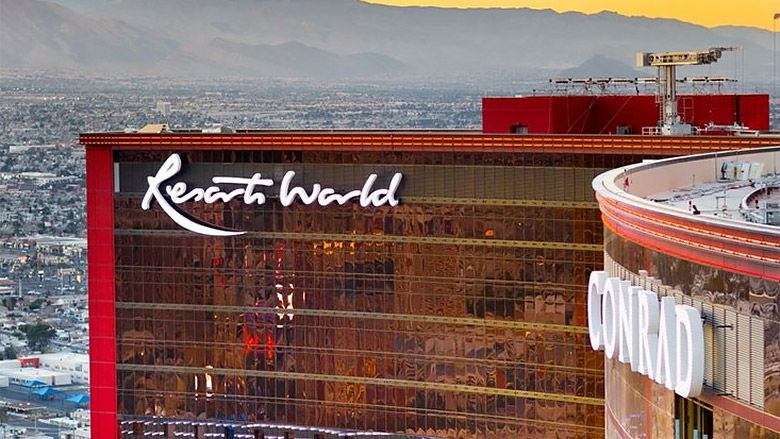

$10.5 Million Fine For Resorts World Las Vegas Casino In Money Laundering Scandal

Table of Contents

Details of the Resorts World Las Vegas Money Laundering Scandal

The Allegations

Resorts World Las Vegas faces allegations of serious failures in its AML compliance program. The Nevada Gaming Control Board (NGCB) investigation revealed a pattern of suspicious transactions, indicating potential money laundering activity. While specific details regarding individual transactions remain confidential due to ongoing investigations, sources suggest the violations involved a significant number of high-value transactions that failed to trigger appropriate scrutiny under the casino's AML procedures.

- Alleged transactions involved significant sums of cash.

- Suspected involvement of individuals with known ties to organized crime (though not officially confirmed).

- Failure to properly report suspicious activity according to the Bank Secrecy Act (BSA).

The Investigation

The investigation into Resorts World Las Vegas' AML failures was a joint effort between the NGCB and the Financial Crimes Enforcement Network (FinCEN). The investigation spanned several months, involving a thorough review of financial records, interviews with casino staff and patrons, and analysis of suspicious activity reports (SARs). Investigators utilized advanced data analytics to identify patterns and anomalies in the casino's financial transactions.

- NGCB conducted on-site inspections and data audits.

- FinCEN provided expertise on federal AML regulations.

- The investigation utilized sophisticated data analysis tools to uncover patterns of suspicious activity.

The Penalties

The $10.5 million fine represents a significant financial penalty for Resorts World Las Vegas. This amount was determined based on the severity and extent of the AML violations. While this fine is substantial, it doesn't fully capture the potential long-term damage to the casino's reputation and future earnings.

- The fine included a civil penalty to address the AML violations.

- No criminal charges have been filed against the casino or any individuals at this time, but further investigations are ongoing.

- The casino may face additional regulatory scrutiny and potential operational restrictions in the future.

Impact of the Fine on Resorts World Las Vegas and the Gaming Industry

Financial Impact

The $10.5 million fine represents a significant financial blow to Resorts World Las Vegas. While the exact impact on its stock price and profitability remains to be seen, analysts predict a negative impact on investor confidence and potential limitations in future investment opportunities.

- Potential for decreased stock value and reduced investor confidence.

- Impact on quarterly earnings and profitability.

- Potential delays or cancellations of planned expansion projects.

Reputational Damage

Beyond the financial ramifications, the money laundering scandal severely damages Resorts World Las Vegas' reputation. The negative publicity associated with such allegations can erode customer trust, leading to a decline in patronage and a loss of revenue.

- Negative media coverage and public perception.

- Potential loss of high-roller clientele.

- Damage to the overall brand image and customer loyalty.

Industry-Wide Implications

The Resorts World Las Vegas case serves as a stark reminder of the pervasive threat of money laundering within the casino industry. It’s likely to result in increased regulatory scrutiny and a heightened focus on AML compliance across the sector.

- Potential for stricter AML regulations and enforcement.

- Increased demand for enhanced AML compliance technology and training.

- Greater transparency and stricter reporting requirements for casinos.

Lessons Learned and Future AML Compliance

Strengthening AML Practices

The scandal necessitates a complete overhaul of AML practices within the casino industry. Casinos must proactively implement robust AML programs, investing in advanced technology, providing comprehensive training for employees, and fostering a culture of compliance.

- Implement advanced transaction monitoring systems to identify suspicious activity.

- Develop comprehensive employee training programs on AML regulations and procedures.

- Establish a clear escalation process for reporting and investigating suspicious activity.

Increased Regulatory Scrutiny

The future will undoubtedly see increased regulatory scrutiny of casinos' AML compliance programs. Casinos need to proactively demonstrate their commitment to compliance and transparency to maintain their operational licenses and protect their reputations.

- Enhanced reporting requirements and more frequent audits.

- Increased penalties for non-compliance with AML regulations.

- Greater collaboration between casinos and regulatory bodies to improve AML effectiveness.

Conclusion: The Resorts World Las Vegas Money Laundering Case – A Wake-Up Call for the Industry

The $10.5 million fine imposed on Resorts World Las Vegas underscores the critical importance of robust AML compliance within the casino industry. This case serves as a stark warning to other casinos, highlighting the severe consequences of failing to adequately address the risks of money laundering. Stringent AML practices are not merely a regulatory requirement; they are essential for maintaining the integrity of the industry, protecting its reputation, and fostering a safe and responsible gambling environment. To prevent similar incidents, casinos must prioritize investment in AML technology, employee training, and proactive risk management. Learn more about AML regulations and best practices to ensure your casino operates ethically and legally. Visit the websites of the Financial Crimes Enforcement Network (FinCEN) and the Nevada Gaming Control Board (NGCB) for more information on casino AML compliance and money laundering prevention.

Featured Posts

-

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025 -

Why Is Reddit Down Right Now Troubleshooting Guide

May 18, 2025

Why Is Reddit Down Right Now Troubleshooting Guide

May 18, 2025 -

White Lotus Snl Goggins Responds To Fan Speculation

May 18, 2025

White Lotus Snl Goggins Responds To Fan Speculation

May 18, 2025 -

Naytilia Mporei I Ellada Na Ginei Pagkosmio Kentro

May 18, 2025

Naytilia Mporei I Ellada Na Ginei Pagkosmio Kentro

May 18, 2025 -

Trumps Middle East Policy Winners And Losers

May 18, 2025

Trumps Middle East Policy Winners And Losers

May 18, 2025

Latest Posts

-

Bringing Your Pet On Uber In Mumbai Rules And Regulations

May 19, 2025

Bringing Your Pet On Uber In Mumbai Rules And Regulations

May 19, 2025 -

Investing In Ubers Driverless Technology An Etf Analysis

May 19, 2025

Investing In Ubers Driverless Technology An Etf Analysis

May 19, 2025 -

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025 -

The Autonomous Future Etf Opportunities With Ubers Driverless Technology

May 19, 2025

The Autonomous Future Etf Opportunities With Ubers Driverless Technology

May 19, 2025 -

Will Ubers Autonomous Vehicles Drive Etf Returns

May 19, 2025

Will Ubers Autonomous Vehicles Drive Etf Returns

May 19, 2025