Is Apple Stock A Buy At $200? One Analyst Predicts $254

Table of Contents

Apple's Current Market Position and Financial Strength

Apple maintains a dominant position in the global technology sector, boasting a massive market capitalization and consistently strong financial performance. Understanding its current financial health is crucial to assessing its future potential. Let's examine some key indicators:

-

Market Capitalization and Sector Standing: Apple consistently ranks among the world's most valuable companies, solidifying its position as a tech industry leader. Its substantial market cap reflects investor confidence in its brand strength and profitability.

-

Recent Financial Performance: Apple's recent financial reports showcase impressive revenue growth fueled by strong iPhone sales and a rapidly expanding services segment. Profit margins remain high, indicating robust pricing power and efficient operations. Analyzing key financial statements (income statement, balance sheet, cash flow statement) provides a clearer picture of its financial health.

-

Key Financial Metrics: Analyzing key metrics offers deeper insights:

- P/E Ratio: This ratio compares the company's stock price to its earnings per share, providing a valuation metric.

- Debt-to-Equity Ratio: This reveals Apple's leverage and financial risk profile.

- Cash Reserves: Apple's substantial cash reserves provide ample financial flexibility for future investments, acquisitions, and shareholder returns.

-

Bullet Points Summarizing Apple's Financial Strength:

- Strong revenue growth driven by iPhone sales and the robust performance of its services sector (Apple Music, iCloud, App Store, etc.).

- High profit margins reflecting strong pricing power and efficient cost management.

- Significant cash reserves providing a strong financial cushion and enabling strategic investments.

- Dominant market share in smartphones and wearables, securing a strong competitive advantage.

Factors Contributing to the $254 Price Target

The analyst's $254 price target is based on several key factors indicating significant future growth potential for Apple. Let's explore these drivers:

-

Analyst Rationale: The specific rationale behind the $254 prediction likely incorporates projections for continued revenue growth, expansion into new markets, and increased profitability across various segments.

-

Potential Growth Drivers: Several factors could propel Apple's stock price higher:

- New Product Launches: The highly anticipated iPhone 15 launch, along with potential breakthroughs in AR/VR technology with a new headset, could significantly boost sales and revenue.

- Expansion into New Markets: Continued expansion into emerging markets presents substantial growth opportunities.

- Services Revenue Growth: Apple's services ecosystem continues to expand, offering recurring revenue streams and high profit margins. This sector provides stability and future growth potential.

-

Macroeconomic Factors: While macroeconomic factors like inflation and interest rates can impact stock prices, Apple's strong financial position and brand loyalty often mitigate these external pressures.

-

Bullet Points Highlighting Growth Potential:

- Anticipation of strong demand for the new iPhone 15 series.

- Potential for substantial revenue generation from a successful AR/VR headset launch.

- Continued expansion and diversification within Apple's services business.

- Increased market penetration in high-growth emerging markets.

Risks and Potential Downsides of Investing in Apple at $200

Despite its strong fundamentals, investing in Apple at $200 carries inherent risks. Understanding these potential downsides is crucial for informed decision-making:

-

Supply Chain Disruptions: Global supply chain vulnerabilities remain a concern, potentially impacting Apple's production capacity and revenue.

-

Geopolitical Uncertainty: Geopolitical events can create uncertainty and negatively impact the stock market, including Apple's performance.

-

Competition: Intense competition from tech giants like Samsung and Google in the smartphone and wearable markets poses a challenge to Apple's market share.

-

Market Correction: Even strong companies like Apple are susceptible to market corrections, which can lead to temporary price declines.

-

Bullet Points Summarizing Potential Risks:

- Supply chain disruptions that could impact production and availability of products.

- Increasing competition from other technology companies vying for market share.

- Potential regulatory scrutiny affecting Apple's operations and future growth.

- Overall market volatility and potential for economic downturns impacting stock prices.

Alternative Investment Strategies and Diversification

While Apple stock presents an attractive investment opportunity, diversification is essential for mitigating risk.

-

Importance of Diversification: Spreading investments across different asset classes reduces the overall portfolio's risk. Investing only in Apple stock exposes your portfolio to the specific risks associated with the company's performance.

-

Alternative Investment Options: Consider diversifying with:

- Index Funds: Provide broad market exposure and reduce reliance on individual stock performance.

- ETFs: Offer targeted sector exposure, allowing you to invest in specific industries or asset classes while diversifying beyond single stocks.

-

Bullet Points Emphasizing Diversification:

- Diversification reduces the impact of any single investment's underperformance.

- Index funds offer a low-cost way to gain broad market exposure.

- ETFs provide diversified exposure to specific sectors or asset classes.

Conclusion: Is Apple Stock Right for You?

Deciding whether Apple stock is a buy at $200 requires careful consideration of its current financial strength, compelling growth potential, and the associated risks. While the $254 price target is ambitious, Apple's robust fundamentals and history of innovation provide a strong case for potential upside. However, investors must remain cognizant of potential downsides and ensure appropriate portfolio diversification. Thorough research and perhaps consultation with a financial advisor are recommended before making any investment decision regarding Apple stock. Weigh the potential rewards against the inherent risks before investing in Apple stock— ultimately, the decision is yours.

Featured Posts

-

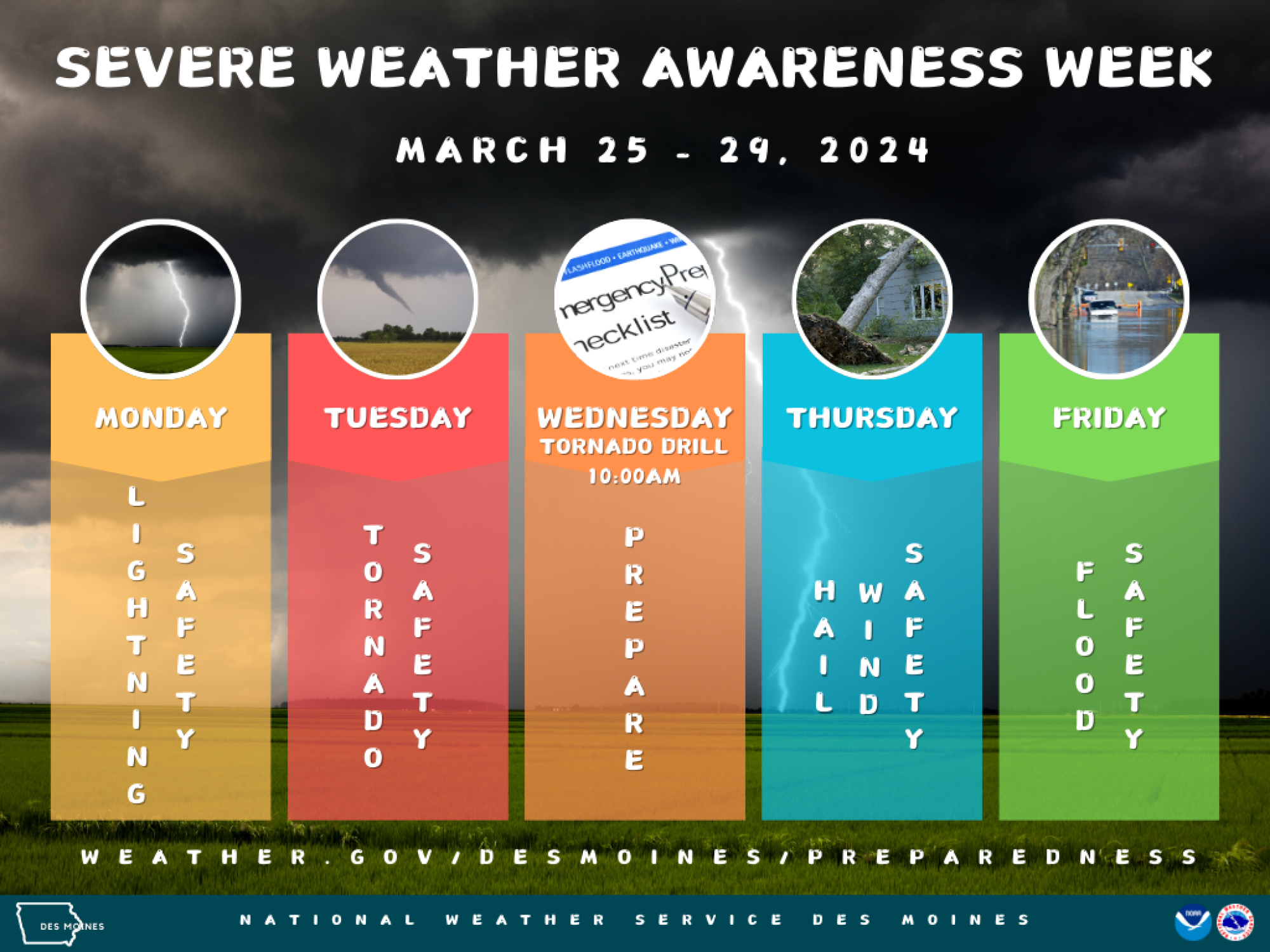

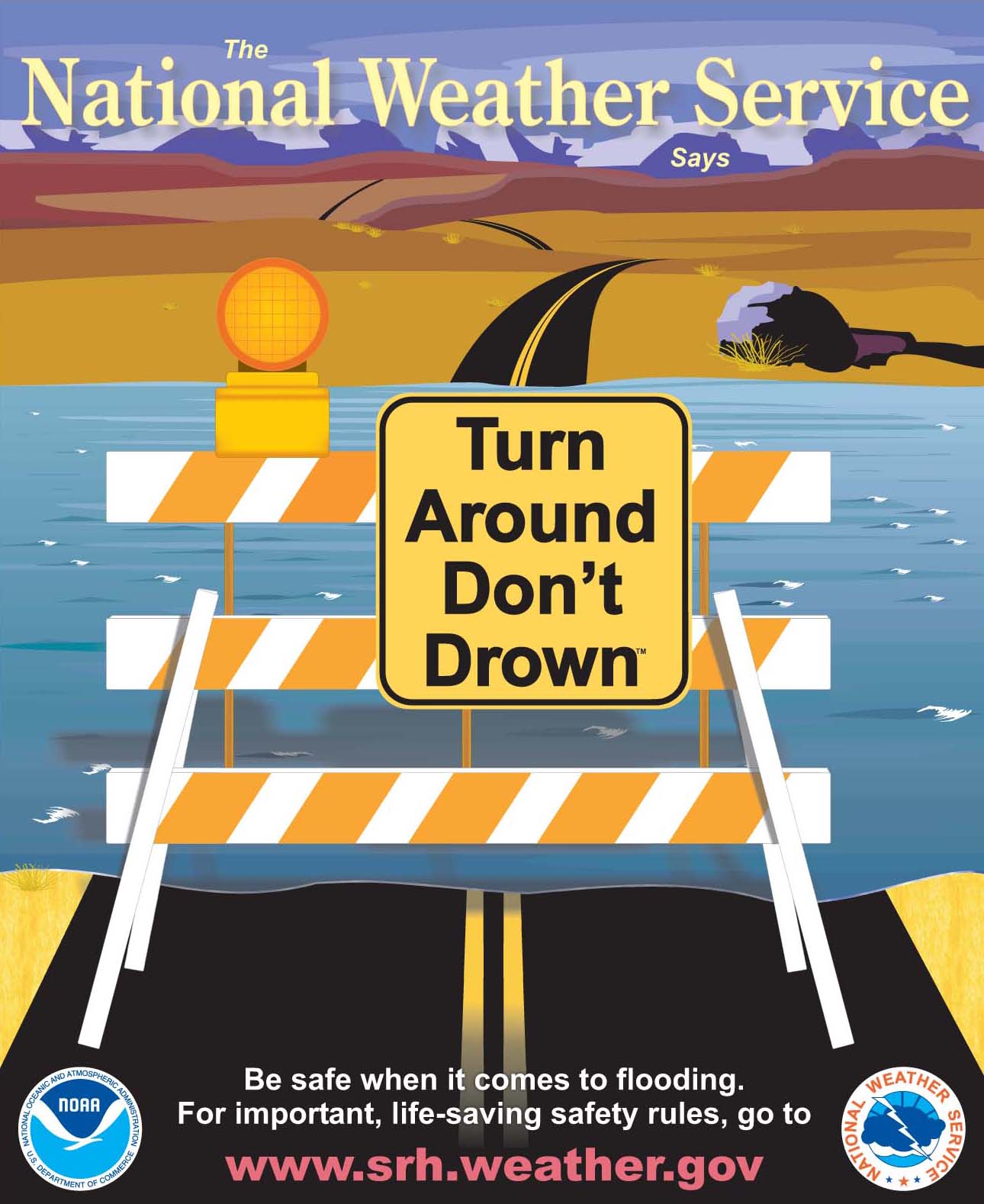

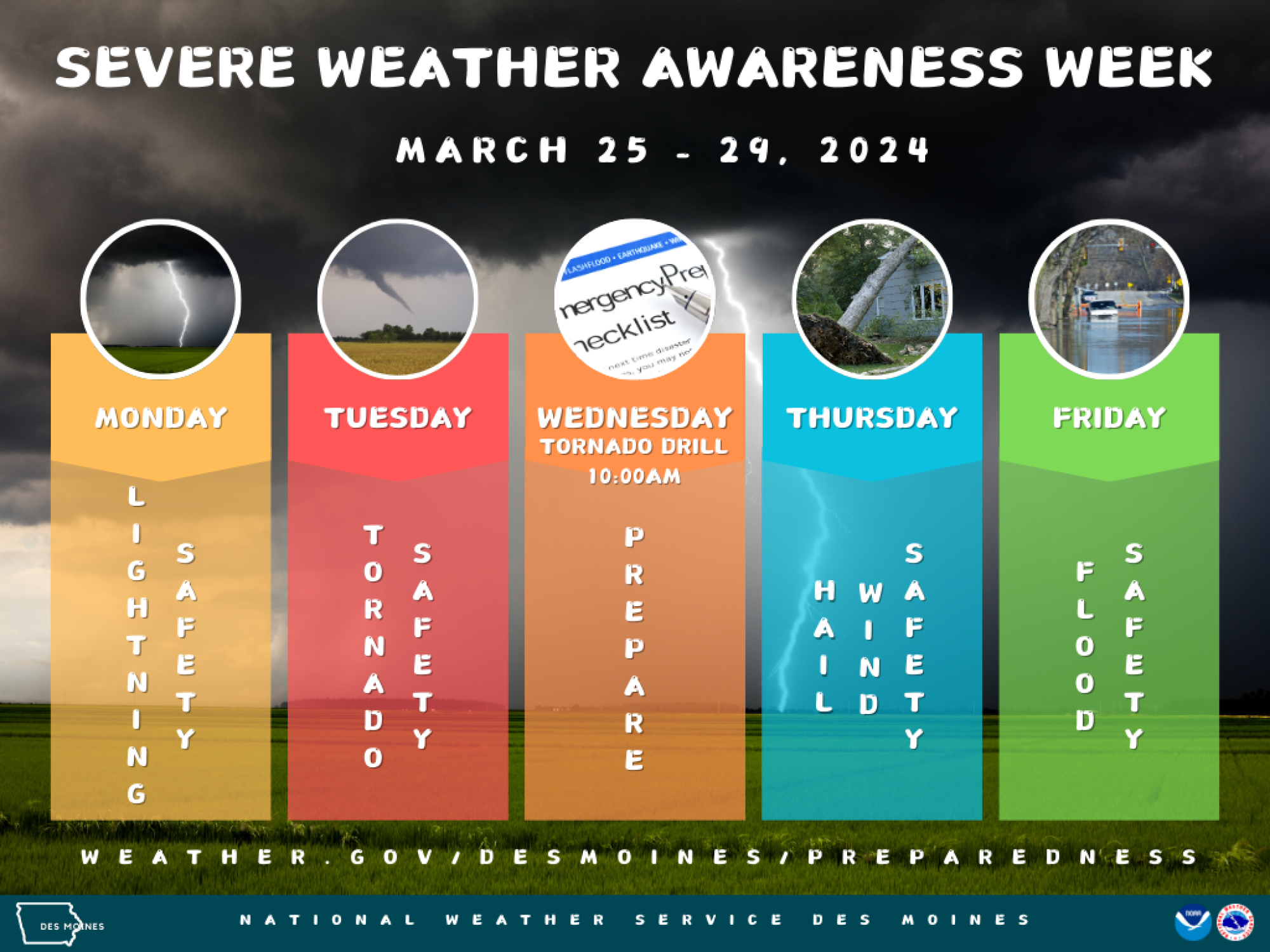

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025 -

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

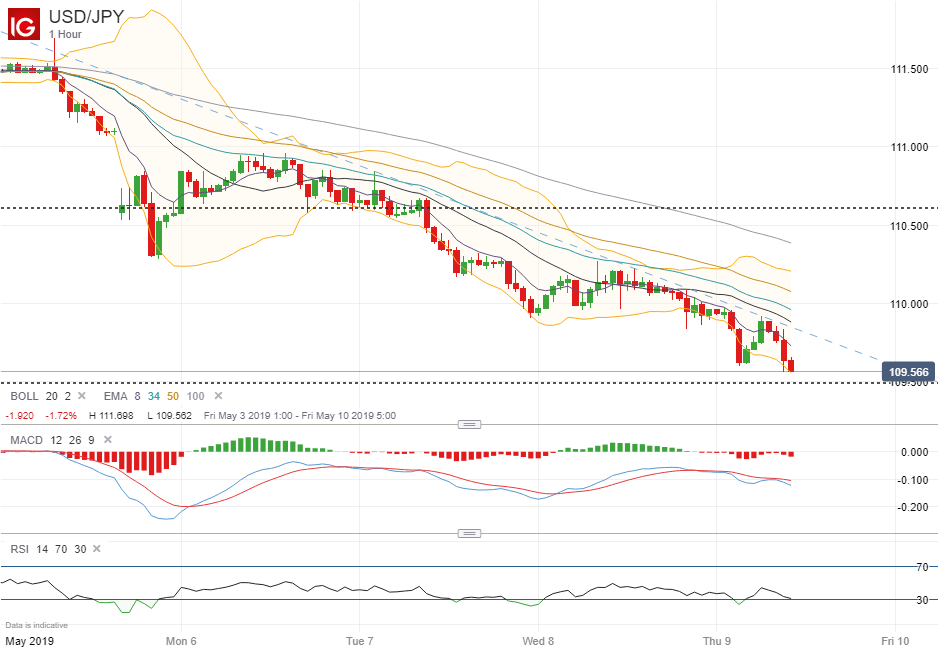

Sharp Decline In Amsterdam Stock Market Trade War Uncertainty Impacts Trading

May 25, 2025

Sharp Decline In Amsterdam Stock Market Trade War Uncertainty Impacts Trading

May 25, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025

Latest Posts

-

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025 -

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025 -

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025 -

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025