Infineon's (IFX) Revised Sales Outlook: Impact Of Trump Tariffs

Table of Contents

The Trump Tariffs and Their Impact on the Semiconductor Industry

The Trump administration implemented tariffs on various imported goods, including semiconductors and related components. These tariffs, intended to protect domestic manufacturers, had significant unintended consequences for the global semiconductor market. The increased costs associated with importing essential raw materials and components led to a ripple effect, impacting the entire supply chain.

The general effects of these tariffs included:

- Increased costs: Manufacturers faced higher import costs for essential components, directly impacting their production costs and profit margins.

- Supply chain disruptions: The imposition of tariffs disrupted established supply chains, leading to delays and uncertainty for many companies.

- Price increases: To offset increased costs, many semiconductor companies, including Infineon, were forced to increase the prices of their products, potentially reducing global demand.

- Reduced global demand: Higher prices due to tariffs led to a decrease in overall global demand for semiconductors.

- Increased competition from domestic manufacturers: While intended, the actual effect of increased competition from domestic manufacturers was limited due to the global nature of the semiconductor supply chain.

- Potential for retaliatory tariffs: The tariffs imposed by the US prompted retaliatory measures from other countries, further complicating the global trade landscape and impacting the semiconductor industry.

Infineon's Initial Sales Projections and Subsequent Revisions

Before the full impact of the Trump tariffs became evident, Infineon (IFX) had released initial sales projections for [Insert timeframe and specific figures if available, citing source]. However, as the tariffs took effect and their consequences unfolded, Infineon was forced to revise its sales outlook. [Insert dates and revised sales figures with sources]. Infineon attributed these revisions primarily to the increased costs associated with tariffs and the resulting decline in demand.

Key aspects of these revisions include:

- Comparison of initial vs. revised sales figures: A clear quantifiable difference should be shown here, highlighting the percentage decrease.

- Specific segments of Infineon's business most affected: Identify the particular product lines or market segments experiencing the most significant negative impacts from the tariffs.

- Infineon's response strategies to mitigate tariff impacts: This could include measures like shifting production to other regions, negotiating with suppliers, and adjusting pricing strategies.

Analyzing the Financial Impact on Infineon (IFX)

The revised sales outlook had a direct and quantifiable impact on Infineon's (IFX) financial performance. The decrease in revenue projections naturally affected profit margins and earnings per share (EPS). This financial strain influenced investor sentiment, resulting in fluctuations in the IFX stock price.

The financial impact can be broken down as follows:

- Changes in revenue projections: Quantify the difference between projected and actual revenue, showcasing the direct financial hit.

- Impact on profit margins: Detail how the tariffs and revised outlook affected Infineon's profitability and margins.

- Effect on investor confidence and stock performance: Discuss the correlation between the news of the revised sales outlook and the subsequent reaction of the stock market.

- Comparison with competitors' performance: How did Infineon (IFX) fare compared to its main competitors in the semiconductor industry during this period? This offers valuable context.

Long-Term Implications and Future Outlook for Infineon (IFX)

The Trump tariffs had long-term consequences for Infineon's (IFX) strategic planning and market positioning. While the immediate effects were negative, the company has likely adapted its strategies to mitigate future trade risks. The potential for ongoing trade disputes remains, underscoring the importance of diversification and resilience in the semiconductor industry.

Looking towards the future:

- Infineon's long-term strategies for mitigating trade risks: Detail any strategies implemented to mitigate future trade-related risks, such as diversifying supply chains or exploring new markets.

- Potential for diversification of supply chains: Discuss how Infineon is working to lessen its reliance on any single region or supplier.

- Opportunities for growth in new markets: Identify potential opportunities for expansion and growth in emerging markets less susceptible to trade tensions.

- Predictions for future sales performance: Offer a cautious yet optimistic outlook for Infineon's future sales performance, considering the lessons learned from the tariff experience.

Conclusion: Understanding the Lasting Effects of Trump Tariffs on Infineon's (IFX) Sales Outlook

The Trump tariffs significantly impacted Infineon's (IFX) revised sales outlook, causing a measurable decrease in revenue and affecting its profitability. The financial implications were substantial, impacting investor confidence and the IFX stock price. These events highlight the vulnerability of the semiconductor industry to global trade policies and the importance of proactive risk management strategies. The lasting effects of these tariffs underscore the need for companies to build resilient supply chains and diversify their markets to navigate future trade uncertainties.

To stay informed about Infineon's (IFX) performance and the continued impact of trade policies on the semiconductor sector, stay updated on financial news outlets and company announcements. Further research into the global semiconductor market and trade relations will help you better understand the dynamics affecting companies like Infineon (IFX) and their future sales outlook.

Featured Posts

-

Democratizing Stock Investing The Jazz Cash K Trade Partnership

May 09, 2025

Democratizing Stock Investing The Jazz Cash K Trade Partnership

May 09, 2025 -

Harry Styles Sports A Retro Mustache In London

May 09, 2025

Harry Styles Sports A Retro Mustache In London

May 09, 2025 -

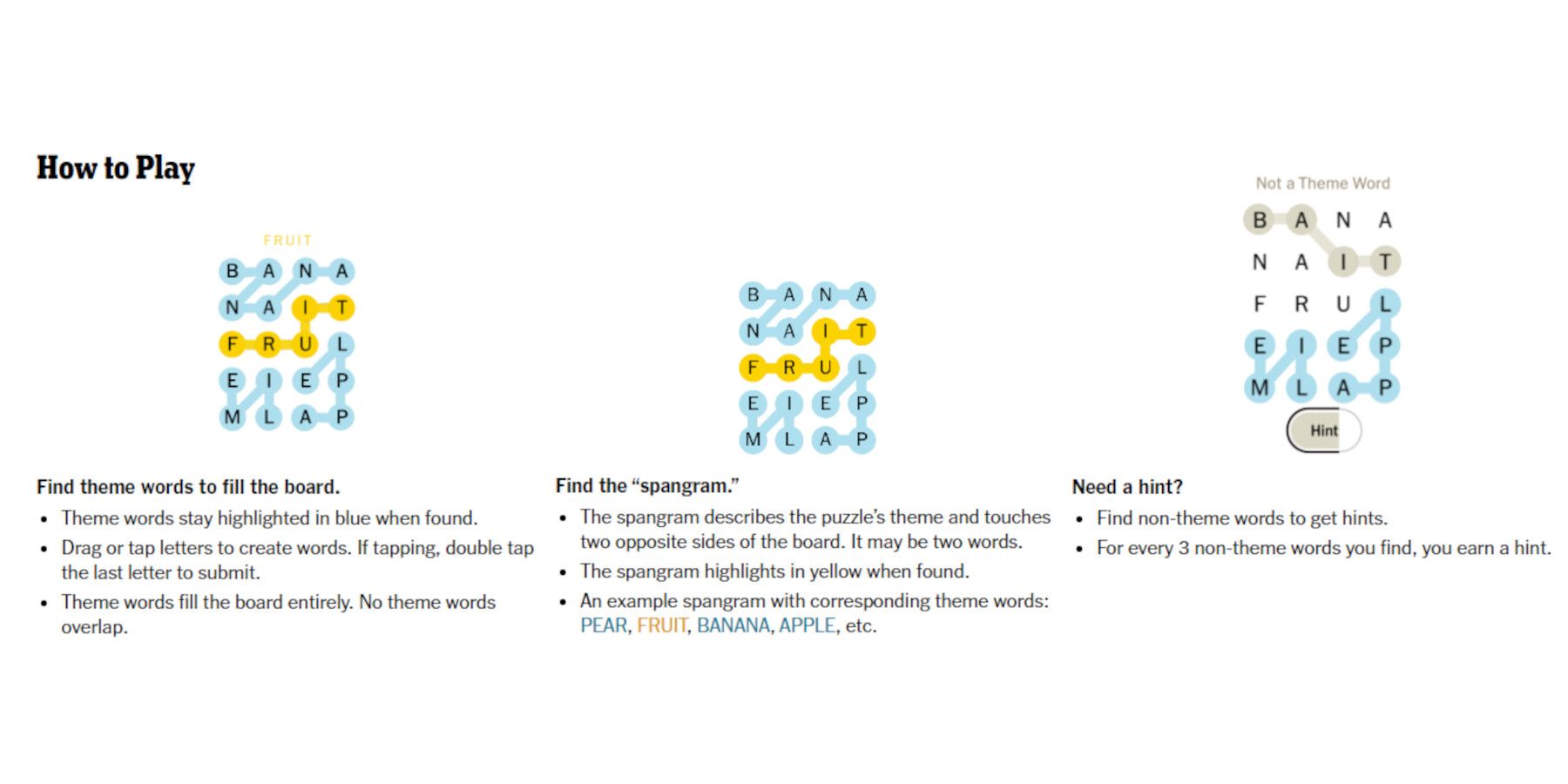

March 4th Nyt Strands Answers Game 366 Walkthrough

May 09, 2025

March 4th Nyt Strands Answers Game 366 Walkthrough

May 09, 2025 -

F1 Update Alpine Boss Delivers Defining Message To Doohan

May 09, 2025

F1 Update Alpine Boss Delivers Defining Message To Doohan

May 09, 2025 -

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025