Securing A Place In The Sun: Tips For Buying Overseas Property

Table of Contents

Researching Your Chosen Location

Before you even start browsing property listings, thorough research is paramount. This involves both broad strokes and meticulous detail.

Due Diligence on the Country

Understanding the legal, financial, and social landscape of your chosen country is crucial. Factors to consider include:

- Visa requirements: Can you easily obtain and maintain a visa to reside in the country, or are there significant restrictions? This is particularly important if you plan to live in your overseas property for extended periods.

- Property taxes: Research local property taxes and rates. These can vary significantly between countries and even regions within a country.

- Inheritance laws: How will the property be handled in the event of your death? Understanding the inheritance laws of the country is vital for long-term planning.

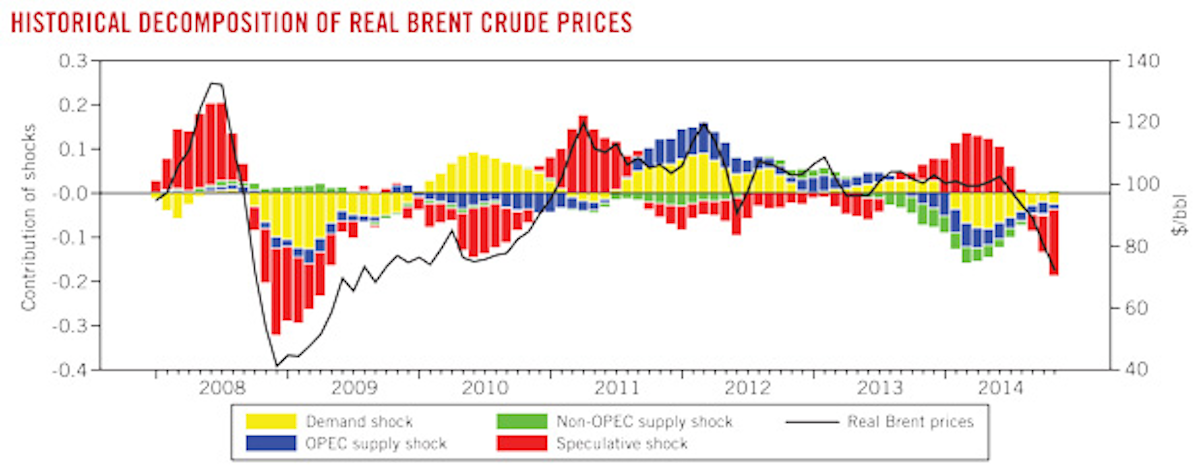

- Currency exchange rates: Fluctuations in currency exchange rates can significantly impact the overall cost of your overseas property and ongoing expenses.

- Political stability: Assess the political stability of the country. Political instability can affect property values and the security of your investment.

Consider the lifestyle aspects too. Does the cost of living align with your budget? What is the climate like? Does the culture appeal to you? These factors contribute significantly to your enjoyment of your overseas property.

Investigating Specific Properties

Once you've narrowed down your location, it's time to scrutinize potential properties.

- Engage a local surveyor or property inspector: A professional inspection can uncover hidden problems that might not be immediately apparent. This is crucial to avoid costly repairs down the line.

- Understand local building codes: Ensure the property complies with all relevant building codes and regulations. Non-compliance can lead to significant legal and financial issues.

- Check property titles and deeds: Verify that the seller has the legal right to sell the property and that the title is clear of any encumbrances or liens. Employing a local lawyer is essential here.

- Use reputable real estate agents: Working with a local real estate agent familiar with the market can significantly streamline the process and provide valuable insights. Look for agents with strong reputations and positive client reviews.

Financing Your Overseas Property Purchase

Securing the necessary funds is a critical step in buying overseas property.

Securing a Mortgage

Obtaining a mortgage for overseas property can be more complex than securing a domestic mortgage.

- International mortgages: Some banks offer international mortgages, but these typically require a larger down payment and stricter lending criteria.

- Local mortgages: You might be able to secure a mortgage from a bank in the country where the property is located. However, language barriers and differing regulations can make this process challenging.

- Down payment requirements: Expect higher down payment requirements compared to domestic mortgages.

- Interest rates and exchange rate fluctuations: Interest rates and currency exchange rates can fluctuate, affecting your monthly payments and the overall cost of the property.

Consider using a mortgage broker specializing in international property transactions. They can help navigate the complexities and find the best financing options for your situation.

Alternative Financing Methods

If securing a mortgage proves difficult, consider alternative financing:

- Cash purchases: Buying with cash eliminates the complexities of securing a mortgage but requires substantial upfront capital.

- Utilizing existing investment portfolios: You may be able to leverage existing investments to finance the purchase.

- Exploring private lending options: Private lenders might be an option, but these often come with higher interest rates and stricter terms.

Legal and Administrative Aspects of Buying Overseas Property

Navigating the legal and administrative processes is crucial for a successful purchase.

Engaging Legal Professionals

Employing a local lawyer specializing in real estate law in your target country is not just advisable – it’s essential.

- Contract review: Your lawyer will meticulously review all contracts to ensure they protect your interests.

- Title search: They will conduct a thorough title search to verify ownership and identify any potential issues.

- Ensuring legal compliance: They will guide you through all legal requirements and ensure compliance with local laws and regulations.

- Understanding local property transfer processes: They will navigate the intricacies of the local property transfer process, making the transaction smoother.

Navigating Bureaucracy

Be prepared for potential bureaucratic hurdles.

- Translation services: Accurate translation of documents is essential.

- Dealing with different legal systems: Legal systems vary significantly across countries. Your lawyer will be your guide.

- Obtaining necessary permits and licenses: Various permits and licenses might be required for the property transfer or future use of the property.

Protecting Your Investment

Once you've secured your overseas property, protecting your investment is key.

Insurance and Property Management

Adequate insurance is crucial.

- Building insurance: Protects against damage to the structure of your property.

- Contents insurance: Covers your belongings within the property.

- Liability insurance: Protects you against potential liability claims.

- Property management companies: Consider using a property management company if you don’t plan to live in the property full-time. They can handle rental income, maintenance, and other aspects of property management.

- Rental income potential: Assess the potential for rental income to offset costs and potentially generate a return on investment.

Long-Term Planning

Think about the long-term implications of your investment.

- Tax residency rules: Understand the tax implications of owning and potentially renting out overseas property, including tax residency rules.

- Capital gains tax: Research the capital gains tax implications when you eventually sell the property.

- Estate planning: Ensure your will and estate plan account for the overseas property.

- Potential long-term rental income: Consider the potential for long-term rental income to offset costs and generate a positive cash flow.

Conclusion

Buying overseas property can be a rewarding experience, but success hinges on thorough research, secure financing, and expert legal assistance. Remember to meticulously research your chosen location, secure appropriate financing, and engage experienced legal professionals throughout the process. Protect your investment through adequate insurance and long-term planning. Ready to turn your dream of owning overseas property into a reality? Start your research today and find the perfect place for you! Don't delay your dream of buying overseas property – begin your search now and unlock a world of possibilities!

Featured Posts

-

Fortnite Update 34 30 Release Date Maintenance Schedule And Patch Notes

May 03, 2025

Fortnite Update 34 30 Release Date Maintenance Schedule And Patch Notes

May 03, 2025 -

Fortnites Changing Landscape The End Of Popular Game Modes

May 03, 2025

Fortnites Changing Landscape The End Of Popular Game Modes

May 03, 2025 -

Kate Moss And Lila Grace Moss Twin In Lbds At London Fashion Week

May 03, 2025

Kate Moss And Lila Grace Moss Twin In Lbds At London Fashion Week

May 03, 2025 -

Boris Johnsons Return A Lifeline For The Conservative Party

May 03, 2025

Boris Johnsons Return A Lifeline For The Conservative Party

May 03, 2025 -

Rupert Lowe The Better Choice To Lead Reform Uk

May 03, 2025

Rupert Lowe The Better Choice To Lead Reform Uk

May 03, 2025

Latest Posts

-

The Ripple Effect Oil Supply Shocks And The Airline Industrys Future

May 04, 2025

The Ripple Effect Oil Supply Shocks And The Airline Industrys Future

May 04, 2025 -

Oil Prices And Airline Profits A Direct Correlation In Times Of Crisis

May 04, 2025

Oil Prices And Airline Profits A Direct Correlation In Times Of Crisis

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

45 Vuelta Ciclista A La Region De Murcia El Suizo Christen Se Lleva El Triunfo

May 04, 2025

45 Vuelta Ciclista A La Region De Murcia El Suizo Christen Se Lleva El Triunfo

May 04, 2025 -

Airlines Face Headwinds Navigating The Impact Of Oil Supply Disruptions

May 04, 2025

Airlines Face Headwinds Navigating The Impact Of Oil Supply Disruptions

May 04, 2025