Is Palantir Stock A Buy Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir Technologies, a leading provider of big data analytics platforms to government and commercial clients, has experienced a rollercoaster ride in recent times. To assess its investment viability before May 5th, a thorough examination of its financial health is crucial.

Q1 2024 Earnings Expectations

Analyst predictions for Palantir's Q1 2024 earnings are varied. Some anticipate robust revenue growth driven by strong government contract wins and expanding commercial partnerships. Others express caution, citing potential headwinds from macroeconomic uncertainty and increased competition in the big data analytics market. Key metrics like revenue growth, operating margins, and free cash flow will be scrutinized closely. A significant deviation from expectations could significantly impact Palantir stock price.

- Revenue Growth: Analysts project a range of [Insert realistic percentage range] revenue growth for Q1 2024. Exceeding this expectation would likely boost investor confidence.

- Profitability: Monitoring the shift from operating losses to profitability, and the sustainability of positive margins, is key to understanding Palantir's long-term financial health.

- Cash Flow: Strong free cash flow generation will be crucial to demonstrate Palantir's ability to fund future growth initiatives and reduce reliance on external funding.

Government Contracts and Future Revenue Streams

Palantir’s revenue significantly relies on government contracts, particularly in the US and allied countries. The company's success depends on securing new contracts and maintaining existing relationships. Geopolitical events and changes in government spending priorities directly impact this revenue stream. However, Palantir is actively diversifying into the commercial sector, which offers potential for stable and substantial growth in the long term. This diversification is vital to mitigate risk associated with reliance on government contracts.

- Government Spending: Government budget cuts or shifts in priorities could negatively affect Palantir's revenue.

- Commercial Partnerships: The success of Palantir's strategy to expand its commercial customer base is crucial for future growth.

Competition and Market Share

Palantir faces stiff competition from established players and emerging startups in the big data analytics market. Companies like AWS, Google Cloud, and Microsoft Azure provide competing solutions, often with broader functionalities and larger market reach. Palantir's ability to differentiate its platform and maintain its competitive advantage is a significant factor to consider.

- Competitive Differentiation: Palantir needs to demonstrate that its platform offers superior value and unique features compared to competitors.

- Market Penetration: The company's success hinges on penetrating new markets and expanding its customer base.

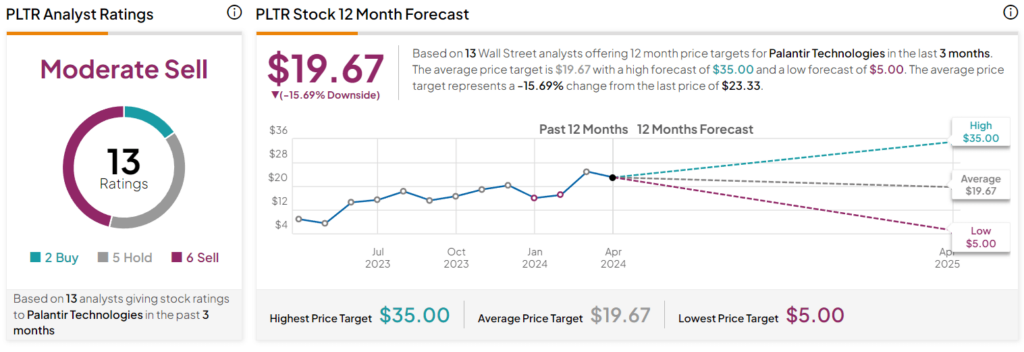

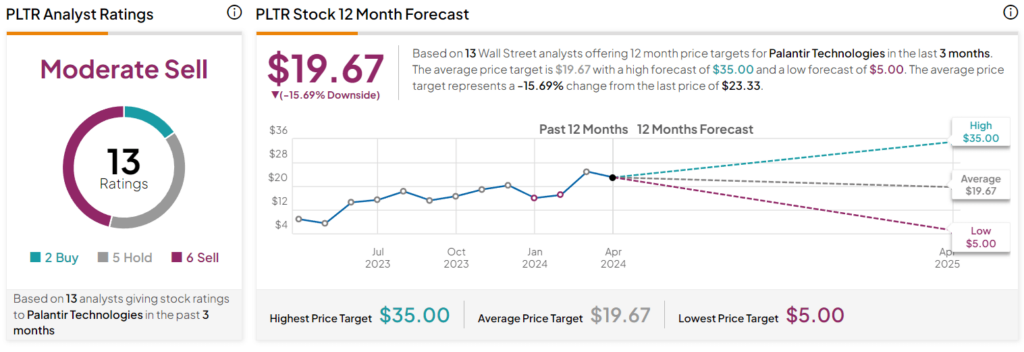

Wall Street Sentiment and Analyst Ratings

Gauging Wall Street sentiment towards Palantir stock is crucial for any investment decision. Analyst ratings and institutional investor activity provide valuable insights.

Analyst Price Targets and Recommendations

Analyst price targets for Palantir stock vary considerably, reflecting the uncertainty surrounding the company's future prospects. The range of targets currently reflects [insert realistic range]. The consensus rating may range from "buy" to "hold" to "sell", depending on the individual analyst's assessment of the company's strengths, weaknesses, and market conditions.

- Price Target Range: A wide range indicates significant disagreement among analysts about Palantir’s future value.

- Buy/Sell/Hold Ratings: These ratings provide a summarized sentiment from financial experts.

Institutional Investor Activity

Monitoring institutional investor activity – buying and selling of Palantir shares by large institutional investors – reveals their confidence level in the company. Significant buying suggests positive sentiment, while significant selling could signal concerns. Insider trading activity also warrants attention, though needs careful interpretation within legal and regulatory contexts.

- Institutional Ownership: High institutional ownership can indicate confidence in the stock's long-term potential.

- Insider Activity: Insider buying may suggest confidence in the company's future, while selling could signal the opposite.

Risk Factors and Potential Downsides

Despite its potential, investing in Palantir stock carries considerable risks. A comprehensive assessment of these risks is essential before making any investment decision.

Valuation and Stock Price Volatility

Palantir stock has a history of high volatility, meaning its price fluctuates significantly. The current valuation of Palantir, relative to its revenue and earnings, is a key factor to consider. Overvaluation could lead to significant price drops.

- Price-to-Sales Ratio: Comparing Palantir's current valuation to its competitors and historical trends is crucial.

- Volatility Risk: High price swings can significantly affect returns.

Dependence on Specific Clients and Projects

Palantir's revenue is concentrated among a relatively small number of clients and projects. This "client concentration risk" makes the company vulnerable to losses if one or more of these key clients experience financial difficulties or cancel projects.

- Client Diversification: Palantir's progress in diversifying its client base is critical for reducing this risk.

- Project Delays: Delays or cancellations of major projects can significantly impact Palantir's revenue and profitability.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis, Palantir stock presents a moderate-to-high-risk investment before May 5th. While the company possesses strong technological capabilities and a potentially lucrative market, its reliance on government contracts, high stock price volatility, and competitive landscape introduce significant uncertainties. The upcoming Q1 2024 earnings report could significantly influence investor sentiment and the stock price. Before making any investment decision, carefully weigh the potential benefits against the considerable risks. Remember to conduct your own thorough research and consider seeking advice from a qualified financial advisor. Make an informed decision about your Palantir stock investment before May 5th by considering the factors discussed in this article.

Featured Posts

-

Handhaven Van De Relatie Brekelmans India Uitdagingen En Oplossingen

May 09, 2025

Handhaven Van De Relatie Brekelmans India Uitdagingen En Oplossingen

May 09, 2025 -

Infineon Ifx Lower Sales Guidance Due To Trump Tariff Uncertainty

May 09, 2025

Infineon Ifx Lower Sales Guidance Due To Trump Tariff Uncertainty

May 09, 2025 -

France And Poland Strengthen Ties New Friendship Treaty On The Horizon

May 09, 2025

France And Poland Strengthen Ties New Friendship Treaty On The Horizon

May 09, 2025 -

Recent Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 09, 2025

Recent Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 09, 2025 -

5 Must Read Stephen King Books For True Fans

May 09, 2025

5 Must Read Stephen King Books For True Fans

May 09, 2025