Is Palantir Stock A Good Investment Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Palantir's financial health is crucial in determining its investment viability. Analyzing its recent performance and future projections gives us valuable insights into its potential.

Revenue Growth and Profitability

Palantir has shown consistent revenue growth in recent quarters, driven by both government contracts and its expanding commercial business. However, profitability remains a key area of focus. Let's examine some key metrics:

- Q4 2023 Revenue: (Insert actual figure here) – representing a (Insert percentage) increase year-over-year.

- Operating Margin: (Insert actual figure here) – indicating (positive/negative) profitability.

- Net Income: (Insert actual figure here) – showing a (positive/negative) trend.

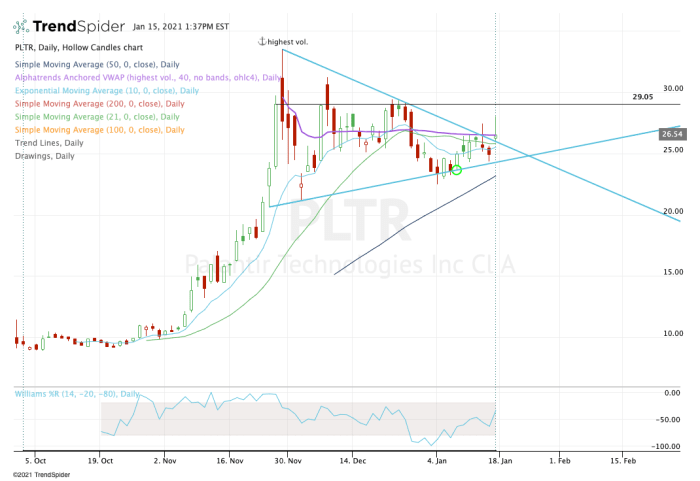

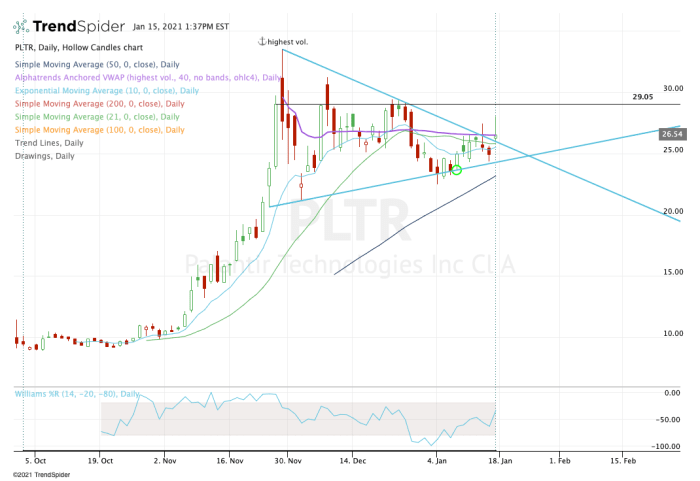

(Insert a relevant chart or graph visualizing revenue growth and profitability trends here)

Factors affecting Palantir's revenue include the success of securing new government contracts, particularly in areas like defense and intelligence, and its ability to penetrate and scale within the commercial market. The latter includes partnerships with large enterprises across various sectors, requiring significant investment in sales and marketing.

Key Partnerships and Government Contracts

Palantir's substantial government contracts form a significant portion of its revenue, providing a degree of stability. However, over-reliance on government contracts presents a risk. The company is strategically diversifying into the commercial sector.

- Significant Government Contracts: (List examples, including estimated contract value and duration)

- Key Commercial Partnerships: (List examples, highlighting the industries and potential for growth)

The risk associated with government contracts lies in the potential for budget cuts, shifts in government priorities, or changes in procurement policies. Diversification into the commercial sector mitigates this risk but requires consistent growth in commercial sales to offset any potential decline in government contracts.

Market Sentiment and Analyst Ratings for Palantir Stock

Understanding market sentiment and analyst opinions is vital for evaluating Palantir stock.

Current Stock Price and Valuation

As of today, Palantir's stock price is (Insert current stock price), with a market capitalization of (Insert market cap). Its valuation compared to competitors is (Insert comparative analysis, including P/E ratio and other relevant metrics). A comparison to similar data analytics companies is needed to determine if the stock is overvalued or undervalued.

- Current Stock Price: (Insert current price)

- P/E Ratio: (Insert P/E ratio)

- Market Capitalization: (Insert market cap)

Analyst Recommendations and Price Targets

Analyst opinions on Palantir stock vary, reflecting the inherent uncertainties of the company's growth trajectory. Some analysts hold a bullish outlook, while others remain cautious.

- Buy Ratings: (Number of analysts and rationale)

- Hold Ratings: (Number of analysts and rationale)

- Sell Ratings: (Number of analysts and rationale)

- Average Price Target: (Insert average price target)

It's crucial to consider the range of analyst opinions and their underlying reasoning before forming your own investment decision.

Risks and Opportunities Associated with Investing in Palantir Stock Before May 5th

Investing in Palantir stock presents both significant risks and potential opportunities.

Potential Risks

Investors need to be aware of several potential risks before investing in Palantir:

- Market Volatility: The tech sector is susceptible to significant price swings.

- Competition: Palantir faces competition from established players in the data analytics market.

- Dependence on Key Clients: Reliance on a few large government contracts poses a risk.

- Regulatory Scrutiny: Government contracts can be subject to regulatory scrutiny.

Potential Opportunities

Despite the risks, Palantir also offers substantial growth opportunities:

- Innovative Technology: Palantir's technology holds significant potential for disrupting various industries.

- Expanding Market Opportunities: The demand for data analytics is rapidly increasing.

- Government Spending on Defense and Intelligence: Ongoing government investment supports growth potential.

- Commercial Market Penetration: Success in the commercial sector promises long-term growth.

A Wall Street Perspective on the May 5th Timeline

The significance of May 5th (or the relevant date) hinges on (explain the significance of the date: earnings release, contract deadline, etc.). This event could significantly impact investor sentiment and the stock price. Expert opinions (if available) on how the events surrounding May 5th might affect Palantir’s stock should be included here. For example, an earnings beat could lead to a stock price increase, while a miss could trigger a sell-off.

Conclusion: Is Palantir Stock a Good Investment Before May 5th?

Palantir presents a complex investment case. While it demonstrates strong revenue growth and holds promising technology, it also faces risks associated with its dependence on government contracts and market volatility. The event on May 5th (or the relevant date) will likely play a crucial role in shaping the short-term outlook for Palantir stock.

Based on the analysis, whether Palantir stock is a "good" investment before May 5th depends heavily on individual risk tolerance and investment horizons. A cautious approach is recommended. Remember that past performance does not guarantee future results.

Call to Action: Before making any investment decisions related to Palantir stock, conduct thorough due diligence, assess your risk tolerance, and consider consulting with a qualified financial advisor for personalized guidance. Careful consideration of the factors outlined in this article regarding Palantir stock will help you make an informed investment decision.

Featured Posts

-

Elizabeth Stewarts Sustainable Spring Collection With Lilysilk

May 10, 2025

Elizabeth Stewarts Sustainable Spring Collection With Lilysilk

May 10, 2025 -

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 10, 2025 -

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025 -

Oilers Vs Sharks Nhl Game Expert Predictions And Betting Odds

May 10, 2025

Oilers Vs Sharks Nhl Game Expert Predictions And Betting Odds

May 10, 2025