Invest In Elon Musk's Private Ventures: A Lucrative Side Hustle

Table of Contents

Understanding the Appeal of Investing in Elon Musk's Companies

The allure of investing in Elon Musk's enterprises stems from a potent combination of factors. It's not just about the potential for financial gain; it's about being part of something transformative.

The Musk Effect

Elon Musk's name itself carries significant weight in the investment world. His reputation for innovation and disruptive business models creates a "Musk premium," driving investor confidence and often inflating valuations.

- Examples of successful Musk ventures and their returns: Tesla's stock price surge, SpaceX's multi-billion dollar valuation, and the early success of other ventures demonstrate his ability to create immense value.

- The Musk Premium: Investors often pay a premium for companies associated with Musk, reflecting the belief in his vision and leadership. This premium significantly impacts valuations, potentially leading to higher returns (but also higher risk).

- Psychological Aspects: The "Musk effect" taps into investor psychology. His visionary approach, coupled with a strong media presence, fosters a sense of excitement and belief in future potential, driving demand for his companies' stock or investment opportunities.

High-Growth Potential

Investing in early-stage, high-growth companies inherently carries substantial risk, but the potential rewards can be equally substantial. Musk's ventures operate in sectors poised for exponential growth:

- High-Growth Sectors: Space exploration (SpaceX), electric vehicles and renewable energy (Tesla), artificial intelligence (Neuralink), and infrastructure innovation (The Boring Company) are all characterized by significant future growth potential.

- Exponential Growth: These sectors are not expected to grow linearly but exponentially, meaning returns can be dramatically higher than in more established markets. However, this also means higher volatility.

- Due Diligence: Mitigating the risk involved requires rigorous due diligence. Understanding the company's financials, competitive landscape, and technological feasibility is crucial before committing any capital.

Accessing Investment Opportunities in Private Ventures

Gaining access to investment opportunities in Elon Musk's private ventures presents significant challenges for individual investors. Traditional routes often require substantial wealth or established networks.

Venture Capital and Private Equity

Venture capital (VC) and private equity (PE) firms are the primary channels for funding private companies like Musk's. Accessing these opportunities directly is difficult for individual investors:

- Connecting with VCs and PEs: Building relationships with VC and PE firms through networking events, industry conferences, and mentorship programs is a long-term strategy.

- Becoming a Limited Partner (LP): One route is becoming an LP in a VC or PE fund. This requires a substantial investment and typically involves sophisticated investors with high net worth.

- High Barriers to Entry: The requirements for individual investors to participate are high, often demanding significant capital and experience.

Investing Through Publicly Traded Companies

Indirect investment is a more accessible route. Tesla, a publicly traded company, provides a way to participate in Musk's ecosystem:

- Publicly Traded Options: Tesla is the most prominent example. Investing in Tesla provides exposure to Musk's influence and innovation in the EV and clean energy sectors. Other companies may offer indirect exposure through partnerships or collaborations.

- Liquidity and Diversification: Publicly traded companies offer greater liquidity compared to private investments. However, the level of direct exposure to Musk's private ventures is limited, and diversification is crucial.

- Market Volatility: Remember that even publicly traded companies associated with Musk can experience significant market volatility.

Alternative Investment Strategies

Less conventional avenues, though potentially riskier, might provide opportunities:

- Angel Investing: Angel investors provide funding to startups in exchange for equity. While less common for established figures like Musk, it's theoretically possible to find opportunities related to his ventures through a strong network.

- Crowdfunding Platforms: Some crowdfunding platforms support innovative projects. However, due diligence is paramount, as many projects on these platforms fail.

- High Risk, High Reward: These approaches offer a chance to participate in early-stage growth but involve significantly higher risk. Thorough research and a high tolerance for risk are essential.

Mitigating Risks and Conducting Due Diligence

Investing in private companies, especially those associated with high-profile individuals, involves significant risk.

Risk Assessment

The inherent volatility of these investments requires careful consideration of various risk factors:

- Market Fluctuations: Economic downturns can significantly impact valuations.

- Technological Disruptions: Rapid technological advancements could render certain ventures obsolete.

- Regulatory Changes: Government regulations and policies can impact a company’s operations and profitability.

- Diversification: Spread your investments across various assets to mitigate risk.

- Long-Term Perspective: High-growth companies often require a long-term investment horizon to realize their potential.

Thorough Research

Due diligence is crucial before committing to any investment:

- Financial Statements: Review the company’s financial performance and projections.

- Management Team: Assess the experience and capabilities of the management team.

- Competitive Landscape: Analyze the competitive environment and the company's market position.

- Intellectual Property: Understand the company’s intellectual property portfolio and its protection.

- Independent Advice: Consider seeking professional advice from financial advisors before making any investment decisions.

Conclusion

Investing in Elon Musk's private ventures can be a potentially lucrative side hustle, offering exposure to high-growth sectors and the chance to participate in transformative innovation. However, it’s essential to approach these investments with a clear understanding of the risks and rewards. By conducting thorough research, diversifying your portfolio, and employing a long-term perspective, you can navigate the challenges and potentially reap the substantial rewards. Start your journey toward potentially lucrative investments in Elon Musk's private ventures today!

Featured Posts

-

Verret Completes Delivery Of Mv Callaway Parker To Ptc

Apr 26, 2025

Verret Completes Delivery Of Mv Callaway Parker To Ptc

Apr 26, 2025 -

Stock Market Today Dow Futures Rise Strong Week Ahead

Apr 26, 2025

Stock Market Today Dow Futures Rise Strong Week Ahead

Apr 26, 2025 -

Your Guide To April Events Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025

Your Guide To April Events Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025 -

February 3rd Nyt Spelling Bee 337 Hints Solutions And Strategies

Apr 26, 2025

February 3rd Nyt Spelling Bee 337 Hints Solutions And Strategies

Apr 26, 2025 -

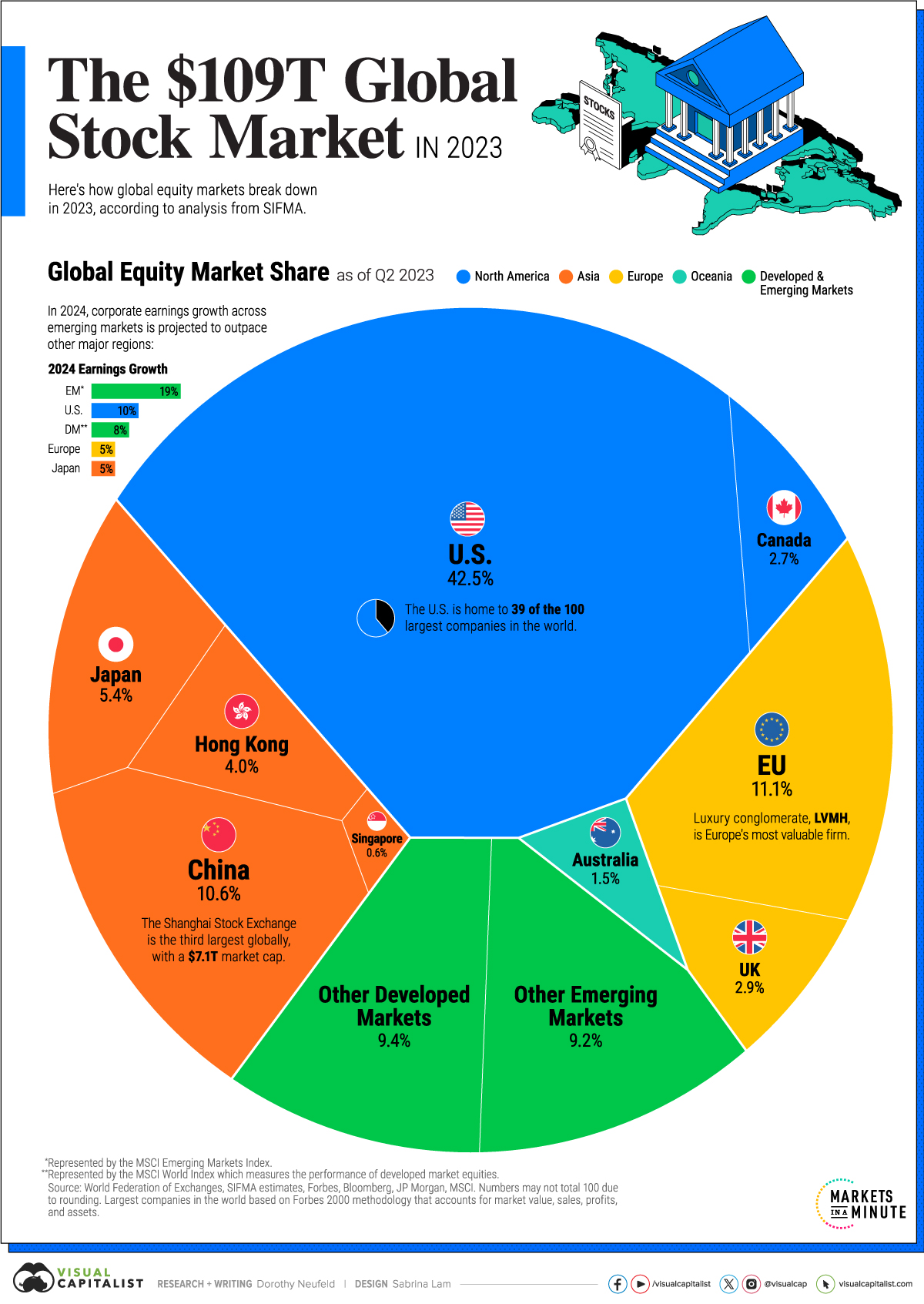

Stock Market Valuation Concerns Bof As Reassurance For Investors

Apr 26, 2025

Stock Market Valuation Concerns Bof As Reassurance For Investors

Apr 26, 2025

Latest Posts

-

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025 -

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025 -

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025 -

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025 -

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025