Jeanine Pirro Advises Against Stock Market Investment In The Coming Weeks

Table of Contents

Pirro's Rationale for Avoiding Stock Market Investment

Jeanine Pirro's concerns regarding the stock market stem from several key factors. Her arguments center around a confluence of economic indicators and geopolitical events that, in her view, point towards potential market instability.

-

Inflationary Pressures: Pirro highlights the persistent inflationary pressures currently impacting the global economy. She argues that high inflation erodes purchasing power and negatively impacts corporate earnings, potentially leading to a market downturn.

-

Recessionary Fears: Pirro expresses concerns about the increasing risk of a recession. She points to slowing economic growth, rising interest rates, and weakening consumer confidence as indicators suggesting a potential economic contraction.

-

Geopolitical Instability: Pirro also cites geopolitical instability, including the ongoing war in Ukraine and rising tensions in other regions, as a significant factor impacting market sentiment. These uncertainties, she argues, create increased volatility and risk for investors.

-

Credibility and Counterarguments: While Pirro's concerns are valid, it's crucial to analyze their context. Her expertise lies in law, not finance. Therefore, her assessment should be considered alongside expert opinions from economists and financial analysts. Counterarguments exist – some argue that the market has already priced in many of these risks.

Analyzing the Current Economic Climate

To assess the validity of Pirro's warning, we must examine the current economic climate using factual data and expert opinions.

-

Inflation Rates: The current inflation rate [cite source, e.g., Bureau of Labor Statistics data] shows [insert current inflation rate and its trend]. While inflation is a concern, its impact on the stock market is complex and depends on several other factors, including corporate profitability and interest rate adjustments.

-

Interest Rates: The Federal Reserve's recent interest rate hikes [cite source, e.g., Federal Reserve announcements] aim to curb inflation but could simultaneously slow economic growth, potentially leading to a recession. The effect of interest rate changes on the stock market is a subject of ongoing debate among economists.

-

Unemployment and GDP Growth: Current unemployment figures [cite source, e.g., Bureau of Labor Statistics] and GDP growth rates [cite source, e.g., Bureau of Economic Analysis] provide a snapshot of the economy's overall health. A combination of high unemployment and sluggish GDP growth would strongly suggest a recession.

-

Market Volatility: The current stock market volatility [cite source, e.g., major market indices data] reflects investor uncertainty regarding the future economic outlook. High volatility introduces increased risk for investors, regardless of their investment strategy.

Alternative Investment Strategies

Heeding Pirro's warning doesn't necessarily mean staying entirely out of the market. Instead, investors can consider alternative strategies to mitigate risk:

-

Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, commodities) reduces exposure to any single market's fluctuations.

-

Risk Management: Implementing robust risk management strategies, such as stop-loss orders and diversification, is crucial.

-

Alternative Assets: Exploring alternative assets like real estate investment trusts (REITs) or high-quality bonds can offer relative stability compared to the stock market.

-

Cash Position: Maintaining a significant cash position allows investors to seize opportunities when the market dips or to ride out periods of uncertainty.

The Importance of Seeking Professional Financial Advice

Navigating the complexities of the stock market and making informed investment decisions requires expertise. Therefore, consulting with a qualified financial advisor is paramount.

-

Personalized Strategy: A financial advisor can create a personalized investment strategy aligned with your individual risk tolerance, financial goals, and time horizon.

-

Expert Guidance: They provide valuable insights into economic trends and market dynamics, helping you navigate uncertainty.

-

Risk Tolerance Assessment: They help assess your risk tolerance, ensuring your investments align with your comfort level.

Conclusion

Jeanine Pirro's caution against stock market investment raises valid concerns, particularly regarding inflation, recessionary risks, and geopolitical uncertainties. However, her assessment should be viewed within the broader context of economic data and expert analysis. The current economic climate presents challenges and opportunities, demanding a careful and informed approach. Before making any investment decisions based on Jeanine Pirro's advice or any other single source, thoroughly assess your personal financial situation and seek guidance from a qualified financial advisor. Don't make rash decisions regarding your stock market investments – informed choices, based on professional advice and thorough research, are key to long-term financial success.

Featured Posts

-

Harry Styles Sports A Retro Mustache In London

May 09, 2025

Harry Styles Sports A Retro Mustache In London

May 09, 2025 -

Harry Styles Reaction To A Failed Snl Impression Attempt

May 09, 2025

Harry Styles Reaction To A Failed Snl Impression Attempt

May 09, 2025 -

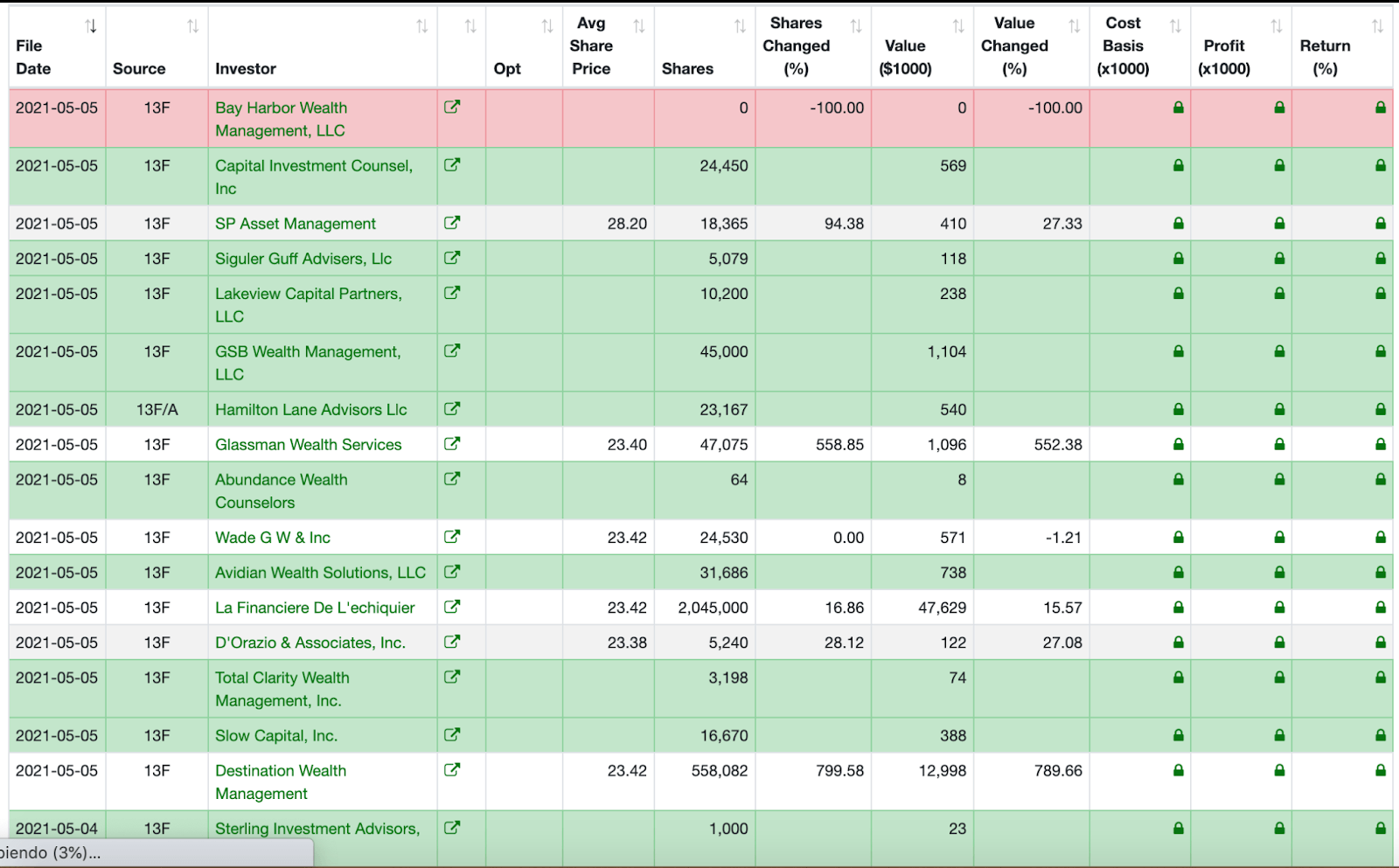

Should You Invest In Palantir Before May 5th A Wall Street Forecast

May 09, 2025

Should You Invest In Palantir Before May 5th A Wall Street Forecast

May 09, 2025 -

India En Brekelmans Een Analyse Van De Samenwerking

May 09, 2025

India En Brekelmans Een Analyse Van De Samenwerking

May 09, 2025 -

Preparing For The Great Decoupling Strategies For Businesses And Governments

May 09, 2025

Preparing For The Great Decoupling Strategies For Businesses And Governments

May 09, 2025