Is Betting On Natural Disasters Like The LA Wildfires A Sign Of The Times?

Table of Contents

H2: The Rise of Disaster Betting Markets

The concept of betting on natural disasters might seem shocking, but the reality is that disaster prediction markets are gaining traction. These markets operate on principles similar to traditional financial markets, with participants buying and selling contracts based on the predicted intensity, duration, and geographical impact of specific events.

H3: The Mechanics of Disaster Prediction Markets

These markets function by aggregating diverse data sources – from weather patterns and geological surveys to climate models and historical records – to generate probabilities and set odds. For instance, a bet might be placed on the total acreage burned in a wildfire season or the projected wind speed of a hurricane. The outcome determines the payout, with the accuracy of predictions influencing the profitability of these "catastrophe bonds" and other related financial instruments.

- Different types of bets available: These range from simple binary options (e.g., will a hurricane hit a specific region?) to complex contracts based on various measurable parameters of a disaster’s impact.

- Regulation and legality: The legality and regulation of disaster betting vary significantly across jurisdictions. Some countries have strict prohibitions, while others are developing frameworks to govern these markets. The lack of consistent regulation presents both opportunities and risks.

- Examples of platforms or companies: While many platforms remain opaque, some insurance companies and specialized financial institutions are actively involved in creating and trading disaster-related derivatives.

The arguments for these markets center on their potential to improve risk assessment and incentivize better disaster preparedness. However, critics raise ethical concerns, arguing that profiting from misfortune is inherently problematic.

H2: The Role of Climate Change in Fueling Disaster Betting

The increasing frequency and severity of natural disasters, largely attributed to climate change, are directly influencing the growth of disaster betting markets. Climate change impacts are making extreme weather events – including wildfires, hurricanes, and floods – more prevalent and unpredictable. This increased volatility translates into higher stakes and potentially greater profits for those involved in prediction markets.

H3: Increased Frequency and Severity of Natural Disasters

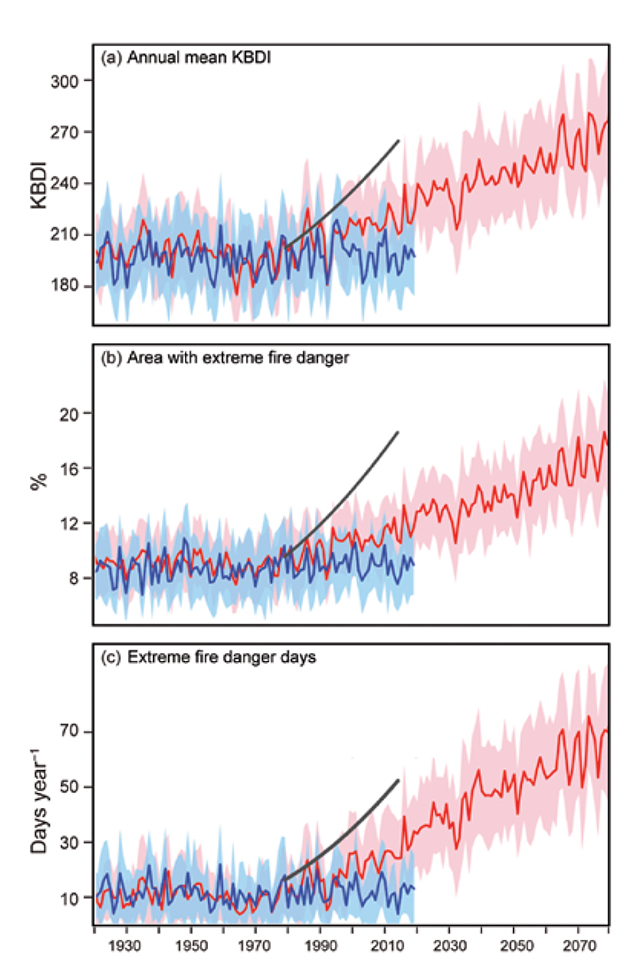

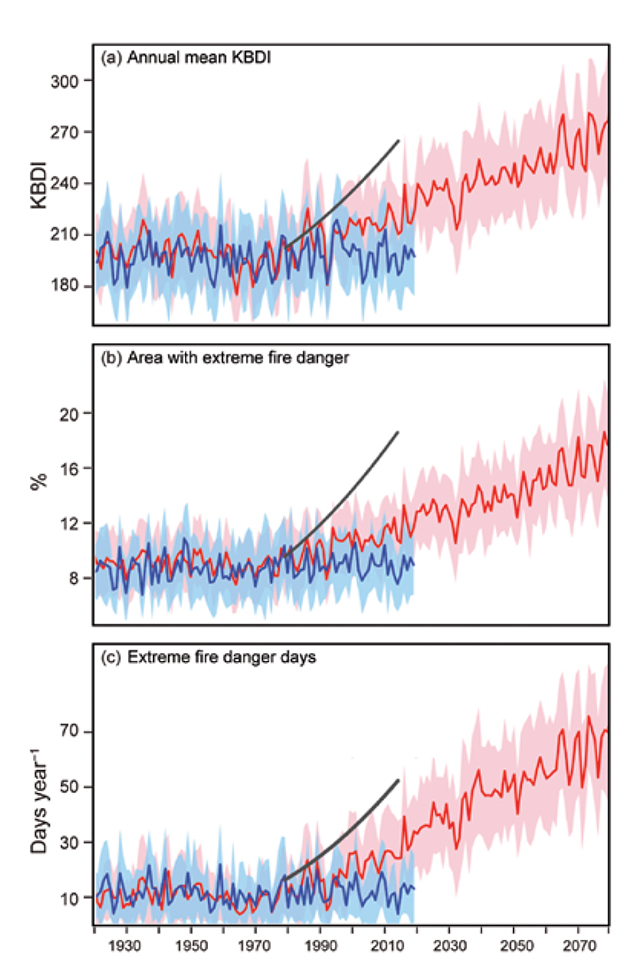

The scientific consensus is clear: climate change is amplifying the risk of catastrophic events.

- Statistical data: Reports from organizations like the IPCC consistently show rising trends in wildfire intensity and frequency, alongside similar patterns for other extreme weather phenomena.

- Climate models: Sophisticated climate models are used to project future disaster risks, helping inform the pricing and trading in these markets. These models, while constantly improving, still contain inherent uncertainties.

- Impact on insurance: The rising cost of disaster relief and insurance premiums is directly tied to the escalating frequency and intensity of natural disasters. This, in turn, affects the dynamics of disaster prediction markets.

The unpredictability introduced by climate change also increases the inherent risk within these betting markets, making accurate prediction exponentially more challenging.

H2: Ethical Considerations and Social Impact

The moral implications of profiting from suffering are central to the debate surrounding disaster betting. The very notion of turning tragedy into a financial opportunity raises significant ethical concerns.

H3: The Moral Implications of Profiteering from Disaster

- Arguments against: Many argue that betting on disasters trivializes human suffering and undermines efforts to provide aid and support to affected communities.

- Potential for exploitation: There's a risk that these markets could be manipulated or exploited, potentially exacerbating existing inequalities.

- Media influence: Media coverage of these markets can shape public perception, potentially normalizing or even encouraging this form of speculative activity.

The potential for these markets to incentivize irresponsible behavior, disregard for environmental protection, or even the exacerbation of social inequalities needs careful consideration.

H2: The Future of Disaster Betting and its Implications

Technological advancements in data analytics, AI, and machine learning are poised to significantly impact the future of disaster betting. More accurate predictive models could lead to more efficient risk management, but also to potentially higher stakes and greater financial volatility.

H3: Technological Advancements and Predictive Modeling

- Improved predictions: Advancements in data analysis and predictive modeling offer the potential for significantly more accurate predictions of natural disasters.

- Role of big data: The ever-increasing availability of big data enhances the predictive capabilities of these models.

- Impact on insurance and relief: More accurate predictions could lead to better-targeted disaster relief and more effective insurance strategies.

The long-term implications are complex. Increased accuracy could reduce the risk for some participants, potentially stabilizing markets. However, it could also lead to increased participation, higher stakes, and potentially exacerbate the ethical dilemmas already present.

Conclusion:

The rise of betting on natural disasters, particularly events like the LA wildfires, is a complex phenomenon. While these markets offer potential benefits for risk assessment and preparedness, the ethical considerations are undeniable. The intertwining of climate change, technological advancements, and human behavior creates a volatile and uncertain landscape. Whether this trend signals a concerning shift in societal attitudes or simply reflects evolving market dynamics remains open to debate. But one thing is certain: the implications of betting on natural disasters warrant careful scrutiny and informed public discussion. We encourage you to research specific disaster prediction markets and engage in thoughtful discussions about the ethical implications of betting on natural disasters, considering the human cost alongside the financial aspects. Understanding the nuances of this emerging field is crucial for navigating its potential risks and benefits responsibly.

Featured Posts

-

Do You Recognize These Faces From April 1999

Apr 25, 2025

Do You Recognize These Faces From April 1999

Apr 25, 2025 -

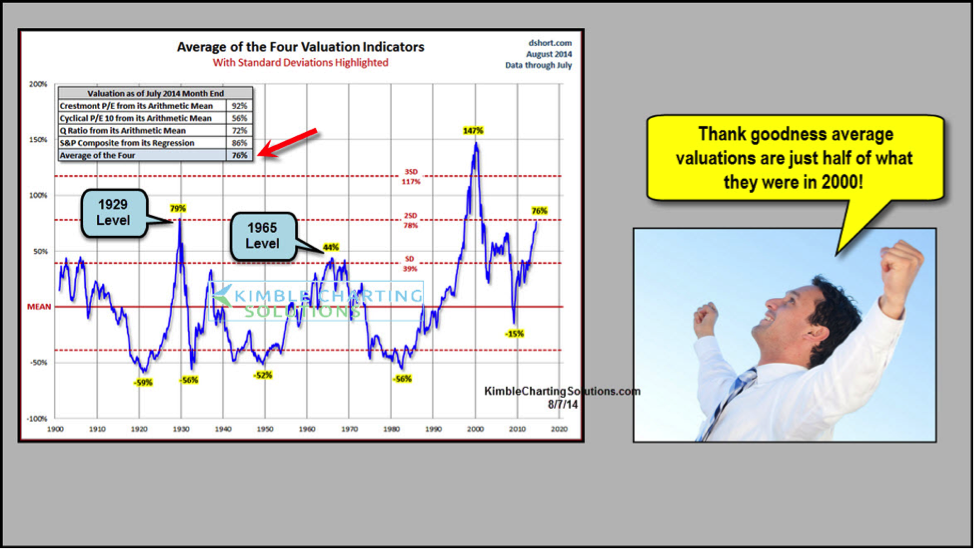

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 25, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 25, 2025 -

Hudsons Bay Closing What The Court Documents Say

Apr 25, 2025

Hudsons Bay Closing What The Court Documents Say

Apr 25, 2025 -

Dangerous Road Conditions In Oklahoma City Multiple Crash Report Watch

Apr 25, 2025

Dangerous Road Conditions In Oklahoma City Multiple Crash Report Watch

Apr 25, 2025 -

Analyzing The Feasibility Of Elon Musks Robotaxi Network

Apr 25, 2025

Analyzing The Feasibility Of Elon Musks Robotaxi Network

Apr 25, 2025

Latest Posts

-

Road Construction Cripples Louisville Restaurants A Call To Action

Apr 30, 2025

Road Construction Cripples Louisville Restaurants A Call To Action

Apr 30, 2025 -

Is Kamala Harris Returning To Politics A Timeline Of Her Plans

Apr 30, 2025

Is Kamala Harris Returning To Politics A Timeline Of Her Plans

Apr 30, 2025 -

Severe Weather Damage In Louisville Request Storm Debris Removal Now

Apr 30, 2025

Severe Weather Damage In Louisville Request Storm Debris Removal Now

Apr 30, 2025 -

Kamala Harris On Re Entering Politics Timing And Ambitions

Apr 30, 2025

Kamala Harris On Re Entering Politics Timing And Ambitions

Apr 30, 2025 -

River Road Construction Louisville Restaurants Plea For Support

Apr 30, 2025

River Road Construction Louisville Restaurants Plea For Support

Apr 30, 2025