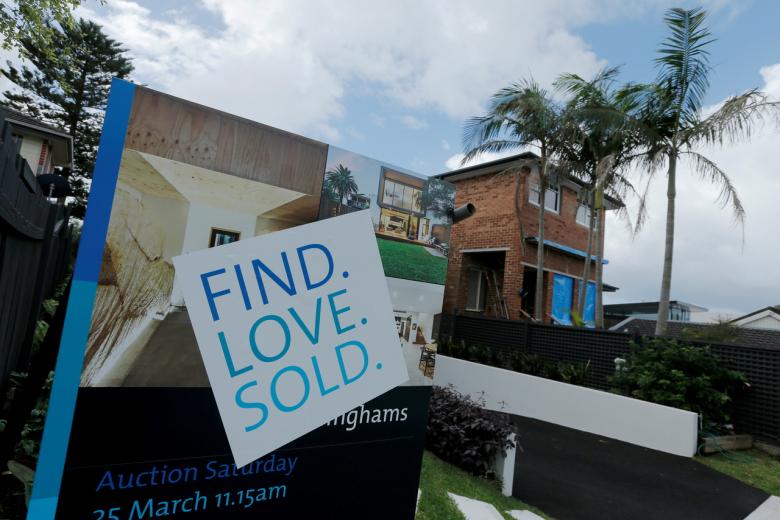

Is A Place In The Sun Right For You? Assessing Your Overseas Property Options

Table of Contents

Defining Your Budget and Financing Options for a Place in the Sun

Before you start browsing idyllic beaches and picturesque villages, you need a solid understanding of your financial capabilities. Owning a "Place in the Sun" involves more than just the purchase price.

Understanding the Total Cost of Overseas Property Ownership

Buying a property abroad comes with a range of associated costs. It's crucial to create a realistic budget that accounts for all potential expenses. These can include:

- Purchase price: The initial cost of the property itself.

- Legal fees: Costs associated with solicitors, conveyancers, and other legal professionals.

- Taxes: Stamp duty, property taxes, and other relevant taxes specific to the country.

- Renovation costs: If the property requires renovations or updates.

- Ongoing maintenance: Regular upkeep, repairs, and potential service charges.

- Insurance: Building insurance and contents insurance.

- Currency exchange fluctuations: The risk of changes in exchange rates affecting the overall cost.

Ignoring these hidden costs can lead to financial difficulties down the line. Therefore, thorough budgeting is paramount.

Securing Financing for Your Overseas Property

Securing financing for an overseas property can be more complex than obtaining a domestic mortgage. Options include:

- Mortgages: Many lenders specialize in overseas mortgages, but the requirements and interest rates may vary.

- Cash purchases: Buying outright eliminates mortgage complexities but requires significant upfront capital.

- Overseas financing options: Some countries offer specific financing options for foreign buyers.

Working with experienced mortgage brokers who specialize in international properties is highly recommended. They can navigate the complexities of securing financing and help you find the best options available.

Choosing the Right Location for Your Place in the Sun

Selecting the right location is critical to your enjoyment and the potential return on your investment.

Researching Potential Locations: Lifestyle, Climate, and Investment Potential

Consider these factors when choosing a location:

- Lifestyle: What kind of lifestyle are you looking for? Do you want access to beaches, mountains, nightlife, or cultural attractions? Proximity to amenities, transport links and healthcare are also vital considerations.

- Climate: Research average temperatures, rainfall, and sunshine hours to ensure the climate suits your preferences.

- Investment potential: Research the local property market. Does the area show potential for capital appreciation or rental income? Consider factors like population growth and tourism.

Utilize online resources, property portals, and travel to potential locations for firsthand research.

Understanding Local Laws and Regulations

Before committing to a purchase, understand the local laws and regulations regarding property ownership:

- Building permits: Required for any renovations or extensions.

- Planning permission: May be required for certain changes or developments.

- Property taxes: Annual property taxes vary significantly between countries and regions.

- Inheritance laws: How will the property be handled upon your death?

- Restrictions on foreign ownership: Some countries have restrictions on the percentage of properties that can be owned by foreigners.

Seeking legal advice from a solicitor specializing in international property law in the chosen country is essential.

Navigating the Legal and Practicalities of Buying a Place in the Sun

The legal process of purchasing an overseas property can be complex. Navigating it successfully requires careful planning and professional assistance.

Working with Local Real Estate Agents and Lawyers

Engaging reputable professionals is crucial:

- Due diligence: Thoroughly investigate the property’s title and history to ensure there are no legal issues.

- Contracts: Carefully review all contracts before signing, seeking legal advice if necessary.

Choosing a reputable real estate agent familiar with the local market and a lawyer specializing in international property transactions will significantly ease the process and protect your interests.

Understanding Property Taxes and Ongoing Costs

Beyond the purchase price, consider the ongoing costs:

- Annual property taxes (council tax equivalents): These can vary significantly by location.

- Community fees: Many properties in complexes or communities have associated fees.

- Maintenance costs: Regular maintenance and repairs are inevitable.

- Insurance premiums: Building and contents insurance are essential.

Accurately estimating these costs and incorporating them into your budget is crucial.

Weighing the Pros and Cons of Owning a Place in the Sun

Before making a decision, carefully weigh the potential advantages and disadvantages.

Advantages: Lifestyle, Investment, and Escape

Owning a "Place in the Sun" offers several potential benefits:

- Improved quality of life: Enjoying a different lifestyle and culture.

- Potential rental income: Generating income by renting out your property.

- Capital appreciation: The property's value may increase over time.

- Holiday home: A comfortable and convenient place to relax and enjoy vacations.

- Escape from daily routines: A chance to unwind and recharge in a different environment.

Disadvantages: Distance, Costs, and Potential Challenges

It's also important to acknowledge the potential drawbacks:

- Travel costs: Flights and other travel expenses can be significant.

- Potential language barriers: Communicating with local professionals and neighbours.

- Property management challenges: Managing the property remotely can be demanding.

- Currency exchange risk: Fluctuations in exchange rates can impact the overall cost and returns.

Conclusion: Is a Place in the Sun the Right Choice for You?

Buying a "Place in the Sun" is a significant investment requiring careful consideration of your budget, location preferences, legal implications, and the advantages and disadvantages. Thorough research and professional advice from real estate agents and lawyers specializing in international property are paramount. Don't rush the process. Start planning your dream "Place in the Sun" today by carefully considering the factors discussed in this article. Begin your research and seek expert advice to make an informed decision about whether overseas property ownership is right for you. Don't just dream of your perfect Place in the Sun – make it a reality!

Featured Posts

-

Fortnite Server Status Is Fortnite Down Update 34 30 Patch Notes

May 03, 2025

Fortnite Server Status Is Fortnite Down Update 34 30 Patch Notes

May 03, 2025 -

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025 -

Is The Eco Flow Wave 3 Portable Climate Control Unit Worth It A Detailed Review

May 03, 2025

Is The Eco Flow Wave 3 Portable Climate Control Unit Worth It A Detailed Review

May 03, 2025 -

2024s Hidden Ps Plus Gem An Underrated Game You Shouldnt Miss

May 03, 2025

2024s Hidden Ps Plus Gem An Underrated Game You Shouldnt Miss

May 03, 2025 -

Ps 5 Vs Xbox Series X S Analyzing Us Market Share

May 03, 2025

Ps 5 Vs Xbox Series X S Analyzing Us Market Share

May 03, 2025

Latest Posts

-

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025 -

The Thunderbolts Initiative Can Marvel Revitalize Its Cinematic Universe

May 04, 2025

The Thunderbolts Initiative Can Marvel Revitalize Its Cinematic Universe

May 04, 2025 -

Marvels Thunderbolts A Critical Look At The Mcus Latest Offering

May 04, 2025

Marvels Thunderbolts A Critical Look At The Mcus Latest Offering

May 04, 2025 -

Solid U S Job Numbers For April 177 000 Jobs Added 4 2 Unemployment

May 04, 2025

Solid U S Job Numbers For April 177 000 Jobs Added 4 2 Unemployment

May 04, 2025 -

How Marvel Can Enhance Its Storytelling And Production Values

May 04, 2025

How Marvel Can Enhance Its Storytelling And Production Values

May 04, 2025