Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Impact

Table of Contents

The Ripple-SEC Lawsuit: A Turning Point for XRP?

The ongoing legal battle between Ripple Labs and the SEC hangs heavy over XRP's price and future. This protracted lawsuit, alleging that XRP is an unregistered security, has created significant XRP regulatory uncertainty, impacting investor confidence and hindering widespread adoption.

-

Recent court decisions and their implications for XRP: Recent rulings have offered glimmers of hope for Ripple, with some judges suggesting that not all XRP sales constituted securities offerings. These decisions have had a positive, albeit temporary, effect on XRP's price, indicating the market's sensitivity to legal developments. However, the overall outcome remains uncertain.

-

Potential outcomes and their effect on XRP price: A favorable ruling could lead to a significant surge in XRP's price, as regulatory clarity would unlock institutional investment and boost market confidence. Conversely, an unfavorable outcome could further depress the price, potentially leading to extended periods of low trading volume.

-

Analysis of expert opinions on the case's progression: Legal experts offer differing opinions on the likelihood of a favorable outcome for Ripple. Some believe the SEC's case is weak, while others point to the complexities of the legal arguments and the potential for appeals. This divergence of expert opinion reflects the inherent uncertainty surrounding the case.

-

How the lawsuit’s resolution might affect XRP's regulatory clarity: The resolution of the XRP lawsuit, regardless of the outcome, is expected to bring much-needed regulatory clarity to the XRP market. This clarity will be crucial for attracting institutional investors and fostering broader adoption. A clear legal framework will define XRP's status, paving the way for greater market stability and potentially higher valuations. The impact of this clarity on XRP's future will be substantial.

The Impact of ETF Approvals on XRP's Price

The recent approvals of Bitcoin and Ethereum ETFs in the US have sent shockwaves through the financial world, marking a significant step toward mainstream crypto adoption. This wave of institutional investment is expected to have a ripple effect across the broader cryptocurrency market, potentially boosting altcoins like XRP.

-

Increased institutional investment in crypto following ETF approvals: ETFs provide a regulated and easily accessible pathway for institutional investors to gain exposure to cryptocurrencies. The success of Bitcoin and Ethereum ETFs has demonstrated the appetite for crypto investments among traditional financial players.

-

Potential ripple effect on altcoins like XRP: While the initial impact is primarily focused on Bitcoin and Ethereum, the increased interest and liquidity in the crypto market are likely to positively impact other significant cryptocurrencies like XRP. Increased market confidence could lead to higher trading volumes and increased investor interest in altcoins.

-

Analysis of past ETF approvals and their influence on market trends: Historically, the approval of new investment vehicles has often led to increased market volatility initially, followed by a period of consolidation and growth. The impact on XRP will depend heavily on the market sentiment and the resolution of the Ripple-SEC lawsuit.

-

Discussion on the likelihood of an XRP ETF in the future: The approval of Bitcoin and Ethereum ETFs may pave the way for future XRP ETF approvals. However, the ongoing Ripple-SEC lawsuit will likely need resolution before an XRP ETF application gains traction. The regulatory landscape will be a key determinant.

Market Sentiment and XRP's Future

Analyzing current market sentiment toward XRP is crucial for understanding its potential. This sentiment is influenced by a complex interplay of factors, including news coverage, social media trends, and technical indicators.

-

Social media trends and news coverage surrounding XRP: Social media platforms are abuzz with discussion about XRP's prospects, with sentiment fluctuating based on legal developments and market trends. Positive news tends to fuel optimism, while negative news can trigger sell-offs.

-

Technical analysis of XRP's price chart and trading volume: Technical analysis of XRP's price charts, trading volume, and other indicators can provide insights into potential price movements. Support and resistance levels, moving averages, and relative strength index (RSI) are among the key metrics analyzed.

-

Comparison of XRP’s performance to other cryptocurrencies: Comparing XRP's performance to other cryptocurrencies helps gauge its relative strength and potential. Its correlation with Bitcoin and other major altcoins is also an important consideration.

-

Discussion of factors that could positively or negatively influence future price movement: Factors such as regulatory developments, technological advancements, adoption rates, and broader macroeconomic conditions can significantly influence XRP's future price movements.

Addressing FUD (Fear, Uncertainty, and Doubt) Surrounding XRP

Addressing the pervasive fear, uncertainty, and doubt surrounding XRP is vital for a balanced perspective. Many misconceptions persist about XRP's capabilities and its place in the crypto ecosystem.

-

Debunking common myths about XRP's scalability and functionality: XRP's scalability has been a subject of debate. While it's not as decentralized as some other cryptocurrencies, its speed and low transaction costs are key advantages for cross-border payments.

-

Addressing concerns about XRP's centralization: The degree of XRP's centralization is a valid concern for some investors. However, understanding the design of XRP and its intended use case can mitigate these concerns.

-

Highlighting XRP's utility in cross-border payments: XRP's primary utility lies in its efficiency and low cost in facilitating cross-border transactions. This key feature differentiates it from other cryptocurrencies and holds significant potential for global financial systems.

Conclusion

The future of XRP remains uncertain, significantly influenced by the ongoing Ripple-SEC lawsuit and the broader crypto market trends. While ETF approvals for other cryptocurrencies could positively impact XRP indirectly, the resolution of the legal battle will be a crucial determinant of its long-term success. However, the current situation presents both opportunities and risks. By carefully analyzing market sentiment, technical indicators, and the unfolding legal proceedings, investors can make more informed decisions about XRP. Stay informed about further developments surrounding the XRP lawsuit and ETF approvals to capitalize on potential future opportunities within the XRP market. Continue researching the XRP market and stay updated on the latest news to make well-informed decisions.

Featured Posts

-

Met Gala 2025 Red Carpets Most Stunning Looks

May 07, 2025

Met Gala 2025 Red Carpets Most Stunning Looks

May 07, 2025 -

Shrakt Laram Wimbratwr Lzyadt Edd Alsyah Fy Albrazyl

May 07, 2025

Shrakt Laram Wimbratwr Lzyadt Edd Alsyah Fy Albrazyl

May 07, 2025 -

Exploring The Allure Of The Glossy Mirage

May 07, 2025

Exploring The Allure Of The Glossy Mirage

May 07, 2025 -

The Young And The Restless Spoilers Will Summers Fate Hinge On Claires Pregnancy

May 07, 2025

The Young And The Restless Spoilers Will Summers Fate Hinge On Claires Pregnancy

May 07, 2025 -

Lotto 6aus49 Ziehung Mittwoch 9 4 2025 Alle Gewinnzahlen

May 07, 2025

Lotto 6aus49 Ziehung Mittwoch 9 4 2025 Alle Gewinnzahlen

May 07, 2025

Latest Posts

-

Ethereum Indicator Signals Potential Buy Opportunity

May 08, 2025

Ethereum Indicator Signals Potential Buy Opportunity

May 08, 2025 -

Before The Rookie Nathan Fillions Unforgettable Wwii Moment

May 08, 2025

Before The Rookie Nathan Fillions Unforgettable Wwii Moment

May 08, 2025 -

Nathan Fillion From Iconic Wwii Movie To The Rookie

May 08, 2025

Nathan Fillion From Iconic Wwii Movie To The Rookie

May 08, 2025 -

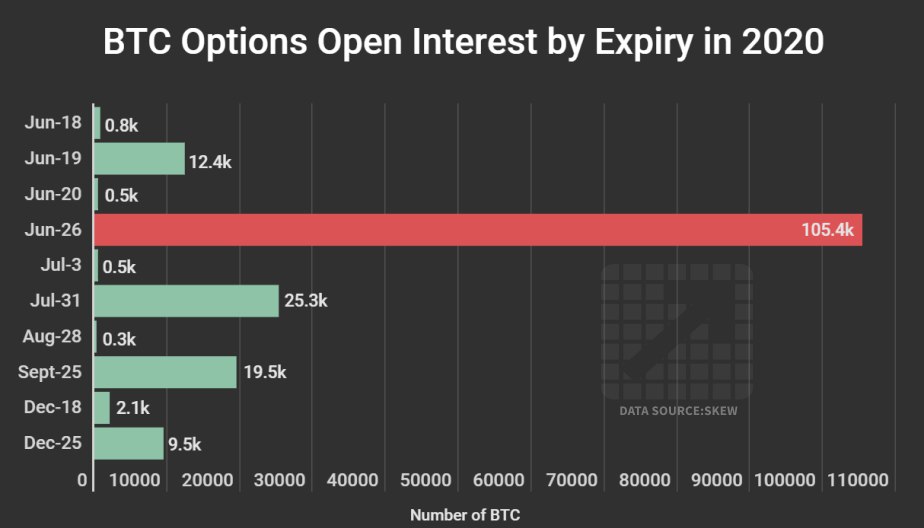

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025 -

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025