Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's current outlook on the stock market is generally cautious but not overtly bearish. While acknowledging the elevated valuations, they aren't predicting an immediate crash. Their assessment is nuanced, considering a multitude of economic indicators. They highlight the persistent strength of the consumer, despite inflation, as a significant positive factor. However, they also point to potential headwinds.

-

Key Economic Predictions: BofA predicts moderate GDP growth, but slightly lower than previous forecasts, due to rising interest rates and persistent inflation. They foresee inflation gradually decreasing throughout the year but remaining above the central bank's target for some time.

-

Overvalued and Undervalued Sectors: BofA's analysis identifies certain technology sectors as potentially overvalued, given their high price-to-earnings (P/E) ratios relative to anticipated future earnings. Conversely, they suggest that certain value-oriented sectors, such as energy and financials, might be relatively undervalued at present.

-

Reasoning for Market Outlook: BofA's cautious optimism stems from the belief that corporate earnings, while potentially slowing, will still support current market levels. However, they emphasize the need for caution given the uncertainties surrounding inflation and interest rate policy.

Key Investor Concerns Regarding High Valuations

High stock market valuations are understandably fueling anxiety among investors. Several key concerns dominate the conversation:

-

Fear of a Market Correction or Crash: The primary concern for many is the potential for a sharp decline in stock prices, mirroring historical market corrections or even a full-blown crash.

-

Concerns About Inflated P/E Ratios: Many stocks trade at significantly higher P/E ratios than their historical averages, leading to concerns about whether current prices are justified by future earnings potential.

-

Worry About Potential Interest Rate Hikes: Rising interest rates increase borrowing costs for businesses and can decrease corporate profitability, potentially impacting stock prices negatively.

-

Uncertainty Surrounding Future Economic Growth: The ongoing economic uncertainty related to inflation, geopolitical risks, and supply chain disruptions is causing significant anxiety and making it difficult to predict future stock market performance.

The Impact of Inflation on Stock Market Valuations

BofA acknowledges that persistent inflation poses a significant risk to stock market valuations. High inflation erodes corporate profit margins, reducing the attractiveness of stocks. BofA's analysis suggests that companies unable to pass on rising costs to consumers will face squeezed profits, potentially leading to lower stock prices.

-

Inflation Forecast: BofA forecasts a gradual decline in inflation but cautions that it might remain elevated for longer than initially expected, posing ongoing challenges to corporate profitability and stock valuations.

-

Inflation's Impact on Different Sectors: The impact of inflation varies across sectors. Companies with pricing power are better positioned to withstand inflationary pressures than those with limited pricing flexibility.

-

Investment Strategies to Protect Against Inflation: BofA suggests strategies like investing in inflation-hedged assets, such as commodities and Treasury Inflation-Protected Securities (TIPS), to mitigate the risks associated with high inflation.

BofA's Recommendations for Investors

BofA advocates for a balanced and cautious approach to investing in the current market environment. While not recommending a wholesale retreat from the market, they advise investors to adopt a more defensive strategy.

-

Portfolio Diversification: BofA emphasizes the importance of diversifying portfolios across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce overall risk.

-

Recommendations for Specific Sectors and Asset Classes: BofA suggests considering value stocks and companies with strong balance sheets and consistent dividend payouts as potentially less risky investments during times of high valuations.

-

Advice on Risk Management: They strongly recommend thorough due diligence before making investment decisions and implementing robust risk management strategies to protect capital.

-

Importance of Long-Term Investment Strategies: BofA emphasizes the significance of maintaining a long-term investment horizon and avoiding emotional decision-making driven by short-term market fluctuations.

Alternative Perspectives and Criticisms of BofA's Analysis

It's crucial to remember that BofA's analysis isn't universally accepted. Some financial experts argue that the market's current valuations are justified by strong corporate earnings growth and technological innovation.

-

Counterarguments to BofA's Assessment: Some analysts argue that inflation is transitory and that current high valuations reflect long-term growth potential.

-

Different Interpretations of Economic Indicators: Different experts may interpret the same economic indicators differently, leading to contrasting market outlooks.

-

Alternative Investment Strategies: Alternative investment strategies, such as focusing on growth stocks or specific emerging markets, are also being advocated by some analysts.

Conclusion: Navigating Investor Concerns About High Stock Market Valuations – A BofA Perspective

BofA's assessment of the current market highlights the significant concerns surrounding high stock market valuations. While not predicting an immediate crash, they advocate for a cautious approach, emphasizing portfolio diversification and risk management. They also highlight the impact of inflation and suggest strategies to mitigate its risks. However, it's essential to remember that this is just one perspective. Before making any investment decisions based on this information or any analysis of high stock market valuations, conduct your own thorough research, consider alternative viewpoints, and consult with a qualified financial advisor. Understanding high stock market valuations requires careful consideration of multiple factors and perspectives to make informed choices that align with your individual risk tolerance and financial goals.

Featured Posts

-

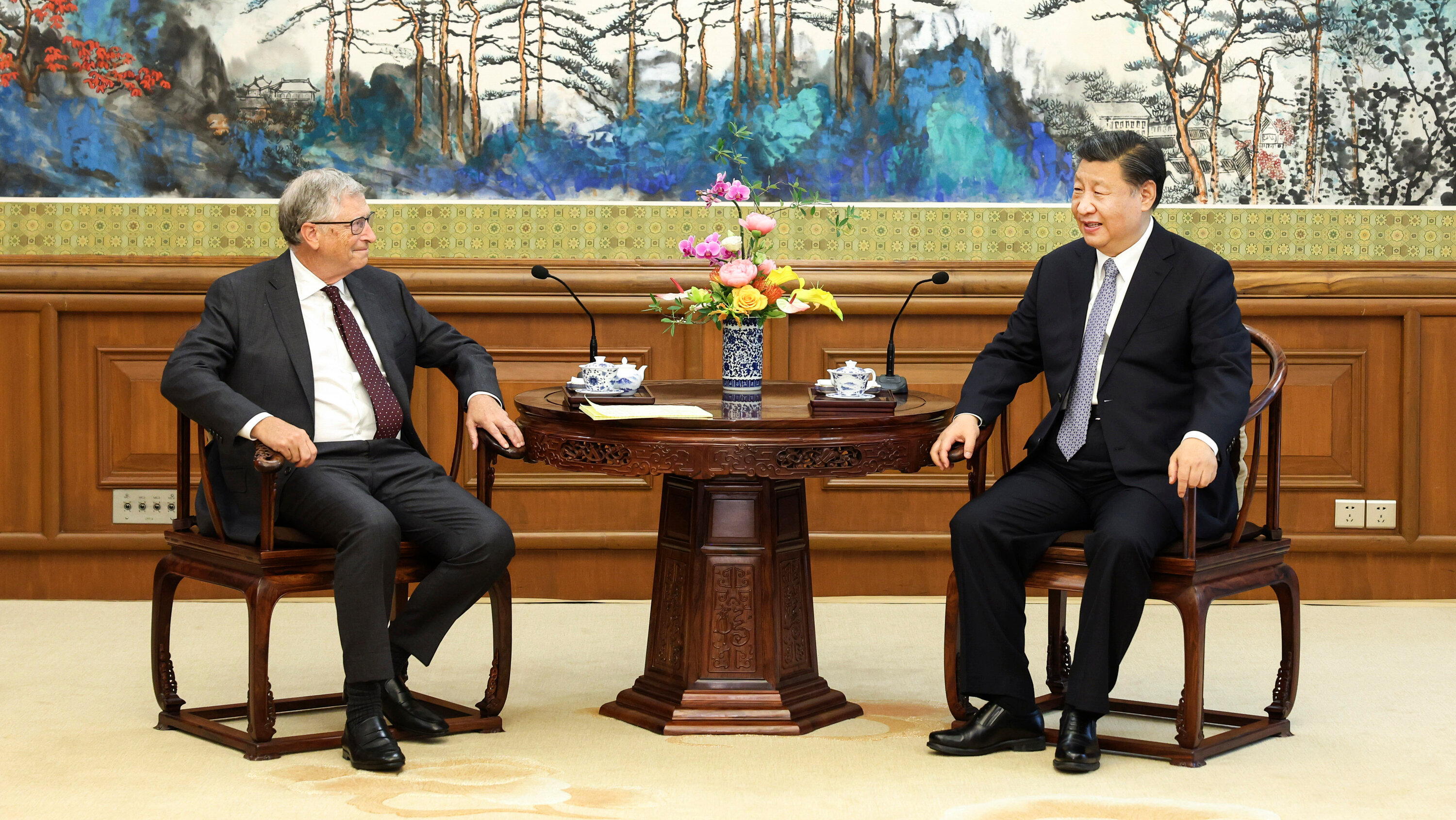

Xi Jinping And The Long Game Chinas Capacity For Extended Conflict With The Us

Apr 25, 2025

Xi Jinping And The Long Game Chinas Capacity For Extended Conflict With The Us

Apr 25, 2025 -

Us Capital Exodus Fuels Record Investment In Japanese Assets

Apr 25, 2025

Us Capital Exodus Fuels Record Investment In Japanese Assets

Apr 25, 2025 -

You Tubes Influence How It Shapes Culture And Communication

Apr 25, 2025

You Tubes Influence How It Shapes Culture And Communication

Apr 25, 2025 -

Renault Confirms 2023 Outlook Strong Electric Vehicle Demand Drives Results

Apr 25, 2025

Renault Confirms 2023 Outlook Strong Electric Vehicle Demand Drives Results

Apr 25, 2025 -

Marvels Jean Grey Casting A Bold And Brilliant Move

Apr 25, 2025

Marvels Jean Grey Casting A Bold And Brilliant Move

Apr 25, 2025

Latest Posts

-

Carnival Cruise Lines 7 Big Announcements For Next Month

Apr 30, 2025

Carnival Cruise Lines 7 Big Announcements For Next Month

Apr 30, 2025 -

Humanoid Robots In Logistics Ups And Figure Ais Joint Venture

Apr 30, 2025

Humanoid Robots In Logistics Ups And Figure Ais Joint Venture

Apr 30, 2025 -

7 Carnival Cruise Line Updates Coming Next Month

Apr 30, 2025

7 Carnival Cruise Line Updates Coming Next Month

Apr 30, 2025 -

Parkland School Board Necessary Changes But Not Revolutionary Overhaul

Apr 30, 2025

Parkland School Board Necessary Changes But Not Revolutionary Overhaul

Apr 30, 2025 -

Cbc Projects Poilievre Loss Conservative Party Faces Setback

Apr 30, 2025

Cbc Projects Poilievre Loss Conservative Party Faces Setback

Apr 30, 2025