Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

5 DO's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Building strong relationships is key to uncovering hidden job opportunities and gaining valuable insights.

- Leverage LinkedIn: Actively engage with professionals in private credit; join relevant groups and participate in discussions.

- Attend Industry Events: Conferences like the Private Debt Investor Forum or smaller, regional events offer excellent networking opportunities.

- Informational Interviews: Reach out to professionals for informational interviews to learn about their careers and gain valuable advice.

- Alumni Networks: Utilize your alma mater's alumni network to connect with graduates working in private credit.

- Professional Organizations: Join organizations like the American Securitization Forum (ASF) or the Association for Corporate Growth (ACG) to expand your professional network.

Remember, quality connections are more valuable than quantity. Focus on building genuine relationships.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They must clearly demonstrate your suitability for the specific private credit role.

- Quantifiable Results: Instead of simply listing your responsibilities, highlight your achievements and quantify your impact wherever possible (e.g., "Increased portfolio yield by 15%").

- Keyword Optimization: Incorporate relevant keywords, such as "credit analysis," "portfolio management," "due diligence," "leveraged loans," "mezzanine financing," "distressed debt," and "private equity," to optimize your application for Applicant Tracking Systems (ATS).

- Customization: Tailor your resume and cover letter to each job application, highlighting the skills and experiences most relevant to the specific role and company.

- Market Understanding: Showcase your understanding of private credit markets, investment strategies, and current market trends.

Do 3: Master the Interview Process

The interview is your chance to shine. Thorough preparation is crucial for success.

- Behavioral Questions: Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result).

- Company Research: Thoroughly research the firm, its investment strategies, recent transactions, and the interviewer's background.

- Technical Proficiency: Demonstrate your knowledge of private credit principles, financial statement analysis, and valuation techniques.

- Insightful Questions: Prepare thoughtful questions to ask the interviewer, showcasing your interest and engagement.

Do 4: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is essential in private credit.

- Software Proficiency: Develop strong skills in Excel, Bloomberg Terminal, and other relevant financial modeling software.

- Portfolio Development: Create a portfolio showcasing your best financial modeling work, including detailed descriptions of your methodology and assumptions.

- Model Explanation: Be prepared to clearly explain your modeling process, assumptions, and results during interviews.

- Analytical Skills: Highlight your ability to analyze financial statements, build robust models, and draw insightful conclusions.

Do 5: Highlight Your Understanding of Private Credit Markets

Demonstrate a comprehensive understanding of the private credit landscape.

- Investment Strategies: Show knowledge of various private credit strategies (direct lending, mezzanine financing, distressed debt, etc.).

- Industry News: Stay updated on industry news and trends through reputable sources like Bloomberg, S&P Global Market Intelligence, and PitchBook.

- Regulatory Knowledge: Demonstrate awareness of relevant regulations and compliance requirements within the private credit sector.

- Passion: Clearly articulate your genuine interest and passion for the private credit industry.

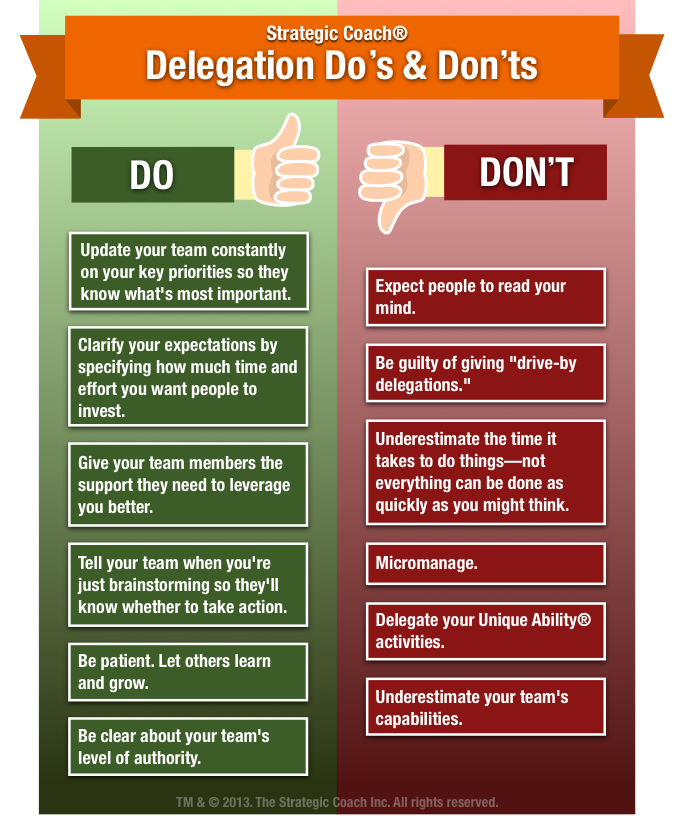

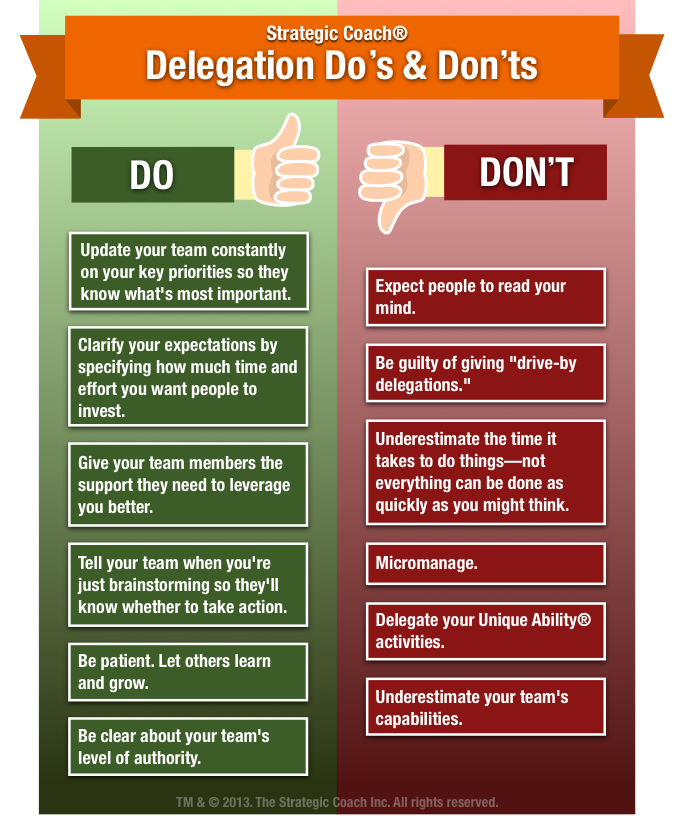

5 DON'Ts to Avoid When Seeking a Private Credit Job

Don't 1: Neglect Networking

Networking is not optional; it's crucial. Don't rely solely on online applications.

- Active Engagement: Attend industry events, connect with professionals on LinkedIn, and proactively seek out networking opportunities.

Don't 2: Submit Generic Applications

Avoid generic applications. Each application must be tailored to the specific role.

- Targeted Approach: Carefully review the job description and tailor your resume and cover letter to highlight relevant skills and experience.

Don't 3: Underprepare for Interviews

Thorough preparation is essential for a successful interview.

- Practice and Research: Practice your answers to common interview questions, and research the firm and interviewer extensively.

Don't 4: Overlook Financial Modeling Proficiency

Financial modeling skills are highly valued in private credit.

- Skill Development: Invest time in developing and honing your financial modeling skills.

Don't 5: Lack Understanding of the Private Credit Landscape

Demonstrate a strong understanding of private credit markets and strategies.

- Continuous Learning: Stay informed about industry trends, regulations, and best practices.

Conclusion

Landing your dream private credit job requires a strategic approach. By focusing on the five "Do's"—strategic networking, tailored applications, mastering the interview process, showcasing financial modeling skills, and demonstrating market expertise—and avoiding the five "Don'ts"—you significantly increase your chances of success. Remember to start networking today, tailor your application materials to each specific opportunity, and thoroughly prepare for interviews. By diligently following these guidelines, you’ll be well-positioned to land your dream private credit role and embark on a rewarding career in this exciting field. Implement these tips and actively pursue your dream private credit job—your success awaits!

Featured Posts

-

Tesla Stock Plunge How Elon Musks Actions Affect Dogecoin

May 09, 2025

Tesla Stock Plunge How Elon Musks Actions Affect Dogecoin

May 09, 2025 -

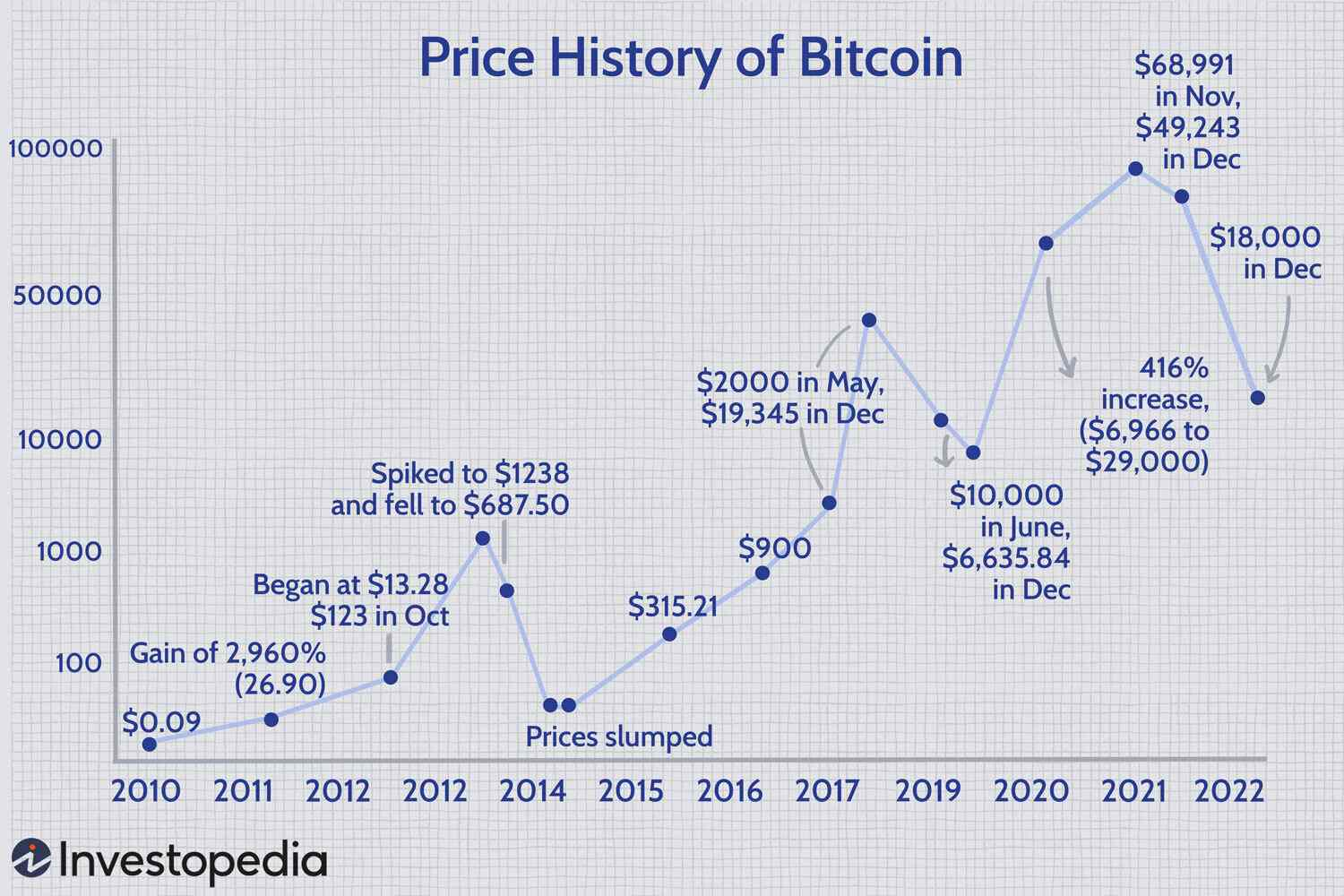

Bitcoin Price Prediction Evaluating The 100 000 Target After Trumps Speech

May 09, 2025

Bitcoin Price Prediction Evaluating The 100 000 Target After Trumps Speech

May 09, 2025 -

Bayern Munich Vs Fc St Pauli A Detailed Match Analysis And Prediction

May 09, 2025

Bayern Munich Vs Fc St Pauli A Detailed Match Analysis And Prediction

May 09, 2025 -

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final

May 09, 2025

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final

May 09, 2025 -

Amy Walsh Shows Solidarity With Wynne Evans Following Sexual Slur Allegations

May 09, 2025

Amy Walsh Shows Solidarity With Wynne Evans Following Sexual Slur Allegations

May 09, 2025