Liberation Day Tariffs: How They Affect Stock Prices And Investment Strategies

Table of Contents

Understanding Liberation Day Tariffs and their Historical Context

Defining Liberation Day Tariffs:

Liberation Day tariffs, if they exist within a specific historical or political context (this needs to be clarified with more information if this is a real event, otherwise replace with a relevant example), refer to tariffs implemented on or around a specific day commemorating liberation. These tariffs can significantly alter the economic landscape by impacting import and export prices, affecting various sectors and influencing overall market stability. The historical background and economic motivations behind these tariffs are key to understanding their potential impact on investment strategies.

- Specific examples of tariffs imposed: (Insert specific historical examples of tariffs imposed around a Liberation Day, if applicable. If no such historical precedent exists, replace with an analogous example of tariffs imposed due to political or economic events. For example, you could discuss tariffs imposed in response to trade wars or specific international incidents.)

- Types of goods or sectors typically affected: (List examples. Commonly affected sectors might include agriculture, manufacturing, or specific technology sectors.)

- Political and economic motivations: (Explain the reasoning behind tariff implementation. This might involve protectionism, retaliatory measures, or attempts to boost domestic industries.)

The Impact of Liberation Day Tariffs on Stock Prices

Immediate Market Reactions:

The announcement or implementation of Liberation Day tariffs often triggers immediate and significant reactions in the stock market. These reactions can be positive or negative, depending on the specific tariffs, the affected sectors, and overall investor sentiment. Market volatility is expected during such periods.

- Examples of past market reactions: (Insert examples of past market reactions to similar tariff announcements or implementations. Consider including data points like percentage changes in specific indices or sectors.)

- Sectors most vulnerable: (Identify sectors particularly vulnerable to tariff increases or decreases. This may include import-dependent industries or those facing increased competition from foreign producers.)

- Role of investor sentiment: (Discuss how investor fear, uncertainty, and doubt (FUD) can affect stock prices during periods of tariff uncertainty.)

Long-Term Effects on Stock Performance:

The long-term consequences of Liberation Day tariffs can be profound and far-reaching. These effects can ripple across the economy, impacting various sectors and ultimately shaping the overall market performance.

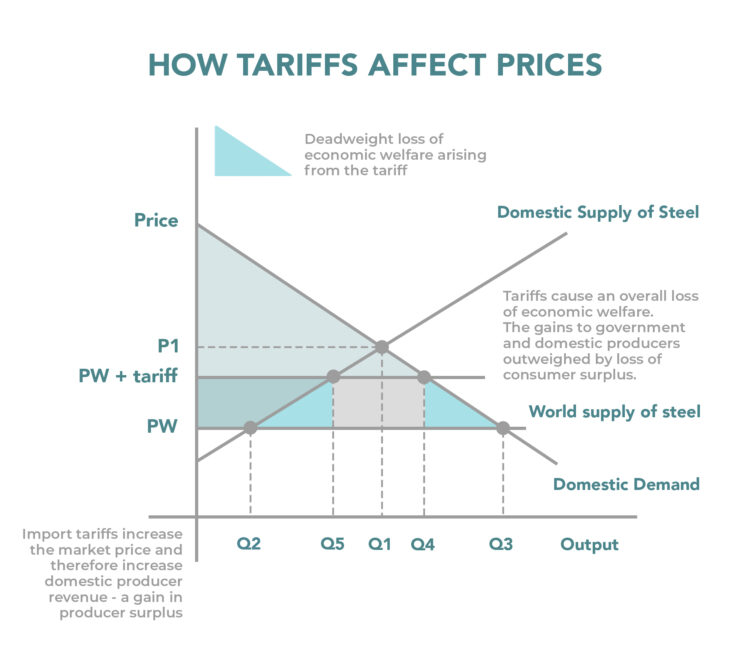

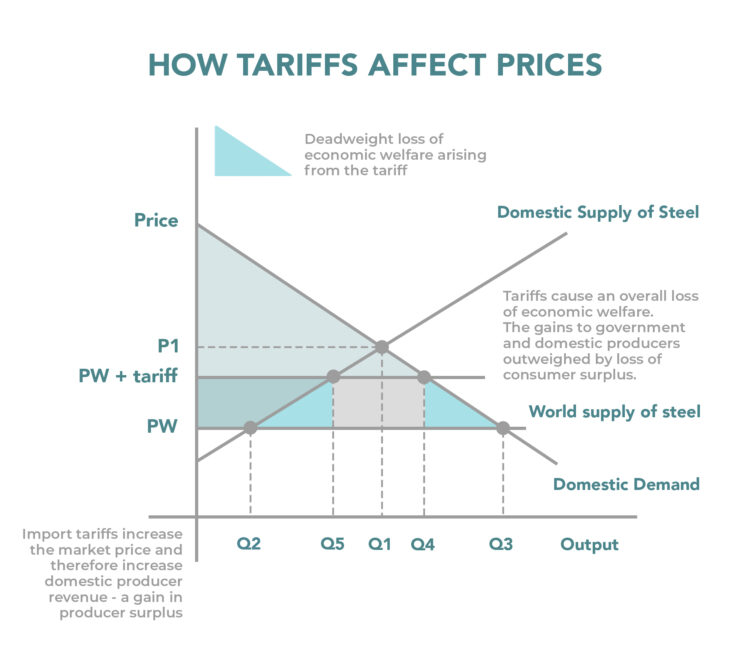

- Potential for inflation/deflation: (Explain how tariffs can impact inflation by increasing the price of imported goods or deflation through reduced demand for certain goods.)

- Impact on corporate earnings: (Discuss how tariffs can affect corporate profitability through increased costs or reduced sales.)

- Effects on international trade: (Explain the potential consequences for international trade relations and global supply chains.)

Developing Effective Investment Strategies in Response to Liberation Day Tariffs

Diversification and Risk Management:

Diversification is crucial during periods of tariff-related uncertainty. A well-diversified portfolio can mitigate the risk associated with market volatility caused by tariff changes.

- Strategies for diversification: (Suggest strategies for diversifying investment portfolios across various sectors, asset classes, and geographies.)

- Methods for hedging against losses: (Discuss methods such as hedging with derivatives or investing in assets negatively correlated with the affected sectors.)

- Role of risk tolerance: (Emphasize the importance of aligning investment decisions with individual risk tolerance levels.)

Identifying Opportunities:

While Liberation Day tariffs present challenges, they also create opportunities for investors who can identify sectors and companies likely to benefit.

- Sectors benefiting from domestic demand: (Identify sectors expected to experience increased domestic demand due to tariff-related import substitution.)

- Companies with diversified supply chains: (Highlight the advantages of investing in companies with strong and diversified international supply chains.)

- Strategies for identifying undervalued companies: (Suggest methods for identifying undervalued companies potentially overlooked due to market volatility.)

Conclusion

Liberation Day tariffs have a significant and multifaceted impact on stock prices and require strategic investment planning. Understanding their historical context, immediate market reactions, and long-term consequences is crucial for informed decision-making. By carefully considering diversification strategies, risk management techniques, and potential investment opportunities, investors can navigate the complexities of tariff-induced market volatility. By understanding the intricacies of Liberation Day tariffs and their influence on stock prices, investors can develop more robust and effective investment strategies. Stay informed about Liberation Day tariff developments and adapt your investment approach accordingly.

Featured Posts

-

Ps Zh Vs Aston Villa Analiz Vsikh Matchiv U Yevrokubkakh

May 08, 2025

Ps Zh Vs Aston Villa Analiz Vsikh Matchiv U Yevrokubkakh

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

Freeway Series Mookie Betts Out Due To Ongoing Health Issue

May 08, 2025

Freeway Series Mookie Betts Out Due To Ongoing Health Issue

May 08, 2025 -

The Bank Of Englands Decision Half Point Cut Or Status Quo

May 08, 2025

The Bank Of Englands Decision Half Point Cut Or Status Quo

May 08, 2025 -

Thunder Vs Trail Blazers Game March 7th Time Tv Channel And Streaming

May 08, 2025

Thunder Vs Trail Blazers Game March 7th Time Tv Channel And Streaming

May 08, 2025

Latest Posts

-

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025 -

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025