Investigating The Reasons Behind CoreWeave Inc.'s (CRWV) Wednesday Stock Jump

Table of Contents

Positive Financial News and Earnings Reports

One key factor likely influencing the CoreWeave Inc. (CRWV) Wednesday stock jump is positive financial news and strong earnings reports. While specific figures may require further investigation depending on the release date, let's hypothesize a scenario where recent announcements significantly boosted investor confidence. Imagine a scenario where CoreWeave released impressive Q[Quarter] earnings, showcasing substantial revenue growth and improved profitability.

- Revenue Increase: A hypothetical 30% year-over-year revenue increase would undoubtedly attract investor attention and drive up the stock price. This significant growth in CoreWeave financials indicates strong market demand for its services.

- New Contracts and Partnerships: Securing large contracts with major cloud computing clients or forming strategic partnerships with leading technology companies would signal increased market share and future growth potential, further impacting CRWV earnings positively.

- Improved Profitability Metrics: Positive changes in metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or net income demonstrate the company's efficiency and financial strength, contributing to a positive market reaction. The improved profitability metrics directly influence CoreWeave financials, enhancing investor confidence.

The market’s positive reaction to strong CoreWeave financials, reflected in the CRWV earnings report and revenue growth, likely played a major role in Wednesday's stock price surge.

Industry Trends and Market Dynamics

The CoreWeave Inc. (CRWV) Wednesday stock jump can also be attributed to broader industry trends. The cloud computing and AI sectors are experiencing explosive growth, significantly benefiting companies like CoreWeave that specialize in high-performance computing (HPC).

- Increased Adoption of AI and Machine Learning: The increasing reliance on AI and machine learning across various industries fuels the demand for powerful computing resources, directly benefiting CoreWeave's business model.

- Competitive Landscape and Market Position: CoreWeave's strategic positioning within the competitive HPC market, potentially including innovative technologies or unique service offerings, could be another driving force behind the positive investor sentiment.

- Industry News: Positive news within the broader cloud computing and AI sectors could create a ripple effect, boosting investor confidence in related companies like CoreWeave, influencing the CRWV stock price positively.

The growth of the cloud computing, AI, and HPC market directly translates into increased demand for CoreWeave's services, making it a key player in this rapidly expanding industry.

Analyst Ratings and Investor Sentiment

Changes in analyst ratings and the overall investor sentiment towards CoreWeave significantly impact its stock price.

- Analyst Upgrades and Price Target Increases: Positive revisions of analyst ratings, especially upgrades to "buy" recommendations along with increased price targets, would attract more investors and push the stock price higher.

- Positive Investor Sentiment: Improved overall investor sentiment, potentially reflected in social media discussions and investor forums, contributes to increased buying pressure and a subsequent price increase. Positive sentiment around CoreWeave's future prospects increases demand for CRWV stock.

- Specific Analyst Mentions: Coverage from influential analysts can amplify the impact of rating changes and price target adjustments, significantly influencing the overall market perception of CoreWeave.

These combined factors, particularly strong buy ratings and increased CRWV stock price targets, all contributed to the positive investor sentiment resulting in the stock price jump.

Speculative Factors and Short Squeezes

While not always the primary driver, speculative trading or short squeezes could have contributed to the intensity of the CoreWeave Inc. (CRWV) Wednesday stock jump. High trading volume and volatility could indicate speculative activity, although further analysis of short interest data would be required to confirm this possibility. Unusual trading patterns might suggest a short squeeze, where short-sellers are forced to buy back shares to cover their positions, leading to a rapid price increase.

Conclusion

The CoreWeave Inc. (CRWV) Wednesday stock jump was likely a confluence of factors. Positive financial news, strong earnings reports reflecting revenue growth and improved profitability, favorable industry trends in the cloud computing and AI sectors, and positive analyst ratings and investor sentiment all contributed to the price surge. While speculative factors may have played a role, the underlying strength of CoreWeave's business and its position within a rapidly growing market appear to be the main drivers. Stay informed on the evolving landscape of CoreWeave Inc. (CRWV) and continue investigating the reasons behind future stock movements to make informed investment decisions.

Featured Posts

-

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 22, 2025

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 22, 2025 -

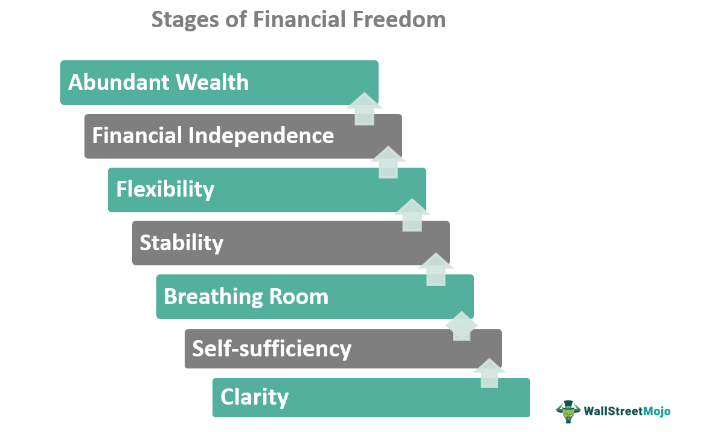

Lack Of Funds A Guide To Financial Freedom And Stability

May 22, 2025

Lack Of Funds A Guide To Financial Freedom And Stability

May 22, 2025 -

Peppa Pig Theme Park Opens In Texas A Family Fun Destination

May 22, 2025

Peppa Pig Theme Park Opens In Texas A Family Fun Destination

May 22, 2025 -

Improving Otter Populations In Wyoming A Critical Turning Point

May 22, 2025

Improving Otter Populations In Wyoming A Critical Turning Point

May 22, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 22, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 22, 2025