Is Joe Biden Responsible For The Slowing US Economy? A Critical Analysis

Table of Contents

H2: Biden's Economic Policies and Their Impact

President Biden's economic agenda has been largely characterized by significant government spending aimed at stimulating economic growth and addressing social needs. Let's analyze the key policy initiatives and their potential consequences.

H3: The American Rescue Plan (ARP)

The American Rescue Plan, a $1.9 trillion stimulus package passed in early 2021, aimed to provide Covid-19 relief and boost the economy.

- Increased Government Spending: The ARP significantly increased government spending, injecting substantial funds into the economy. This provided immediate relief to individuals and businesses, but also raised concerns about inflationary pressures.

- Potential for Inflationary Pressures: The massive injection of funds into an already recovering economy contributed to increased demand, exceeding supply in several sectors, leading to price increases. Economists debate the precise extent of the ARP's contribution to inflation, with some arguing it was a significant factor, while others point to global supply chain issues as the primary driver.

- Job Creation Aspects: The ARP funded job creation programs and provided unemployment benefits, supporting employment levels during the recovery. However, the long-term impact on sustainable job growth remains a subject of ongoing discussion.

- Impact on Supply Chains: Increased demand fueled by the ARP, coupled with existing supply chain disruptions, exacerbated inflationary pressures and contributed to shortages of goods.

H3: Infrastructure Investment and Jobs Act (IIJA)

The IIJA, a bipartisan infrastructure bill, represents a long-term investment in upgrading America's infrastructure.

- Job Creation Potential: The IIJA is expected to create numerous jobs in construction and related industries, boosting economic activity over the next several years.

- Impact on GDP Growth: Increased infrastructure spending is projected to contribute positively to GDP growth in the long term, although the immediate impact on economic indicators might be minimal.

- Long-Term Infrastructure Improvements: The IIJA promises to improve the nation's infrastructure, enhancing productivity and efficiency in the future. This is a long-term investment with delayed returns.

- Potential Inflationary Pressure from Increased Demand: Similar to the ARP, the IIJA's increased government spending could contribute to inflationary pressures, though the effect is likely to be spread over a longer period.

H3: Fiscal and Monetary Policy Interactions

The Biden administration's fiscal policies have interacted with the Federal Reserve's monetary policy responses, shaping the overall economic environment.

- Interest Rate Hikes: The Federal Reserve has raised interest rates to combat inflation, impacting borrowing costs for businesses and consumers. This has slowed economic growth, a necessary but potentially painful measure to curb inflation.

- Inflation Control Measures: The Fed's actions, alongside fiscal policy decisions, aim to bring inflation under control, but this often comes at the cost of slower economic growth.

- Impact on Investment: Higher interest rates make investment more expensive, potentially hindering business expansion and job creation.

- Impact on Employment: Slowing economic growth resulting from interest rate hikes can lead to higher unemployment, a trade-off policymakers must carefully manage.

H2: External Factors Affecting the US Economy

It's crucial to recognize that numerous factors beyond President Biden's direct control have significantly impacted the US economy.

H3: Global Inflation and Supply Chain Disruptions

Global factors have played a significant role in the economic slowdown:

- The War in Ukraine: The war in Ukraine has disrupted global energy markets, leading to increased energy prices worldwide, impacting inflation in the US.

- Pandemic-Related Supply Chain Issues: The lingering effects of the COVID-19 pandemic have caused significant supply chain disruptions, leading to shortages and price increases.

- Energy Price Increases: Soaring energy costs have increased production costs for businesses and reduced consumer purchasing power.

- Global Inflation Trends: Global inflation is a significant factor impacting the US economy, reflecting interconnected global markets.

H3: Geopolitical Instability

Geopolitical events and tensions exert considerable influence on the US economy:

- Trade Wars: Trade disputes and tariffs can disrupt international trade, affecting economic growth.

- Sanctions: Economic sanctions imposed on other countries can have ripple effects on the global economy, including the US.

- International Relations Impacting Economic Confidence: Uncertainty in international relations can negatively affect investor confidence and business investment.

H2: Counterarguments and Alternative Perspectives

Attributing the economic slowdown solely to President Biden's policies would be an oversimplification.

H3: Arguments Against Biden's Responsibility

Arguments minimizing Biden's role often highlight:

- Pre-existing Economic Vulnerabilities: The US economy faced pre-existing vulnerabilities, including high levels of debt and inequality, inherited from previous administrations.

- The Legacy of the Trump Administration: Some argue that the economic policies of the previous administration contributed to the current challenges.

- Positive Aspects of Biden's Policies: While acknowledging challenges, supporters point to positive aspects of Biden’s policies, such as job growth in specific sectors and investments in renewable energy.

H3: Alternative Explanations for Economic Slowdown

Other factors beyond presidential policies contribute to economic fluctuations:

- Natural Economic Cycles: Economic downturns are a natural part of the business cycle, independent of any specific administration's policies.

- Technological Disruptions: Rapid technological change can disrupt industries and lead to temporary economic adjustments.

- Changing Consumer Behavior: Shifts in consumer spending patterns and preferences can influence economic growth.

3. Conclusion

Determining whether Joe Biden is solely responsible for the slowing US economy is overly simplistic. While his administration's policies, particularly the scale of government spending, have likely contributed to inflationary pressures, numerous external factors, including global supply chain disruptions, geopolitical instability, and the lingering effects of the pandemic, play equally significant roles. The current economic climate is a complex interplay of domestic and international forces. To form your own informed opinion on the question, "Is Joe Biden Responsible for the Slowing US Economy?", research economic data, consider diverse viewpoints, and explore the impacts of the American Rescue Plan, the Infrastructure Investment and Jobs Act, and the Federal Reserve's monetary policy. Further investigation into the complexities of global inflation and supply chain issues will provide a more complete understanding of this multifaceted challenge.

Featured Posts

-

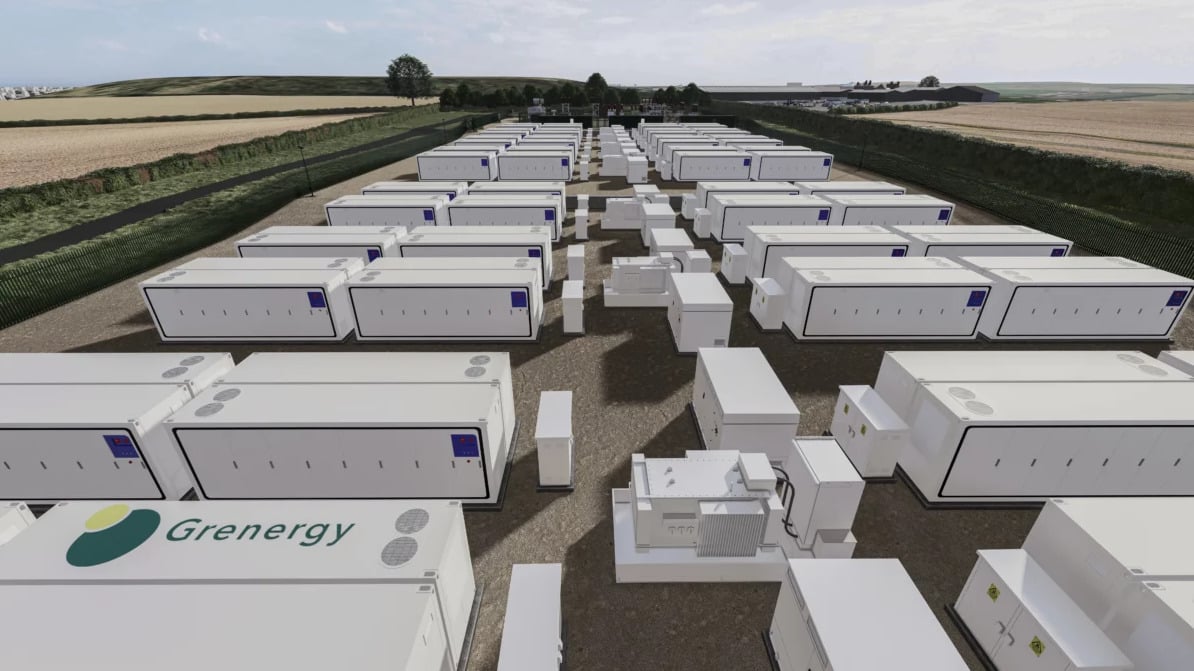

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Labours Image Problem A Deep Dive Into The Nasty Party Accusation

May 03, 2025

Labours Image Problem A Deep Dive Into The Nasty Party Accusation

May 03, 2025 -

Macau Casino Revenue Beats Forecasts In Pre Golden Week Period

May 03, 2025

Macau Casino Revenue Beats Forecasts In Pre Golden Week Period

May 03, 2025 -

Avrupa Birligi Ile Ortak Gelecegimiz Is Birliginin Oenemi

May 03, 2025

Avrupa Birligi Ile Ortak Gelecegimiz Is Birliginin Oenemi

May 03, 2025 -

Strathdearn Community Project Reaches Milestone Pupils Help Break Ground For Affordable Housing In Tomatin

May 03, 2025

Strathdearn Community Project Reaches Milestone Pupils Help Break Ground For Affordable Housing In Tomatin

May 03, 2025

Latest Posts

-

Chinas Automotive Landscape A Deep Dive Into The Experiences Of Bmw And Porsche

May 04, 2025

Chinas Automotive Landscape A Deep Dive Into The Experiences Of Bmw And Porsche

May 04, 2025 -

Challenges Facing Premium Automakers In China A Look At Bmw And Porsche

May 04, 2025

Challenges Facing Premium Automakers In China A Look At Bmw And Porsche

May 04, 2025 -

How Middle Managers Drive Performance And Improve Employee Engagement

May 04, 2025

How Middle Managers Drive Performance And Improve Employee Engagement

May 04, 2025 -

The China Market Obstacles And Opportunities For Luxury Car Manufacturers

May 04, 2025

The China Market Obstacles And Opportunities For Luxury Car Manufacturers

May 04, 2025 -

Beyond Bmw And Porsche The Broader Implications Of Chinas Automotive Market

May 04, 2025

Beyond Bmw And Porsche The Broader Implications Of Chinas Automotive Market

May 04, 2025