Investing In Palantir Before May 5th: What Wall Street Thinks

Table of Contents

Current Wall Street Sentiment on Palantir

Understanding the current Wall Street sentiment on Palantir is crucial before making any investment decisions. Analyzing analyst ratings and price targets provides a valuable snapshot of the market's overall expectation for PLTR stock. Investment banks and analysts offer a range of opinions, reflecting the inherent complexities and uncertainties involved in predicting Palantir's future performance.

-

Overview of recent analyst upgrades/downgrades: Recent months have seen a mixed bag of analyst ratings for Palantir. While some firms have issued buy ratings, citing strong growth potential in the AI and data analytics sectors, others maintain a hold or even a sell rating, expressing concerns about profitability and valuation. These differing opinions highlight the inherent uncertainty surrounding PLTR stock.

-

Average price target and range of predictions: The average price target for Palantir stock varies across different analyst firms. While some analysts predict a significant price increase, others offer more conservative forecasts. This wide range underscores the diverse perspectives and expectations within the financial community. It's important to remember that price targets are just estimations and not guarantees of future performance.

-

Key factors driving the current sentiment: Several key factors influence current Wall Street sentiment on Palantir. These include the company's recent contract wins (both government and commercial), its progress in developing and deploying AI-powered solutions, its overall revenue growth, and the broader macroeconomic environment and its impact on the tech sector. Strong government contracts often positively influence analyst ratings, while concerns about competition and profitability can lead to more cautious assessments.

Analyzing Palantir's Recent Performance and Future Growth Potential

Examining Palantir's recent financial performance and assessing its future growth potential is vital for any prospective investor. Analyzing revenue growth, profitability, and key market trends will provide a clearer picture of the company's prospects.

-

Review of Q4 2022 and recent financial results: Palantir's recent financial reports provide valuable insights into its performance. Analyzing key metrics like revenue growth, operating margins, and customer acquisition will help determine whether the company is meeting or exceeding expectations. Pay close attention to the breakdown of revenue between government and commercial sectors to gauge the diversification of the company's income streams.

-

Analysis of Palantir's key growth drivers (Government vs. Commercial): Palantir's revenue is derived from both government and commercial contracts. Understanding the relative strengths and growth prospects of each sector is vital. The government sector often provides stability but might be subject to regulatory changes and budgetary constraints. The commercial sector offers higher growth potential but may be more competitive.

-

Discussion of the company's long-term strategic plans and market opportunities: Palantir's long-term strategic plans are crucial to its future success. The company’s focus on artificial intelligence and its expansion into new markets will be key factors influencing its future growth potential. Analyzing the company's roadmap for innovation and market penetration provides a sense of its long-term viability.

-

Assessment of the risks and challenges facing Palantir: No investment is without risk. Analyzing potential challenges facing Palantir is equally important as evaluating its opportunities. This includes assessing competition, technological disruptions, and potential regulatory hurdles.

Factors to Consider Before Investing in Palantir Before May 5th

Investing in Palantir before the May 5th earnings report presents both opportunities and risks. Thorough due diligence is paramount.

-

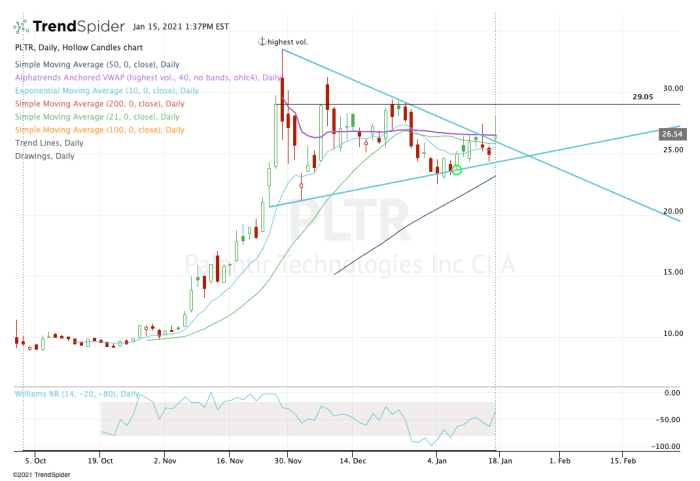

Discussion of the inherent volatility of tech stocks: Palantir stock, like many tech stocks, is known for its price volatility. This means its price can fluctuate significantly in short periods, potentially leading to substantial gains or losses.

-

Potential impact of the upcoming earnings report on the stock price: Earnings reports often trigger significant stock price movements. If Palantir beats expectations, the stock price might rise; if it falls short, the opposite could occur. The volatility surrounding earnings announcements is a significant risk factor.

-

Risks associated with relying on analyst predictions: While analyst ratings and price targets provide valuable information, they should not be solely relied upon. Analyst predictions are not guarantees of future performance and are subject to error.

-

Importance of diversification in investment portfolios: Diversification is a crucial risk management strategy. Investing a significant portion of your portfolio in a single stock, especially a volatile one like Palantir, can be risky.

Alternative Investment Strategies

Before investing in Palantir, consider alternative investment strategies. Diversification is key to mitigating risk. A balanced portfolio with a mix of assets, including bonds, real estate, and other stocks, is generally a more conservative approach than concentrating investments in a single, potentially volatile stock. Long-term investment strategies can help mitigate short-term market fluctuations.

Conclusion

Investing in Palantir before its May 5th earnings report requires careful consideration of various factors. While the company shows promise in the AI and data analytics sectors, the inherent volatility of the stock and the uncertainty surrounding the earnings announcement present significant risks. Wall Street sentiment is mixed, reflecting this uncertainty. Before making any investment decisions regarding Palantir stock, conduct your own thorough research and consider consulting with a financial advisor. Weigh the potential risks and rewards carefully, considering your overall investment strategy and risk tolerance. Remember, investing in Palantir, or any stock, involves risk. Don't hesitate to conduct further research on Palantir stock and its future prospects.

Featured Posts

-

Hl Yktb Barys San Jyrman Asmh Bahrf Mn Dhhb Fy Dwry Abtal Awrwba

May 10, 2025

Hl Yktb Barys San Jyrman Asmh Bahrf Mn Dhhb Fy Dwry Abtal Awrwba

May 10, 2025 -

From Wolves To The Summit A Footballers Inspiring Success Story

May 10, 2025

From Wolves To The Summit A Footballers Inspiring Success Story

May 10, 2025 -

Choppy Trade Characterizes Todays Stock Market Sensex And Nifty 50 Finish Flat

May 10, 2025

Choppy Trade Characterizes Todays Stock Market Sensex And Nifty 50 Finish Flat

May 10, 2025 -

Unprovoked Racist Attack Leaves Family Devastated

May 10, 2025

Unprovoked Racist Attack Leaves Family Devastated

May 10, 2025 -

Is Palantir Stock A Good Investment Before May 5th A Wall Street Perspective

May 10, 2025

Is Palantir Stock A Good Investment Before May 5th A Wall Street Perspective

May 10, 2025