Is Palantir Stock A Good Investment In 2024? A Detailed Look

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core offerings revolve around two primary platforms: Gotham and Foundry. Gotham caters primarily to government agencies, providing advanced data analytics for intelligence, defense, and security applications. Foundry, on the other hand, targets the commercial sector, offering a platform for businesses to integrate and analyze their vast datasets to improve operational efficiency and decision-making. Understanding these distinct revenue streams is crucial for assessing the future of Palantir stock.

Analyzing revenue growth trends is key to predicting Palantir's future performance. While government contracts form a significant portion of Palantir's revenue, the company is actively expanding its commercial partnerships. This diversification strategy aims to reduce reliance on government spending and ensure a more stable revenue stream.

- Government contracts and their stability: These contracts often involve long-term partnerships, providing a degree of predictability, but they can also be subject to budgetary fluctuations and political changes.

- Growth in commercial sector partnerships: The success of Palantir's expansion into the commercial market will be a major determinant of its long-term growth and the Palantir stock price.

- Recurring revenue model analysis: Palantir's move toward a recurring revenue model, where customers pay ongoing subscriptions for access to its platforms, reduces revenue volatility and enhances predictability.

- Potential for new product launches and market expansion: Innovation and expansion into new markets are crucial for sustained growth and a positive outlook for Palantir stock.

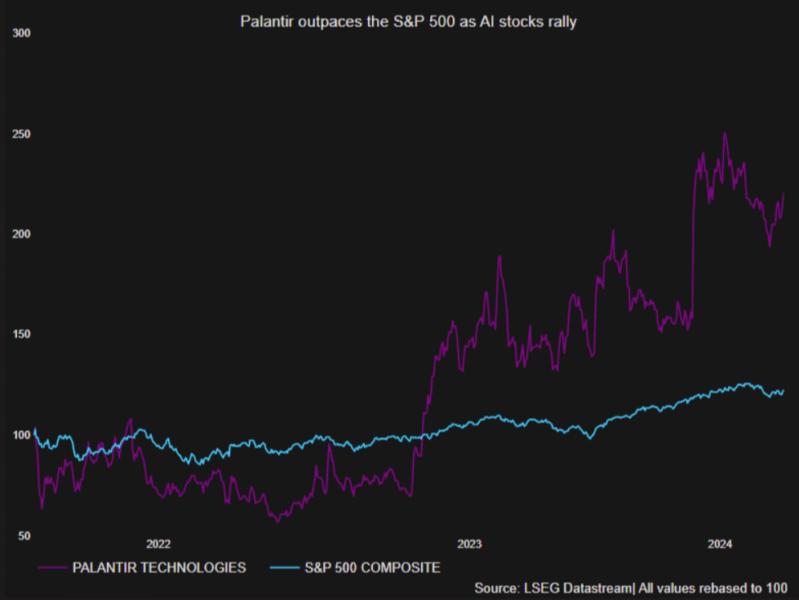

Financial Performance and Valuation

Palantir's financial health is a critical factor in evaluating its investment potential. While the company has shown significant revenue growth, profitability remains a key area of focus. Examining metrics like profit margins, debt-to-equity ratio, and cash flow provides a comprehensive understanding of its financial stability. Comparing Palantir's valuation metrics, such as its price-to-earnings ratio (P/E), to those of its competitors in the data analytics space helps determine whether its stock is overvalued or undervalued.

- Profitability margins and growth trajectory: Analyzing the trend of profit margins indicates the efficiency of Palantir's operations and its ability to generate profit from its revenue.

- Debt-to-equity ratio and financial risk assessment: A high debt-to-equity ratio suggests higher financial risk, while a lower ratio indicates greater financial stability.

- Price-to-earnings ratio (P/E) and other key valuation metrics: Comparing Palantir's P/E ratio to industry averages provides insights into its valuation relative to its competitors.

- Comparison to competitors in the data analytics space: Benchmarking Palantir against companies like Snowflake, Datadog, and others offers a comparative perspective on its financial performance and valuation.

Market Position and Competitive Landscape

Palantir operates in a competitive market, with established tech giants and emerging players vying for market share. Understanding Palantir's competitive advantages – its strong government relationships, its proprietary technology, and its deep expertise in data analytics – is crucial. However, potential threats from competitors, technological advancements, and changing market dynamics must also be considered.

- Strengths of Palantir's technology and expertise: Palantir's technology is known for its power and complexity, giving it a competitive edge in certain niches.

- Threats from existing and emerging competitors: The data analytics landscape is constantly evolving, with new players emerging and established companies expanding their offerings.

- Market share analysis and growth potential: Analyzing Palantir's market share and its potential for growth in different sectors provides insights into its future prospects.

- Technological advancements and innovation within the sector: Staying ahead of the curve in terms of technological innovation is essential for Palantir to maintain its competitive advantage.

Risks and Potential Challenges

Investing in Palantir stock involves several potential risks. The company's significant reliance on government contracts exposes it to budgetary constraints and political shifts. Competition from established tech giants with deeper pockets and broader resources also presents a challenge. Economic downturns can negatively impact both government and commercial spending, affecting Palantir's revenue.

- Dependence on government contracts: Government contracts can be unpredictable, and a shift in government priorities could significantly impact Palantir's revenue.

- Competition from established tech giants: Companies like Microsoft, Google, and Amazon pose a significant threat due to their resources and market reach.

- Economic downturns and their potential impact: Economic instability can lead to reduced spending on data analytics solutions, affecting Palantir's growth.

- Geopolitical risks and their influence: Global political instability can disrupt contracts and negatively affect Palantir's operations.

Analyst Predictions and Future Outlook

Analyst reports offer valuable insights into the potential future performance of Palantir stock. While opinions vary, understanding the consensus price target and the factors driving those predictions provides a broader perspective. Examining the range of opinions helps assess the uncertainty surrounding Palantir's future and its potential impact on the Palantir stock price.

- Consensus price target for Palantir stock: The average price target from various analysts gives a general market sentiment for the stock.

- Range of analyst opinions and differing perspectives: Divergent opinions highlight the uncertainty surrounding Palantir's future performance.

- Factors influencing the predictions: Understanding the factors that analysts consider crucial for Palantir's future, such as revenue growth, profitability, and competitive pressures, is essential for forming your own informed opinion.

- Long-term growth prospects for the company: Analysts' assessments of the long-term potential of Palantir's technology and market position contribute to their overall outlook.

Conclusion

Whether Palantir stock is a good investment in 2024 is a complex question with no easy answer. While the company boasts innovative technology and a strong position in government and commercial markets, it faces significant challenges, including competition and economic uncertainty. The analysis suggests that Palantir's future performance hinges on its ability to diversify its revenue streams, maintain its technological advantage, and navigate a competitive landscape.

Ultimately, the decision of whether or not Palantir stock is a good investment for you in 2024 depends on your individual circumstances and risk tolerance. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir stock.

Featured Posts

-

Palantir Technologies Stock Wall Streets Prediction Before May 5th

May 10, 2025

Palantir Technologies Stock Wall Streets Prediction Before May 5th

May 10, 2025 -

From Pay Pal To Space X Unpacking Elon Musks Path To Financial Success

May 10, 2025

From Pay Pal To Space X Unpacking Elon Musks Path To Financial Success

May 10, 2025 -

Elon Musk And Dogecoin A Look At The Correlation Between Tesla Stock And Crypto

May 10, 2025

Elon Musk And Dogecoin A Look At The Correlation Between Tesla Stock And Crypto

May 10, 2025 -

Stiven Fray Stal Rytsarem Korol Charlz Iii Vozvel Aktera V Rytsarskoe Dostoinstvo

May 10, 2025

Stiven Fray Stal Rytsarem Korol Charlz Iii Vozvel Aktera V Rytsarskoe Dostoinstvo

May 10, 2025 -

Solutions For Nyt Strands Game 403 Thursday April 10th

May 10, 2025

Solutions For Nyt Strands Game 403 Thursday April 10th

May 10, 2025