Is Palantir Stock Overvalued Or Undervalued? A Current Market Assessment

Table of Contents

Palantir's Financial Performance and Growth Trajectory

Revenue Growth and Profitability Analysis:

Palantir's revenue growth has been a key focus for investors. Let's examine the numbers:

- Q1 2023: [Insert actual Q1 2023 revenue figures]. This represents a [percentage]% increase/decrease compared to Q1 2022.

- FY 2022: [Insert actual FY 2022 revenue figures]. This showcases a [percentage]% growth compared to FY 2021.

- Long-Term Trend: Palantir has demonstrated [overall trend - e.g., consistent, fluctuating] revenue growth over the past few years.

However, profitability remains a concern. While Palantir is showing revenue growth, its path to profitability is still under development. [Insert data on net income/loss, operating margin etc. for the relevant periods]. Comparing these figures to industry competitors like [mention key competitors and their profitability metrics] provides a valuable context for evaluating Palantir's performance. Significant contracts with government agencies and increasing commercial partnerships are key drivers influencing its revenue streams.

Future Growth Prospects and Market Opportunities:

Palantir operates in a large and expanding market for big data analytics and artificial intelligence. Its addressable market includes government agencies, commercial enterprises, and other sectors demanding advanced data analysis capabilities. Key growth drivers include:

- Government contracts: Palantir's strong relationships with government agencies worldwide provide a steady stream of revenue and opportunities for future expansion.

- Commercial adoption: Increasing adoption of Palantir's Foundry platform by commercial clients signifies a broadening revenue base and a move away from over-reliance on government contracts.

However, risks to future growth include:

- Intense competition: The big data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Economic downturn: A potential economic recession could negatively impact spending on data analytics solutions, affecting Palantir's revenue.

Valuation Metrics and Comparative Analysis

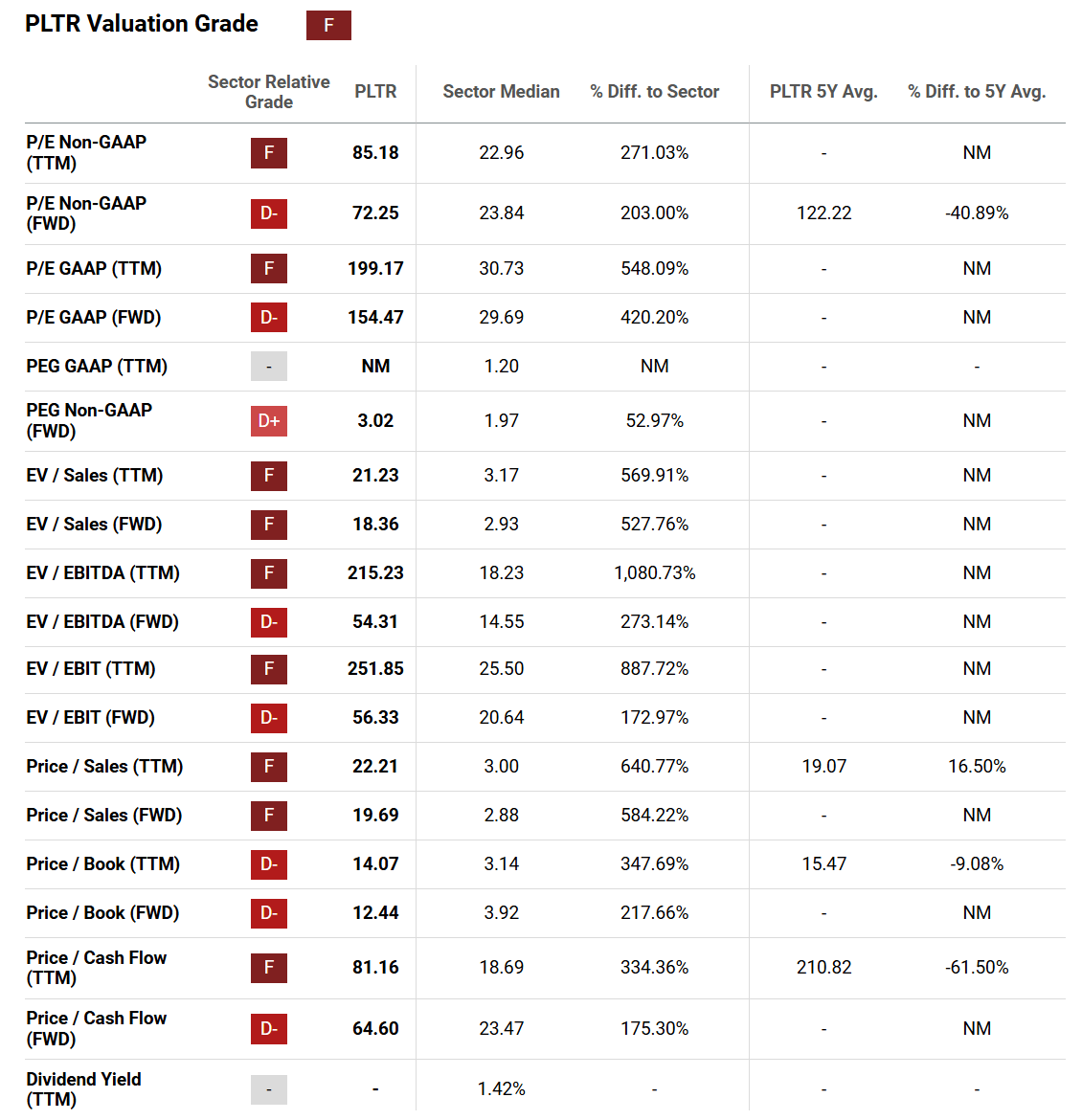

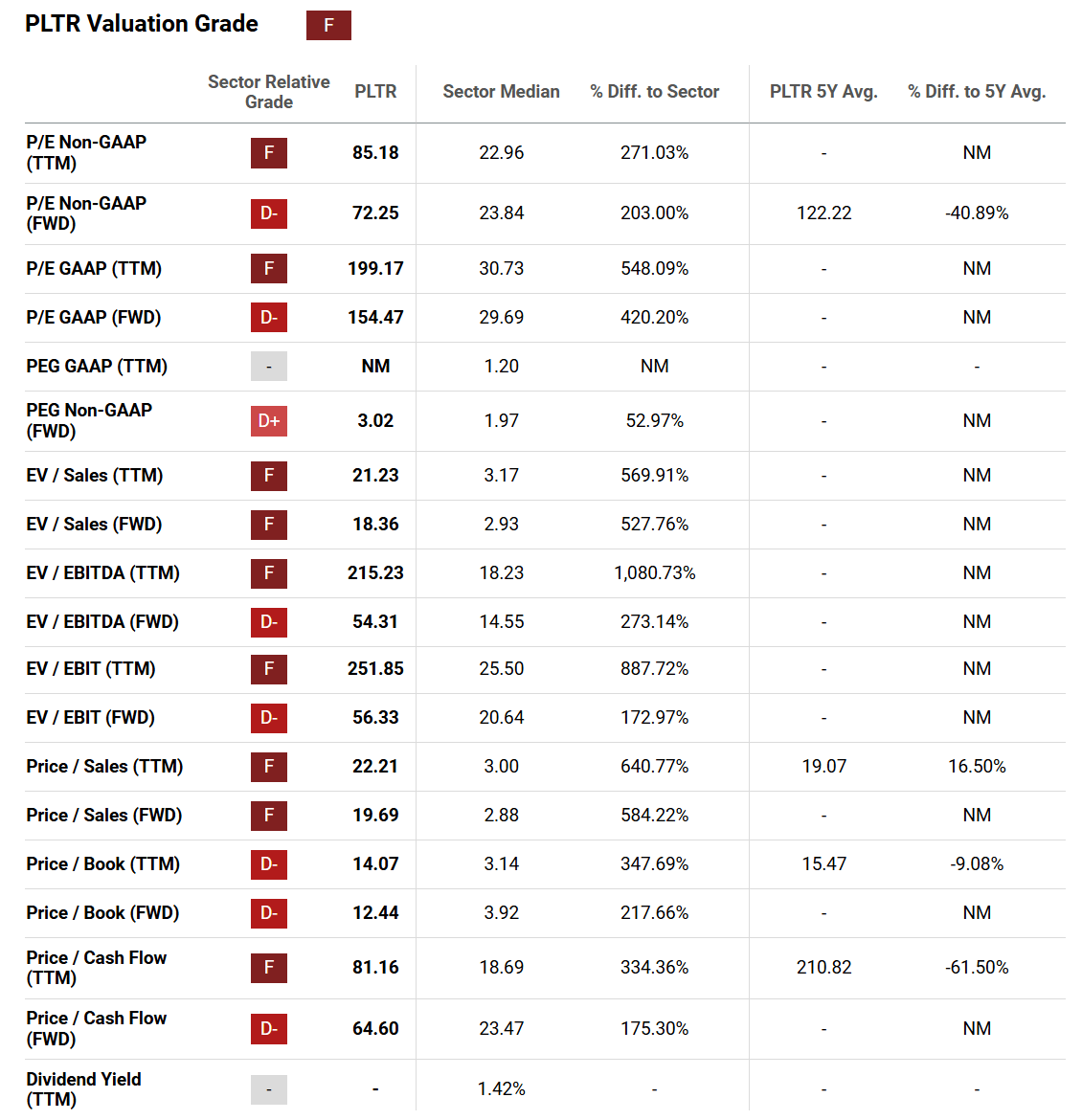

Key Valuation Ratios:

Several valuation ratios provide insights into Palantir's valuation:

- Price-to-Earnings (P/E) Ratio: [Calculate and interpret Palantir's P/E ratio]. Comparing this to the P/E ratios of its competitors, such as [mention competitors and their P/E ratios], helps determine whether Palantir is overvalued or undervalued relative to its peers.

- Price-to-Sales (P/S) Ratio: [Calculate and interpret Palantir's P/S ratio]. This metric offers an alternative valuation perspective, particularly relevant for companies with high growth but low or negative earnings.

These ratios, in conjunction with other relevant metrics, help build a comprehensive picture of Palantir's valuation.

Discounted Cash Flow (DCF) Analysis (Optional):

A DCF analysis provides a more in-depth valuation by projecting future cash flows and discounting them back to their present value. While a comprehensive DCF is beyond the scope of this article, it's crucial to understand that the assumptions made in a DCF (discount rate, growth rates, etc.) significantly influence the results.

Competitive Landscape and Market Dynamics

Major Competitors and Market Share:

Palantir faces competition from established players like [mention key competitors like Microsoft, Google, etc.] and emerging startups in the big data analytics space. Palantir's competitive advantages include its strong government relationships and its specialized data integration and analysis capabilities. However, disadvantages include its relatively high pricing and the potential for disruption from innovative technologies.

Industry Trends and Technological Disruptions:

The big data analytics industry is constantly evolving, with trends like cloud computing, artificial intelligence, and machine learning shaping the competitive landscape. Palantir's ability to adapt to these changes and integrate emerging technologies into its platforms will be crucial for its continued success. Potential technological disruptions could come from open-source alternatives or entirely new approaches to data analysis.

Risk Factors and Potential Downsides

Financial Risks:

Palantir's high growth rate is accompanied by potential financial risks. [Discuss any relevant financial risks such as high debt levels, cash flow concerns, etc.]

Operational Risks:

Challenges in scaling its operations to meet growing demand and maintaining data security could pose significant operational risks. [Discuss cybersecurity threats and their impact.]

Regulatory Risks:

Changes in government policies, particularly concerning data privacy and security, could significantly impact Palantir's business. [Discuss potential regulatory hurdles.]

Conclusion: Is Palantir Stock a Buy, Sell, or Hold?

Based on our analysis of Palantir's financial performance, valuation metrics, competitive landscape, and inherent risks, a definitive conclusion regarding its undervaluation or overvaluation is complex. While Palantir shows strong revenue growth and operates in a large and expanding market, profitability remains a concern, and competition is intense. The company's valuation appears to be heavily influenced by its growth prospects and future potential.

Overall Assessment: The current market price of Palantir stock reflects a high degree of uncertainty and future expectations. A cautious approach is warranted.

Investment Recommendation (with Disclaimer): Given the inherent risks and uncertainties, a "hold" or potentially a "buy" for long-term, high-risk investors might be considered. However, this is not financial advice.

Call to Action: While this analysis provides insights into the Palantir stock valuation, remember to conduct thorough due diligence before investing. Understand the risks involved in investing in Palantir and consult with a financial professional for personalized advice. Remember to carefully assess the Palantir stock valuation in the context of your individual investment strategy and risk tolerance.

Featured Posts

-

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025 -

Illegal Access To Patient Records Nottingham Hospital Investigates Nhs Staff Involvement In Stabbing Victim Case

May 09, 2025

Illegal Access To Patient Records Nottingham Hospital Investigates Nhs Staff Involvement In Stabbing Victim Case

May 09, 2025 -

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025 -

Which Cryptocurrency Will Weather The Trade War Storm

May 09, 2025

Which Cryptocurrency Will Weather The Trade War Storm

May 09, 2025 -

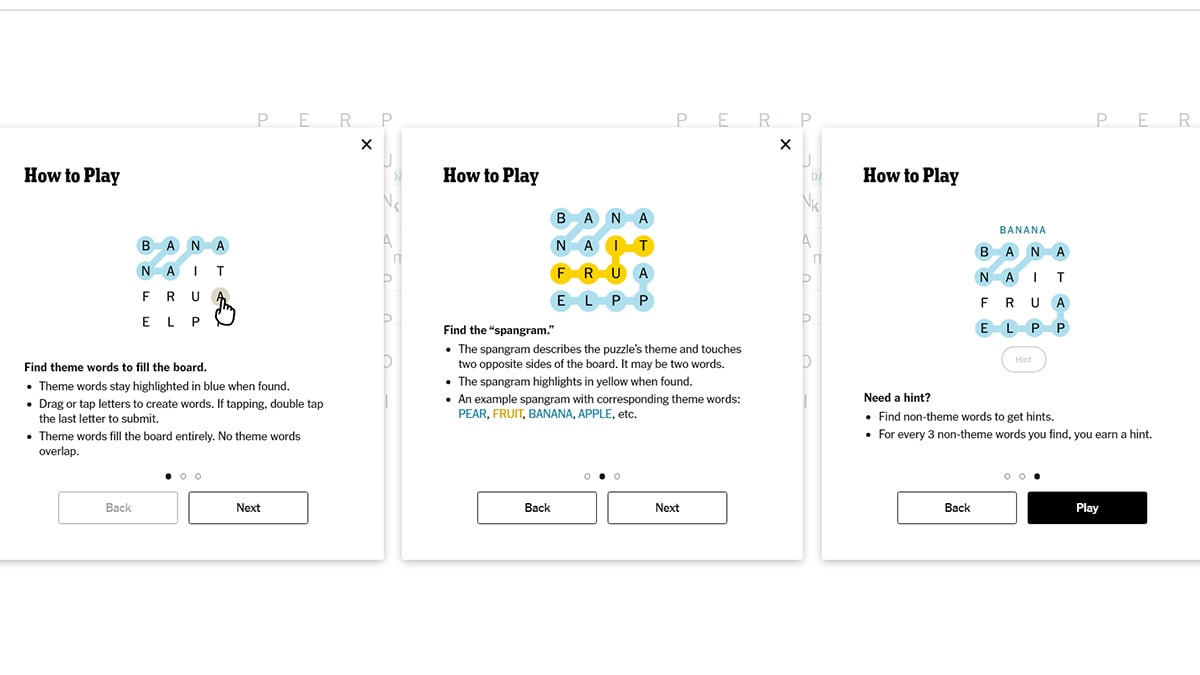

Unlock Nyt Strands Puzzle 377 March 15 Solutions Provided

May 09, 2025

Unlock Nyt Strands Puzzle 377 March 15 Solutions Provided

May 09, 2025