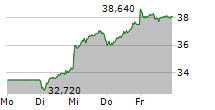

Stock Market Today: Dow Futures Rise, Strong Week Ahead

Table of Contents

Dow Futures Surge: A Positive Indicator

Analyzing the Dow Jones Industrial Average Futures

The increase in Dow futures is a significant positive indicator, reflecting a generally optimistic market sentiment. This suggests that investors are anticipating positive developments in the coming days and weeks.

- Percentage Increase: At the time of writing, Dow futures are up by X%, indicating a strong bullish sentiment. (Note: Replace X% with the actual percentage increase at the time of publishing).

- Trading Volume: High trading volume accompanies this increase, suggesting significant investor participation and confidence in the upward trend.

- Influencing News: Recent positive news regarding [mention specific news, e.g., easing trade tensions, positive corporate announcements] has likely contributed to this surge.

Technically, the Dow futures' breakout above the [mention resistance level] resistance level and the strengthening of positive momentum indicators like the [mention specific indicator, e.g., Relative Strength Index (RSI)] further reinforce the bullish outlook. This suggests a sustained upward trend is likely.

Impact on Other Major Indices

The positive momentum in Dow futures is expected to have a ripple effect on other major indices. The S&P 500 and Nasdaq are also likely to experience upward pressure.

- Projected Values: Based on current trends, the S&P 500 is projected to [mention projected value or percentage increase], while the Nasdaq is anticipated to [mention projected value or percentage increase].

- Investor Behavior: Investor confidence, bolstered by the Dow's performance, often leads to increased buying activity across all major indices, pushing them higher. This positive feedback loop is a key driver of market-wide growth.

Key Factors Driving the Market Upward

Positive Economic Data

Recent economic data releases have contributed significantly to investor confidence and the subsequent market upswing.

- Key Data Points: Positive employment numbers, showing [mention specific numbers, e.g., X thousand new jobs added], a decline in inflation to [mention percentage], and a robust GDP growth rate of [mention percentage] are all contributing factors.

- Impact on Sentiment: These positive indicators suggest a healthy and growing economy, reducing investor anxieties and encouraging further investment in equities.

Corporate Earnings Reports

Strong corporate earnings reports have further fueled market optimism.

- Strong Performers: Companies like [mention specific companies with strong earnings] have reported better-than-expected results, boosting investor confidence in their respective sectors and the broader market.

- Earnings Surprises: Positive earnings surprises, where companies exceed analysts' expectations, are often powerful catalysts for stock price increases and overall market sentiment.

Geopolitical Factors

While geopolitical events can often introduce volatility, current developments seem to be having a positive, or at least neutral, impact on the market.

- Current Situation: [Mention specific geopolitical events and their perceived impact. For example: "The recent de-escalation of tensions in [region] has reduced investor uncertainty."].

- Influence on Risk Appetite: A more stable geopolitical landscape generally translates to increased investor risk appetite, allowing for more investment in equities.

Outlook for the Week Ahead: Opportunities and Risks

Potential for Continued Growth

The positive momentum witnessed today suggests potential for continued growth throughout the week.

- Catalysts for Growth: Upcoming economic announcements, such as [mention specific announcements], and further corporate earnings reports could provide additional catalysts for upward movement.

- Support and Resistance Levels: While the upward trend is promising, it's important to monitor key support levels at [mention support levels] and resistance levels at [mention resistance levels] to gauge the sustainability of the current rally.

Identifying Potential Risks

Despite the positive outlook, investors should remain aware of potential risks that could trigger a market correction.

- Potential Risks: Unexpectedly weak economic data, renewed geopolitical instability, or a sudden shift in interest rate policies could negatively impact the market.

- Impact on Sentiment: Negative surprises can quickly reverse the current positive sentiment, leading to a sell-off and market decline.

Conclusion

In summary, Dow futures are up, signaling a potentially strong week ahead for the stock market. Positive economic data, strong corporate earnings, and a relatively stable geopolitical landscape are contributing to the upward trend. However, investors should remain vigilant and aware of potential risks. Understanding the nuances of the stock market, analyzing market trends, and consistently reviewing the Dow futures and other indices are key to successful trading and investment strategies.

Call to Action: Stay informed about the latest developments in the stock market today. Don't miss out on the opportunities – stay updated on the stock market today! Regularly check for updates to make informed decisions about your investments and trading activities.

Featured Posts

-

Find Kendrick Lamar And Sza Concert Tickets United Kingdom

Apr 26, 2025

Find Kendrick Lamar And Sza Concert Tickets United Kingdom

Apr 26, 2025 -

Krogkommissionens Recension Stockholm Stadshotell En Grundlig Bedoemning

Apr 26, 2025

Krogkommissionens Recension Stockholm Stadshotell En Grundlig Bedoemning

Apr 26, 2025 -

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025 -

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025 -

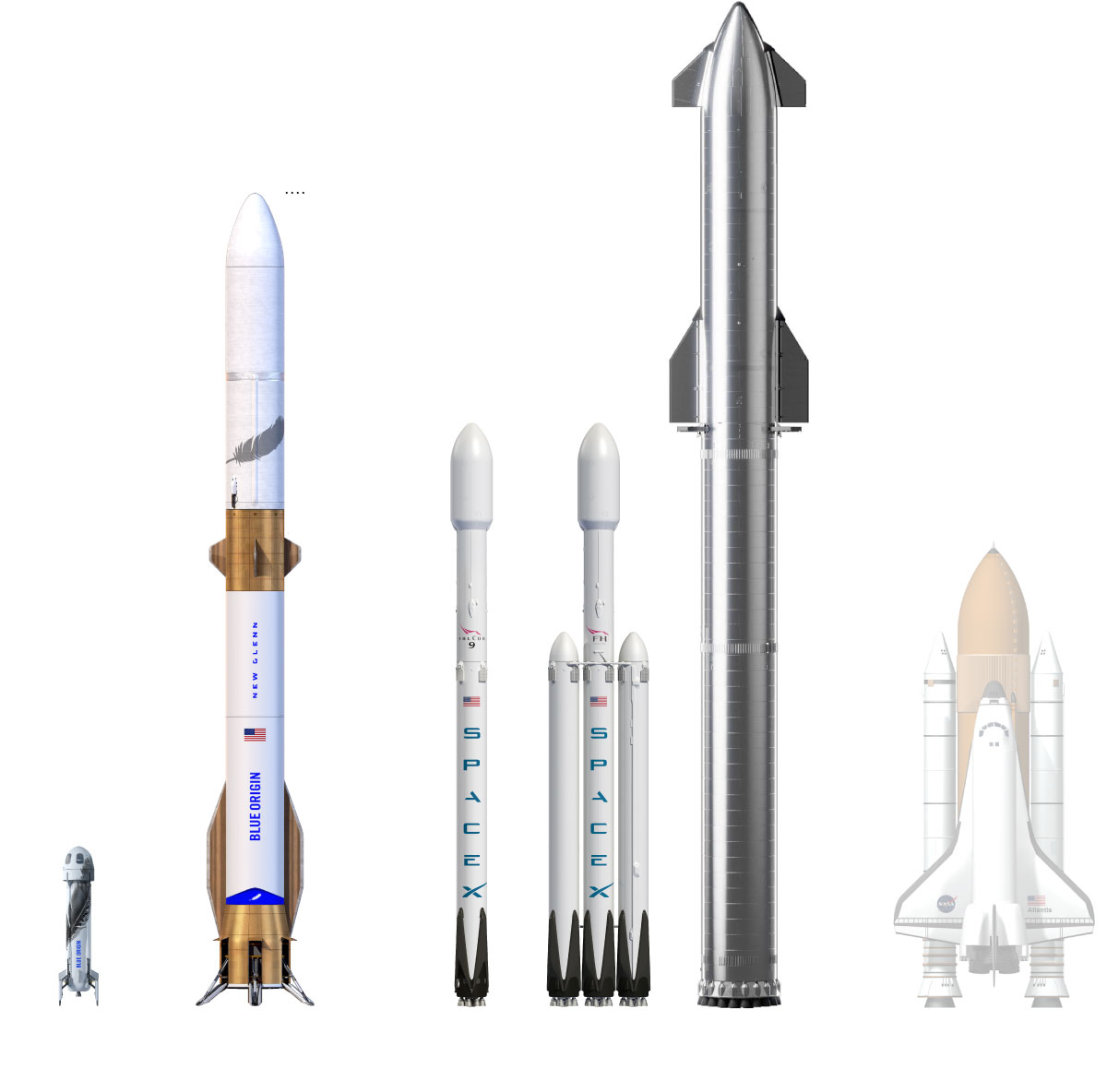

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 26, 2025

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 26, 2025

Latest Posts

-

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025 -

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025 -

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025