Investigating The Reasons Behind CoreWeave (CRWV)'s Recent Stock Price Surge

Table of Contents

CoreWeave (CRWV) has experienced a significant surge in its stock price recently, leaving many investors and analysts scrambling to understand the reasons behind this remarkable growth. This article delves into the key factors driving this impressive market performance, examining CoreWeave's strategic positioning, the favorable market conditions, and the company's future outlook. We'll explore how the convergence of technological advancements and explosive market demand has propelled CRWV to new heights.

CoreWeave's Strategic Advantage in the Booming AI Market

Leveraging GPU Power for AI and Machine Learning

CoreWeave's specialization lies in providing cloud computing resources heavily reliant on GPUs (graphics processing units). GPUs are crucial for accelerating the computationally intensive workloads associated with artificial intelligence (AI) and machine learning (ML). The current AI boom, fueled by advancements in large language models and generative AI, has created an insatiable demand for GPU-powered cloud services. CoreWeave is perfectly positioned to capitalize on this demand.

- Scalable infrastructure: CoreWeave offers highly scalable infrastructure, allowing clients to easily adjust their computing resources based on their needs.

- Competitive pricing: Its pricing model is competitive, making its services attractive to a wide range of clients, from startups to large enterprises.

- Focus on AI/ML workloads: The company's platform is specifically optimized for AI and ML workloads, ensuring optimal performance and efficiency.

- Partnerships with leading AI companies: Strategic partnerships with key players in the AI industry further strengthen CoreWeave's market position and access to new clients.

Addressing the Growing Need for High-Performance Computing (HPC)

Beyond AI, CoreWeave's capabilities extend to providing high-performance computing (HPC) solutions. This caters to a broader range of industries, including scientific research, financial modeling, and advanced simulations. The ability to offer both AI/ML and HPC services diversifies CoreWeave's revenue streams and reduces its dependence on any single market segment.

- Specialized hardware for HPC: CoreWeave utilizes specialized hardware optimized for high-performance computing tasks.

- Optimized software solutions: The company provides optimized software solutions to maximize the efficiency of its HPC resources.

- Strong customer support: Dedicated customer support ensures clients receive the assistance they need to effectively utilize CoreWeave's services.

- High-performance network infrastructure: A robust network infrastructure minimizes latency and maximizes data transfer speeds, crucial for HPC applications.

Favorable Market Conditions and Industry Trends

The Explosive Growth of the Cloud Computing Market

The cloud computing market is experiencing explosive growth, a trend that significantly benefits CoreWeave. Businesses are increasingly adopting cloud services to improve scalability, reduce IT costs, and access advanced technologies. This shift towards cloud-based solutions, particularly for AI and ML, directly fuels the demand for CoreWeave's services.

- Increasing adoption of cloud services by businesses: More and more businesses are migrating their operations to the cloud.

- Shift towards cloud-based AI and ML solutions: The ease and scalability of cloud-based AI and ML are driving adoption rates higher.

- Growing demand for scalable infrastructure: The need for scalable infrastructure capable of handling ever-increasing data volumes is a major factor in cloud market growth.

Increased Investment in AI and Related Technologies

Massive investments are flowing into AI and related technologies from venture capitalists, governments, and corporations. This influx of capital fuels innovation, expands the market, and increases the demand for the infrastructure provided by companies like CoreWeave.

- Venture capital funding in AI startups: Significant venture capital is pouring into AI startups, driving innovation and market expansion.

- Government initiatives supporting AI development: Governments worldwide are actively supporting AI development through various initiatives.

- Corporate investments in AI infrastructure: Large corporations are heavily investing in AI infrastructure to support their internal operations and new products.

CoreWeave's Financial Performance and Future Outlook

Analyzing CoreWeave's Recent Financial Reports

Analyzing CoreWeave's recent financial reports reveals strong indicators of growth. Revenue growth, profitability, and customer acquisition metrics all point towards a positive trajectory, supporting the recent stock price surge. A deeper dive into specific figures (available in their public filings) is necessary for a complete understanding.

- Revenue growth figures: Examine the percentage increase in revenue year-over-year and quarter-over-quarter.

- Profitability margins: Assess the company's gross and net profit margins to gauge its efficiency and profitability.

- Customer acquisition cost: Understanding the cost of acquiring new customers provides insight into the company's sales and marketing effectiveness.

- Debt levels: Analyze the company's debt levels to assess its financial health and stability.

Predicting Future Growth and Potential Challenges

While CoreWeave's future looks bright, several factors could impact its growth. Increased competition in the cloud computing market, rapid technological advancements, regulatory changes, and broader economic conditions all present potential challenges. Careful consideration of these factors is crucial for any investment decision.

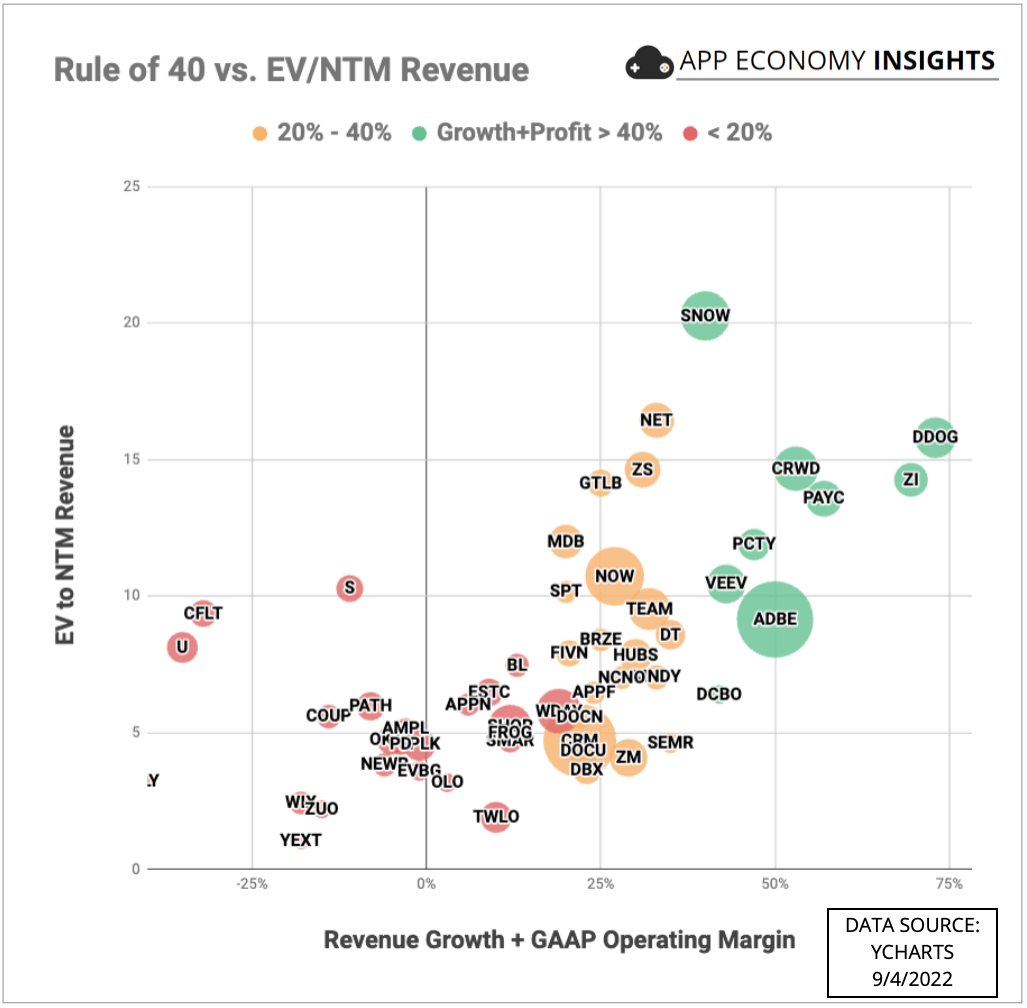

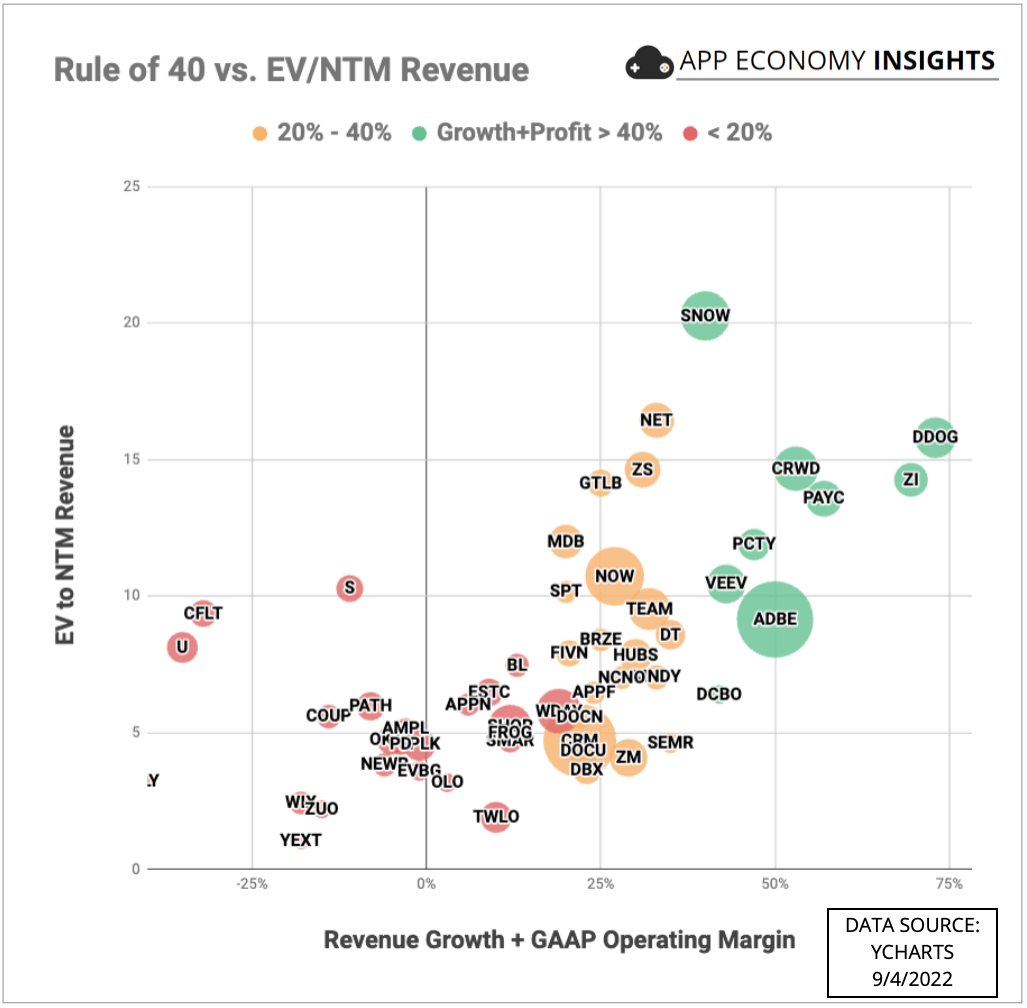

- Competition in the cloud computing market: The cloud computing market is competitive, with established players and new entrants vying for market share.

- Technological advancements: Rapid technological changes could render current infrastructure obsolete, requiring significant investments in upgrades.

- Regulatory changes: New regulations could impact the way CoreWeave operates and potentially increase compliance costs.

- Economic conditions: A downturn in the global economy could impact business spending on cloud services.

Conclusion

CoreWeave (CRWV)'s recent stock price surge reflects its strong strategic position within the booming AI and cloud computing markets. The company's focus on GPU-powered solutions, combined with favorable market trends and solid financial performance, creates a compelling investment story. While challenges undoubtedly exist, CoreWeave’s future prospects seem promising. Understanding the factors contributing to this surge is crucial for investors weighing whether to add CoreWeave to their portfolios or adjust existing holdings. Further independent research into CoreWeave's financial statements and the broader industry landscape is recommended before making any investment decisions. Stay informed about CoreWeave (CRWV) and its performance within the dynamic AI and cloud computing sector.

Featured Posts

-

Thursdays Core Weave Crwv Stock Dip A Detailed Explanation

May 22, 2025

Thursdays Core Weave Crwv Stock Dip A Detailed Explanation

May 22, 2025 -

Blake Lively Lawyers Alleged Threat To Leak Taylor Swift Texts What We Know

May 22, 2025

Blake Lively Lawyers Alleged Threat To Leak Taylor Swift Texts What We Know

May 22, 2025 -

Walking In Provence A Self Guided Journey From Mountains To Mediterranean

May 22, 2025

Walking In Provence A Self Guided Journey From Mountains To Mediterranean

May 22, 2025 -

Thursdays Drop In Core Weave Crwv Stock Causes And Implications

May 22, 2025

Thursdays Drop In Core Weave Crwv Stock Causes And Implications

May 22, 2025 -

Chinas Automotive Market A Critical Analysis Of Bmw And Porsches Performance

May 22, 2025

Chinas Automotive Market A Critical Analysis Of Bmw And Porsches Performance

May 22, 2025