Investing In Uber's Self-Driving Technology Through ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy and its Market Potential

Uber's Advanced Technologies Group (ATG) is at the forefront of the autonomous vehicle revolution. Their ambition is to build a fully self-driving fleet capable of providing safe and reliable transportation services globally. This involves significant investment in research and development, encompassing cutting-edge technologies and strategic partnerships. The market potential for self-driving technology is enormous, with projections suggesting a multi-trillion dollar industry in the coming decades. Uber's significant investment and technological progress position them as a key player in this rapidly expanding market.

Key aspects of Uber's self-driving technology include:

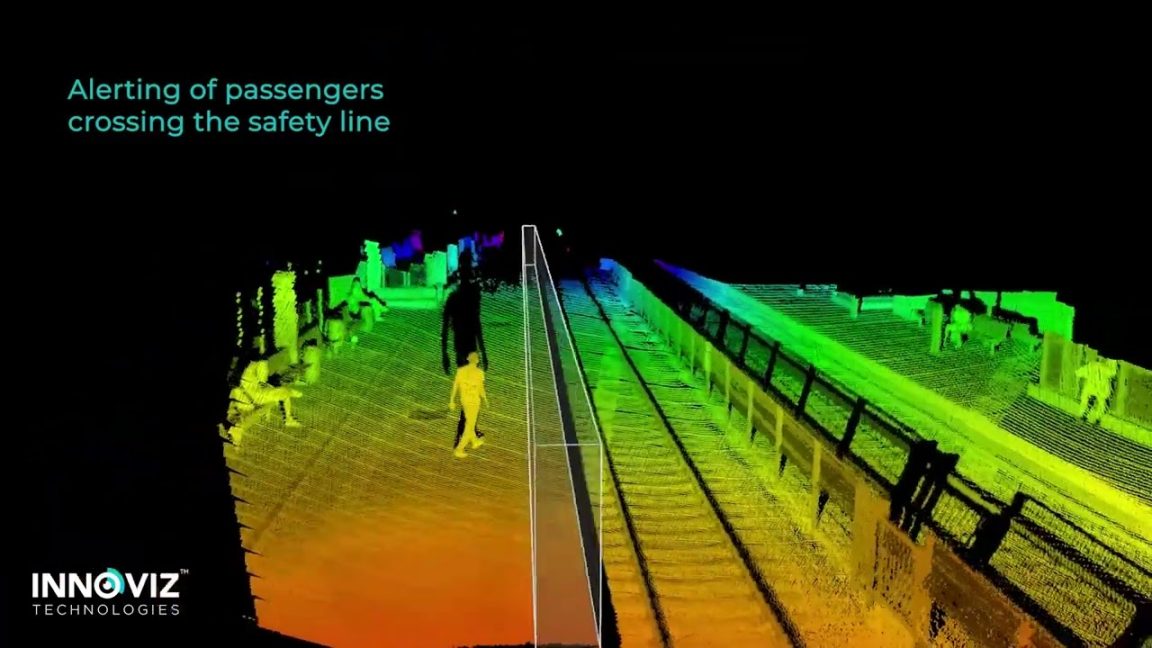

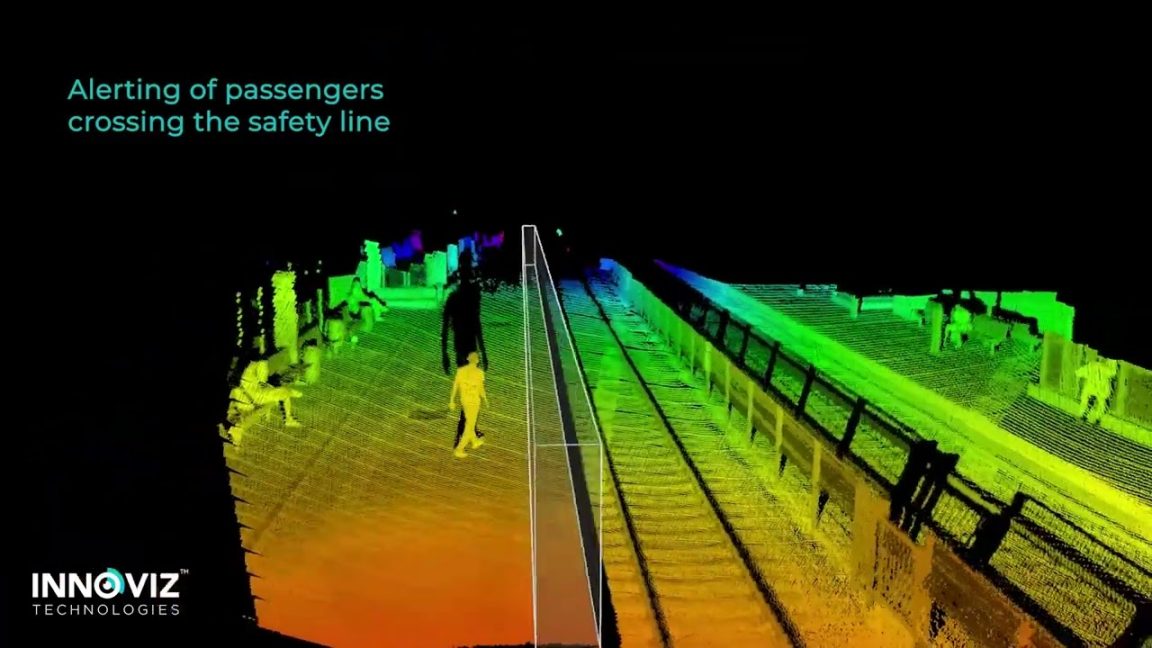

- Advanced sensor technology: Utilizing lidar, radar, and cameras to create a comprehensive 360-degree view of the surrounding environment.

- AI-powered mapping and navigation: Leveraging machine learning and artificial intelligence to navigate complex road networks and traffic conditions.

- Safety features and testing protocols: Rigorous testing and development of safety mechanisms to ensure the reliability and security of their autonomous systems.

- Partnerships and collaborations: Collaborating with other technology companies and automotive manufacturers to accelerate innovation and deployment.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Investing directly in individual companies involved in self-driving technology can be risky. ETFs offer a solution by providing diversified exposure to multiple companies across the sector, mitigating individual company-specific risks. These funds invest in a basket of stocks, including those involved in various aspects of the autonomous vehicle ecosystem – from sensor technology and AI software to automotive manufacturers and mapping services.

While it's impossible to find an ETF solely focused on Uber's ATG (as it's a private division), several ETFs offer indirect exposure to the broader autonomous vehicle sector, potentially including companies that benefit from Uber's advancements or are developing competing technologies. Investors should research specific ETF holdings carefully. (Note: Specific ETF ticker symbols are omitted here to avoid providing investment advice. Thorough independent research is crucial before investing.)

Key features to consider when selecting an ETF:

- Expense ratio: A lower expense ratio translates to lower costs for the investor.

- Asset allocation: Analyze the ETF's holdings to ensure alignment with your investment goals.

- Performance history: Review past performance, but remember that past performance is not indicative of future results.

- Fund manager expertise: Research the experience and track record of the fund management team.

Assessing the Risks and Rewards of Investing in Autonomous Vehicle ETFs

Investing in autonomous vehicle technology, even through diversified ETFs, carries risks. The sector is still relatively young, facing significant challenges:

- Technological risks: Unexpected technical hurdles and delays in development.

- Regulatory risks: Changes in government regulations could impact the adoption and commercialization of self-driving technology.

- Competition risks: Intense competition among various companies vying for market share.

- Market risks: Overall market fluctuations can affect the performance of even well-diversified ETFs.

However, the potential rewards are substantial. The long-term growth potential of the autonomous vehicle market is significant, presenting investors with the opportunity for considerable returns. A long-term investment horizon is crucial for navigating the inherent volatility of this emerging sector.

Diversification and Risk Management Strategies

Diversification is key to mitigating risk. Incorporating autonomous vehicle ETFs into a broader investment portfolio, alongside other asset classes such as bonds, real estate, or other technology sectors, can help reduce overall portfolio volatility. This strategic diversification minimizes the impact of any single sector's underperformance.

Navigating the Future of Transportation: Your Guide to Investing in Uber's Self-Driving Tech Through ETFs

Investing in the future of transportation through ETFs offers a compelling approach to gain exposure to Uber's self-driving technology advancements and the broader autonomous vehicle market. While the potential for high returns is significant, careful consideration of the associated risks is crucial. Remember that thorough research and due diligence are paramount before making any investment decisions. Consult with a qualified financial advisor to assess your risk tolerance and develop an investment strategy that aligns with your individual goals. Start your research today and explore suitable Uber-related self-driving car ETFs and autonomous vehicle investments to potentially capitalize on the growth potential of this innovative sector.

Featured Posts

-

Bilbao Bbk Live 2025 Damiano David Sparks And Kaytranada Added To The Bill

May 18, 2025

Bilbao Bbk Live 2025 Damiano David Sparks And Kaytranada Added To The Bill

May 18, 2025 -

Gridlock On Gop Tax Bill Medicaid And Clean Energy Changes Spark Conservative Backlash

May 18, 2025

Gridlock On Gop Tax Bill Medicaid And Clean Energy Changes Spark Conservative Backlash

May 18, 2025 -

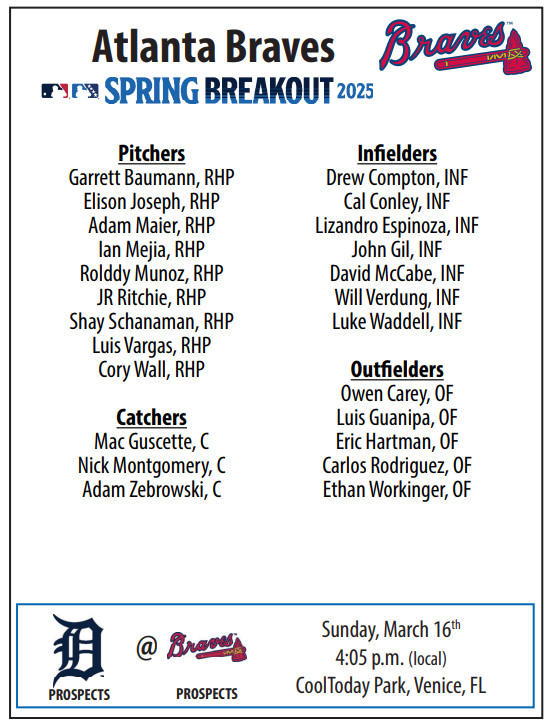

Spring Breakout Rosters 2025 Unveiled

May 18, 2025

Spring Breakout Rosters 2025 Unveiled

May 18, 2025 -

10 5 Million Fine For Resorts World Las Vegas Casino In Money Laundering Scandal

May 18, 2025

10 5 Million Fine For Resorts World Las Vegas Casino In Money Laundering Scandal

May 18, 2025 -

Spring Breakout Rosters 2025 A Look At The Top Contenders

May 18, 2025

Spring Breakout Rosters 2025 A Look At The Top Contenders

May 18, 2025

Latest Posts

-

Viyna V Ukrayini Pedro Paskal Pidtrimuye Zelenskogo Pislya Zustrichi Z Trampom

May 18, 2025

Viyna V Ukrayini Pedro Paskal Pidtrimuye Zelenskogo Pislya Zustrichi Z Trampom

May 18, 2025 -

Pedro Paskal Ta Vizit Zelenskogo Do S Sh A Pidtrimka Ukrayini Vid Gollivudskogo Aktora

May 18, 2025

Pedro Paskal Ta Vizit Zelenskogo Do S Sh A Pidtrimka Ukrayini Vid Gollivudskogo Aktora

May 18, 2025 -

Zelenskiy I Tramp Reaktsiya Pedro Paskalya Na Sobytiya V Ukraine

May 18, 2025

Zelenskiy I Tramp Reaktsiya Pedro Paskalya Na Sobytiya V Ukraine

May 18, 2025 -

Jennifer Aniston Reaches Out To Pedro Pascal Post Dinner Speculation

May 18, 2025

Jennifer Aniston Reaches Out To Pedro Pascal Post Dinner Speculation

May 18, 2025 -

Podderzhka Ukrainy Pedro Paskal O Vstreche Zelenskogo I Trampa

May 18, 2025

Podderzhka Ukrainy Pedro Paskal O Vstreche Zelenskogo I Trampa

May 18, 2025