Investing In XRP (Ripple): Is Now The Right Time?

Table of Contents

Understanding XRP and its Functionality

XRP is the native cryptocurrency of Ripple, a technology company focused on providing global payment solutions. RippleNet, Ripple's payment network, utilizes XRP to facilitate fast and cost-effective cross-border transactions for financial institutions. Unlike cryptocurrencies designed primarily for decentralized applications (dApps), XRP's primary function is to bridge the gap between different currencies, improving the speed and efficiency of international money transfers.

XRP boasts several technological advantages. Its unique consensus mechanism allows for significantly faster transaction speeds compared to Bitcoin or Ethereum. This enhanced speed, coupled with lower transaction fees, makes it an attractive option for high-volume transactions. However, XRP's centralized nature, unlike truly decentralized cryptocurrencies like Bitcoin, is a point of contention for some. Its reliance on Ripple's infrastructure also raises questions about its long-term decentralization.

- Faster transaction speeds than Bitcoin or Ethereum.

- Lower transaction fees compared to other cryptocurrencies.

- Focus on institutional adoption and banking partnerships.

- Scalability designed for high-volume transactions.

- Centralized nature potentially impacting its decentralization claims.

Ripple's Legal Battles and Their Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and investor sentiment. The SEC alleges that Ripple sold XRP as an unregistered security, a claim Ripple vehemently denies. The outcome of this case remains uncertain, creating significant volatility in XRP's price. A favorable ruling for Ripple could lead to a substantial price surge, while an unfavorable outcome could result in a significant decline. This legal uncertainty is a major factor to consider when evaluating investing in XRP.

- SEC lawsuit arguments: The SEC claims XRP is a security, while Ripple argues it's a currency.

- Potential scenarios: A win for Ripple could boost XRP's price; a loss could severely depress it.

- Expert opinions: Legal experts offer varying predictions on the likely outcome of the case.

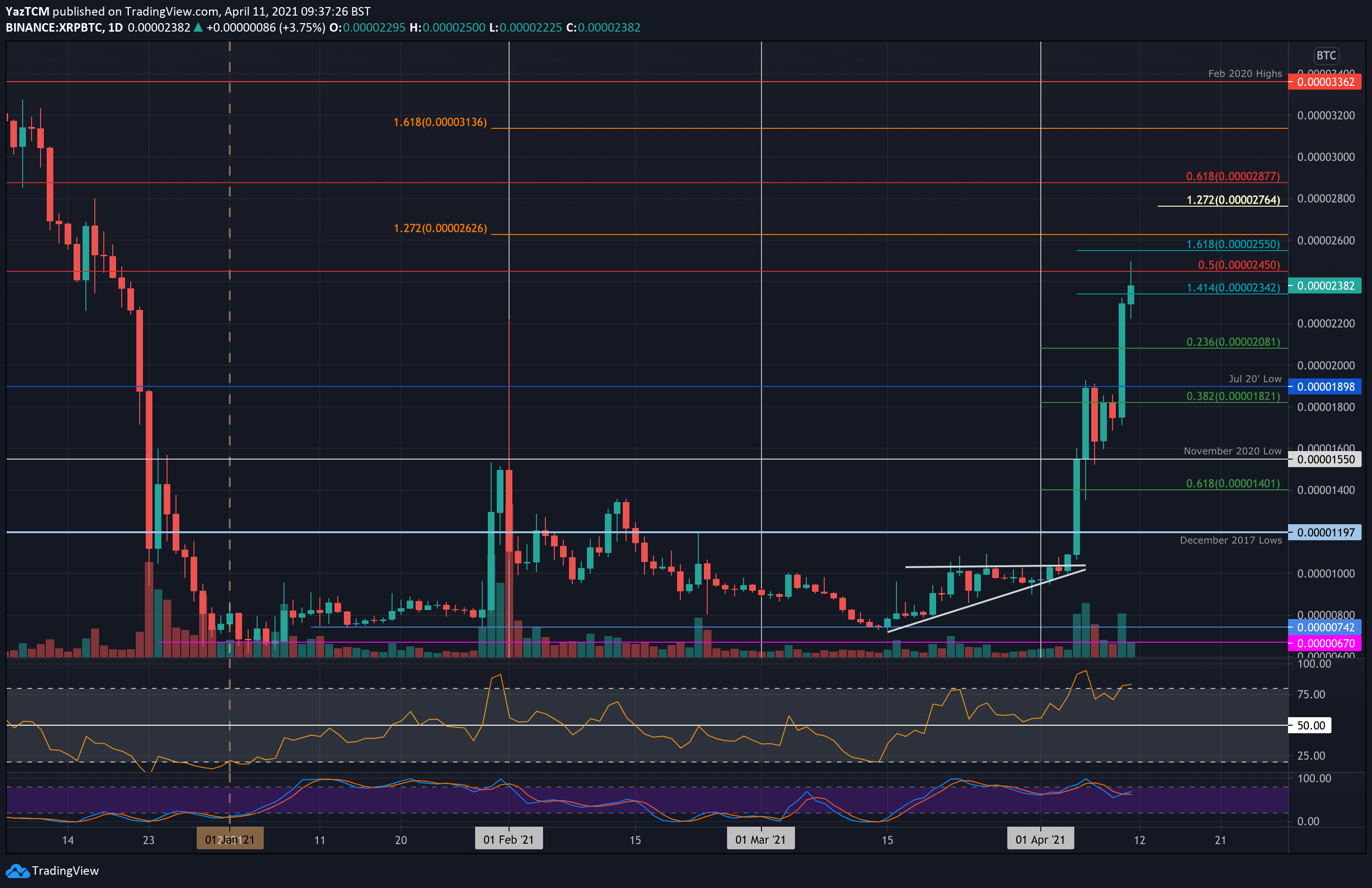

Market Analysis and Price Prediction (with Disclaimer)

Analyzing XRP's price performance requires considering various factors, including regulatory changes, overall market sentiment, and the rate of adoption by financial institutions. While historical price charts can provide some insight, predicting future price movements is inherently speculative. Technical indicators, such as moving averages and relative strength index (RSI), can offer additional signals, but should be interpreted cautiously. Fundamental analysis focusing on Ripple's partnerships and technological advancements also plays a significant role.

- Historical price charts: Examining past performance can reveal trends, but not predict the future.

- Technical indicators: Tools like moving averages and RSI can provide clues but are not foolproof.

- Fundamental analysis: Ripple's partnerships and technological progress influence XRP's value.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly speculative and carry significant risk. Past performance is not indicative of future results.

Risks and Rewards of Investing in XRP

Investing in XRP, like any cryptocurrency, involves substantial risk. Market volatility, regulatory uncertainty, and the potential for market manipulation are all significant concerns. However, the potential rewards can be equally significant. Early adoption of a potentially successful cryptocurrency could yield substantial returns. Diversification and risk management are essential strategies for mitigating these risks. Consider employing dollar-cost averaging to reduce the impact of price fluctuations.

- Risk assessment: XRP investments carry high risk due to market volatility and regulatory uncertainty.

- Risk mitigation: Diversification, dollar-cost averaging, and careful research can help mitigate risk.

- Potential rewards: High potential returns compensate for the high-risk nature of the investment.

Conclusion: Should You Invest in XRP Right Now?

Investing in XRP presents a complex scenario. While XRP's technology and Ripple's partnerships offer potential for growth, the ongoing legal battle and inherent volatility of the cryptocurrency market introduce considerable risk. The potential rewards are significant, but only for those who understand and accept the high level of risk involved.

Based on the analysis, a decision on whether to invest in XRP should not be rushed. Thorough due diligence is paramount. Carefully consider the risks, assess your risk tolerance, and only invest what you can afford to lose. Before making any decisions related to investing in XRP, consulting with a qualified financial advisor is strongly recommended. Ultimately, the decision of whether or not to engage in investing in XRP rests solely with the individual investor after careful consideration of all factors.

Featured Posts

-

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala Zasto

May 02, 2025

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala Zasto

May 02, 2025 -

Schroders Q1 Asset Drop Client Stock Exodus

May 02, 2025

Schroders Q1 Asset Drop Client Stock Exodus

May 02, 2025 -

Remembering Priscilla Pointer A Legacy Of Acting And Mentorship

May 02, 2025

Remembering Priscilla Pointer A Legacy Of Acting And Mentorship

May 02, 2025 -

Dash Rendar Action Figure Hasbros Star Wars Shadow Of The Empire Release

May 02, 2025

Dash Rendar Action Figure Hasbros Star Wars Shadow Of The Empire Release

May 02, 2025 -

Dr Shradha Malik Addressing The Silence Around Mental Health

May 02, 2025

Dr Shradha Malik Addressing The Silence Around Mental Health

May 02, 2025

Latest Posts

-

Graeme Souness Picks His All Time Premier League Best

May 02, 2025

Graeme Souness Picks His All Time Premier League Best

May 02, 2025 -

Souness Names His Top Premier League Player

May 02, 2025

Souness Names His Top Premier League Player

May 02, 2025 -

Graeme Souness Premier League Favourite Player Revealed

May 02, 2025

Graeme Souness Premier League Favourite Player Revealed

May 02, 2025 -

Islas Health Battle Inspires Graeme Sounesss Epic Swim

May 02, 2025

Islas Health Battle Inspires Graeme Sounesss Epic Swim

May 02, 2025 -

The Impact Of Social Media Assessing Rupert Lowes X Strategy For Uk Political Reform

May 02, 2025

The Impact Of Social Media Assessing Rupert Lowes X Strategy For Uk Political Reform

May 02, 2025