Palantir Stock: Analyzing The Viability Of A 40% Increase In 2025

Table of Contents

Palantir's Current Financial Performance and Growth Trajectory

Analyzing Palantir's financial health is crucial for any Palantir stock price prediction. Recent quarterly and annual reports reveal a complex picture. While revenue growth has been impressive, profitability remains a work in progress. Let's examine some key Palantir financials:

- Revenue Growth: Palantir has consistently shown strong revenue growth, exceeding expectations in several quarters. However, the sustainability of this growth needs careful consideration. Is this growth organic, or driven by specific large contracts?

- Earnings Per Share (EPS): Palantir's EPS has fluctuated, highlighting the challenges associated with balancing rapid expansion with profitability. Investors should scrutinize the trend to determine if it aligns with their investment goals.

- Profit Margins: Palantir's profit margins remain under pressure due to significant investments in research and development and sales & marketing. Analyzing these margins is vital for assessing the long-term financial viability of the company.

- Debt Levels: Understanding Palantir's debt load is critical for evaluating its financial stability and future prospects. High levels of debt could constrain future growth initiatives.

Analyzing these metrics against industry benchmarks will paint a more complete picture of Palantir's financial health and its capacity for the projected 40% stock increase. The key question is whether the current growth model is sustainable in the long term and whether it can support such a dramatic increase in stock valuation.

Key Drivers for Potential Palantir Stock Growth in 2025

Several factors could contribute to Palantir stock growth by 2025. Let's explore the most significant:

Government Contracts and Expansion

Government contracts form a substantial part of Palantir's revenue. Continued success in securing new contracts, particularly in defense and intelligence, is crucial for achieving a 40% stock price increase. Key factors to consider include:

- Geopolitical Landscape: Increased global instability could lead to higher government spending on data analytics and intelligence, benefiting Palantir.

- Contract Renewals: Successfully renewing existing contracts ensures a stable revenue stream.

- International Expansion: Expanding into new government markets internationally presents significant growth opportunities. This requires navigating complex regulatory landscapes and building strong relationships with foreign governments.

Commercial Market Penetration and Adoption

Palantir's success in the commercial market is equally vital. Growth hinges on increased adoption of its software solutions across various sectors. This success depends on:

- Client Acquisition: Palantir needs to continuously acquire new commercial clients across various industries.

- Software Adoption Rate: The rate at which existing clients adopt Palantir's software solutions determines revenue growth.

- Competitive Landscape: Intense competition from other data analytics companies requires Palantir to maintain a significant competitive advantage.

Technological Innovation and Product Development

Continuous innovation is essential for Palantir's long-term success. Investment in research and development is crucial for:

- New Product Releases: Introducing new and improved products strengthens Palantir's offerings and attracts new clients.

- Technological Advancements: Staying at the cutting edge of data analytics technology is vital for maintaining a competitive edge.

- Adaptability: The ability to adapt to evolving market trends and client needs is paramount for long-term growth.

Potential Risks and Challenges to a 40% Stock Increase

While the potential for growth is significant, several risks could hinder Palantir's stock price appreciation:

- Increased Competition: The data analytics market is becoming increasingly competitive, potentially squeezing profit margins.

- Economic Downturn: A global recession could impact government and commercial spending on Palantir's services.

- Regulatory Changes: Changes in data privacy regulations could limit Palantir's operations or increase compliance costs.

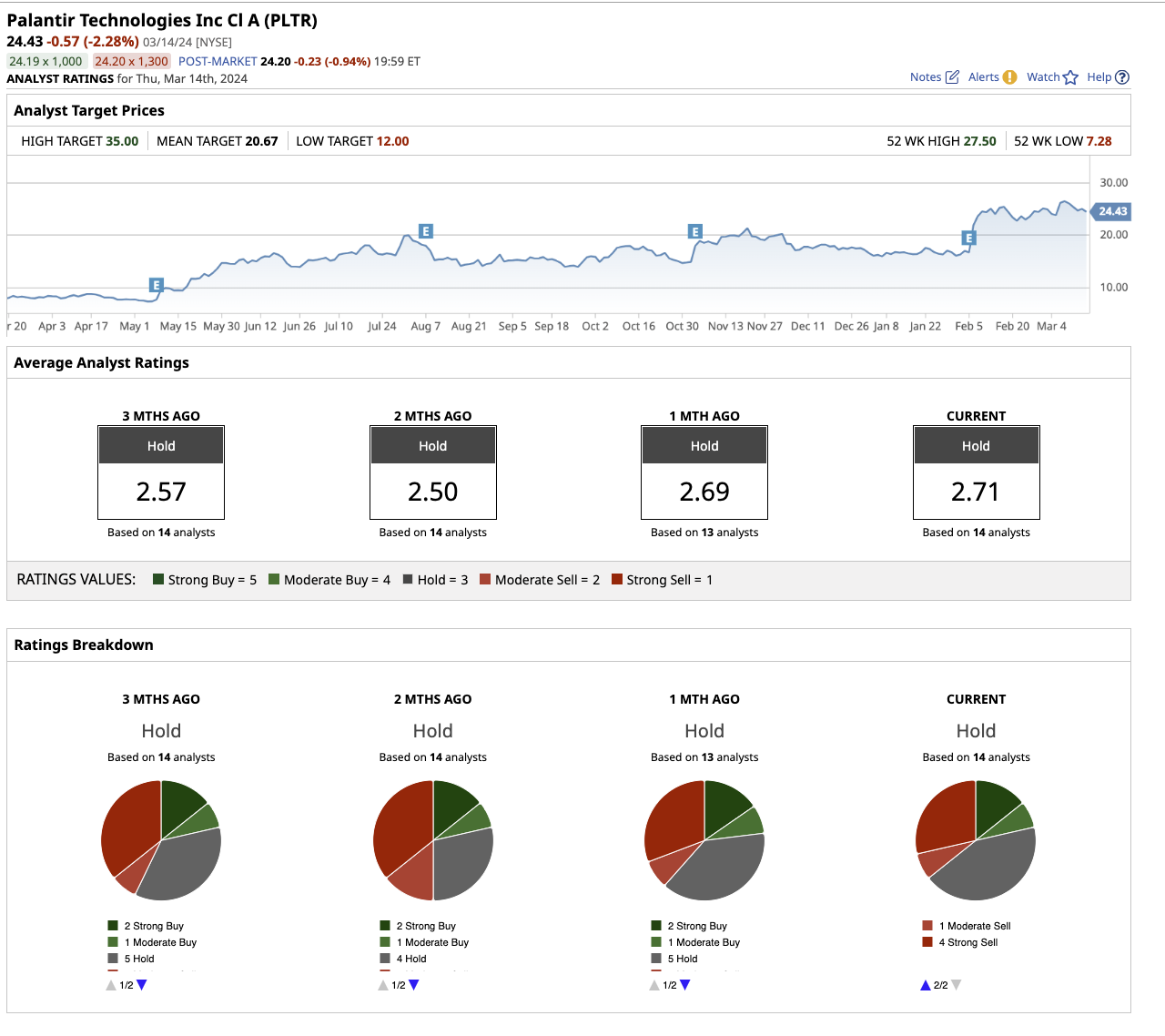

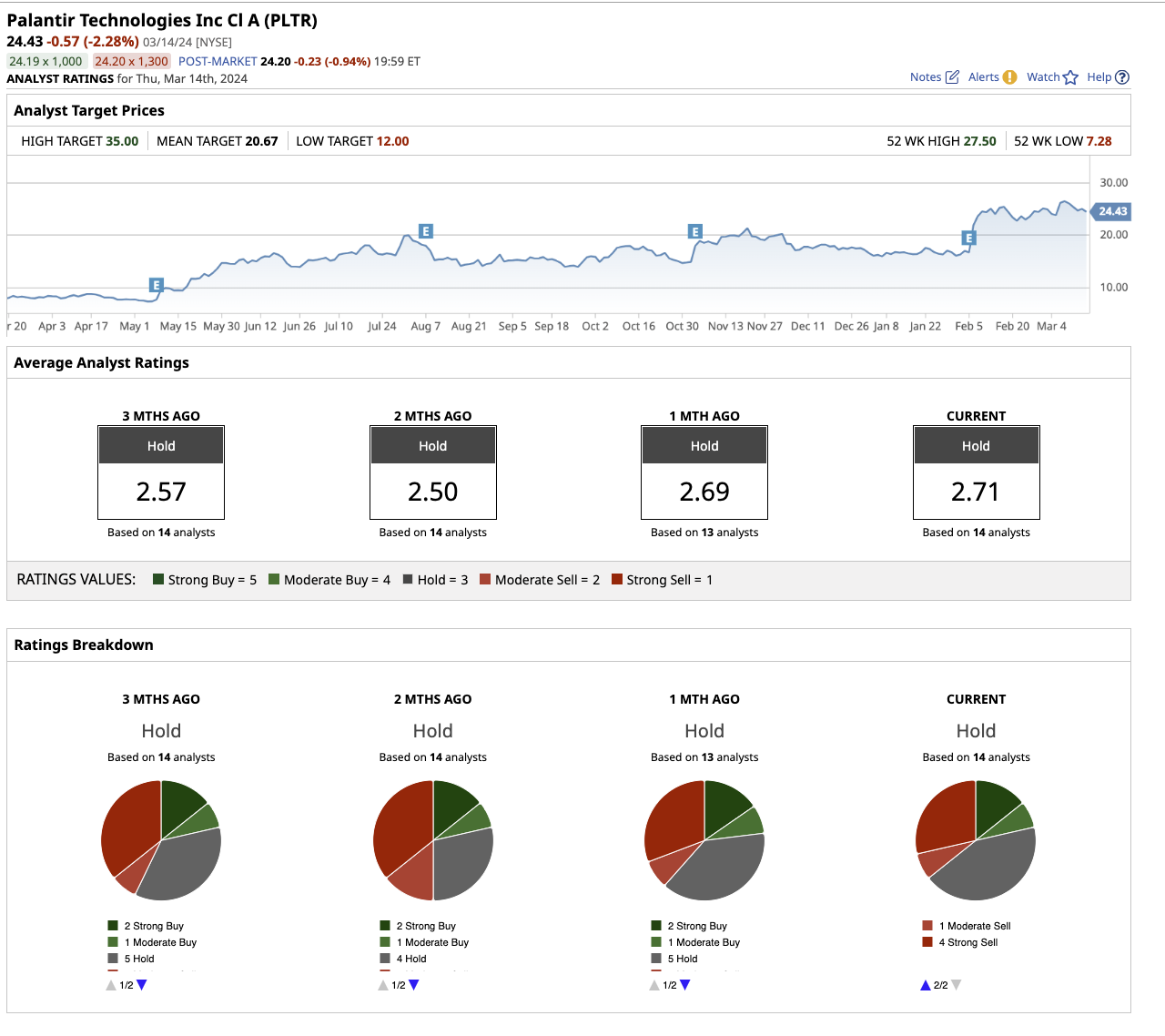

- Stock Volatility: Palantir's stock price is known for its volatility, creating significant risk for investors.

Conclusion: Investing in Palantir Stock: A 40% Rise in 2025 - Realistic or Not?

Our analysis reveals that while Palantir possesses significant growth potential, fueled by government contracts, commercial market expansion, and technological innovation, a 40% stock increase by 2025 is ambitious and hinges on several key factors. The company faces considerable risks, including competition, economic downturns, and regulatory hurdles. The sustainability of its current growth trajectory, coupled with its ability to navigate these challenges, will ultimately determine whether this ambitious goal is realistic. Conduct your own thorough due diligence before investing in Palantir stock. Remember, this analysis of Palantir stock's potential 40% increase by 2025 is just one perspective; your own research is crucial.

Featured Posts

-

Gpb Capital Founders Conviction David Gentile Gets 7 Years For Fraud

May 10, 2025

Gpb Capital Founders Conviction David Gentile Gets 7 Years For Fraud

May 10, 2025 -

The Tarlov Pirro Clash A Heated Debate On The Canada Trade War

May 10, 2025

The Tarlov Pirro Clash A Heated Debate On The Canada Trade War

May 10, 2025 -

Interest Rates Unchanged Fed Weighs Inflation And Unemployment Risks

May 10, 2025

Interest Rates Unchanged Fed Weighs Inflation And Unemployment Risks

May 10, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 10, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 10, 2025 -

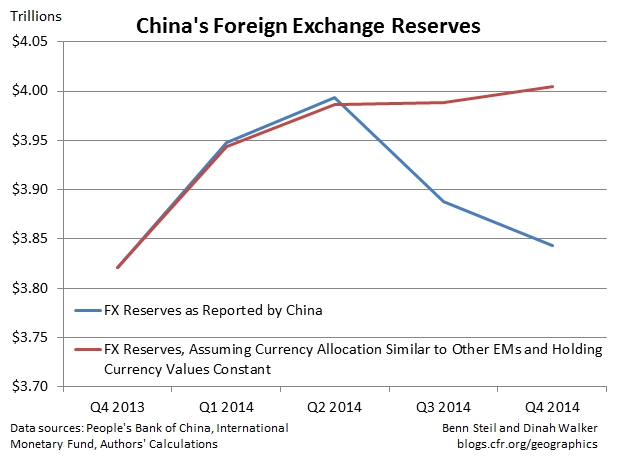

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 10, 2025

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 10, 2025