Is Ethereum Ready For A Price Breakout? Bullish Signals And Market Analysis

Table of Contents

On-Chain Metrics Suggesting an Impending Ethereum Price Breakout

Several on-chain metrics paint a picture of increasing activity and potential price appreciation for Ethereum. These signals suggest a growing demand for ETH and increased confidence in the network's future.

Increased Network Activity: A surge in network activity is a strong indicator of growing user engagement and potential price appreciation. We're seeing multiple signs pointing towards a potential Ethereum price breakout:

- Rising Transaction Counts: Daily transaction counts on the Ethereum network have seen a significant percentage increase in recent weeks, exceeding [Insert Percentage]% compared to the previous month. This surge indicates growing adoption and usage of the Ethereum blockchain.

- Elevated Gas Fees: While historically high gas fees have been a concern, a moderate increase in recent weeks, coupled with increased transaction volume, suggests strong demand. This is a positive sign, indicating users are willing to pay more to use the network. You can track this data on sites like [Link to Etherscan].

- Active Addresses: The number of unique addresses interacting with the Ethereum network is also on the rise. This increase in active addresses suggests a growing user base, contributing to higher demand for ETH. [Link to Glassnode or similar].

Growing DeFi Activity on Ethereum: The thriving decentralized finance (DeFi) ecosystem on Ethereum continues to be a major driver of demand for ETH. The total value locked (TVL) in DeFi protocols has been steadily increasing:

- TVL Growth: The total value locked in leading DeFi protocols like Aave, Uniswap, and Compound has experienced significant growth in [mention time period], exceeding [insert number] billion USD. This demonstrates increasing confidence in DeFi applications built on Ethereum.

- Impact on Demand: This substantial TVL growth directly translates into increased demand for ETH, as users need ETH to interact with DeFi protocols and participate in various yield farming and lending activities.

Development Activity and Upgrades: The ongoing development and upgrades to the Ethereum network, such as the recently completed Shanghai upgrade, are crucial for long-term price appreciation.

- Shanghai Upgrade: The Shanghai upgrade, enabling withdrawals of staked ETH, has improved liquidity and reduced the perceived risk associated with staking, contributing to a more positive market sentiment.

- Upcoming Upgrades: Future upgrades focusing on scalability and efficiency will further enhance Ethereum's capabilities, potentially attracting more developers and users, fostering a healthier ecosystem and stimulating price growth.

Macroeconomic Factors Influencing Ethereum Price Breakout Potential

Several macroeconomic factors also contribute to the potential for an Ethereum price breakout. These broader economic trends and market sentiments heavily influence cryptocurrency prices.

Overall Cryptocurrency Market Sentiment: The overall mood within the broader cryptocurrency market is crucial. A bullish sentiment often translates into increased demand for various cryptocurrencies, including Ethereum.

- Bitcoin's Price Action: Bitcoin’s price movements often influence the entire cryptocurrency market. A sustained bull run for Bitcoin would likely boost the entire market cap and also positively affect Ethereum's price.

- Market Capitalization: The increasing market capitalization of the cryptocurrency market as a whole indicates growing investor confidence and may lead to a spillover effect on Ethereum.

- Fear and Greed Index: Tracking the crypto fear and greed index can provide insights into overall market sentiment, providing another indicator of potential price movement.

Regulatory Landscape and Institutional Adoption: The regulatory landscape and increasing institutional adoption significantly impact price stability and volatility.

- Regulatory Announcements: Favorable regulatory developments, even at a regional level, can improve investor confidence and attract more institutional investors.

- Institutional Investments: Large-scale institutional investments in ETH demonstrate growing acceptance and bolster price stability, which can provide a foundation for a breakout.

Global Economic Conditions: Global economic conditions, like inflation rates and recessionary fears, inevitably impact cryptocurrency prices.

- Inflation and Interest Rates: High inflation and rising interest rates often lead to investors seeking alternative assets, potentially boosting demand for cryptocurrencies like Ethereum. Conversely, a period of lower inflation can also stabilize the market.

- Correlation with Traditional Markets: While correlations between traditional markets and crypto are complex, observing the interplay between these markets can offer insights into potential shifts in investor sentiment.

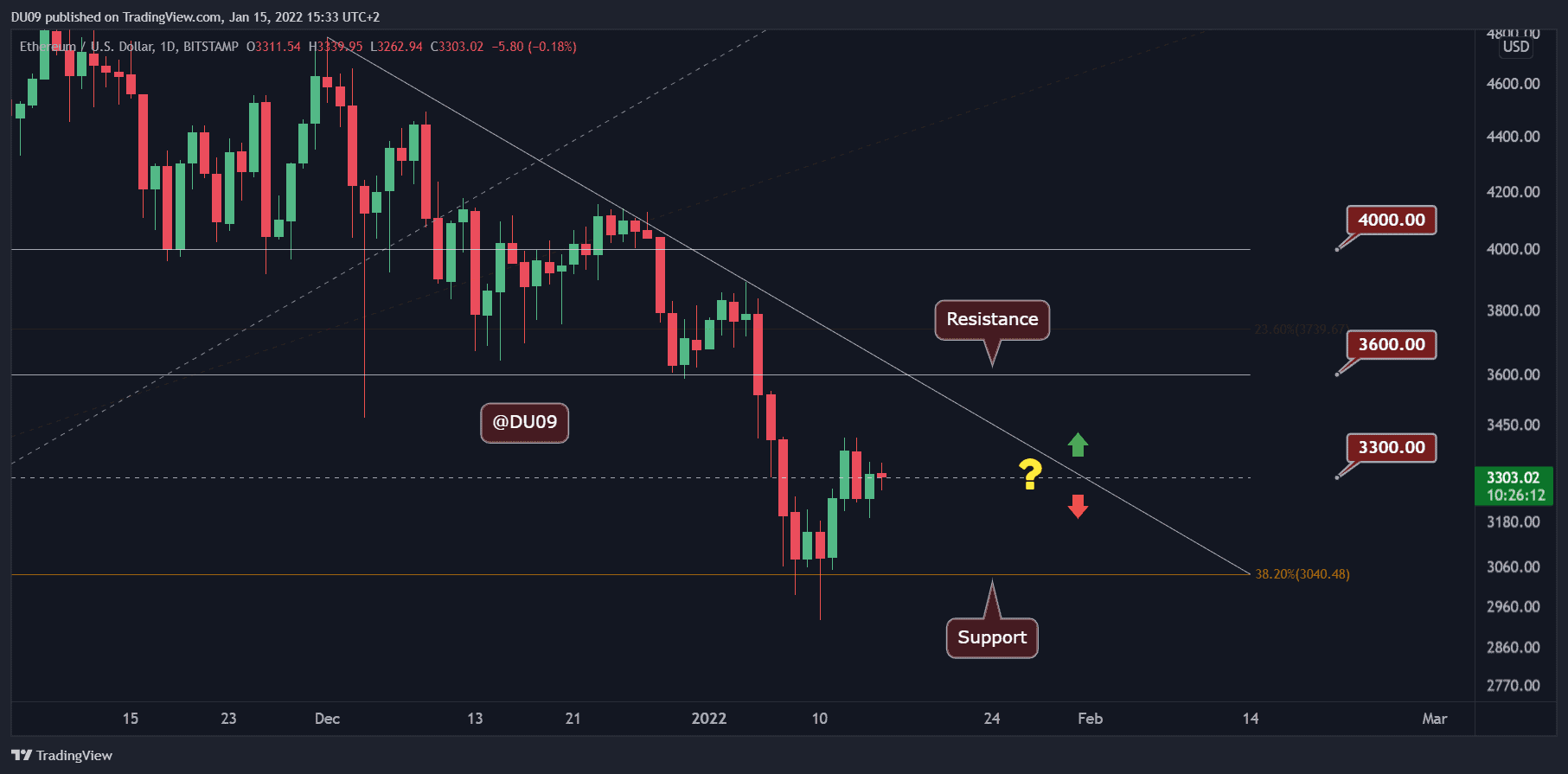

Technical Analysis: Chart Patterns and Indicators Predicting an Ethereum Price Breakout

Technical analysis offers another perspective on the potential for an Ethereum price breakout, examining chart patterns and technical indicators.

Price Chart Patterns: Certain chart patterns can signal upcoming price movements:

- Head and Shoulders Pattern: A reversal pattern that, if confirmed, could signal a downward trend. Conversely, an inverse head and shoulders pattern suggests a potential upward movement.

- Cup and Handle Pattern: A bullish continuation pattern suggesting a potential price increase following a period of consolidation.

- Flags and Pennants: These consolidation patterns can signal a continuation of a previous trend. Analyzing these patterns and their breakouts offers valuable insights into potential price targets. [Include relevant charts and images]

Technical Indicators: Several technical indicators provide further insights into potential price movements:

- Relative Strength Index (RSI): An RSI reading below 30 often suggests the asset is oversold, potentially signaling a price rebound.

- Moving Average Convergence Divergence (MACD): A bullish crossover (MACD line crossing above the signal line) can indicate a potential price increase.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help identify support and resistance levels. [Include relevant charts and images]

Conclusion

Our analysis of on-chain metrics, macroeconomic factors, and technical indicators reveals a complex picture of the potential for an Ethereum price breakout. While several bullish signals suggest a positive outlook, it's crucial to remember that the cryptocurrency market is inherently volatile. The interplay between growing network activity, positive macroeconomic conditions, and favorable technical patterns points towards a potential upward trend. However, factors like regulatory uncertainty and the broader economic landscape could still impact price movements.

Final Verdict: While the evidence suggests a potential for an Ethereum price breakout, investors should exercise caution and acknowledge the inherent risks associated with cryptocurrencies.

Call to Action: Stay informed about the latest developments impacting the Ethereum price. Continue to research "Ethereum price breakout" opportunities, monitor market news closely, and remember to diversify your investment portfolio. Subscribe to our newsletter for future updates and in-depth analyses on Ethereum price predictions and cryptocurrency market analysis!

Featured Posts

-

Daily Lotto Results For Thursday April 17 2025

May 08, 2025

Daily Lotto Results For Thursday April 17 2025

May 08, 2025 -

Hkd Usd Plummets Hong Kong Dollar Interest Rate Hits 2008 Low Following Intervention

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rate Hits 2008 Low Following Intervention

May 08, 2025 -

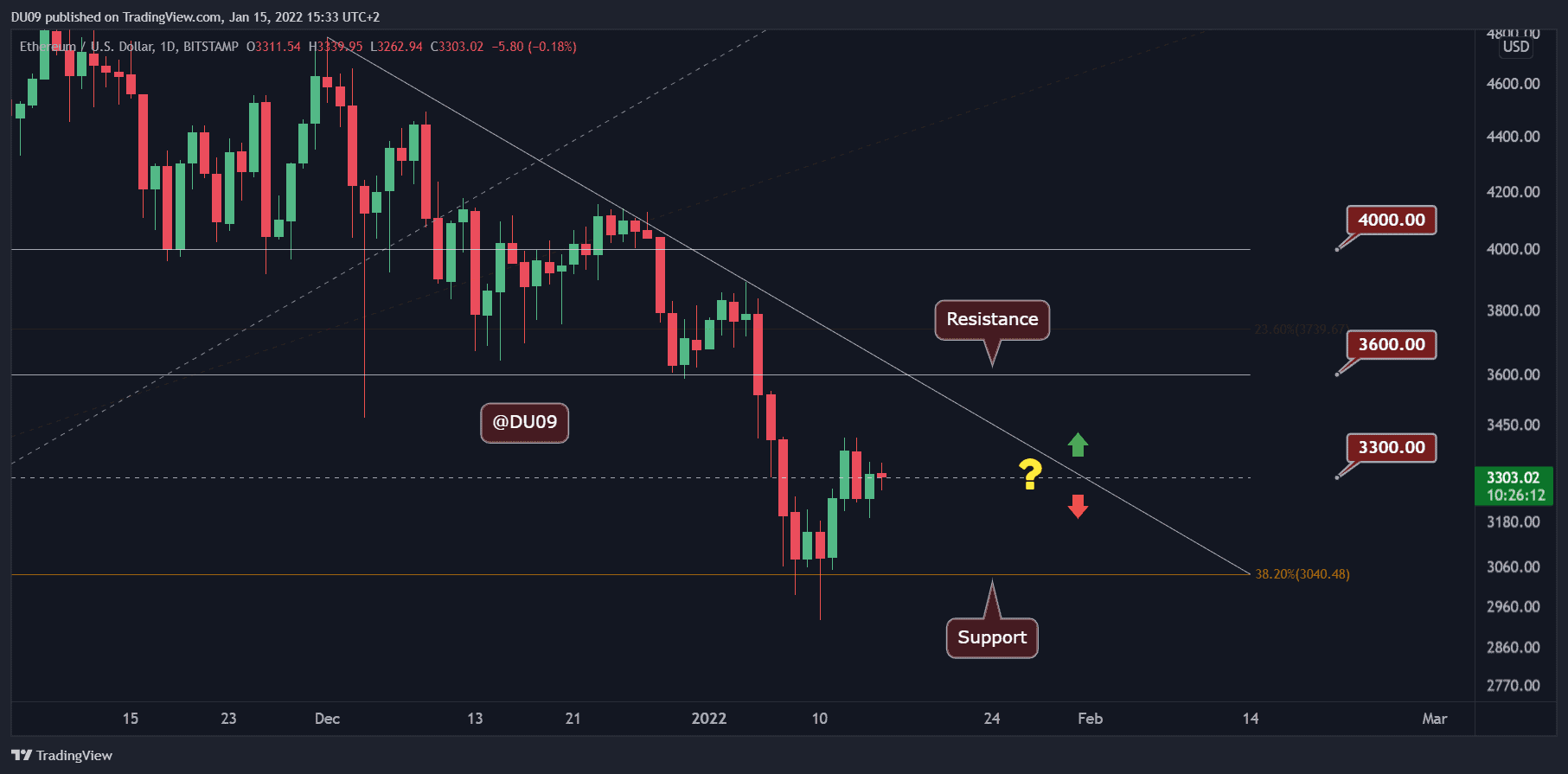

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025 -

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025 -

Dwps 5 Billion Universal Credit Refund Whos Eligible

May 08, 2025

Dwps 5 Billion Universal Credit Refund Whos Eligible

May 08, 2025

Latest Posts

-

Historical Universal Credit Payments Your Right To A Refund

May 08, 2025

Historical Universal Credit Payments Your Right To A Refund

May 08, 2025 -

Universal Credit Hardship Payments Reclaiming Whats Yours

May 08, 2025

Universal Credit Hardship Payments Reclaiming Whats Yours

May 08, 2025 -

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025 -

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025