Jim Cramer's Take On CoreWeave (CRWV): Its OpenAI Connection

Table of Contents

CoreWeave's Business Model and its Reliance on AI

CoreWeave's business model centers around providing specialized cloud computing services tailored for high-performance computing (HPC) and AI workloads. Their revenue is primarily generated by offering access to a massive infrastructure of Graphics Processing Units (GPUs), the workhorses of modern AI. These GPUs are crucial for training complex AI models and performing inference – the process of using a trained model to make predictions.

- Specialized GPU Cloud Computing: CoreWeave doesn't just offer generic cloud services; they focus on the demanding needs of AI and HPC applications, making them a preferred choice for businesses with high computational requirements.

- Powering AI Model Training and Inference: Their platform is optimized for AI model training, allowing developers to train larger and more sophisticated models faster than ever before. They also provide infrastructure for inference, enabling the deployment of these trained models into production environments.

- Target Market: CoreWeave's target market includes AI startups, large enterprises seeking to integrate AI into their operations, and research institutions conducting cutting-edge AI research. This broad target market positions them for significant growth.

- Revenue Streams and Growth Potential: CoreWeave's revenue is directly tied to the growing demand for GPU-powered cloud computing. The explosive growth of the AI market ensures significant future growth potential for CRWV, provided they can scale their infrastructure effectively.

CoreWeave operates in a competitive landscape, facing established players like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. However, their specialization in GPU-based cloud computing and their focus on the rapidly evolving AI market gives them a distinct competitive advantage.

The CoreWeave-OpenAI Relationship: A Strategic Partnership

The partnership between CoreWeave and OpenAI is a cornerstone of CoreWeave's success. CoreWeave provides a significant portion of the computing infrastructure that powers OpenAI's operations, including the training of large language models like GPT.

- Critical Infrastructure Provider: CoreWeave's massive GPU cluster is essential for OpenAI's research and development efforts, enabling them to train their advanced AI models.

- Mutual Benefits: The partnership benefits both companies. OpenAI gains access to robust and scalable infrastructure, while CoreWeave benefits from the association with a leading AI company and increased brand recognition.

- Market Position and Investor Confidence: The OpenAI partnership significantly boosts CoreWeave's market position and investor confidence, solidifying their reputation as a key player in the AI infrastructure space.

- Future Collaboration: This partnership lays the groundwork for future collaborations and potentially the development of innovative AI services.

The CoreWeave-OpenAI relationship highlights the increasing importance of specialized cloud infrastructure in the AI revolution. The success of this collaboration indicates a strong future for both companies and underscores the critical role of high-performance computing in powering the next generation of AI applications.

Jim Cramer's Assessment of CoreWeave (CRWV) Stock

Jim Cramer's opinions on CoreWeave (CRWV) stock have been largely positive, emphasizing the company's strategic position within the burgeoning AI market and the strength of its OpenAI partnership.

- Positive Outlook: While specific quotes require referencing his broadcasts, Cramer has generally expressed optimism about CoreWeave’s future, highlighting its potential for substantial growth.

- Growth and Profitability: He likely focuses on the company’s potential for rapid revenue growth driven by increased demand for AI infrastructure.

- Predictions and Recommendations: Again, specifics depend on the particular broadcast, but his recommendations likely reflect the potential rewards of investing in a company at the forefront of AI innovation.

- Cautions and Concerns: However, even a bullish commentator like Cramer will likely caution about the risks associated with investing in a high-growth tech stock, especially given the volatility of the market.

It’s crucial to understand that Cramer’s opinions are not financial advice. His investment style is aggressive and might not suit all investors. Always conduct your own thorough research before making any investment decisions.

Analyzing the Risks and Rewards of Investing in CRWV

Investing in CRWV, like any investment in a high-growth tech company, comes with inherent risks and rewards.

- Market Volatility: The tech sector is notoriously volatile, and CRWV’s stock price will likely fluctuate significantly depending on market sentiment, competitive pressures, and the overall performance of the AI market.

- Financial Performance: Carefully examine CoreWeave's financial statements and projections, understanding their revenue streams, profitability, and debt levels.

- Competition: The cloud computing market is fiercely competitive. Analyze CoreWeave's competitive advantages and its ability to maintain its market share.

- Technological Disruption: Rapid technological advancements could render CoreWeave's current technology obsolete.

The potential rewards, however, are significant. The rapid growth of the AI market presents a substantial opportunity for CoreWeave, and its strategic partnership with OpenAI positions it favorably for long-term success. Weighing these potential risks and rewards is crucial for any investor considering a position in CRWV.

Conclusion

Jim Cramer's positive assessment of CoreWeave (CRWV) is largely based on the company's strong position in the AI infrastructure market and its critical partnership with OpenAI. While this relationship presents substantial growth potential, investors must remember that investing in CRWV involves significant risk due to market volatility and the competitive nature of the industry. This article provides insights into Cramer’s viewpoint and the intricacies of CoreWeave’s business, but it's not a substitute for independent analysis.

Call to Action: Before investing in CoreWeave (CRWV) or any other stock, conduct your own thorough due diligence. Research the company’s financials, competitive landscape, and the broader AI market. Consult with a financial advisor to ensure your investment decisions align with your risk tolerance and financial goals. Learn more about CoreWeave and make informed decisions regarding CoreWeave investment.

Featured Posts

-

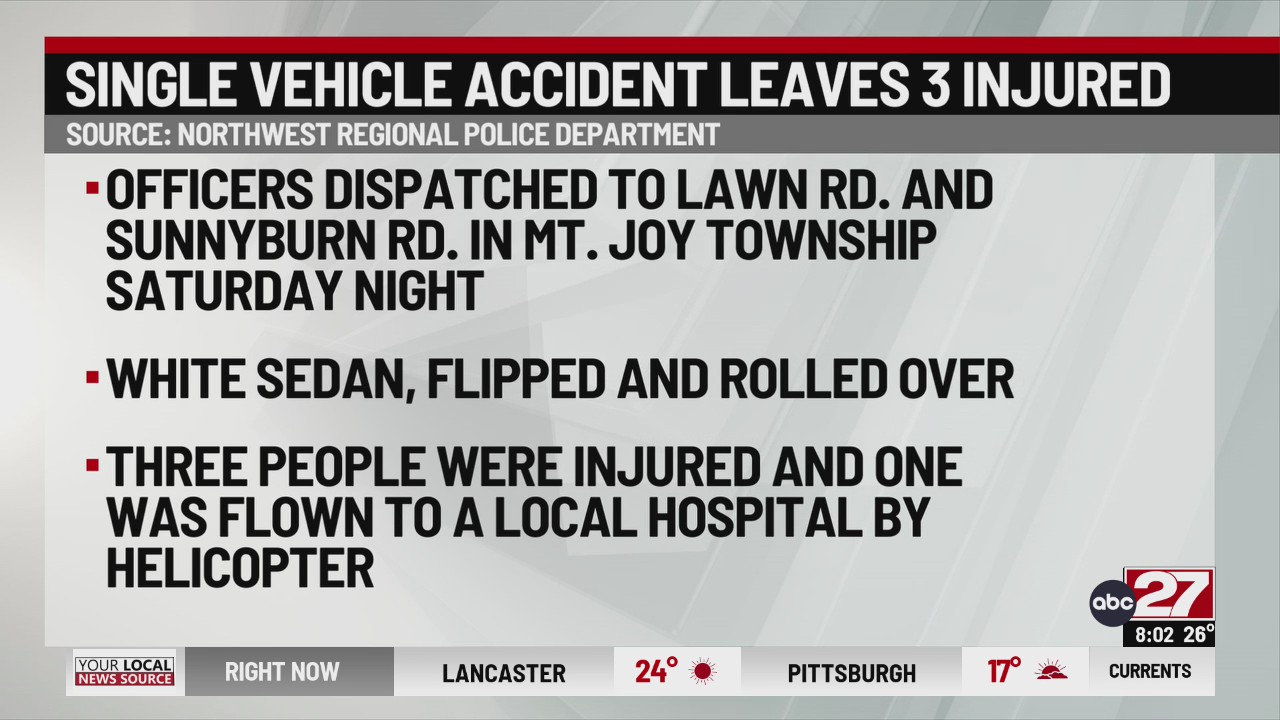

Lancaster County Police Respond To Shooting Incident

May 22, 2025

Lancaster County Police Respond To Shooting Incident

May 22, 2025 -

New Uw Documentary People Helping Pronghorn Recover From A Severe Winter

May 22, 2025

New Uw Documentary People Helping Pronghorn Recover From A Severe Winter

May 22, 2025 -

Core Weave Crwv And Open Ai A Deep Dive Based On Jim Cramers Analysis

May 22, 2025

Core Weave Crwv And Open Ai A Deep Dive Based On Jim Cramers Analysis

May 22, 2025 -

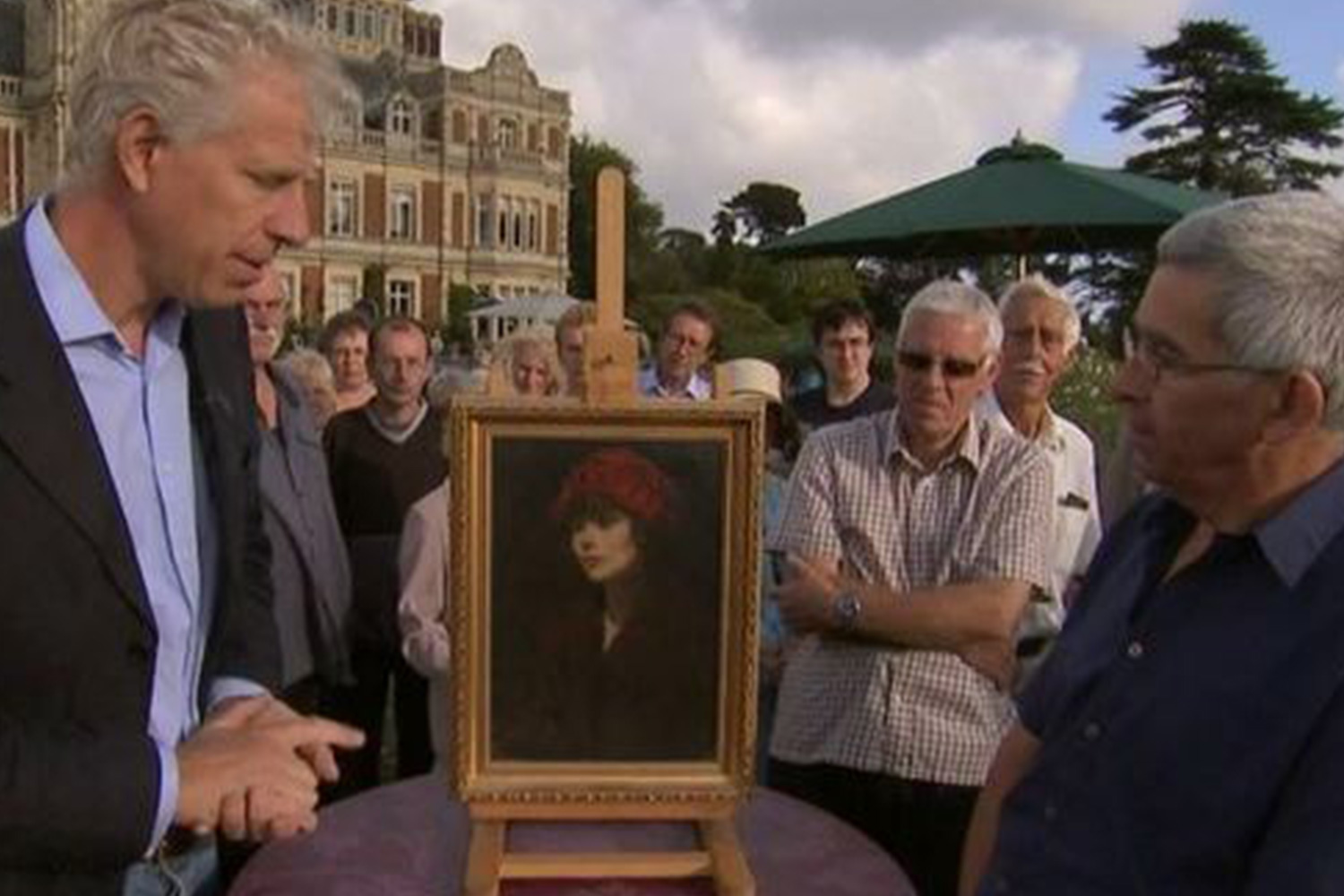

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 22, 2025

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 22, 2025 -

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025