Investing In XRP (Ripple) In 2024: Is Sub-$3 A Buying Opportunity?

Table of Contents

XRP's Current Market Position and Future Potential

XRP Price History and Volatility

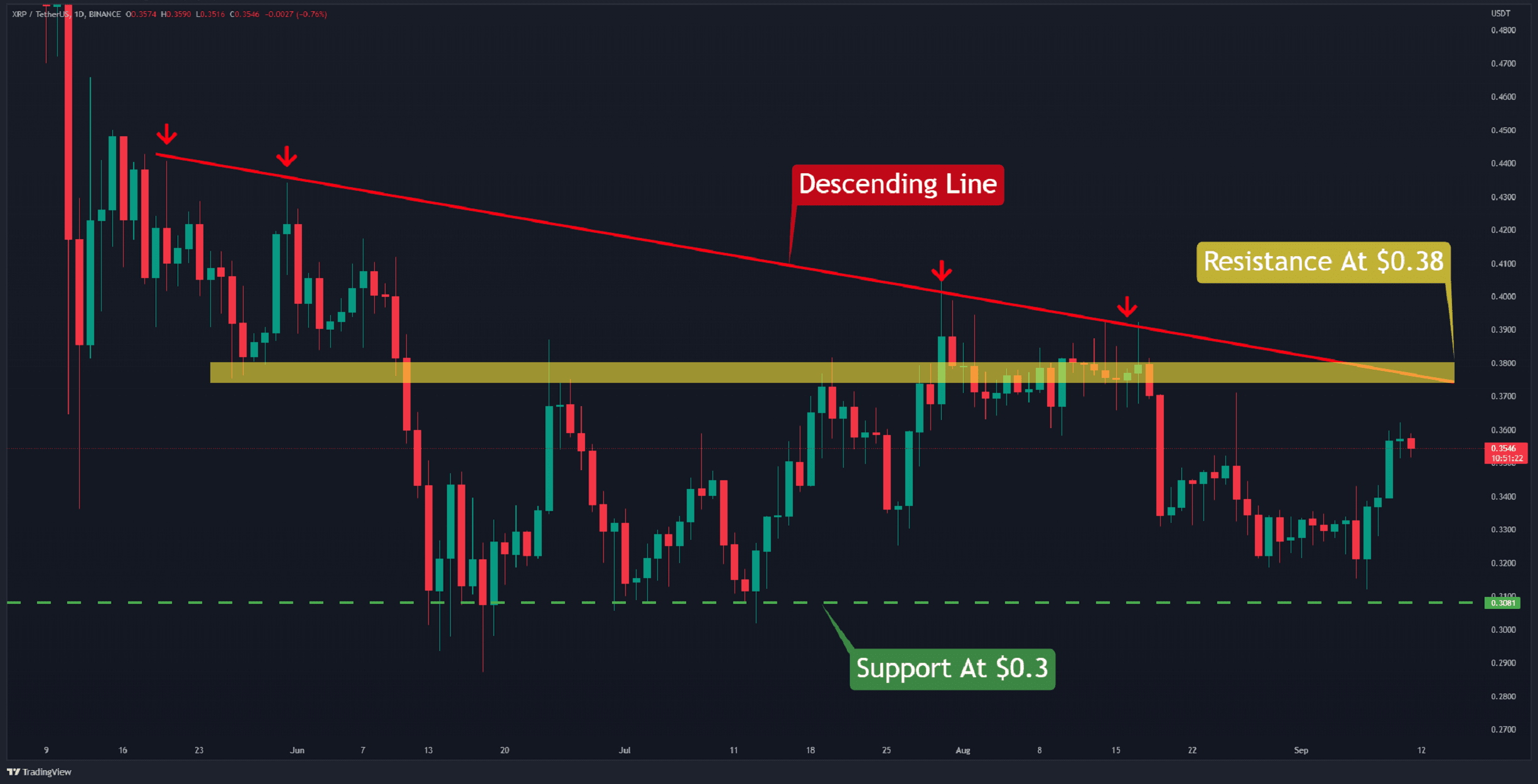

XRP, like many cryptocurrencies, has experienced significant price volatility. Analyzing the XRP price chart reveals periods of explosive growth followed by sharp corrections. The historical data shows highs exceeding $3 in the past, but also substantial drops. This volatility stems from several factors, including regulatory uncertainty surrounding the ongoing SEC lawsuit, overall market sentiment within the cryptocurrency space, and the general unpredictable nature of the crypto market. Understanding this inherent volatility is paramount before investing.

- Key Historical Price Points: Note significant highs and lows throughout XRP's history to provide context (this would require inserting a chart and specific data points).

- Volatility Factors: Regulatory changes, market sentiment shifts (FOMO and FUD), major technological breakthroughs or setbacks.

- Keywords: XRP price chart, XRP historical data, XRP volatility, XRP price prediction 2024.

Ripple's Legal Battle and its Impact on XRP

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and overall market sentiment. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this legal battle will likely have a profound effect on XRP's future. A positive ruling could potentially lead to significant price appreciation, while a negative outcome could cause a further decline. This regulatory uncertainty contributes to the overall volatility.

- Potential Outcomes: Analyze both positive and negative scenarios for the lawsuit.

- Impact on Sentiment: Explain how the lawsuit affects investor confidence and trading volume.

- Keywords: Ripple SEC lawsuit, XRP legal battle, regulatory uncertainty, XRP legal update.

Technological Advancements and Adoption of XRP

Despite the legal challenges, Ripple continues to develop its technology and expand its network, RippleNet. Improvements in speed, efficiency, and scalability of XRP's underlying technology enhance its potential as a cross-border payment solution. Increased adoption by financial institutions and businesses is another key factor for growth. Partnerships and collaborations with major players in the financial industry could propel XRP's value.

- Technological Improvements: Detail specific advancements in Ripple's technology.

- Adoption Growth: Highlight examples of financial institutions using XRP.

- Keywords: XRP technology, RippleNet, cross-border payments, blockchain technology, XRP adoption rate.

Factors Influencing XRP's Price in 2024

Macroeconomic Conditions and Crypto Market Trends

Broader macroeconomic conditions significantly impact cryptocurrency markets, including XRP. Bitcoin's price often influences the price movements of altcoins like XRP. Factors such as inflation, interest rates, geopolitical events, and overall global economic health all contribute to crypto market volatility and directly influence XRP's market cap.

- Bitcoin's Correlation: Discuss the historical relationship between Bitcoin and XRP prices.

- Macroeconomic Impacts: Analyze the potential effect of economic factors on XRP's value.

- Keywords: Crypto market trends, Bitcoin price, macroeconomic factors, XRP market cap, inflation, interest rates.

Adoption by Financial Institutions and Businesses

Ripple's success hinges on increasing adoption by financial institutions. Many banks and payment providers are exploring and implementing RippleNet for faster, cheaper cross-border payments. Broader adoption will likely boost XRP's demand and, consequently, its price. Tracking the progress of RippleNet's adoption is crucial for evaluating XRP's potential.

- Case Studies: Provide examples of successful XRP implementations in the financial sector.

- Future Adoption: Analyze the potential for wider use by financial institutions.

- Keywords: Institutional adoption, XRP adoption, RippleNet adoption, financial institutions, remittance.

Community Sentiment and Social Media Influence

Social media plays a substantial role in shaping investor sentiment towards XRP. News, announcements, and influencer opinions can generate FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt), leading to price fluctuations. It's crucial to be aware of this influence but remember to conduct your own thorough research before making any investment decisions.

- Social Media Analysis: Discuss the overall sentiment towards XRP on platforms like Twitter and Reddit.

- Influence of News: Analyze how news events impact XRP's price.

- Keywords: XRP community, social media sentiment, crypto news, FOMO, FUD, XRP news.

Is Sub-$3 a Buying Opportunity? A Risk Assessment

Potential Risks and Rewards

Investing in XRP involves significant risk. The ongoing legal battle, inherent cryptocurrency volatility, and overall market uncertainty are factors to consider. However, a favorable outcome in the SEC lawsuit could lead to significant price appreciation. Diversifying your investment portfolio is crucial to mitigate risk.

- Risk Factors: Detail the potential downsides of investing in XRP.

- Reward Potential: Explain the potential for high returns if the investment is successful.

- Keywords: Risk assessment, XRP investment risks, potential rewards, portfolio diversification.

Investment Strategies and Considerations

Several investment strategies can be employed, including dollar-cost averaging (DCA) to mitigate risk, or a lump-sum investment if you have a higher risk tolerance. Setting realistic investment goals and determining your risk tolerance are crucial before investing. Remember to conduct thorough due diligence and consult a financial advisor if necessary.

- Investment Strategies: Explain DCA and lump-sum investment approaches.

- Risk Tolerance: Emphasize the importance of understanding your personal risk profile.

- Keywords: Investment strategies, dollar-cost averaging, risk tolerance, financial advice, XRP investment strategy.

Conclusion: Making Informed Decisions about XRP Investment

Several factors influence XRP's price in 2024, including the Ripple SEC lawsuit's outcome, technological advancements, market conditions, and community sentiment. Investing in XRP below $3 might present a compelling buying opportunity for some, but it’s essential to carefully weigh the potential rewards against the considerable risks. Remember to conduct your own thorough research, assess your risk tolerance, and make informed decisions based on your own investment goals before investing in XRP or any other cryptocurrency. Don't rely solely on price predictions; focus on understanding the underlying technology, adoption rates, and the overall market landscape.

Featured Posts

-

Aansluiting Stroomnet Geweigerd Kampen Dagvaardt Enexis

May 01, 2025

Aansluiting Stroomnet Geweigerd Kampen Dagvaardt Enexis

May 01, 2025 -

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

9 Ways Target Starbucks Differ From Standalone Stores

May 01, 2025

9 Ways Target Starbucks Differ From Standalone Stores

May 01, 2025 -

Should You Buy Xrp Now Analyzing The Recent 400 Price Increase

May 01, 2025

Should You Buy Xrp Now Analyzing The Recent 400 Price Increase

May 01, 2025 -

Xrp Price Prediction Analyzing The Future Value Of Ripples Digital Currency

May 01, 2025

Xrp Price Prediction Analyzing The Future Value Of Ripples Digital Currency

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025