Japanese Central Bank's Ueda Cautions On Long-Yield Increase And Contagion

Table of Contents

Ueda's Concerns Regarding Rising Long-Term Yields

Ueda's recent statements highlight a growing unease within the BOJ concerning the upward pressure on long-term JGB yields. This pressure poses a significant challenge to the bank's existing Yield Curve Control (YCC) policy, designed to maintain low borrowing costs and stimulate economic activity.

-

Yield Curve Control Adjustments: The BOJ's YCC policy aims to keep the 10-year JGB yield around zero. However, recent increases in yields suggest market participants are anticipating future adjustments to this policy, potentially including an outright abandonment of YCC. This uncertainty is contributing to bond market volatility.

-

Inflation Expectations and Bond Market Volatility: The rise in JGB yields reflects growing market expectations of future inflation and interest rate hikes, both domestically and globally. Investors are demanding higher yields to compensate for the perceived increase in inflation risk. This increased demand is driving up yields and increasing the volatility of the Japanese bond market.

-

Impact on Japanese Financial Institutions: A rapid increase in long-term yields could severely impact Japanese financial institutions holding large portfolios of JGBs. Significant losses could ripple through the financial system, undermining the stability of the Japanese economy.

The Risk of Global Contagion from Japanese Monetary Policy Changes

The potential for global contagion stemming from changes in the BOJ's monetary policy is a significant concern. Japan's economy is deeply interconnected with global financial markets, and any significant shifts in its monetary policy could have far-reaching consequences.

-

Global Financial Market Instability: A sudden shift away from the BOJ's YCC policy could trigger volatility in the yen, impacting global currency markets and potentially destabilizing other financial markets around the world. This instability could further affect investor confidence, leading to capital flight from riskier assets.

-

Yen Volatility and Currency Fluctuations: Changes in the BOJ's policy stance are likely to cause significant fluctuations in the value of the yen. A weakening yen could increase import costs for Japan, potentially fueling further inflation, while a strengthening yen could negatively impact exports. These currency fluctuations would have knock-on effects on global trade and financial flows.

-

Impact on Emerging Markets: Emerging markets are particularly vulnerable to shifts in Japanese monetary policy. These markets often rely heavily on capital inflows from developed economies like Japan, and a sudden shift in policy could trigger capital outflows, leading to financial crises in these more vulnerable economies.

The BOJ's Balancing Act: Inflation, Growth, and Yield Curve Control

The BOJ faces a challenging balancing act. It needs to maintain price stability (inflation targeting) while supporting economic growth and managing the risks associated with its YCC policy.

-

Inflation Targeting and Economic Growth: The BOJ's primary mandate is to maintain price stability. However, excessively aggressive efforts to combat inflation could stifle economic growth. The BOJ must find a delicate balance between these two crucial objectives.

-

Challenges of Maintaining YCC: Maintaining YCC while addressing rising inflation presents a significant policy dilemma. Sticking with YCC risks fueling inflation further, while abandoning it could lead to increased borrowing costs and potentially trigger a financial crisis.

-

Alternative Monetary Policy Tools: The BOJ could explore alternative monetary policy tools to address the current situation. These could include adjusting its quantitative easing program or implementing targeted measures to support specific sectors of the economy. However, each option presents its own set of potential risks and drawbacks.

-

Economic Consequences of Policy Choices: Each policy decision carries significant economic consequences. The BOJ must carefully weigh the potential benefits and risks of each option before making any substantial changes to its current monetary policy stance.

Conclusion

Governor Ueda's cautious statements underscore the substantial risks associated with rising long-term yields in Japan and the potential for serious global contagion. The BOJ faces a complex balancing act, navigating its monetary policy amidst growing inflationary pressures and the urgent need to maintain financial stability both domestically and internationally. Understanding the intricacies of the BOJ's approach to yield curve control and its potential impact on global markets is crucial for investors, policymakers, and anyone closely monitoring the global financial landscape. Stay informed about the evolving situation regarding the Japanese Central Bank's response to rising long-term yields and the potential for global contagion. Follow reputable financial news sources for updates on the BOJ’s monetary policy and its implications for the global economy. A deep understanding of the Japanese Central Bank's actions is vital for navigating the complexities of the global financial landscape.

Featured Posts

-

Urgent Hudsons Bay Announces Nationwide Store Closure And Staff Terminations

May 29, 2025

Urgent Hudsons Bay Announces Nationwide Store Closure And Staff Terminations

May 29, 2025 -

Liberty Poole Red Hot In A Mini Dress After Love Island

May 29, 2025

Liberty Poole Red Hot In A Mini Dress After Love Island

May 29, 2025 -

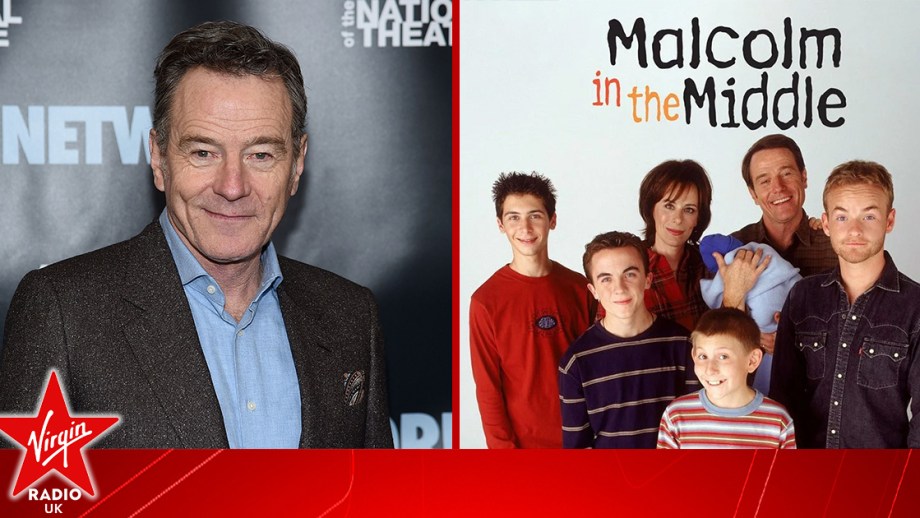

Bryan Cranston Discusses A Potential Malcolm In The Middle Reboot And Its Divergences

May 29, 2025

Bryan Cranston Discusses A Potential Malcolm In The Middle Reboot And Its Divergences

May 29, 2025 -

Alteaqd Me Tah Brshlwnt Ykshf En Qrarh Almfajy

May 29, 2025

Alteaqd Me Tah Brshlwnt Ykshf En Qrarh Almfajy

May 29, 2025 -

Sinners Louisiana Horror Films Theatrical Release Date Announced

May 29, 2025

Sinners Louisiana Horror Films Theatrical Release Date Announced

May 29, 2025

Latest Posts

-

Carcamusas Receta Paso A Paso Y Beneficios De Este Plato Toledano

May 31, 2025

Carcamusas Receta Paso A Paso Y Beneficios De Este Plato Toledano

May 31, 2025 -

Receta De Carcamusas Un Sabroso Plato Tipico De Toledo

May 31, 2025

Receta De Carcamusas Un Sabroso Plato Tipico De Toledo

May 31, 2025 -

Emergency Response Over 100 Firefighters Tackle Major East London Shop Fire

May 31, 2025

Emergency Response Over 100 Firefighters Tackle Major East London Shop Fire

May 31, 2025 -

Receta Tradicional De La Brascada Valenciana

May 31, 2025

Receta Tradicional De La Brascada Valenciana

May 31, 2025 -

Descubre La Receta Autentica De Las Carcamusas Toledanas

May 31, 2025

Descubre La Receta Autentica De Las Carcamusas Toledanas

May 31, 2025