Investing In Uber's Driverless Technology: An ETF Analysis

Table of Contents

Understanding the Potential of Autonomous Vehicle Technology

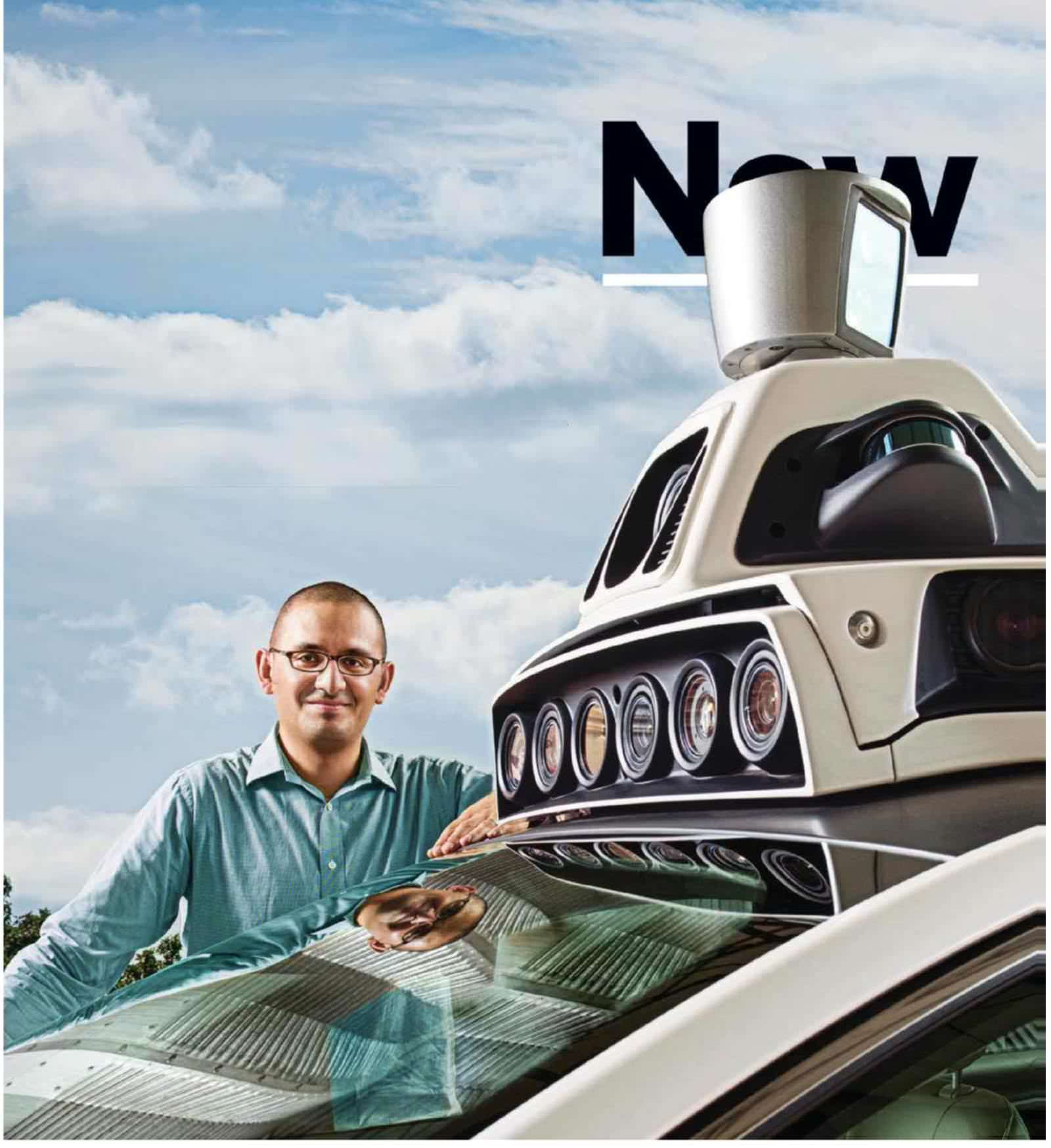

The autonomous vehicle (AV) market is poised for explosive growth. Self-driving cars promise to revolutionize transportation and logistics, creating a massive market disruption with far-reaching consequences. Uber, with its Advanced Technologies Group (ATG), is a key player in this transformation, investing heavily in research and development to bring self-driving technology to its ride-sharing and delivery services.

- Massive market disruption potential: Autonomous vehicles could reshape urban planning, reduce traffic congestion, and improve road safety.

- Increased efficiency and reduced operational costs: Self-driving fleets can operate 24/7, optimizing routes and minimizing downtime, leading to significant cost savings for companies like Uber.

- Potential for significant long-term growth and return on investment: The long-term growth potential of the AV market is substantial, offering attractive investment opportunities for forward-thinking investors.

- Uber's Advanced Technologies Group (ATG) and its progress in autonomous driving: Uber's ATG is actively developing and testing autonomous driving technology, aiming to integrate it into its core services.

- Competition and technological challenges: While the potential is enormous, the autonomous vehicle sector faces significant competition and technological hurdles. Developing safe and reliable self-driving systems is a complex and ongoing process.

Identifying ETFs with Exposure to Uber's Driverless Tech

Direct investment in Uber's ATG is not a viable option for most individual investors. However, ETFs offer a diversified approach to gain exposure to the broader autonomous vehicle sector, including companies contributing to Uber's technological advancements.

- Analyzing ETFs focused on technology, robotics, and artificial intelligence (AI): Many ETFs focus on these sectors, which are crucial for autonomous driving development.

- Identifying ETFs with holdings in companies involved in sensor technology, mapping, and AI software crucial for autonomous driving: Look for ETFs with significant holdings in companies supplying these critical components.

- Considering ETFs with exposure to companies supplying components to autonomous vehicle manufacturers: This includes companies producing lidar sensors, cameras, and other hardware vital for self-driving cars.

- Specific examples of relevant ETFs: Examples include the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the Invesco QQQ Trust (QQQ), which hold companies involved in various aspects of autonomous vehicle technology. Always conduct your own thorough research.

- Highlighting the importance of due diligence and understanding ETF holdings: Before investing, carefully review the ETF's holdings to ensure alignment with your investment goals and risk tolerance.

Assessing Risk and Diversification Strategies

Investing in emerging technologies like autonomous vehicles carries inherent risks. The industry is still developing, facing regulatory uncertainty and potential technological setbacks.

- Technological risks and regulatory uncertainties: Unforeseen technical challenges and evolving regulations could significantly impact the success of autonomous vehicle companies and related ETFs.

- Market volatility and potential for loss of investment: The autonomous vehicle market is volatile, and investments can fluctuate significantly.

- The benefits of diversification to mitigate risk: Diversifying your portfolio across different asset classes reduces your overall risk.

- Suggesting combining autonomous vehicle ETFs with other asset classes for balanced portfolio management: Consider balancing your autonomous vehicle ETF investments with other less volatile asset classes, such as bonds or real estate.

- Importance of considering personal risk tolerance before investing: Only invest an amount you are comfortable potentially losing.

Analyzing ETF Performance and Future Outlook

Analyzing past performance is crucial, but it's not a guarantee of future results. Many factors influence the future prospects of autonomous vehicle technology and related ETFs.

- Review historical ETF performance data (if available): While past performance is not indicative of future results, reviewing historical data provides valuable context.

- Discussing the impact of technological advancements on ETF returns: Breakthroughs in AI, sensor technology, and mapping will significantly influence ETF performance.

- Analyzing the influence of regulatory changes on the autonomous vehicle sector: Government regulations play a crucial role in the adoption and growth of autonomous vehicles.

- Forecasting potential growth based on market analysis and expert opinions: Market research reports and expert analyses can provide insights into future growth potential.

- Mentioning potential challenges and opportunities for the future of autonomous vehicle ETFs: Ongoing challenges and new opportunities will continuously shape the landscape of autonomous vehicle ETFs.

Conclusion

Investing in Uber's driverless technology through ETFs presents a compelling opportunity for investors seeking exposure to this transformative sector. While direct investment in Uber's ATG is not feasible for most, carefully selected ETFs provide diversified exposure to the broader autonomous vehicle ecosystem, mitigating risk and potentially yielding significant returns. By understanding the risks, performing due diligence, and implementing a diversified investment strategy, investors can strategically position themselves to benefit from the growth of this exciting technology. Remember to conduct thorough research and consider seeking financial advice before investing in any ETF related to Uber's driverless technology or the broader autonomous vehicle market.

Featured Posts

-

Eortasmos Tis Kyriakis Ton Myroforon Sta Ierosolyma

May 19, 2025

Eortasmos Tis Kyriakis Ton Myroforon Sta Ierosolyma

May 19, 2025 -

Canadian Government Rebuts Oxford Report On Us Tariffs

May 19, 2025

Canadian Government Rebuts Oxford Report On Us Tariffs

May 19, 2025 -

The Ultimate Guide To Orlandos Highest Rated Southern Restaurants

May 19, 2025

The Ultimate Guide To Orlandos Highest Rated Southern Restaurants

May 19, 2025 -

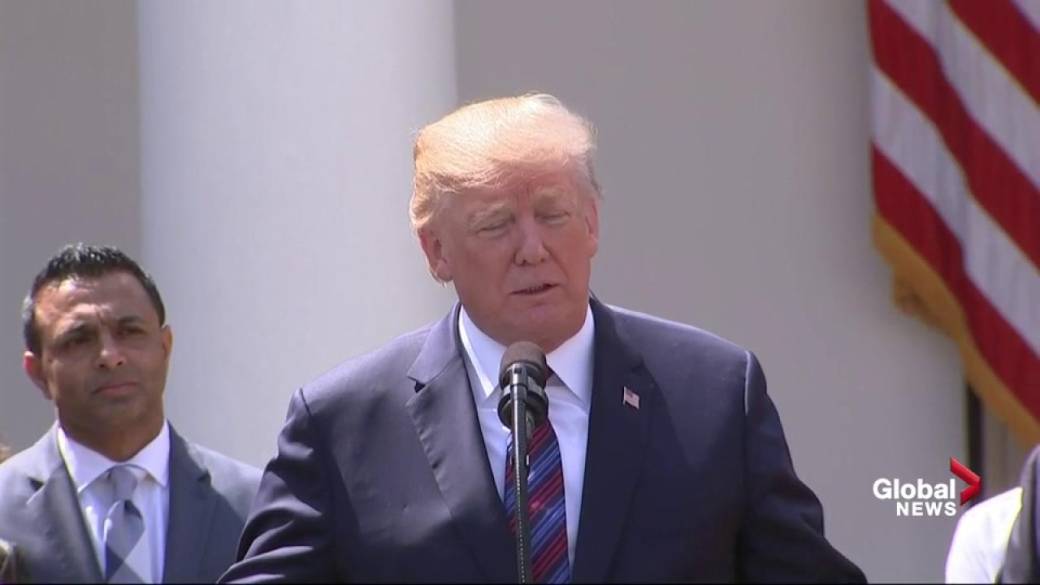

Elecciones Proximas Analisis De Los Aspirantes A Diputados De Nueva Corriente

May 19, 2025

Elecciones Proximas Analisis De Los Aspirantes A Diputados De Nueva Corriente

May 19, 2025 -

Protes Eortes Maioy Stis Enories Tis Kastorias Enas Odigos

May 19, 2025

Protes Eortes Maioy Stis Enories Tis Kastorias Enas Odigos

May 19, 2025