Sharp Decline In Amsterdam Stock Market: Trade War Uncertainty Impacts Trading

Table of Contents

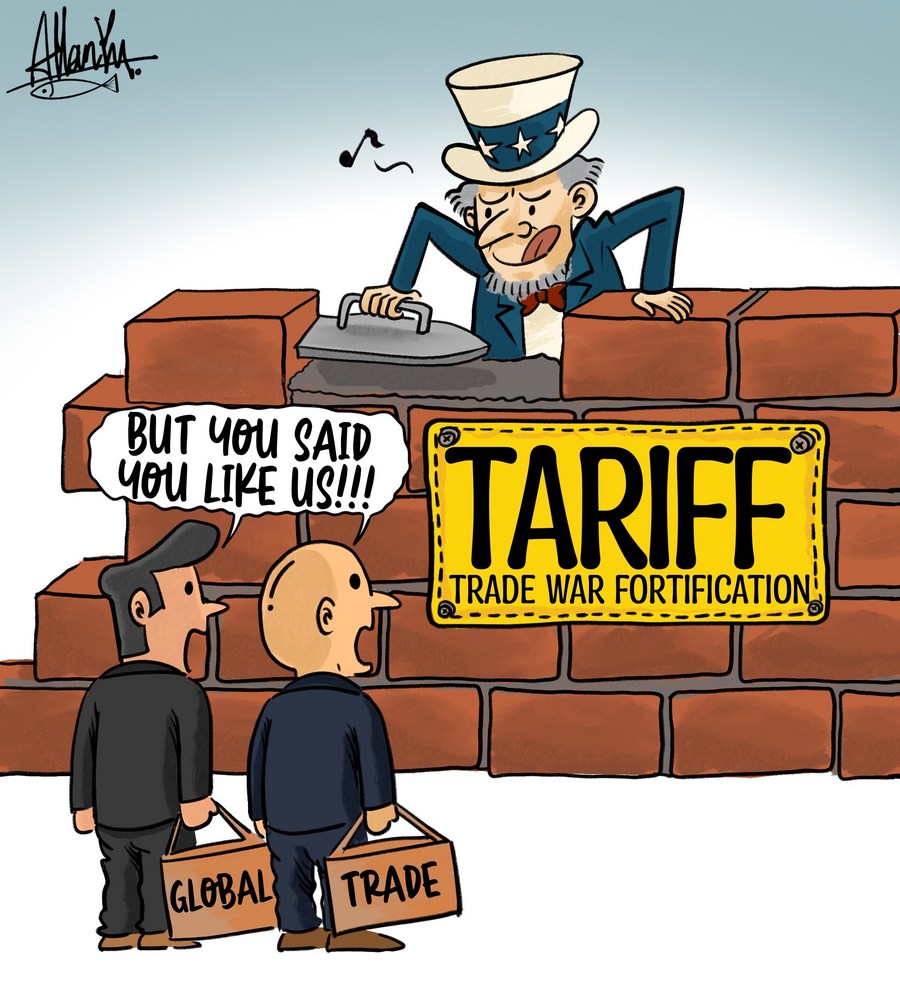

Trade War Uncertainty as the Primary Catalyst

Escalating trade tensions, particularly between major global economies like the US and China, have created a significant ripple effect, impacting businesses operating both within the Netherlands and internationally. This uncertainty is a key catalyst for the recent decline in the Amsterdam Stock Market. The resulting instability significantly affects investor confidence and trading strategies.

- Increased tariffs: Higher import costs for Dutch businesses directly impact profitability and competitiveness, leading to reduced output and potential job losses. This directly impacts stock prices of affected companies.

- Supply chain disruption: Trade wars disrupt established global supply chains, affecting Dutch exports and leading to production delays and increased costs. This uncertainty makes long-term investment planning difficult.

- Reduced consumer confidence: Economic uncertainty stemming from trade wars leads to decreased consumer spending, negatively impacting businesses reliant on domestic demand. This decreased spending further impacts stock prices.

- Negative impact on business investment: Facing an uncertain future, businesses are hesitant to invest in expansion or new projects, slowing economic growth and impacting stock market performance. The AEX index, for example, saw a 5% drop in the last quarter (Source: [Insert reputable source here, e.g., Euronext Amsterdam]).

Impact on Specific Sectors of the Amsterdam Stock Market

The impact of trade war uncertainty isn't evenly distributed across all sectors of the Amsterdam Stock Market. Export-oriented industries, particularly those heavily reliant on international trade, are disproportionately vulnerable.

- Technology sector: Companies heavily reliant on global supply chains for components or distribution are particularly affected by tariffs and trade restrictions.

- Agriculture sector: Dutch agricultural exports, such as flowers and dairy products, are susceptible to increased tariffs and trade barriers. We've seen significant stock price drops in several prominent agricultural companies (Source: [Insert reputable source, e.g., financial news website]).

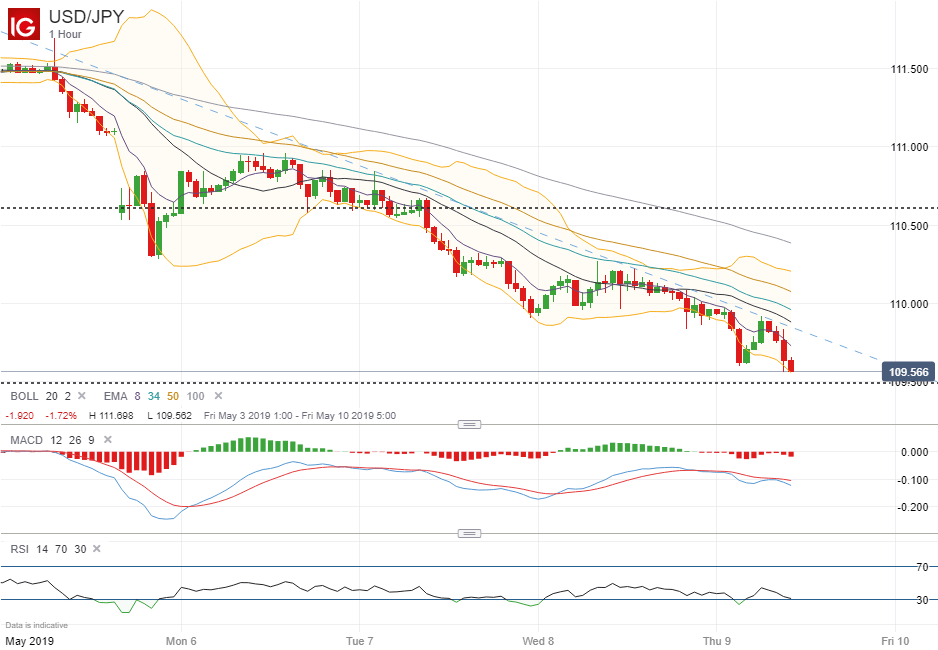

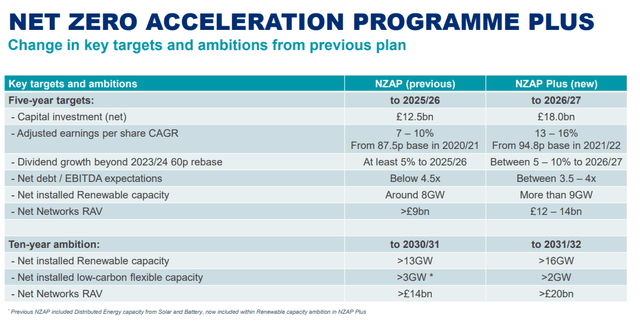

- Manufacturing sector: Manufacturing businesses reliant on imported materials face increased production costs, impacting profitability and share prices. Smaller companies, with less financial resilience, are particularly vulnerable. The chart below illustrates the comparative performance of these sectors over the past six months. [Insert chart/graph here]

Investor Sentiment and Trading Volatility

The decline in the Amsterdam Stock Market is significantly fueled by growing investor anxieties and a shift in market sentiment. Trade war uncertainty has led to increased volatility and risk aversion among investors.

- Increased market volatility: Panic selling driven by fear and uncertainty has resulted in heightened market volatility and increased trading volumes. This makes accurate market prediction extremely difficult.

- Decrease in foreign investment: The uncertainty surrounding the Dutch economy is deterring foreign investors, leading to a reduction in capital inflow and putting further downward pressure on the market.

- Shift in investor strategies: Many investors are shifting from long-term investment strategies to short-term, risk-averse approaches, focusing on preservation of capital rather than growth.

- Growing reluctance to take on risk: The overall market climate is characterized by a growing reluctance to invest in riskier assets, impacting the valuation of growth stocks and smaller companies. Leading financial analysts such as [Name of analyst] at [Financial institution] have voiced concerns about the long-term consequences of this trend. (Source: [Insert link to analyst report])

Potential Economic Consequences for the Netherlands

The sharp decline in the Amsterdam Stock Market has significant implications for the broader Dutch economy. The repercussions extend beyond the stock market itself and impact various aspects of the national economy.

- Impact on GDP growth: Reduced business investment and decreased consumer spending contribute to a slowdown in GDP growth, potentially leading to economic recession.

- Potential job losses: Businesses facing higher costs and reduced demand may resort to layoffs, increasing unemployment rates.

- Government response: The Dutch government may need to implement economic stimulus measures to mitigate the negative impact of the market decline.

- Long-term effects on economic stability: Persistent trade uncertainty could have long-term consequences for the Dutch economy, impacting its competitiveness and overall stability. The Central Bank of the Netherlands has already expressed concern about these potential long-term effects (Source: [Insert reputable source, e.g., De Nederlandsche Bank]).

Strategies for Navigating Market Volatility

Navigating a volatile market requires careful planning and a proactive approach. Investors can consider the following strategies to mitigate risk and potentially benefit from market fluctuations:

- Diversification: Diversifying investment portfolios across different asset classes and geographic regions helps to reduce overall risk exposure.

- Risk assessment and management: Conduct thorough risk assessments to understand the potential impacts of trade wars on your investments.

- Alternative investment options: Explore alternative investment options such as bonds or real estate to balance risk and potentially generate stable returns.

- Professional financial advice: Seek personalized advice from experienced financial professionals to develop a tailored investment strategy appropriate to your individual circumstances.

Conclusion

The sharp decline in the Amsterdam Stock Market is a direct result of several factors, most prominently the uncertainty generated by escalating global trade wars. This uncertainty has impacted various sectors of the Dutch economy, leading to increased trading volatility and significant consequences for investors. The potential long-term effects on the Dutch economy necessitate a cautious approach to investment decisions.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and global trade relations. Adopt a cautious and informed approach to your investment decisions, diversifying your portfolio and considering professional financial advice to navigate the current market volatility. Learn more about effective investment strategies to mitigate risk in a volatile Amsterdam Stock Market. Don't hesitate to consult with financial professionals for personalized guidance.

Featured Posts

-

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025 -

Najvaecsie Nemecke Spolocnosti Prepustaju Tisice Ludi Prichadzaju O Pracu

May 25, 2025

Najvaecsie Nemecke Spolocnosti Prepustaju Tisice Ludi Prichadzaju O Pracu

May 25, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 25, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 25, 2025 -

Escape To The Countryside Top Destinations And Considerations

May 25, 2025

Escape To The Countryside Top Destinations And Considerations

May 25, 2025

Latest Posts

-

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025 -

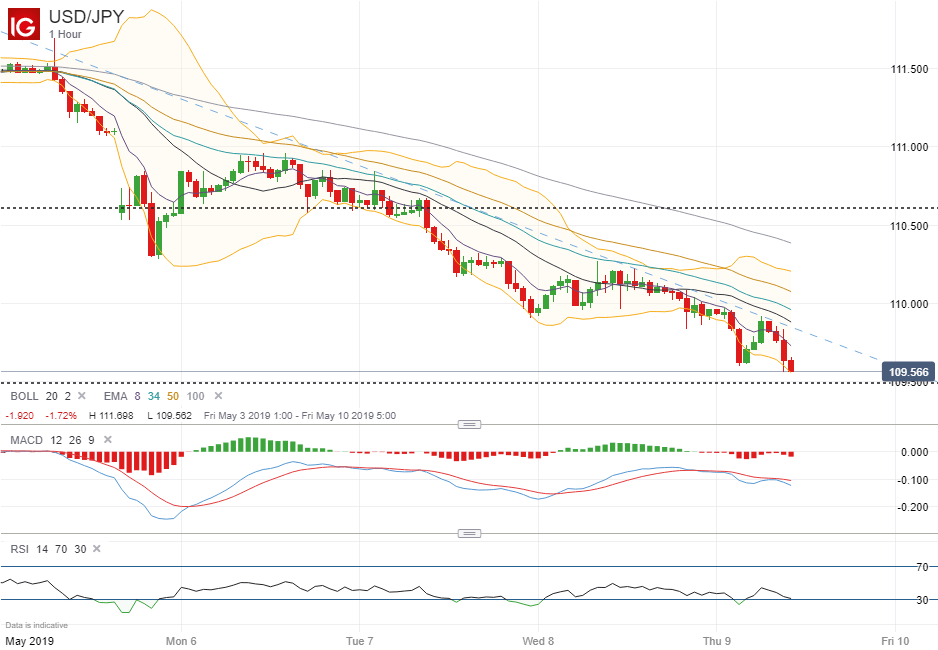

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025 -

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025