Investing In Stability: Microsoft In The Age Of Trade Wars

Table of Contents

In the turbulent landscape of global trade wars, finding stable investments can feel like searching for a needle in a haystack. However, some companies, like Microsoft, demonstrate remarkable resilience. This article explores why Microsoft stock presents a compelling investment opportunity even amidst the uncertainty of international trade disputes. We'll delve into Microsoft's diverse revenue streams, its strong competitive position, and its potential for long-term growth, making a case for its role in a well-diversified portfolio. Understanding the strengths of Microsoft stock as a hedge against trade war uncertainty is crucial for investors seeking long-term investment stability.

H2: Microsoft's Diversified Revenue Streams: A Hedge Against Trade Wars

Navigating the complexities of global trade requires a robust investment strategy. Microsoft's diverse revenue streams act as a powerful hedge against the risks associated with trade wars. Unlike companies heavily reliant on a single product or geographic market, Microsoft's multifaceted business model minimizes vulnerability to trade tensions.

H3: Cloud Computing Dominance (Azure):

Azure, Microsoft's cloud computing platform, is a major driver of growth and a key factor in its resilience. Its global reach significantly mitigates the impact of regional trade disputes. If one market experiences challenges, growth in other regions can compensate.

- Azure's global infrastructure lessens reliance on any single geographic region.

- Growth in cloud services is less susceptible to trade tariffs than physical hardware sales.

- Azure consistently outperforms market expectations, consistently gaining market share against competitors like Amazon Web Services (AWS) and Google Cloud. Analysts predict continued substantial growth for Azure in the coming years.

- Azure boasts a diverse customer base:

- Small and medium-sized businesses (SMBs)

- Large enterprises across various industries

- Government organizations worldwide

H3: Productivity and Business Processes (Office 365, Dynamics 365):

Microsoft's productivity suite and business process solutions provide another layer of stability. The recurring revenue model of Office 365 and Dynamics 365 generates predictable income streams, less susceptible to the volatility of one-time sales.

- The subscription-based model of Office 365 ensures consistent revenue, regardless of fluctuating market conditions.

- Office 365's ubiquitous presence across industries makes it an indispensable tool, mitigating the impact of trade wars.

- Dynamics 365's role in enterprise resource planning (ERP) solidifies its position as a critical business application, further enhancing the stability of this revenue stream.

H3: Gaming (Xbox):

The global appeal of Xbox gaming significantly reduces the company's reliance on any single market, offering further diversification against the risks of trade wars.

- The global nature of the gaming market minimizes vulnerability to regional trade disruptions.

- The Xbox Game Pass subscription service provides a recurring revenue stream, adding to the stability of this segment.

- Xbox sales are geographically diversified, minimizing the impact of potential trade restrictions in any single country.

H2: Microsoft's Strong Competitive Advantage in a Shifting Market

Microsoft's enduring success stems from a combination of factors that solidify its strong competitive advantage even in a volatile global landscape. This makes Microsoft stock a compelling long-term investment opportunity.

H3: Innovation and R&D:

Microsoft's significant investment in research and development (R&D) fuels ongoing innovation and maintains its competitive edge.

- Consistent high spending on R&D ensures Microsoft remains at the forefront of technological advancements.

- This commitment to innovation translates into a steady stream of new products and services, maintaining its market leadership.

- Microsoft holds a vast portfolio of patents and intellectual property, protecting its innovations and reinforcing its competitive moat.

H3: Brand Recognition and Loyalty:

Microsoft's established brand trust and strong customer loyalty provide a significant buffer against economic downturns.

- Decades of brand building have instilled significant trust and loyalty among consumers and businesses.

- This strong brand reputation translates into resilient customer retention rates even during times of economic uncertainty.

- The strength of the Microsoft ecosystem—encompassing Windows, Office, Azure, and Xbox—further reinforces customer loyalty and mitigates the risk of switching to competitors.

H3: Strategic Acquisitions and Partnerships:

Microsoft's history of strategic acquisitions and partnerships further diversifies its business and mitigates risk.

- Acquisitions like GitHub and LinkedIn have expanded Microsoft's reach and capabilities, strengthening its position in key markets.

- Strategic partnerships enhance market penetration and access to new technologies, contributing to growth and resilience.

H2: Long-Term Growth Potential and Investment Stability

The long-term outlook for Microsoft is positive, with multiple avenues for growth and a sustainable business model that contributes to long-term investment stability.

H3: Expanding Market Opportunities:

Emerging markets represent significant growth opportunities for Microsoft.

- Microsoft actively pursues strategies to penetrate these markets, leveraging its existing strengths and adapting to local needs.

- Areas like artificial intelligence (AI), the Internet of Things (IoT), and cybersecurity offer substantial potential for future revenue growth.

H3: Sustainable Business Model:

Microsoft's business model emphasizes recurring revenue streams, resulting in predictable earnings and financial stability.

- The subscription-based models of Office 365 and Azure contribute to predictable income flows.

- Microsoft maintains a strong balance sheet and healthy financial metrics, reflecting its financial strength and stability.

H3: Dividend Policy:

Microsoft's dividend policy further enhances its appeal as a long-term investment.

- A consistent dividend payout provides investors with a steady stream of income.

- The historical dividend growth demonstrates Microsoft's commitment to returning value to shareholders.

Conclusion:

In conclusion, while global trade wars create uncertainty, investing in companies like Microsoft offers a path towards stability. Its diversified revenue streams, strong competitive position, and significant growth potential make Microsoft stock an attractive addition to a well-diversified portfolio. The company's resilience in the face of economic headwinds underscores its long-term viability. Consider adding Microsoft stock to your investment strategy for a more stable and potentially lucrative future. Start researching Microsoft stock today and explore the opportunities for long-term investment in this tech giant. Don't overlook the potential of tech stocks like Microsoft for investment stability in uncertain times; diversification with Microsoft stock may be a wise choice for your portfolio.

Featured Posts

-

Paddy Pimbletts Ufc 314 Fight Will He Become Champion

May 15, 2025

Paddy Pimbletts Ufc 314 Fight Will He Become Champion

May 15, 2025 -

Steffens Subpar Performance Earthquakes Suffer Defeat Against Rapids

May 15, 2025

Steffens Subpar Performance Earthquakes Suffer Defeat Against Rapids

May 15, 2025 -

6 1 Billion Celtics Sale What It Means For The Future Of The Franchise

May 15, 2025

6 1 Billion Celtics Sale What It Means For The Future Of The Franchise

May 15, 2025 -

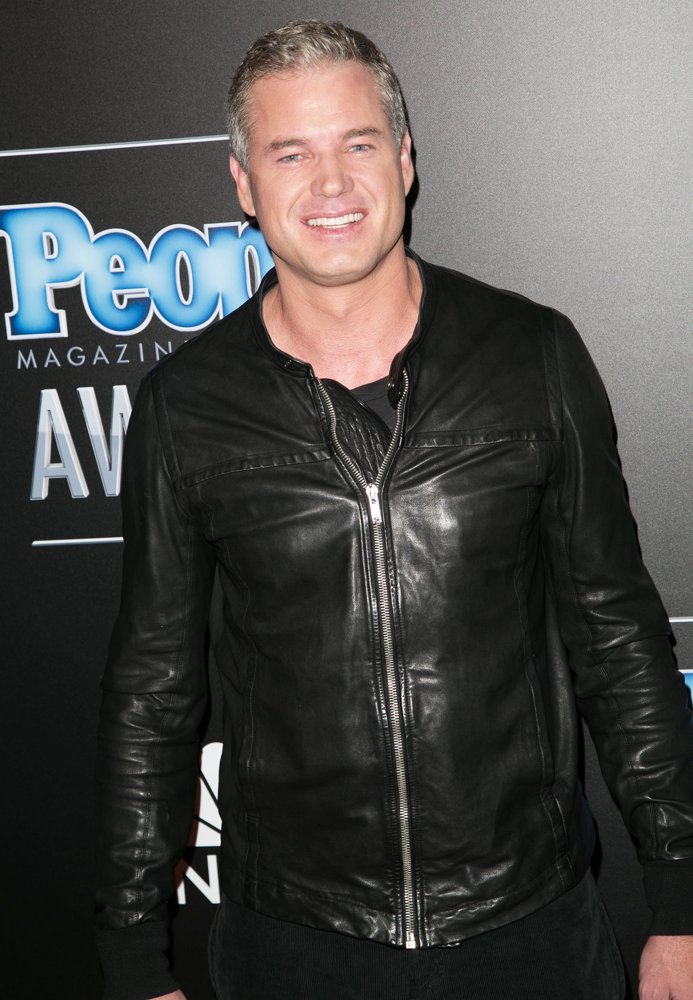

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025 -

Ledra Palace Ta Dijital Isguecue Piyasasi Veri Tabani Tanitimi

May 15, 2025

Ledra Palace Ta Dijital Isguecue Piyasasi Veri Tabani Tanitimi

May 15, 2025