Is $2 The Bottom For XRP? A Deep Dive Into XRP Price Prediction

Table of Contents

Ripple's Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and overall market sentiment. The uncertainty surrounding the outcome casts a long shadow over investor confidence. Understanding the potential ramifications is crucial for any XRP price prediction.

-

Potential Outcomes: The SEC alleges Ripple violated securities laws through its sale of XRP. A favorable ruling for Ripple could lead to a significant price surge, as the regulatory uncertainty would be lifted. Conversely, an unfavorable ruling could cause a further price drop. A settlement could result in a mixed reaction, depending on its terms.

-

Impact on Investor Sentiment: The lawsuit has created a climate of fear, uncertainty, and doubt (FUD) impacting trading volume and investor participation. Many exchanges delisted XRP during the height of the legal battle, further depressing its price. A clear resolution, regardless of the outcome, is likely to bring much-needed clarity and potentially stabilize the market.

-

Expert Opinions and Legal Analyses: Legal experts offer varying opinions on the likely outcome. Some predict a victory for Ripple, citing the unique characteristics of XRP and its use within RippleNet. Others believe the SEC has a strong case, emphasizing the potential for XRP to be classified as a security. These differing perspectives highlight the uncertainty inherent in the situation.

(Include charts here showing XRP price correlation with key legal developments, such as the filing of the lawsuit, significant court hearings, and any major announcements.)

Technical Analysis: Chart Patterns and Indicators Suggesting Potential Support Levels

Technical analysis provides valuable insights into potential price movements. By examining XRP's price charts and employing various indicators, we can identify potential support and resistance levels.

-

Key Indicators: Analyzing XRP's price history using moving averages (e.g., 50-day and 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) can reveal potential turning points. These indicators help assess the strength of buying and selling pressure.

-

Support and Resistance Levels: Historical price data reveals potential support levels where buying pressure may outweigh selling pressure. Identifying these levels is crucial for determining whether $2 represents a true bottom or just a temporary respite. Resistance levels, conversely, represent areas where selling pressure may be strong.

-

Chart Patterns: Observing chart patterns such as double bottoms, head and shoulders, or triangles can provide further clues about potential price movements. These patterns can suggest areas of potential support or breakout points.

(Include visuals here – charts and graphs illustrating the technical analysis, clearly labeled with indicators and key support/resistance levels.)

Fundamental Analysis: Ripple's Technology and Partnerships Influencing XRP's Value

Beyond the legal battles, Ripple's underlying technology and partnerships contribute significantly to XRP's long-term value proposition.

-

RippleNet and xRapid: RippleNet, a global payment network, utilizes XRP to facilitate faster and cheaper cross-border transactions. xRapid, a solution leveraging XRP for on-demand liquidity, is a key component of this network. Increased adoption of RippleNet and xRapid can drive demand for XRP.

-

On-Demand Liquidity (ODL): ODL is a crucial aspect of Ripple's technology, allowing financial institutions to source liquidity on demand using XRP. Its growing adoption signifies increased utility for XRP and could positively influence its price.

-

Ripple Partnerships: Ripple's partnerships with various financial institutions globally are crucial for the adoption and growth of its technology. These partnerships demonstrate the growing acceptance of Ripple's solutions and potentially translate into increased demand for XRP.

-

Blockchain Technology and Cryptocurrency Adoption: The overall adoption of blockchain technology and cryptocurrencies plays a vital role in the future price of XRP. Wider acceptance of cryptocurrencies as a legitimate form of payment and store of value would benefit XRP.

(Include data here on transaction volume, adoption rates of ODL, and details on significant partnerships.)

Considering the Wider Crypto Market

The broader cryptocurrency market significantly impacts XRP's price. It's crucial to consider the overall market sentiment and the performance of other major cryptocurrencies, especially Bitcoin.

-

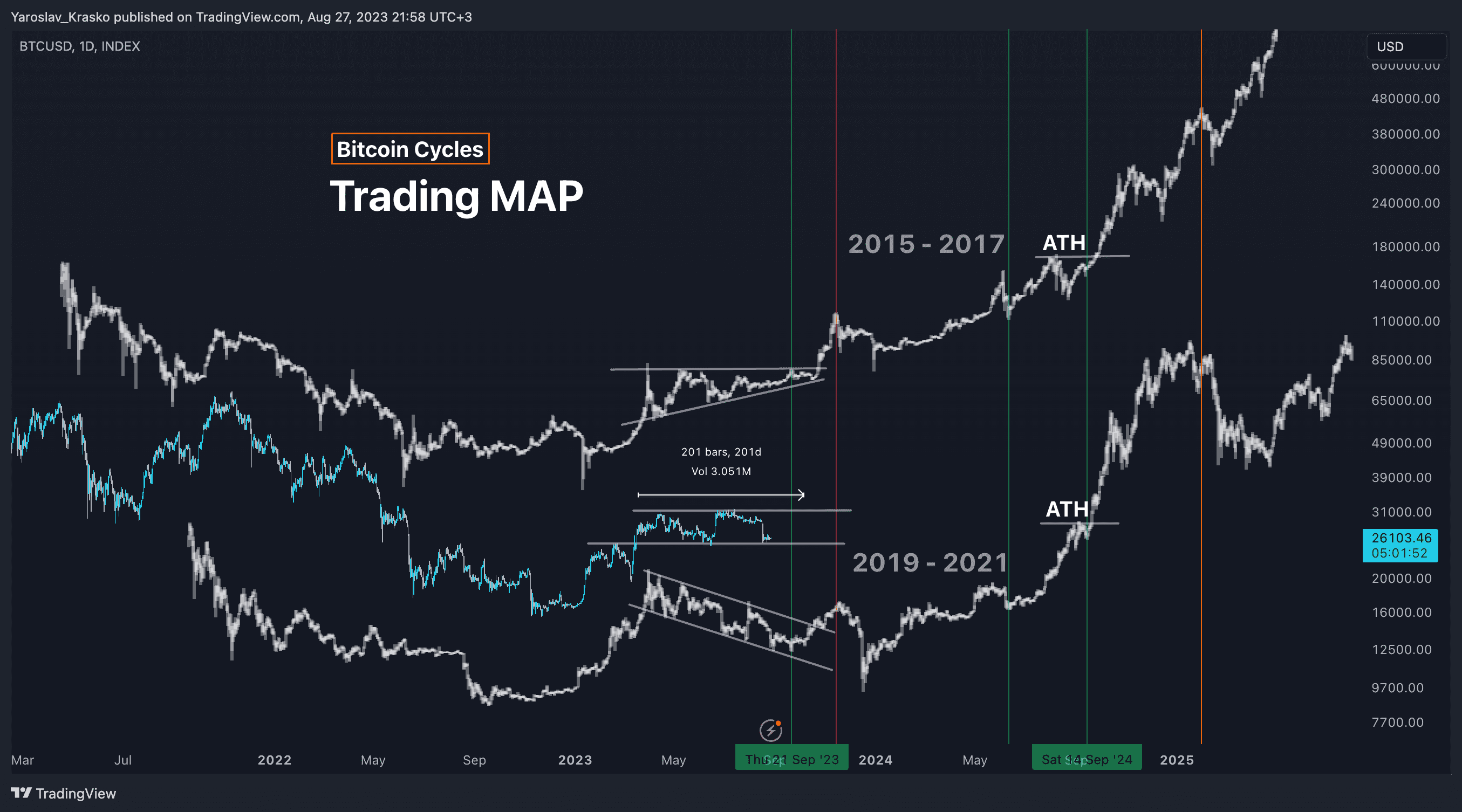

Bitcoin's Price Movements: Bitcoin often acts as a benchmark for the entire crypto market. Significant price movements in Bitcoin usually have a ripple effect on altcoins like XRP.

-

Market Sentiment: General investor sentiment, fear, greed, and overall market confidence greatly influence crypto prices. Negative news or events can lead to widespread sell-offs, while positive developments can trigger rallies.

-

Altcoin Season: Periods known as "altcoin seasons" see a surge in the performance of altcoins relative to Bitcoin. These periods can lead to significant gains for XRP, depending on various market dynamics.

Conclusion

Predicting the precise bottom for XRP remains a challenging task, given the inherent volatility of the cryptocurrency market. However, considering Ripple's legal battle, technical indicators, fundamental factors, and the broader crypto market suggests that while $2 might represent a significant support level, it's not a guarantee of the absolute bottom. The outcome of the SEC lawsuit will be a major catalyst. While technical analysis points to potential support levels, fundamental factors like RippleNet adoption and partnerships indicate long-term potential. The overall cryptocurrency market sentiment will also play a crucial role.

While predicting the precise bottom for XRP remains challenging, understanding the factors influencing its price is crucial for informed investment decisions. Continue your research on XRP price prediction and stay updated on the latest developments to make well-informed decisions about your crypto investments. Learn more about XRP and its potential by exploring our other resources on [link to relevant resources].

Featured Posts

-

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising This Week

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising This Week

May 08, 2025 -

Missing Dwp Correspondence Avoiding A 6 828 Benefit Penalty

May 08, 2025

Missing Dwp Correspondence Avoiding A 6 828 Benefit Penalty

May 08, 2025 -

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025 -

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025 -

Daily Lotto Draw Tuesday 15th April 2025 Results

May 08, 2025

Daily Lotto Draw Tuesday 15th April 2025 Results

May 08, 2025

Latest Posts

-

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025 -

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025 -

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025 -

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025