Is Apple Stock A Buy After Strong Q2 Earnings?

Table of Contents

Analyzing Apple's Q2 Earnings Report

Apple's Q2 earnings report painted a picture of robust growth and profitability. Let's delve into the specifics:

Revenue Growth and Key Drivers

Apple's revenue growth in Q2 was driven by a combination of factors, demonstrating the company's diversified revenue streams.

- iPhone Sales: While exact figures vary depending on the source, iPhone sales showed healthy growth, exceeding expectations in several key markets. This success can be attributed to the strong demand for the latest iPhone models and continued upgrades by existing users.

- Services: Apple's Services segment, encompassing Apple Music, iCloud, Apple Pay, and the App Store, continues to be a powerhouse, demonstrating strong growth and high profitability. This segment shows resilience even during economic uncertainty. This segment saw a [Insert Percentage]% increase in revenue.

- Wearables, Home, and Accessories: This category, encompassing Apple Watch, AirPods, and other accessories, also showed consistent growth, driven by the popularity of wearables and the expanding ecosystem of Apple products. Revenue increased by approximately [Insert Percentage]%.

- Mac: The Mac segment showed [positive/negative - insert data] growth, indicating [insert reasoning, e.g., strong demand for new models, or a market slowdown].

Profitability and Margins

Apple's profitability remains remarkably strong.

- Gross Profit Margin: Apple maintained a healthy gross profit margin of [Insert Percentage]%, reflecting efficient manufacturing and pricing strategies.

- Operating Margin: The operating margin also remained high at approximately [Insert Percentage]%, demonstrating effective cost management and strong operational efficiency.

- Net Income Margin: Net income margin came in at [Insert Percentage]%, exceeding expectations and highlighting the company's ability to translate revenue into profit.

These margins, when compared to previous quarters and industry competitors, demonstrate Apple's continued dominance and financial health.

Future Outlook and Guidance

Apple's guidance for the next quarter was [positive/cautious - insert data], reflecting [insert reasoning, e.g., confidence in product demand, or concerns about macroeconomic conditions]. Key takeaways from the earnings call included:

- [Insert specific statement from the earnings call about future expectations for iPhone sales].

- [Insert specific statement from the earnings call about the growth prospects of the Services segment].

- [Insert specific statement from the earnings call regarding any potential challenges or risks].

Factors Influencing Apple Stock Price

Several factors beyond the Q2 earnings report influence Apple's stock price:

Market Sentiment and Investor Confidence

Current market conditions play a significant role in investor sentiment towards Apple.

- General Market Trends: A positive overall market trend generally benefits Apple, while a downturn can negatively impact its stock price, even with strong earnings.

- Analyst Ratings: Analyst ratings and price targets for Apple stock are closely watched by investors and can influence buying and selling decisions.

- News and Events: Any significant news affecting Apple (e.g., product launches, regulatory actions, or lawsuits) can impact investor confidence and the stock price.

Competition and Industry Trends

Apple faces intense competition, and emerging technological trends pose both opportunities and challenges.

- Key Competitors: Companies like Samsung, Google, and other tech giants constantly challenge Apple's market position.

- Technological Advancements: Advancements in AI, VR/AR, and other technologies could disrupt Apple's market dominance or create new opportunities for growth.

Valuation Metrics

Assessing Apple's valuation is crucial.

- P/E Ratio: Apple's P/E ratio currently stands at [Insert Data], indicating [insert analysis: e.g., whether it is high or low compared to historical data and industry peers].

- Price-to-Sales Ratio: The Price-to-Sales ratio is [Insert Data], providing another perspective on Apple's valuation relative to its revenue generation.

Risks and Potential Downsides

While Apple's Q2 performance was strong, several risks could impact future performance:

Supply Chain Issues

Disruptions to Apple's global supply chain could affect production and sales, impacting profitability and stock price.

Economic Slowdown

A global economic slowdown could reduce consumer spending, affecting demand for Apple products.

Geopolitical Risks

Geopolitical instability, trade wars, or sanctions could disrupt Apple's operations or market access in key regions.

Conclusion: Is Apple Stock a Buy? A Final Verdict

Apple's strong Q2 earnings demonstrate continued financial health and growth. However, market conditions, competition, and potential risks must be considered. Based on the analysis, Apple stock presents a potentially attractive investment opportunity, but not without its inherent risks. While the robust Q2 earnings are positive, investors should carefully consider the valuation metrics, competitive landscape, and potential economic headwinds.

While further research is always recommended, Apple stock's performance after its strong Q2 earnings presents a compelling case for investors considering adding it to their portfolios. Conduct your due diligence and consider the factors discussed to make an informed decision about whether Apple stock is right for you. Remember to diversify your investments and consult with a financial advisor before making any investment decisions.

Featured Posts

-

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025 -

Trade War Fears Trigger 7 Drop In Amsterdam Stock Market Opening

May 25, 2025

Trade War Fears Trigger 7 Drop In Amsterdam Stock Market Opening

May 25, 2025 -

Unconfirmed Glastonbury Act Us Band Fuels Rumors With Mysterious Social Media Update

May 25, 2025

Unconfirmed Glastonbury Act Us Band Fuels Rumors With Mysterious Social Media Update

May 25, 2025 -

Annie Kilner Spotted Running Errands Following Husbands Night Out

May 25, 2025

Annie Kilner Spotted Running Errands Following Husbands Night Out

May 25, 2025 -

Escape To The Country Activities And Experiences In Rural Britain Or Relevant Country

May 25, 2025

Escape To The Country Activities And Experiences In Rural Britain Or Relevant Country

May 25, 2025

Latest Posts

-

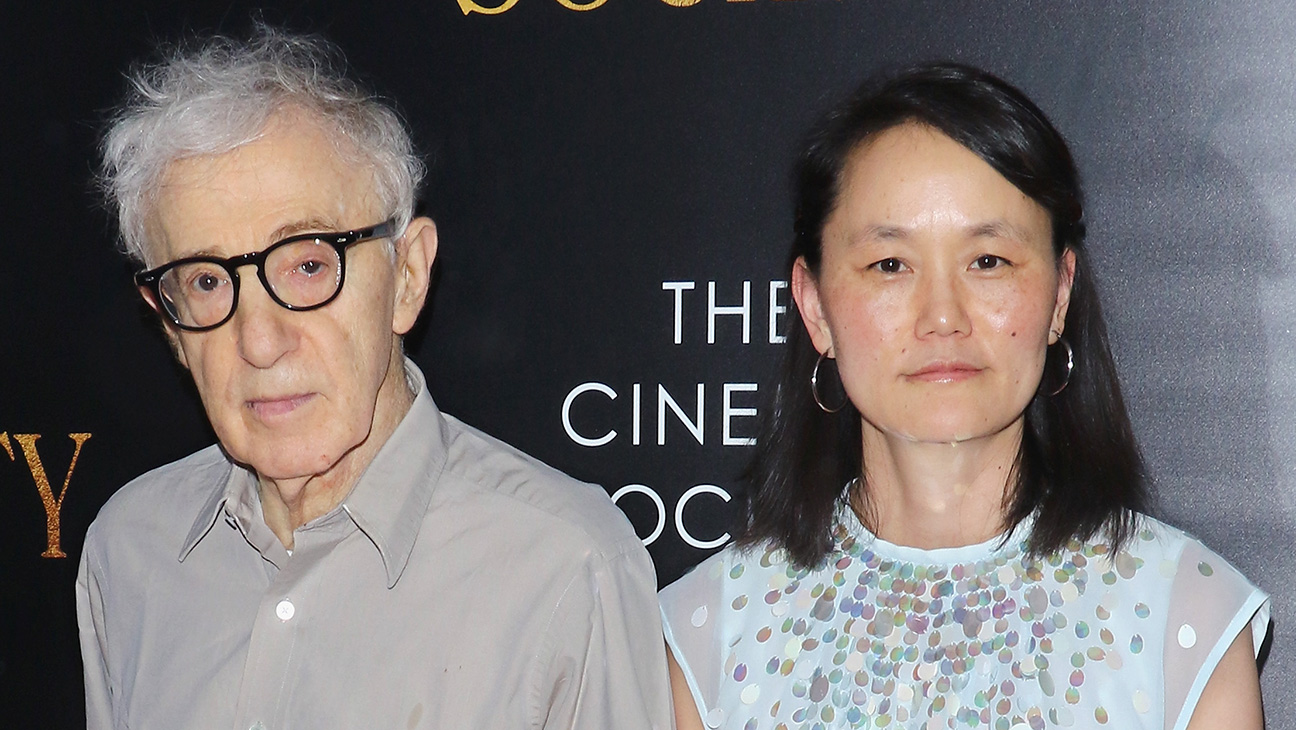

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025