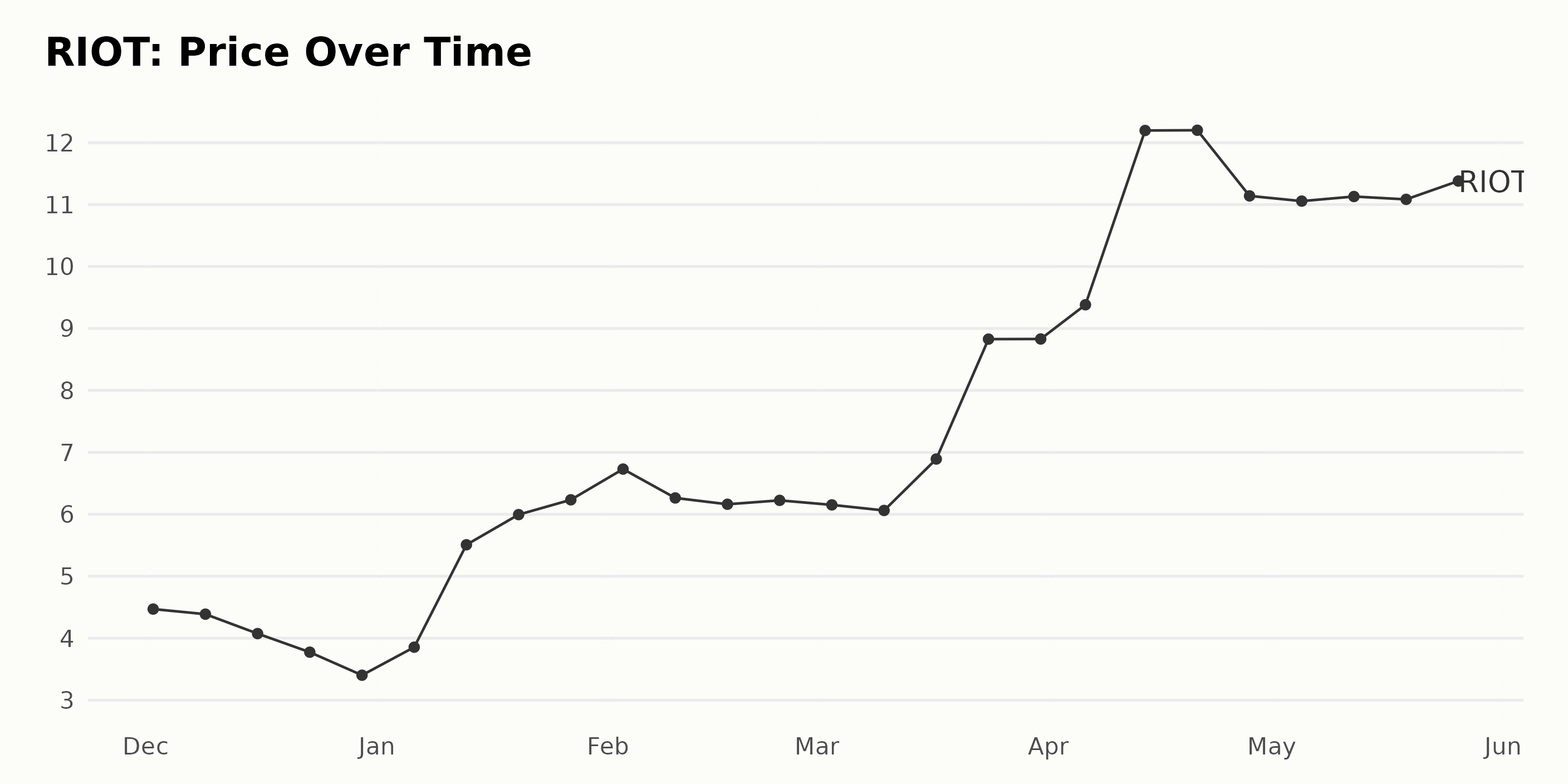

Is Riot Platforms Stock A Buy At 52-Week Lows? A Comprehensive Analysis

Table of Contents

Riot Platforms' Business Model and Financial Performance

Riot Platforms' core business revolves around Bitcoin mining, a capital-intensive operation requiring substantial computing power and energy resources. Understanding its operational efficiency and financial health is crucial to evaluating the stock's potential.

Bitcoin Mining Operations:

- Mining Capacity and Hash Rate: Riot Platforms boasts a substantial Bitcoin mining capacity, expressed through its hash rate (a measure of its computing power). Consistent upgrades and expansions are key to maintaining competitiveness in this rapidly evolving industry. Analyzing the company's reported hash rate growth is essential for assessing its future Bitcoin mining output.

- Geographical Locations and Facilities: The strategic location of Riot Platforms' mining facilities is critical, influencing energy costs and regulatory compliance. Understanding where its operations are concentrated provides insight into potential risks related to regional energy prices and environmental regulations.

- Profitability and Revenue: Riot Platforms' profitability is directly tied to the price of Bitcoin. High Bitcoin prices translate to higher revenue and profits, while a price drop can significantly impact its financial performance. Analyzing its historical revenue and profit margins in relation to Bitcoin's price fluctuations is key to understanding its risk profile.

- Expansion Plans and Infrastructure Upgrades: Riot Platforms' ongoing investments in expanding its mining capacity and upgrading its infrastructure signal its commitment to growth. These initiatives impact the company's future profitability and competitiveness.

Financial Health and Debt:

- Balance Sheet Analysis: A thorough review of Riot Platforms' balance sheet is crucial. This includes examining its debt levels, cash reserves, and overall financial stability. A high debt-to-equity ratio could indicate significant financial risk.

- Cash Flow and Liquidity: Analyzing Riot Platforms' cash flow provides insights into its ability to manage operational expenses and withstand periods of low Bitcoin prices. Strong positive cash flow suggests resilience.

- Profitability Margins and Operating Expenses: Understanding Riot Platforms' profit margins and the efficiency of its operational expenses is vital to assessing its long-term sustainability. Improving operating margins suggests growing efficiency and a healthier business model.

Market Analysis and Bitcoin's Future

The cryptocurrency market, particularly Bitcoin, is notoriously volatile, directly impacting Riot Platforms' stock price. Understanding the market landscape and the future trajectory of Bitcoin is critical for investment decisions.

Bitcoin Price Volatility and its Impact:

- Historical Correlation: Analyzing the historical correlation between Bitcoin's price and Riot Platforms' stock price reveals the extent to which the stock price is driven by Bitcoin's performance.

- Future Price Predictions: While predicting Bitcoin's price is speculative, considering potential price movements (both upward and downward) is essential for gauging the risk involved in investing in Riot Platforms.

- Influencing Factors: Several factors can influence Bitcoin's price, including regulatory changes, widespread adoption, and technological advancements. Understanding these factors helps investors assess potential market shifts.

Competitive Landscape:

- Market Share and Competition: Riot Platforms competes with other major Bitcoin mining companies. Assessing its market share and competitive advantages is crucial for understanding its long-term prospects.

- Efficiency Comparisons: Comparing Riot Platforms' mining efficiency (measured by hash rate per unit of energy consumed) against competitors reveals its relative competitiveness.

- Industry Growth Potential: The overall growth potential of the Bitcoin mining industry plays a significant role in determining Riot Platforms' future. Market saturation and technological advancements influence this growth.

Valuation and Investment Risks

Before making any investment decision, a thorough valuation analysis and a careful assessment of the risks involved are necessary.

Stock Valuation Metrics:

- Price-to-Earnings (P/E) Ratio: Comparing Riot Platforms' P/E ratio to its peers and industry averages helps determine if it's overvalued or undervalued.

- Price-to-Book (P/B) Ratio: The P/B ratio provides insight into the market's assessment of the company's net asset value.

- Future Growth Potential: Assessing Riot Platforms' future growth prospects, considering factors like expansion plans and market conditions, helps project its future valuation.

Risks and Considerations:

- Regulatory Risks: The regulatory landscape surrounding Bitcoin and cryptocurrency mining is constantly evolving, posing significant risk to Riot Platforms.

- Energy Costs and Power Supply: High energy costs can significantly impact the profitability of Bitcoin mining. Reliable access to affordable and sustainable power is crucial.

- Bitcoin Price Crashes: Sharp declines in Bitcoin's price can dramatically impact Riot Platforms' revenue and profitability, posing a major investment risk.

Conclusion:

Whether Riot Platforms stock is a buy at its 52-week lows depends on your risk tolerance and investment horizon. While its substantial mining capacity and expansion plans are positive, the inherent volatility of Bitcoin and the regulatory uncertainties surrounding the cryptocurrency industry pose considerable risks. The analysis suggests that while the current low price may seem attractive, careful consideration of the financial health, competitive landscape, and Bitcoin's price trajectory is paramount. A thorough due diligence process is crucial before investing in Riot Platforms stock. Consider your investment strategy carefully before investing in Riot Platforms stock. Conduct thorough due diligence to determine if Riot Platforms stock aligns with your risk tolerance and financial goals.

Featured Posts

-

Securing A Place In The Sun Tips For Buying Overseas Property

May 03, 2025

Securing A Place In The Sun Tips For Buying Overseas Property

May 03, 2025 -

Mental Health Courses By Government Ignou Tiss Nimhans And More

May 03, 2025

Mental Health Courses By Government Ignou Tiss Nimhans And More

May 03, 2025 -

1 Mayis Emek Ve Dayanisma Guenue Tarih Boyunca Yasanan Arbedeler

May 03, 2025

1 Mayis Emek Ve Dayanisma Guenue Tarih Boyunca Yasanan Arbedeler

May 03, 2025 -

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 03, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 03, 2025 -

Sony Play Station Voucher Glitch Users Receive Free Credit Compensation

May 03, 2025

Sony Play Station Voucher Glitch Users Receive Free Credit Compensation

May 03, 2025

Latest Posts

-

Reintroduction Of Ow Subsidies In The Netherlands A Potential Bidder Incentive

May 04, 2025

Reintroduction Of Ow Subsidies In The Netherlands A Potential Bidder Incentive

May 04, 2025 -

Dutch Government Explores Ow Subsidy Revival To Attract Bidders

May 04, 2025

Dutch Government Explores Ow Subsidy Revival To Attract Bidders

May 04, 2025 -

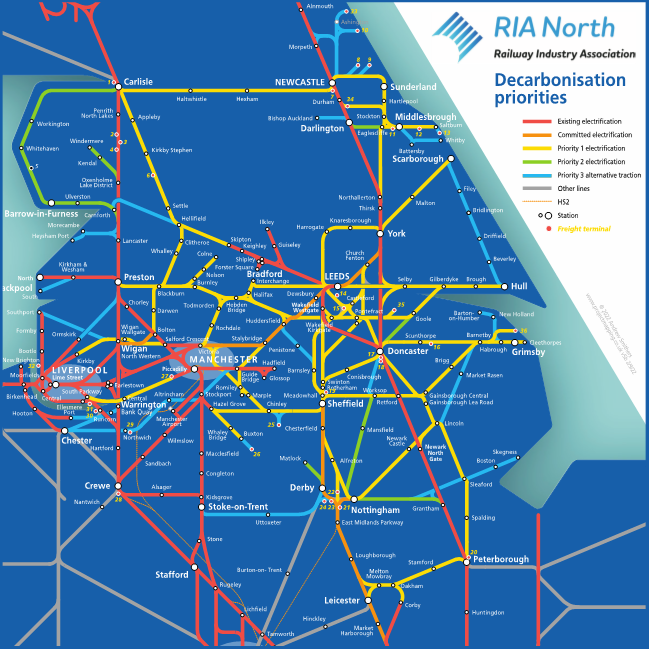

The Power Of Wind Innovative Solutions For Railway Electrification

May 04, 2025

The Power Of Wind Innovative Solutions For Railway Electrification

May 04, 2025 -

Is A Leadership Change At Reform Necessary The Farage Lowe Debate

May 04, 2025

Is A Leadership Change At Reform Necessary The Farage Lowe Debate

May 04, 2025 -

Sustainable Rail Exploring The Potential Of Wind Powered Trains

May 04, 2025

Sustainable Rail Exploring The Potential Of Wind Powered Trains

May 04, 2025