Is Palantir Stock A Good Buy Before May 5th? Analyzing The Risks And Rewards

Table of Contents

H2: Palantir's Recent Financial Performance and Future Projections

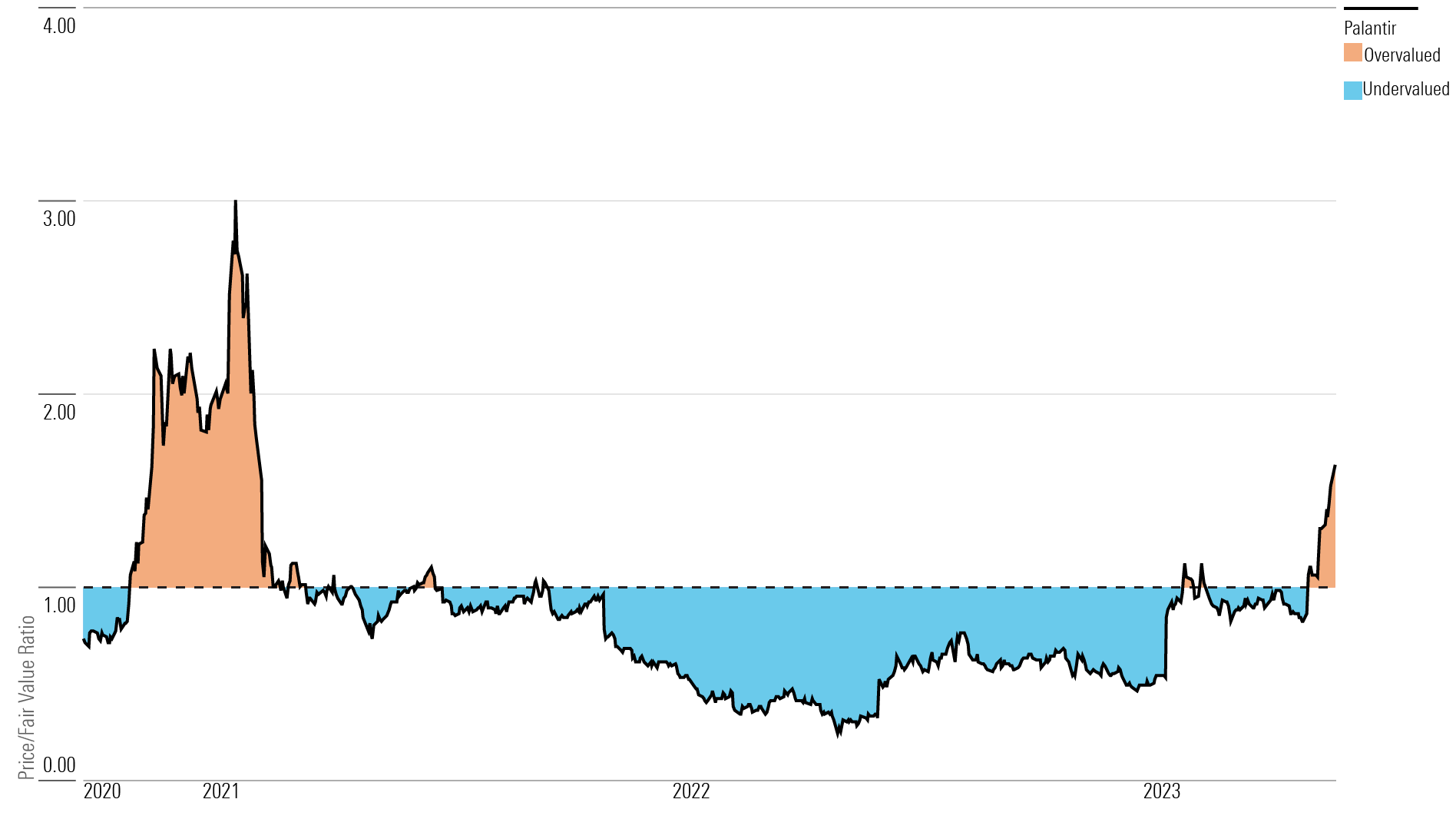

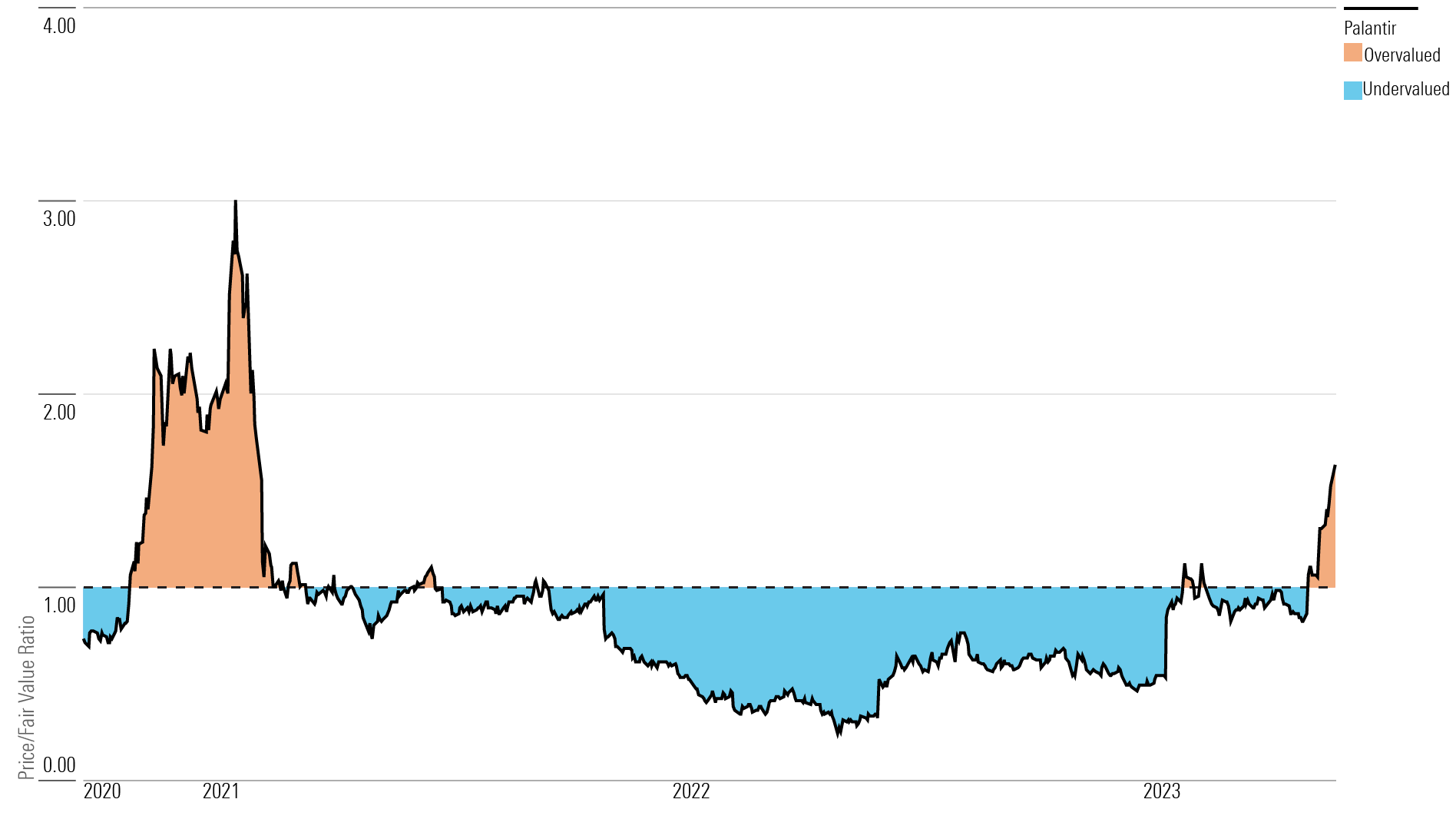

Palantir's financial performance is a key factor in determining whether the stock is a good buy. Understanding its revenue growth, profitability, and future projections is crucial.

H3: Revenue Growth and Profitability:

Palantir has shown consistent revenue growth in recent years, driven by strong performance in both government contracts and commercial partnerships. However, profitability remains a key area of focus for investors.

- Revenue Growth: Palantir's revenue growth rate has been impressive, though the rate of growth may fluctuate quarter to quarter. Analyzing the quarterly and annual reports reveals the underlying trends and drivers of this growth. For example, [Insert specific data from recent financial reports, citing sources like Palantir's investor relations website]. This growth is fueled by increasing demand for Palantir's data analytics platform across various sectors.

- Profitability Trends: Palantir's operating margin and net income are crucial indicators of its financial health. While the company has shown progress in improving its profitability, it's essential to consider the overall trends and factors impacting these metrics. [Insert specific data on operating margin and net income, with citations]. Future projections indicate a continued focus on improving efficiency and profitability.

- Key Financial Metrics: Analyzing key metrics like Palantir revenue, Palantir profit margin, Palantir earnings, and Palantir financial performance provide a holistic picture of the company's financial health. Investors should carefully track these figures to understand the long-term trajectory of the company's financial success.

H3: Government Contracts vs. Commercial Partnerships:

Palantir's revenue stream is a blend of government contracts and commercial partnerships. Understanding the balance and risks associated with each is crucial for assessing the stock's prospects.

- Government Contracts: A significant portion of Palantir's revenue comes from government contracts, particularly in the defense and intelligence sectors. This provides a stable revenue stream but also carries geopolitical risks and potential fluctuations based on government budgets and priorities. [Provide examples and data on government contracts, if available].

- Commercial Partnerships: Palantir's expansion into commercial partnerships diversifies its revenue streams and mitigates the reliance on government contracts. This presents significant growth potential, but also introduces competition and the need to adapt to the demands of the private sector. [Provide examples and data on commercial partnerships].

- Revenue Diversification: The balance between Palantir government contracts and Palantir commercial clients is an important factor in evaluating the company's risk profile. A more diversified revenue stream generally reduces the overall risk associated with the stock.

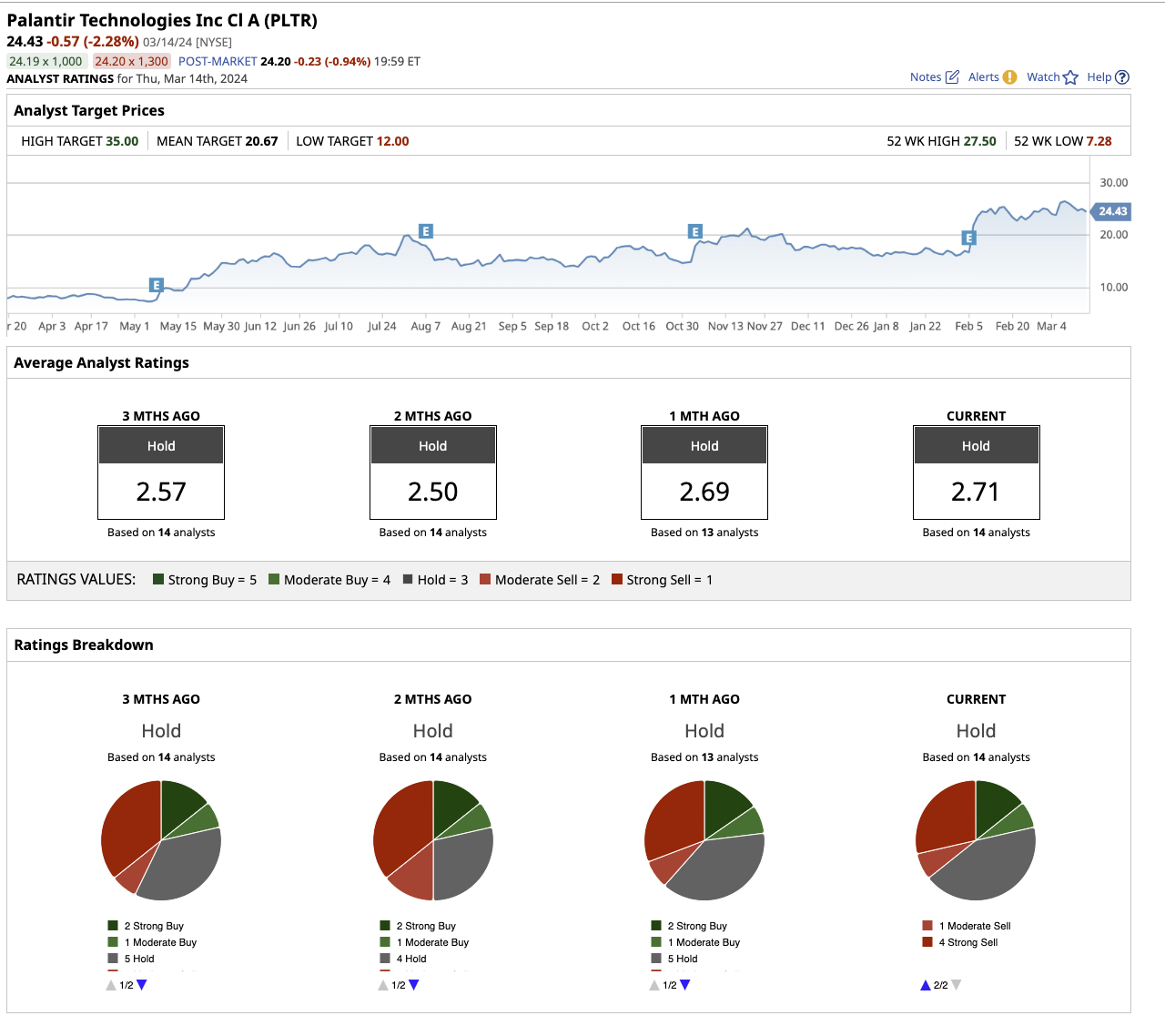

H2: Analyzing the Market Conditions and Their Impact on Palantir Stock

The broader market conditions significantly influence Palantir's stock price. Understanding these conditions and their potential impact is vital.

H3: Overall Market Sentiment and Tech Stock Performance:

The overall performance of the tech sector and market sentiment play a large role in shaping Palantir's stock price. Factors like interest rates and inflation significantly impact investor confidence and valuations.

- Macroeconomic Environment: The current tech stock market is influenced by several macroeconomic factors, including inflation, interest rates, and geopolitical events. These factors affect investor sentiment and can lead to market volatility. [Discuss current market conditions and their potential impact on tech stocks, referencing relevant indices like the Nasdaq].

- Market Volatility: The current market environment is characterized by a degree of uncertainty, leading to increased market volatility. This can impact Palantir stock price prediction, making accurate forecasting challenging.

- Interest Rate Impact and Inflation Impact: Rising interest rates and inflation can negatively affect growth stocks like Palantir, as investors may shift their investments towards more conservative options. [Discuss the specific impacts of interest rates and inflation on Palantir].

H3: Competitor Analysis:

Palantir operates in a competitive landscape, and analyzing its key competitors is essential for assessing its future prospects.

- Key Competitors: Palantir faces competition from established players and emerging startups in the data analytics and government contracting sectors. [List and briefly describe key competitors].

- Competitive Advantages: Palantir's strengths lie in its proprietary technology, strong government relationships, and increasing commercial traction. However, it faces challenges from competitors offering similar capabilities. [Analyze Palantir's strengths and weaknesses compared to competitors].

- Competitive Landscape: Understanding the Palantir competitors and the overall data analytics competition and government contracting competition is crucial for evaluating the company's ability to maintain and grow its market share. [Discuss the competitive landscape and its implications for Palantir].

H2: Assessing the Risks and Rewards of Investing in Palantir Stock Before May 5th

Before making any investment decisions, it's crucial to weigh the potential risks and rewards.

H3: Potential Risks:

Investing in Palantir stock carries inherent risks:

- Reliance on Large Clients: Palantir's revenue is somewhat concentrated among a few large clients. The loss of a key client could significantly impact its financial performance.

- Competition: Intense competition in the data analytics and government contracting sectors poses a threat to Palantir's growth.

- Geopolitical Risks: Government contracts are susceptible to geopolitical risks and changes in government priorities.

- Market Volatility: Overall stock market risk and market volatility can significantly impact Palantir's stock price.

- Regulatory Hurdles: Potential regulatory changes could impact Palantir's operations and future growth. These Palantir risk factors must be carefully considered.

H3: Potential Rewards:

Despite the risks, investing in Palantir offers significant potential rewards:

- Long-Term Growth Potential: The increasing demand for data analytics and government services presents a significant growth opportunity for Palantir. This Palantir growth potential is a key driver for investment.

- Technological Advancements: Palantir's continued investment in research and development positions it for future innovation and market leadership.

- Market Share Expansion: Palantir has the potential to expand its market share by leveraging its technological advantages and strong client relationships.

- Investment Returns: Successful execution of its strategy could lead to significant investment returns for long-term investors.

3. Conclusion:

Investing in Palantir stock before May 5th presents both significant risks and potential rewards. The company's financial performance, market position, and future prospects need careful consideration. Its revenue growth is driven by a mix of government contracts and commercial partnerships, each presenting unique risks and opportunities. The overall market conditions and competitive landscape also play crucial roles. The potential for Palantir growth potential is high, but investors should carefully assess the Palantir risk factors before making any decisions. Make an informed decision about whether Palantir stock is a good buy for you before May 5th by conducting your own research and considering your personal risk tolerance. Weigh the potential rewards of Palantir's growth against the inherent risks in the current market conditions. Remember to always consult with a qualified financial advisor before making any investment decisions related to Palantir stock or any other security.

Featured Posts

-

How To Buy Elizabeth Arden Skincare On A Budget

May 10, 2025

How To Buy Elizabeth Arden Skincare On A Budget

May 10, 2025 -

Indonesia Reserve Holdings Drop Significantly Impact Of Rupiah Depreciation

May 10, 2025

Indonesia Reserve Holdings Drop Significantly Impact Of Rupiah Depreciation

May 10, 2025 -

India Pakistan Tensions Cast Shadow On Imfs Pakistan Loan Review

May 10, 2025

India Pakistan Tensions Cast Shadow On Imfs Pakistan Loan Review

May 10, 2025 -

Palantir Stock Analyzing The Viability Of A 40 Increase In 2025

May 10, 2025

Palantir Stock Analyzing The Viability Of A 40 Increase In 2025

May 10, 2025 -

Povernennya Kinga Politichni Zayavi Pro Trampa Ta Maska

May 10, 2025

Povernennya Kinga Politichni Zayavi Pro Trampa Ta Maska

May 10, 2025