Trade War Fears Trigger 7% Drop In Amsterdam Stock Market Opening

Table of Contents

The Impact of Trade War Fears on Global Markets

The current global trade situation is characterized by significant uncertainty and rising protectionism. Countries are imposing tariffs and enacting trade restrictions, creating a climate of fear and instability for investors worldwide. This uncertainty significantly impacts investor confidence, leading to a ripple effect across global markets. Trade wars disrupt established global supply chains, increasing costs and delays for businesses. Furthermore, tariffs directly increase the cost of goods, impacting both businesses and consumers. This economic uncertainty causes businesses to postpone expansion plans and reduce investment, further dampening economic growth.

- Increased uncertainty leads to decreased investment: Investors are hesitant to commit capital in an unpredictable environment.

- Global supply chains are disrupted: Tariffs and restrictions slow down or halt the flow of goods across borders.

- Tariffs increase the cost of goods: Consumers face higher prices, reducing purchasing power and potentially leading to lower demand.

- Businesses postpone expansion plans: Uncertainty makes long-term planning and investment risky.

Statistics show a clear correlation between escalating trade tensions and global market volatility. For example, the recent trade disputes between major economies have already led to declines in other major stock markets, such as those in Hong Kong and Tokyo, highlighting the interconnectedness of the global financial system.

Specific Factors Affecting the Amsterdam Stock Market

The Amsterdam stock market, like other European exchanges, possesses unique vulnerabilities making it particularly susceptible to global trade uncertainties. Its dependence on international trade makes it highly sensitive to disruptions in global supply chains. Specific sectors, particularly technology and export-oriented industries, are disproportionately affected by this downturn. Dutch companies with significant international operations are facing reduced demand and increased production costs. The strength of the Euro relative to other global currencies also plays a role, impacting the competitiveness of Dutch exports.

- Dependence on international trade: The Dutch economy relies heavily on exports, making it vulnerable to trade barriers.

- Exposure to specific industries sensitive to trade conflicts: Technology and export-oriented sectors are particularly vulnerable to trade wars.

- Impact on Dutch companies with significant international operations: These companies face challenges with increased tariffs and supply chain disruptions.

- Role of the Euro in the global economic climate: A weaker Euro can make Dutch exports more competitive but also increases the cost of imports.

Several companies in the Amsterdam stock market experienced significant drops in their share prices, including those heavily reliant on global trade and supply chains. For example, [Insert example of a specific company and explain why it was affected].

Investor Response and Market Reactions

The immediate reaction of investors to the news of the 7% drop was widespread panic selling. Trading volume surged during the opening hours, reflecting the heightened volatility in the market. Investors engaged in mass sell-offs of stocks, seeking to minimize their losses in the face of uncertainty. This led to an increased demand for safe-haven assets like gold, as investors sought refuge from the volatile equity market. There was also a clear "flight to quality," with investors shifting their investments towards more stable markets perceived as less risky. Financial analysts are offering varied predictions and market forecasts, ranging from cautious optimism to dire warnings depending on the resolution of the trade disputes.

- Mass sell-offs of stocks: Investors rushed to liquidate their holdings to avoid further losses.

- Increased demand for safe-haven assets (e.g., gold): Investors sought the security of non-volatile assets.

- Flight to quality – investors moving to more stable markets: Capital flowed out of the Amsterdam stock market and into perceived safer markets.

- Analyst predictions and market forecasts: Experts offered widely varying predictions depending on trade dispute developments.

“[Quote from a financial analyst regarding the situation],” stated [Analyst's Name and Title].

Potential Long-Term Consequences for the Amsterdam Stock Market and Dutch Economy

The 7% drop in the Amsterdam stock market carries significant potential long-term consequences for both the market and the broader Dutch economy. A prolonged period of uncertainty could severely impact consumer confidence, potentially leading to decreased spending and economic slowdown. Businesses might respond by reducing their workforce, leading to job losses. GDP growth could be negatively affected, impacting the overall economic health of the Netherlands. The Dutch government may need to implement economic stimulus packages or other interventions to mitigate the impact of this downturn. These issues could also have wider implications for the European Union economy given the Netherlands’ integration into the EU market.

- Impact on consumer confidence: Uncertainty can lead to decreased consumer spending and economic stagnation.

- Potential for job losses: Businesses facing reduced demand might resort to layoffs.

- Effect on GDP growth: Economic slowdown will negatively impact GDP growth.

- Government interventions and stimulus packages: Government actions might be necessary to stimulate the economy.

Conclusion

The 7% drop in the Amsterdam stock market at its opening was a direct result of escalating trade war fears, highlighting the market's sensitivity to global economic uncertainty. The event underscores the significant impact of trade tensions on investor confidence and the potential for long-term economic consequences for the Netherlands and the wider European Union. The specific vulnerabilities of the Amsterdam stock market, its reliance on international trade, and the exposure of certain sectors were key factors in this significant downturn. Understanding the dynamics of the Amsterdam stock market and the impact of global trade disputes is critical for navigating these turbulent economic times.

Call to Action: Stay informed about the evolving situation and its impact on the Amsterdam stock market. Monitor global trade developments and consult with financial advisors for personalized guidance on navigating the complexities of the Amsterdam stock market and its future performance. Careful analysis of the Amsterdam stock market is crucial in these turbulent times.

Featured Posts

-

Net Asset Value Nav Analysis Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Analysis Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

Auto Tariff Relief Hopes Lift European Shares Lvmh Slumps

May 25, 2025

Auto Tariff Relief Hopes Lift European Shares Lvmh Slumps

May 25, 2025 -

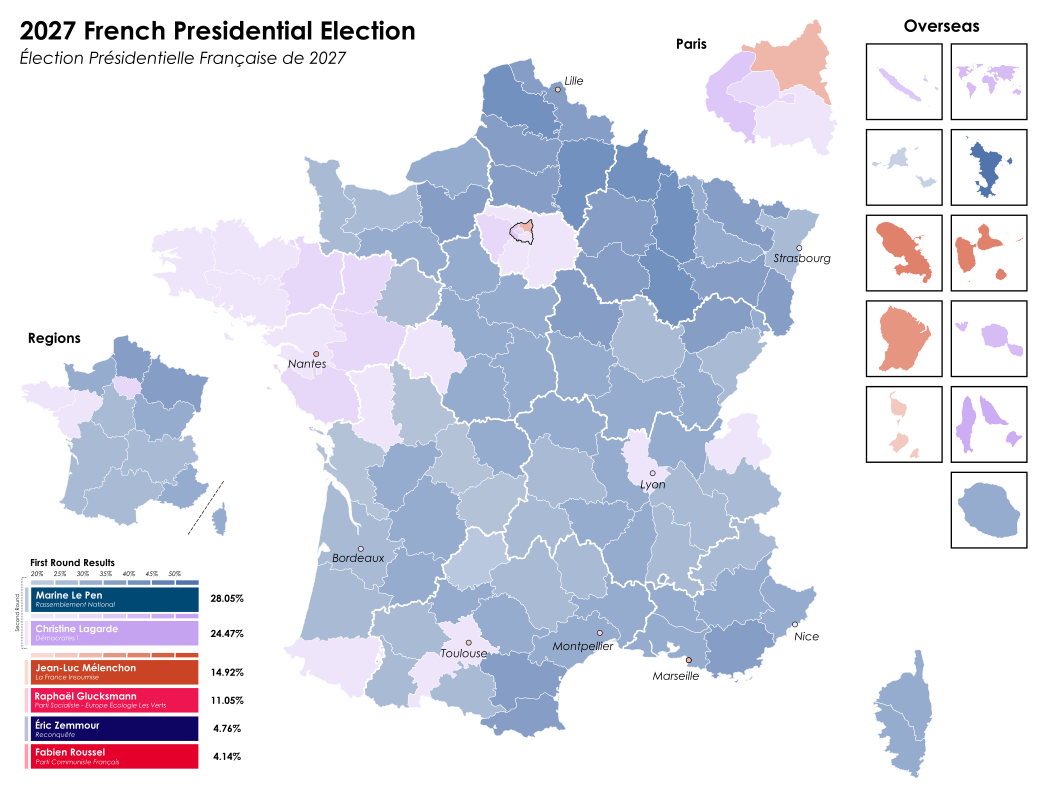

The 2027 French Presidential Election Jordan Bardellas Campaign Strategy

May 25, 2025

The 2027 French Presidential Election Jordan Bardellas Campaign Strategy

May 25, 2025 -

Kerings Sales Decline Demna Gvasalias First Gucci Collection Unveiled In September

May 25, 2025

Kerings Sales Decline Demna Gvasalias First Gucci Collection Unveiled In September

May 25, 2025 -

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 25, 2025

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 25, 2025

Latest Posts

-

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Perspective

May 25, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Perspective

May 25, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Its Potential Impact

May 25, 2025

Activision Blizzard Acquisition Ftcs Appeal And Its Potential Impact

May 25, 2025 -

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 25, 2025

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 25, 2025 -

The Impact Of Over The Counter Birth Control On Reproductive Healthcare Post Roe V Wade

May 25, 2025

The Impact Of Over The Counter Birth Control On Reproductive Healthcare Post Roe V Wade

May 25, 2025 -

Chat Gpt Creator Open Ai Under Ftc Investigation

May 25, 2025

Chat Gpt Creator Open Ai Under Ftc Investigation

May 25, 2025