview With Perplexitys Ceo

Apr 28, 2025 -

Extreme Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

Extreme Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Analyzing The Countrys Top Business Locations For 2024 Or Relevant Year

Apr 28, 2025

Analyzing The Countrys Top Business Locations For 2024 Or Relevant Year

Apr 28, 2025 -

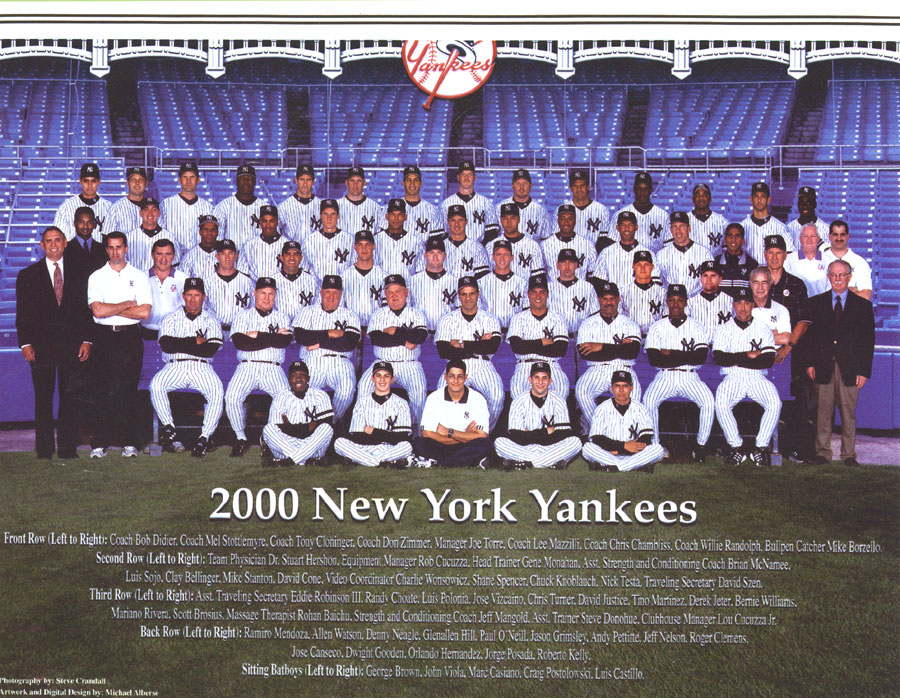

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025

Latest Posts

-

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025 -

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025 -

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025