Is This XRP's Big Moment? ETF Hopes, SEC Shakeups, And Ripple's Transformation

Table of Contents

The Alluring Prospect of XRP ETFs

The approval of an XRP exchange-traded fund (ETF) would be a watershed moment for the cryptocurrency. Currently, investors seeking exposure to XRP face hurdles involving navigating cryptocurrency exchanges, managing private keys, and dealing with the inherent volatility of the crypto market. An XRP ETF would dramatically alter this landscape.

-

Impact on Price and Market Adoption: The increased accessibility and liquidity offered by an ETF would likely attract a surge of institutional and retail investors. This influx of capital could significantly boost XRP's price and drive wider market adoption. We've seen similar effects with Bitcoin and Ethereum ETF approvals in other jurisdictions.

-

Regulatory Hurdles and Timelines: The SEC's approval process for crypto ETFs is notoriously rigorous and often lengthy. Applications require comprehensive disclosures, demonstrating adherence to strict regulatory standards and risk management protocols. The timeline for approval can vary considerably, ranging from months to years, depending on the completeness of the application and the SEC's ongoing review of the cryptocurrency market.

-

Specific ETF Applications and Implications: While specific applications for XRP ETFs are still under review or yet to be filed, their potential approval would reshape the XRP investment landscape. The sheer number of investors gaining access through traditional brokerage platforms would be transformative for XRP's price and liquidity. Success here would mirror the impact seen with other crypto ETFs gaining approval.

-

Bullet Points:

- Increased liquidity and accessibility for investors, making XRP trading easier and more convenient.

- Potential price surge due to increased demand from institutional and retail investors.

- Enhanced legitimacy and institutional adoption, leading to greater confidence in XRP.

- Comparison with other crypto ETF approvals (Bitcoin, Ethereum) shows a clear pattern of price increases following regulatory approval.

The SEC Shakeup and its Ripple Effect on XRP

The recent changes in SEC leadership have injected considerable uncertainty—and perhaps hope—into the ongoing legal battle between the SEC and Ripple. The implications for XRP are substantial.

-

Implications of Recent SEC Leadership Changes: The new leadership at the SEC could bring a different approach to cryptocurrency regulation. A more nuanced and potentially crypto-friendly stance could significantly impact the outcome of the Ripple lawsuit and future regulatory decisions regarding XRP.

-

Potential for a More Crypto-Friendly Regulatory Environment: A shift towards a more balanced regulatory approach could pave the way for clearer guidelines for cryptocurrencies like XRP, fostering innovation and reducing regulatory uncertainty.

-

Impact on XRP's Price and Future: The outcome of the Ripple lawsuit and the overall regulatory landscape will undeniably impact XRP's price and long-term prospects. A positive resolution could unlock significant growth potential, while a negative outcome could create further volatility.

-

Bullet Points:

- Impact of the new SEC chair's views on crypto and potential for a more favorable regulatory environment.

- Potential for settlement or dismissal of the Ripple lawsuit, removing a major overhang on XRP's price.

- Shift in regulatory approach towards cryptocurrencies could lead to greater clarity and investor confidence.

- Uncertainty and volatility surrounding SEC decisions will continue to influence the XRP market.

Ripple's Transformation: Beyond the SEC Lawsuit

Ripple has been actively pursuing strategic initiatives and technological advancements independent of the SEC lawsuit. This proactive approach demonstrates a long-term vision that extends beyond the immediate legal challenges.

-

Strategic Initiatives and Technological Advancements: Ripple's focus on enterprise solutions, particularly its On-Demand Liquidity (ODL) product, is gaining traction globally. This showcases Ripple's commitment to practical applications of blockchain technology within the financial sector.

-

Focus on Enterprise Solutions and Partnerships: Ripple is actively forging partnerships with financial institutions, expanding the reach and utility of XRP. These collaborations showcase the real-world application of XRP and its potential to facilitate cross-border payments.

-

Building a Robust and Decentralized Ecosystem: Ripple's investment in the XRP Ledger's development underscores its commitment to creating a robust and decentralized ecosystem. These efforts contribute to the overall health and scalability of XRP.

-

Bullet Points:

- Focus on On-Demand Liquidity (ODL) and its increasing adoption by financial institutions globally.

- New partnerships and collaborations with financial institutions driving real-world use cases for XRP.

- Technological innovations and upgrades to the XRP Ledger enhancing efficiency and scalability.

- Community growth and development efforts fostering a strong and engaged user base.

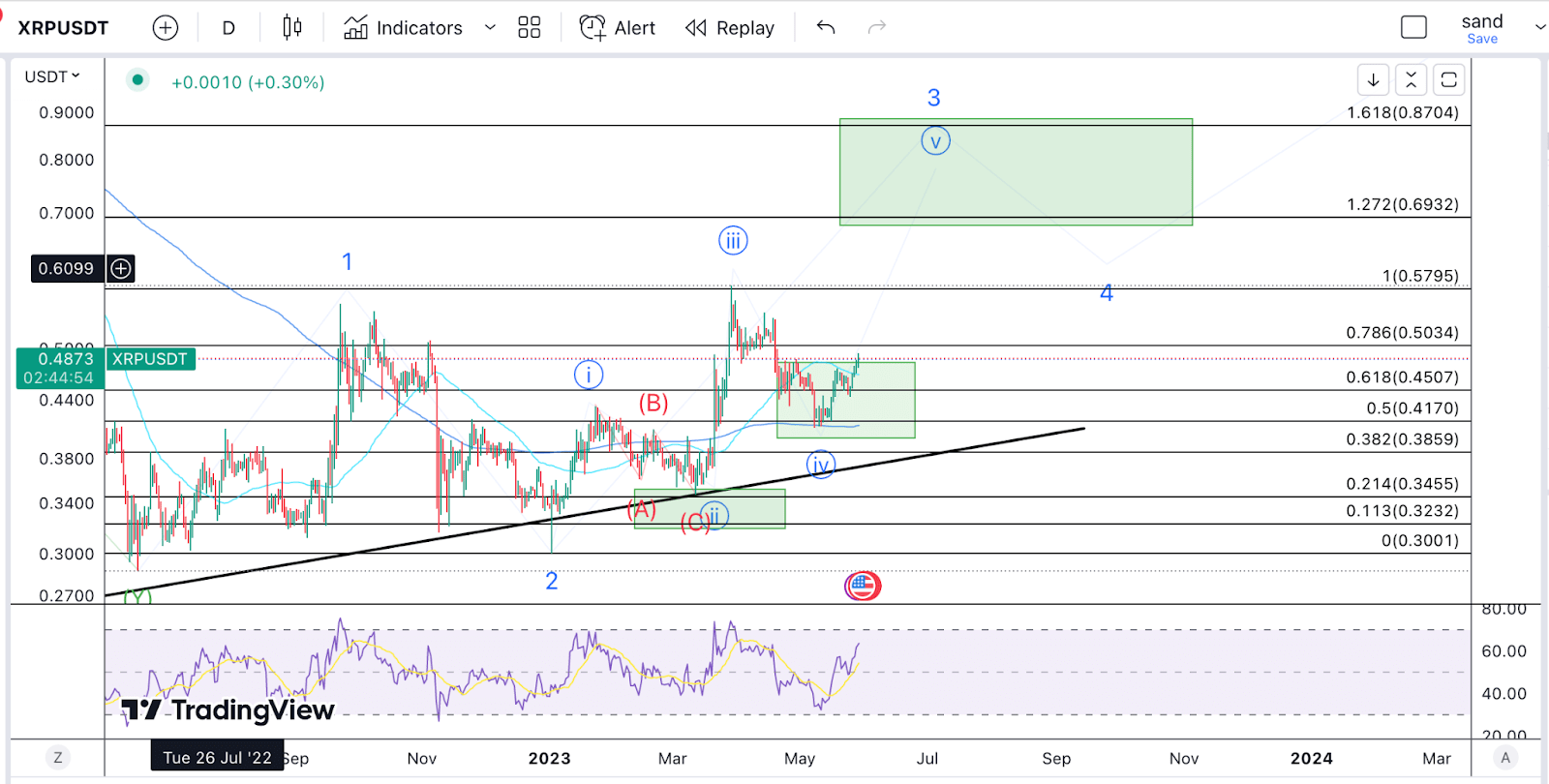

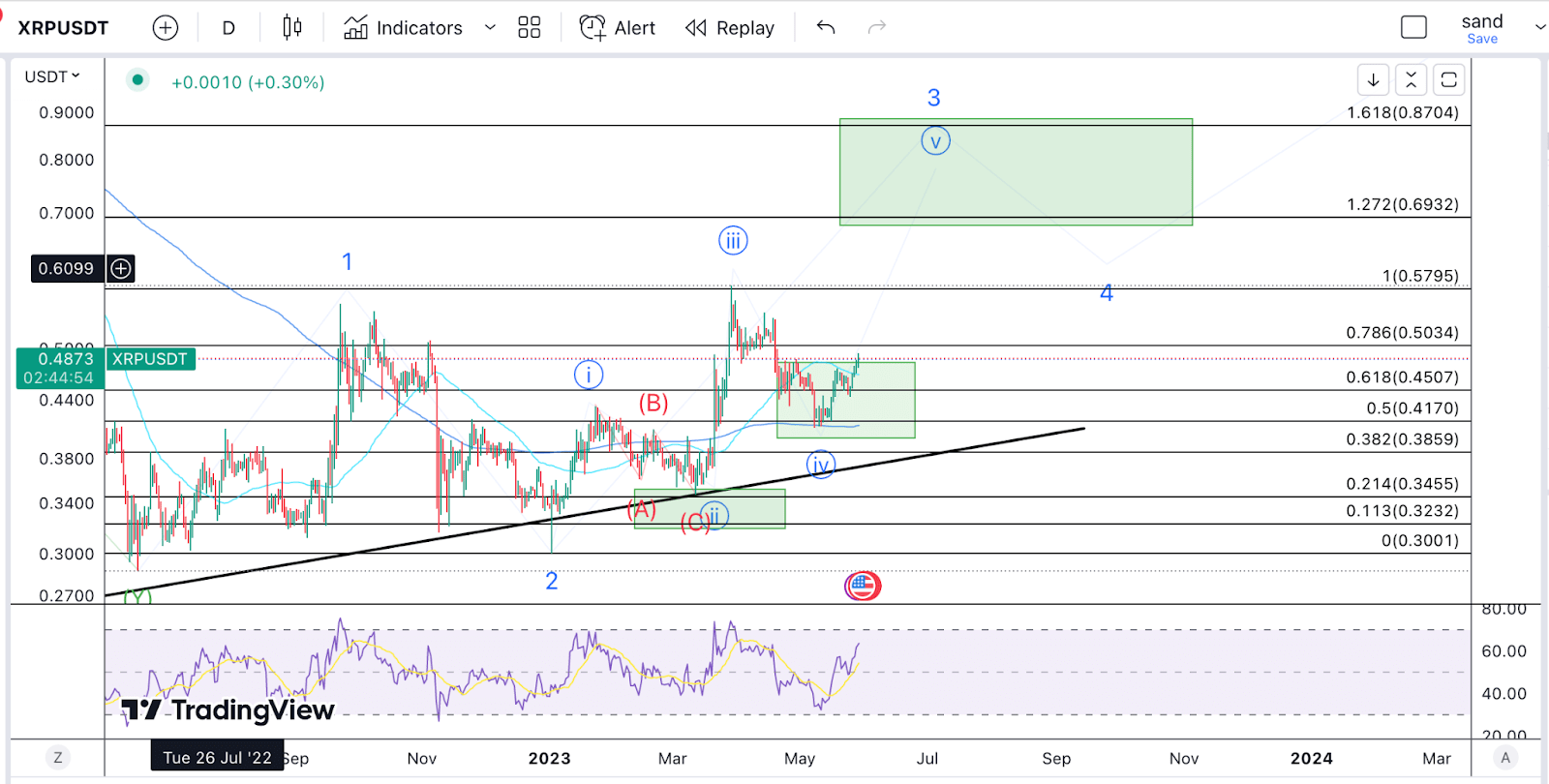

XRP Price Analysis and Future Predictions

Analyzing XRP's price requires considering multiple factors, including the potential for ETF approval, the outcome of the SEC lawsuit, and overall market sentiment.

-

Current XRP Price Trends and Patterns: XRP's price has historically shown considerable volatility, influenced by various factors, including regulatory news, market sentiment, and technological developments. Analyzing historical price performance provides valuable context for understanding current trends.

-

Potential Price Targets Based on Different Scenarios: Different scenarios – ETF approval, a favorable SEC ruling, increased institutional adoption – suggest varying price targets. These scenarios offer a spectrum of possibilities, ranging from moderate growth to substantial price appreciation.

-

Technical Analysis and Market Sentiment Indicators: Technical indicators like moving averages, RSI, and trading volume can provide insights into short-term price movements and overall market sentiment. Combining technical analysis with fundamental factors provides a more holistic view.

-

Bullet Points:

- Historical price performance provides context for evaluating current price trends and volatility.

- Technical indicators (moving averages, RSI, etc.) offer insights into short-term price momentum.

- Market capitalization and trading volume indicate the overall market interest in XRP.

- Analyst predictions and price forecasts provide a range of potential future price scenarios.

Conclusion

This article explored the convergence of several key factors that could significantly impact XRP's future: the potential approval of XRP ETFs, the ongoing SEC legal battle and its potential outcomes, and Ripple's proactive strategy. The confluence of these events may indeed be shaping XRP's destiny. While the future remains uncertain, the potential for XRP's growth is undeniable. Stay informed on the latest developments surrounding XRP, Ripple, and the evolving regulatory landscape to make informed decisions about this potentially transformative cryptocurrency. Keep researching the impact of potential XRP ETFs and SEC decisions on your investment strategy. Is this your big moment with XRP?

Featured Posts

-

From Northumberland To The World One Mans Handmade Boat Journey

May 01, 2025

From Northumberland To The World One Mans Handmade Boat Journey

May 01, 2025 -

Remembering Priscilla Pointer Actress Dies At 100

May 01, 2025

Remembering Priscilla Pointer Actress Dies At 100

May 01, 2025 -

Stroomuitval Breda 30 000 Klanten Treft Elektriciteitsstoring

May 01, 2025

Stroomuitval Breda 30 000 Klanten Treft Elektriciteitsstoring

May 01, 2025 -

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025 -

Sbi Holdings And Xrp A Significant Development In The Crypto Market

May 01, 2025

Sbi Holdings And Xrp A Significant Development In The Crypto Market

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025