To Buy Or Not To Buy Palantir Stock Before May 5th: A Wall Street Perspective

Table of Contents

1. Introduction:

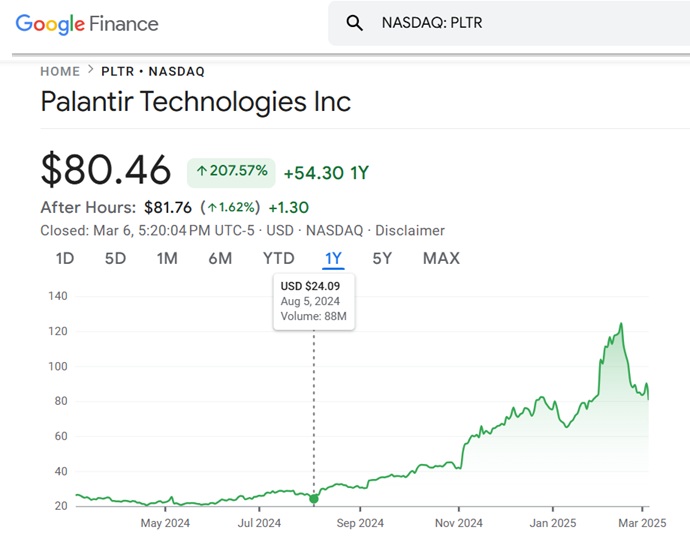

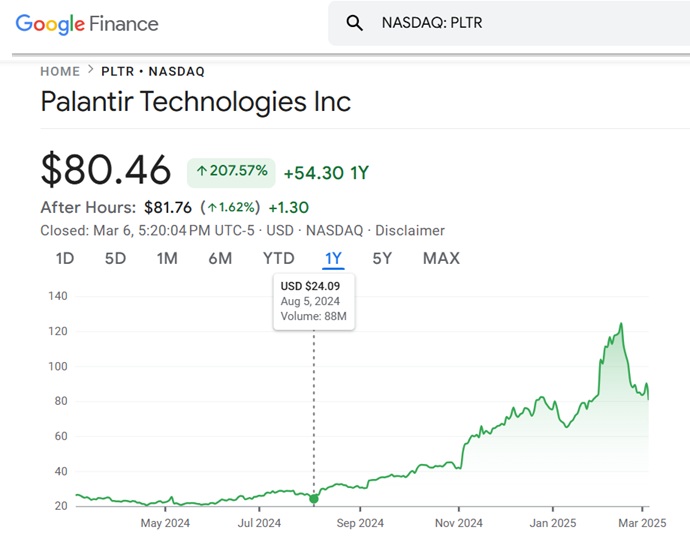

Palantir's stock price has experienced significant volatility lately, fueled by speculation surrounding its upcoming Q1 2024 earnings report and potential major contract announcements. The company, known for its sophisticated data analytics platforms used by government agencies and commercial enterprises, plays a vital role in the burgeoning big data and artificial intelligence market. This analysis aims to assess whether buying Palantir stock before May 5th presents a sound investment opportunity from a Wall Street perspective, considering the upcoming events and current market dynamics.

2. Main Points:

H2: Palantir's Recent Financial Performance and Future Projections:

H3: Q1 2024 Earnings Expectations: Analysts are keenly awaiting Palantir's Q1 2024 earnings report. While precise figures remain elusive until the official release, projections suggest continued revenue growth, though profitability may still be a challenge. Key financial metrics like EPS (Earnings Per Share), revenue growth rate, and operating margin will be under intense scrutiny.

- Potential for exceeding expectations: Successful new contract wins, particularly in the rapidly expanding AI sector, could significantly boost earnings and investor confidence.

- Potential for falling short of expectations: Unforeseen delays in contract signings or increased competition could impact revenue and profitability, potentially leading to negative market reactions.

- Significant news impacting projections: Any announcements concerning major partnerships or strategic initiatives before May 5th will heavily influence the market's perception of Palantir's short-term outlook. Keep an eye on official press releases and financial news outlets for updates.

H3: Long-Term Growth Potential: Palantir's long-term growth prospects are promising, driven by several key factors. The increasing demand for advanced data analytics across various sectors, coupled with Palantir's strong foothold in government and commercial markets, positions the company for sustained expansion. Furthermore, its growing involvement in the AI space offers significant opportunities for future growth.

- Market opportunities and competitive advantages: Palantir's unique platform offers advanced capabilities in data integration, analysis, and visualization, setting it apart from competitors. Its strong relationships with government agencies and large corporations provide a solid foundation for future growth.

- Key partnerships and technological advancements: Strategic partnerships and continuous investment in research and development are vital for maintaining a competitive edge. Successful implementations of its AI-powered solutions will be crucial in demonstrating its value proposition.

- Examples of successful implementations: Highlighting successful case studies showcasing the impact of Palantir's platforms on its clients will enhance investor confidence and underscore the company's long-term value.

H2: Analyzing Key Risk Factors for Palantir Stock:

H3: Valuation and Market Sentiment: Palantir's valuation relative to its peers and overall market conditions plays a critical role. Comparing its P/E ratio, market capitalization, and other valuation metrics to competitors like Snowflake and Databricks is essential for assessing its attractiveness. Market sentiment towards the stock, influenced by broader economic factors and investor confidence, adds another layer of complexity.

- P/E ratio, market capitalization, and other valuation metrics: These metrics are essential in determining whether Palantir is currently overvalued or undervalued compared to its peers and historical trends.

- Potential market risks, including economic downturns or shifts in investor confidence: Macroeconomic factors such as interest rate hikes, inflation, or a potential recession can significantly impact investor sentiment and consequently, Palantir's stock price.

H3: Geopolitical and Regulatory Risks: Palantir operates in a sector sensitive to geopolitical events and regulatory changes. Data privacy concerns and international relations can impact its operations and contract awards.

- Specific geopolitical events or regulatory changes that could impact Palantir's business: Any shifts in government policies regarding data security or international relations could influence the demand for Palantir's services.

- The company's mitigation strategies: Analyzing Palantir's strategies for navigating these risks, such as compliance efforts and diversification of its customer base, is crucial for a comprehensive assessment.

H2: Comparing Palantir to Competitors in the Data Analytics Sector:

H3: Competitive Landscape Analysis: The data analytics sector is fiercely competitive. Comparing Palantir's strengths and weaknesses against key rivals like Snowflake and Databricks is crucial.

- Market share, technological capabilities, and customer bases: Analyzing the relative market share, technical capabilities, and customer bases of Palantir and its competitors provides insight into its competitive positioning.

- Competitive advantages and disadvantages of Palantir: Identifying Palantir's unique selling points, such as its government connections or proprietary algorithms, alongside its potential weaknesses, such as its high valuation or dependence on specific clients, offers a nuanced view of its prospects.

H2: Expert Opinions and Wall Street Analyst Ratings:

H3: Consensus View on Palantir Stock: Consulting reputable financial news sources and analyst reports provides valuable insights into Wall Street's collective view on Palantir stock.

- Specific analysts and their recommendations: Gathering diverse opinions from leading analysts helps gauge the range of expectations and potential outcomes for Palantir stock.

- Range of opinions and potential discrepancies: Analyzing the range of analyst ratings and target prices allows for a more informed decision, acknowledging the inherent uncertainties in market predictions.

- Links to reputable financial news sources: Referencing sources like the Wall Street Journal, Bloomberg, and reputable financial analysis firms adds credibility and transparency to the analysis.

3. Conclusion:

This analysis has highlighted both the potential upside and downside of investing in Palantir stock before May 5th. While Palantir possesses long-term growth potential fueled by the expanding AI and data analytics markets, significant short-term risks related to earnings reports, market sentiment, and geopolitical factors remain. Therefore, a cautious approach is recommended.

Final Recommendation: Based on the current information and analysis, a "hold" or "wait-and-see" approach before May 5th appears prudent. Allowing the Q1 2024 earnings report and any significant announcements to unfold before making any investment decision will provide greater clarity on Palantir's near-term trajectory.

Call to Action: Investing in Palantir stock, or any stock for that matter, requires thorough due diligence. Before making any investment decisions related to Palantir stock, conduct your own comprehensive research, consult with a qualified financial advisor, and consider your personal risk tolerance. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

White House Cocaine Incident Secret Service Announces Conclusion Of Investigation

May 09, 2025

White House Cocaine Incident Secret Service Announces Conclusion Of Investigation

May 09, 2025 -

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025 -

Rio Ferdinand Predicts Champions League Finalists Arsenals Chances

May 09, 2025

Rio Ferdinand Predicts Champions League Finalists Arsenals Chances

May 09, 2025 -

Snls Failed Harry Styles Impression His Honest Response

May 09, 2025

Snls Failed Harry Styles Impression His Honest Response

May 09, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Downturn

May 09, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Downturn

May 09, 2025

Latest Posts

-

Examining The Bangkok Posts Coverage Of Transgender Issues In Thailand

May 10, 2025

Examining The Bangkok Posts Coverage Of Transgender Issues In Thailand

May 10, 2025 -

Recent Bangkok Post Articles On Transgender Equality And Inclusion

May 10, 2025

Recent Bangkok Post Articles On Transgender Equality And Inclusion

May 10, 2025 -

Have You Been Affected Sharing Transgender Experiences Under Trumps Executive Orders

May 10, 2025

Have You Been Affected Sharing Transgender Experiences Under Trumps Executive Orders

May 10, 2025 -

The Bangkok Post And The Push For Transgender Rights In Thailand

May 10, 2025

The Bangkok Post And The Push For Transgender Rights In Thailand

May 10, 2025 -

The Effect Of Trumps Executive Orders On Transgender Individuals

May 10, 2025

The Effect Of Trumps Executive Orders On Transgender Individuals

May 10, 2025