Is Palantir Stock A Good Buy Before May 5th? A Comprehensive Overview

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir stock has experienced considerable volatility in recent months. While it has shown periods of growth, it has also faced downturns reflecting the broader market trends and investor sentiment. Understanding Palantir's recent financial health is crucial before considering an investment.

Analyzing key financial indicators like revenue growth, profitability, and debt levels provides a clearer picture. Let's examine some key figures:

- Q4 2022 Earnings: [Insert Q4 2022 earnings data here – include specifics like revenue figures, net income or loss, and EPS. Source the data]. This data reveals [interpret the data – positive or negative trends and comparison to previous quarters].

- Revenue Growth: Palantir has demonstrated [insert percentage] revenue growth in [specify time period]. This reflects [explain the reasons for this growth – e.g., success in government contracts, growth in commercial sector].

- Profitability: Palantir's profitability [discuss profitability, referencing net income margin or other relevant metrics. Explain the factors contributing to profitability or lack thereof]. Comparing this to competitors like [mention competitors such as AWS, Microsoft Azure, Google Cloud] reveals [compare and contrast – where Palantir stands].

- Debt Levels: Palantir's debt levels are [describe the debt levels – high, low, stable]. This is [explain the implications of this for the company's financial health and future prospects].

Upcoming Events and Catalysts Affecting Palantir Stock

Several upcoming events and catalysts could significantly impact Palantir's stock price before May 5th. Understanding these potential influences is vital for informed investment decisions.

- Earnings Reports: The upcoming [mention any upcoming earnings reports and their expected release dates] could provide crucial insights into Palantir's financial performance and future guidance. Positive results could lead to increased investor confidence and a rise in the stock price, while negative results might trigger a downturn.

- Product Launches and Partnerships: Palantir is known for its innovative data analytics platforms. Any new product launches or strategic partnerships announced before May 5th could significantly affect investor sentiment. [Mention any anticipated announcements or rumored partnerships].

- Government Contracts: Palantir's substantial revenue stream comes from government contracts. The awarding of new contracts or extensions of existing agreements would positively influence the stock price. Conversely, delays or cancellations could have a negative impact.

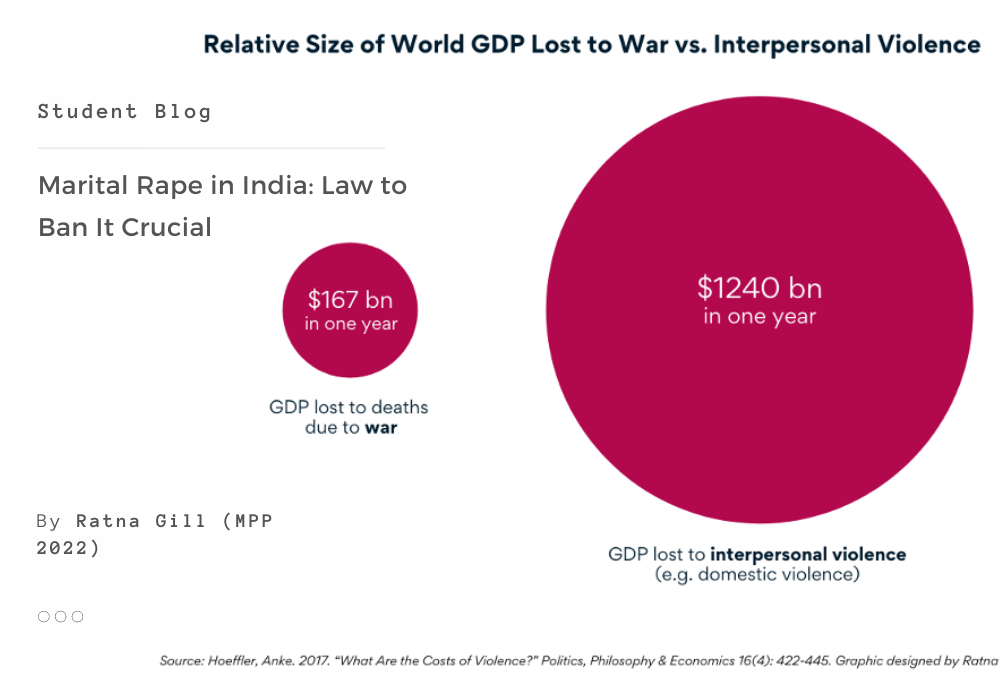

- Geopolitical Factors: Global political instability and economic uncertainty can significantly impact the tech sector, and Palantir is not immune to these external factors. [Mention any significant geopolitical events that might affect Palantir].

Analyzing Palantir's Valuation and Future Growth Potential

Analyzing Palantir's valuation and future growth potential is crucial for assessing its investment worthiness.

- Market Capitalization and Valuation Metrics: Palantir's current market capitalization is [insert current market cap]. Its P/E ratio is [insert P/E ratio] which [compare to industry average and competitors]. This valuation reflects [interpret the valuation - is it overvalued, undervalued, or fairly valued? Explain your reasoning].

- Long-Term Growth Prospects: Palantir operates in the rapidly growing data analytics market, catering to both government and commercial clients. Its position in this market offers significant potential for long-term growth. However, the company faces stiff competition from established players, requiring ongoing innovation and adaptation.

- Market Expansion and New Revenue Streams: Palantir's growth strategy includes [mention Palantir's expansion plans – into new markets, product development, etc.]. The success of these initiatives will be crucial for its future financial performance.

- Risks and Challenges: The company faces challenges such as intense competition, dependence on government contracts, and the need to continually innovate to maintain its competitive edge.

Risk Assessment for Investing in Palantir Stock

Investing in Palantir stock carries inherent risks that potential investors must carefully consider.

- Market Volatility: The tech sector is known for its volatility, and Palantir stock is no exception. Market downturns can significantly impact the stock price.

- Competition: Palantir faces intense competition from established tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These competitors possess significant resources and market share.

- Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could impact the company's financial performance.

- Potential for Losses: Investing in stocks always involves the risk of losing some or all of your investment. Before investing in Palantir, carefully assess your risk tolerance.

- Diversification: To mitigate risk, diversify your investment portfolio. Don't put all your eggs in one basket.

Conclusion

Ultimately, whether Palantir stock is a good buy before May 5th depends on your individual investment goals and risk tolerance. The company demonstrates growth potential in a dynamic market, but faces significant competition and inherent risks. Conduct your own due diligence, consider the factors discussed in this overview, and make an informed decision about investing in Palantir stock. Remember to always carefully evaluate your investment strategy before buying or selling Palantir or any other stock. Understanding Palantir stock's performance and future prospects requires careful consideration of its financial health, upcoming catalysts, valuation, and inherent risks.

Featured Posts

-

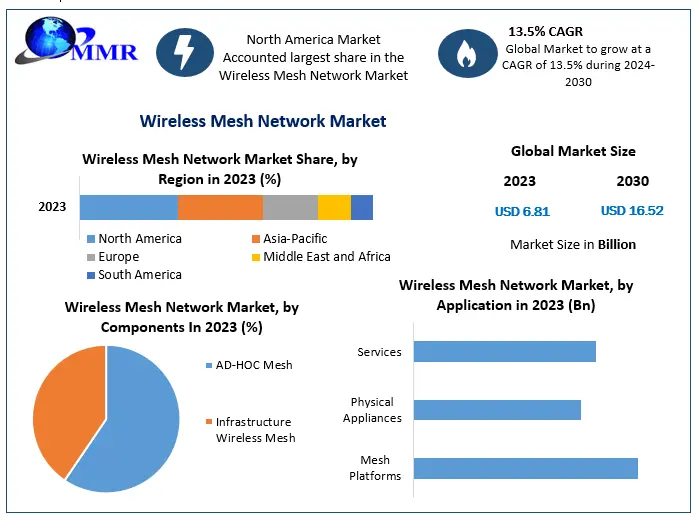

Wireless Mesh Network Market Size And Growth A 9 8 Cagr Forecast

May 09, 2025

Wireless Mesh Network Market Size And Growth A 9 8 Cagr Forecast

May 09, 2025 -

Imfs 1 3 Billion Loan To Pakistan A Review Amidst Regional Instability

May 09, 2025

Imfs 1 3 Billion Loan To Pakistan A Review Amidst Regional Instability

May 09, 2025 -

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025 -

Clash On Canada Trade Tarlov Challenges Pirros Position

May 09, 2025

Clash On Canada Trade Tarlov Challenges Pirros Position

May 09, 2025 -

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025